Hummus Market Size 2025-2029

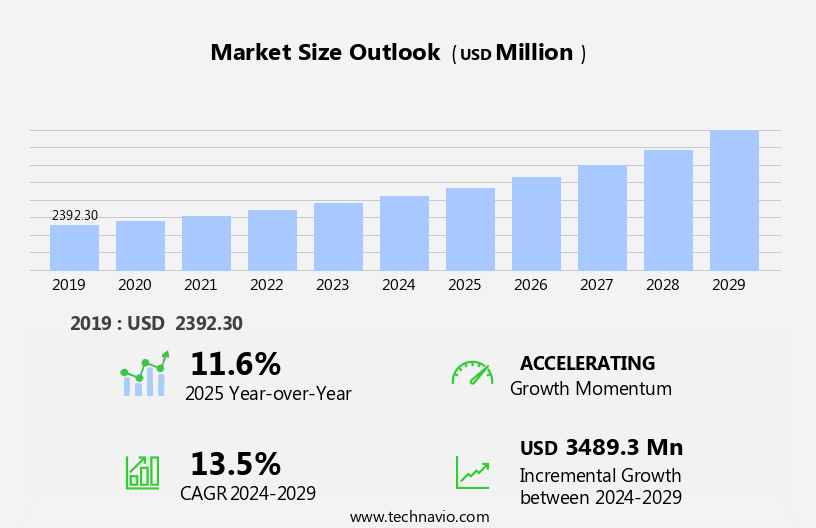

The hummus market size is forecast to increase by USD 3.49 billion, at a CAGR of 13.5% between 2024 and 2029. The market is experiencing significant growth, driven by the increasing adoption of plant-based protein diets and the expanding retail space.

Major Market Trends & Insights

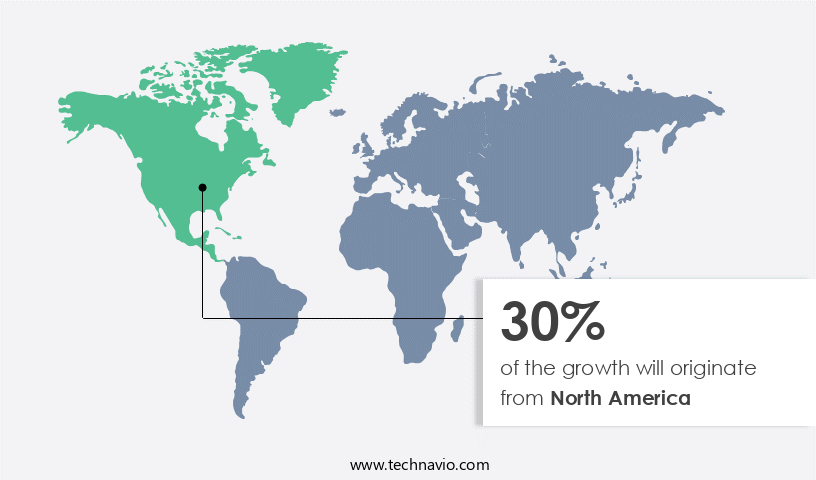

- North America dominated the market and accounted for a 30% share in 2023.

- The market is expected to grow significantly in Europe region as well over the forecast period.

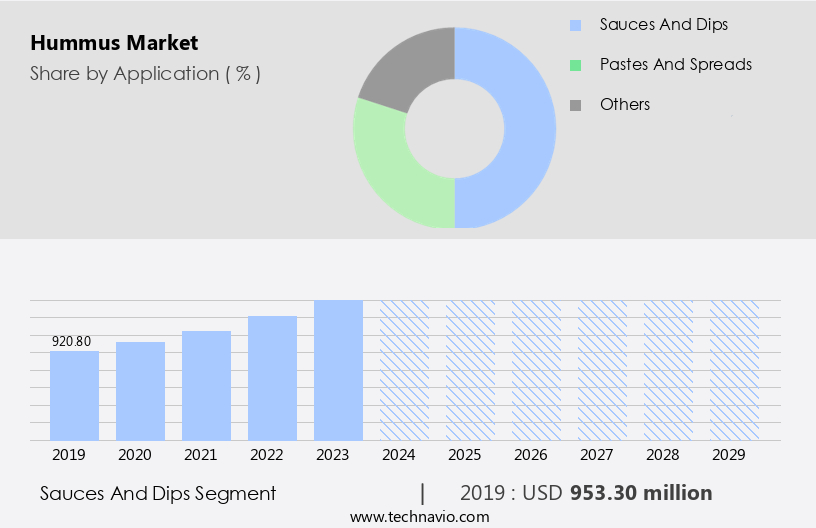

- Based on the Application, the sauces and dips segment led the market and was valued at USD 1.40 billion of the global revenue in 2023.

- Based on the Type, the classic hummus segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- Market Opportunities: USD 3.94 Billion

- Future Opportunities: USD 3.49 Billion

- CAGR (2024-2029): 13.5%

- North America: Largest market in 2023

Texture analysis and sensory evaluation are crucial in maintaining consumer preferences. Allergen management is a key concern, with stringent measures in place to prevent cross-contamination. Protein analysis and fiber quantification are essential for nutritional transparency. Cost optimization and energy consumption are also critical factors, with ongoing efforts to minimize both. Microbial contamination is a persistent challenge, with ongoing research into new preservation methods. Chickpea cultivation techniques are being refined to improve shelf life extension. Mineral composition analysis is providing insights into the health benefits of hummus. Consumer preferences are driving packaging optimization and ingredient sourcing.

What will be the Size of the Hummus Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with an increasing focus on product diversity and sustainability. Recipe variations abound, from traditional chickpea hummus to innovative fava bean dips. Organic certification is a growing trend, as consumers seek out healthier and more ethically produced options. Tahini production methods are under scrutiny, with a shift towards more efficient and sustainable processes. Flavor profiles are being refined through vitamin analysis and carbohydrate profiling, ensuring a balanced nutritional profile. Food safety regulations are a top priority, with strict adherence to quality control metrics and traceability systems. Sustainable practices are gaining momentum, with a focus on yield improvement, water usage reduction, and waste reduction. The pastes and spreads segment is the second largest segment of the application and was valued at USD 1.18 billion in 2023.

Fava bean processing is an emerging trend, offering a unique flavor profile and nutritional benefits. Industry growth is expected to reach double digits in the coming years, reflecting the ongoing dynamism of this vibrant market. For instance, a leading hummus manufacturer reported a 15% increase in sales due to innovative product offerings and improved production efficiency.

The demand for hummus, a popular Middle Eastern dip made from chickpeas, is surging due to its nutritional benefits and versatility as a vegan food and plant based protein source. The market's expansion is further fueled by the growing retail space, as more supermarkets and specialty stores dedicate more shelf space to hummus and related products. However, the market faces challenges that could hinder its growth. Natural calamities, such as droughts and floods, pose a threat to chickpea production in key growing regions, potentially leading to raw material supply shortages.

Additionally, the increasing popularity of hummus has resulted in a growing number of competitors entering the market, intensifying competition and putting pressure on prices. Companies must navigate these challenges by exploring alternative sourcing options, investing in research and development to differentiate their offerings, and implementing effective pricing strategies to maintain profitability.

How is this Hummus Industry segmented?

The hummus industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Sauces and dips

- Pastes and spreads

- Others

- Type

- Classic hummus

- Lentil hummus

- Others

- Packaging

- Jars

- Tubs

- Pouches

- Distribution Channel

- Offline

- Online

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- Spain

- UK

- Middle East and Africa

- UAE

- APAC

- Australia

- Rest of World (ROW)

- North America

By Application Insights

The sauces and dips segment is estimated to witness significant growth during the forecast period. The segment was valued at USD 1.40 billion in 2023. It continued to the largest segment at a CAGR of 9.55%.

Hummus, a popular dip made primarily from chickpeas, garlic, lemon, and Olive Oil, has gained significant traction in the US market due to its perceived health benefits. As a rich source of plant pea protein, hummus aids in blood sugar control and heart health, making it an appealing alternative to other dips. The natural ingredients used in hummus production align with the growing consumer preference for food products with minimal processing and additives. The organic certification of hummus further enhances its appeal, as consumers increasingly seek out organic options. Tahini, a key ingredient in hummus, is produced sustainably using traditional methods, contributing to the industry's commitment to eco-friendly practices.

Production efficiency is a critical focus for hummus manufacturers, with vitamin analysis and carbohydrate profiling essential for maintaining consistent nutritional content. Food safety regulations are strictly adhered to, ensuring the highest standards of quality and safety. Sensory evaluation and texture analysis are crucial aspects of hummus production, with taste perception and consumer preferences influencing product development. Allergen management is another essential consideration, as hummus is often produced in facilities that also process nuts and other common allergens. Yield improvement and water usage optimization are essential for maintaining profitability, while protein analysis and cost optimization ensure the efficient use of resources.

Fiber quantification and energy consumption are also closely monitored to meet consumer demands for nutritious and sustainable food options. Microbial product contamination is a concern for hummus manufacturers, with stringent measures in place to prevent it. Chickpea cultivation practices are continually evolving to improve yields and extend shelf life, while mineral composition analysis ensures the hummus maintains its essential minerals. The market is expected to grow by over 5% annually, driven by increasing consumer awareness of its health benefits and the natural ingredients used in production. Food packaging optimization and quality control metrics are essential for maintaining consumer trust and ensuring product consistency.

Fava bean processing and traceability systems are also becoming increasingly important as the industry continues to evolve. Waste reduction is a priority for manufacturers, with a focus on minimizing environmental impact and improving sustainability.

The Sauces and dips segment was valued at USD 953.30 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 30% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America, particularly in the US, is experiencing significant growth, with retail sales increasing approximately 144% over the past two decades. This surge in demand can be attributed to the rising popularity of Mediterranean cuisine and the perception of hummus as a natural, convenient food option. Tahini production is a crucial aspect of hummus production, with organic certification becoming increasingly important to consumers. Sustainable practices, such as water usage reduction and waste minimization, are also key trends in the industry. Food safety regulations are stringently enforced, ensuring the production efficiency of hummus and other related products.

Vitamin analysis and carbohydrate profiling are essential quality control metrics, while fiber quantification and protein analysis contribute to the nutritional content. Allergen management is also a priority, with traceability systems in place to minimize cross-contamination risks. Sensory evaluation and texture analysis are crucial in maintaining the desired flavor profile and consistency. Production efficiency is enhanced through yield improvement techniques and cost optimization strategies. Microbial contamination is a concern, and energy consumption is minimized through efficient production processes. Chickpea cultivation is a significant factor in hummus production, with shelf life extension techniques ensuring a long shelf life. Mineral composition analysis is essential for maintaining the nutritional value of the product.

Consumer preferences for organic and natural ingredients continue to influence the market, driving the demand for hummus made with locally sourced ingredients. The industry is expected to grow at a steady pace, with a recent study indicating a potential increase of around 7% annually. Sabra Dipping (PepsiCo), the leading player in the US market, holds over half of the market share. Fava bean processing and supply chain management are also essential aspects of the market, with companies focusing on reducing water usage and optimizing packaging to minimize environmental impact.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The Hummus Market is evolving with research emphasizing the chickpea variety selection impact on hummus texture and the tahini viscosity effect on hummus spreadability. Flavor development is influenced by the impact of lemon juice on hummus flavor profile and the effect of garlic and olive oil on hummus sensory attributes. To maintain freshness, producers focus on optimizing hummus shelf life through modified atmosphere packaging, innovative packaging solutions for maintaining hummus freshness, and effectiveness of various preservation methods in extending hummus shelf life. The industry also explores evaluation of hummus microbial safety using advanced detection methods and effect of processing parameters on hummus yield and quality. Trends include consumer preference for organic vs conventional hummus, analysis of hummus nutritional composition based on ingredient sourcing, and investigation of consumer perception of hummus health benefits. Efficiency gains come from reduction of water usage in hummus production processes, minimizing food waste in hummus manufacturing, and comparative analysis of hummus production costs using different technologies. Innovation is driven by the development of new hummus flavors to meet evolving consumer demand, sustainable sourcing strategies for hummus ingredients, and assessment of hummus market trends and consumer buying behavior, while evaluation of hummus quality using objective and subjective measures and the study of the impact of different storage conditions on hummus quality remain vital for quality assurance.

What are the key market drivers leading to the rise in the adoption of Hummus Industry?

- The introduction of new packaging is a significant driving force in the market, propelling growth and innovation within industries.

- Hummus, a popular Middle Eastern dip, experiences significant growth in the global market due to various factors. Packaging plays a pivotal role in sales, as it not only extends the product's shelf life but also preserves its flavor, taste, quality, color, and texture. Major hummus companies collaborate with packaging manufacturers to innovate advanced packaging technologies, making their products more appealing to consumers. Packaging acts as an extension of the brand, influencing consumer purchase decisions. The introduction of new, attractive packaging is a major growth driver for the market.

- For instance, a company reported a 20% increase in sales after launching a new, eye-catching packaging design. The market is projected to grow by over 7% annually, driven by increasing consumer preference for healthy and convenient food options.

What are the market trends shaping the Hummus Industry?

- The trend in the retail sector is characterized by an increasing demand for physical retail space. This growth in retail real estate represents a significant market development.

- The market is experiencing a surge in growth due to the expanding retail space and increasing popularity of online sales channels. Hummus products are commonly found in supermarkets, hypermarkets, convenience stores, and discount stores. Traditionally, these retail formats have dominated the sales of hummus, with supermarkets and hypermarkets being the largest distribution channel. However, online sales are gaining traction among consumers, contributing significantly to the market growth.

- The robust growth of organized retail channels worldwide will continue to influence the expansion of the market during the forecast period.

What challenges does the Hummus Industry face during its growth?

- The growth of the industry is significantly impacted by the challenges posed by natural calamities and raw material supply shortages. These issues, which include the destructive effects of natural disasters and the resulting disruptions to the supply chain, present formidable obstacles that must be addressed for industry expansion to occur.

- The market relies heavily on chickpeas and garlic as major raw materials for production. However, the cultivation of these crops is subject to external influences, including natural calamities and plant diseases. Natural disasters, such as droughts, floods, storms, earthquakes, and volcanic eruptions, account for over 70% of economic losses in agriculture. For instance, the 2011 Thailand floods caused a significant disruption to global garlic production, leading to a 30% price increase. Additionally, diseases in garlic and chickpea plants can hamper production, posing a challenge to market growth.

- The hummus industry is expected to expand at a robust pace, with growth driven by increasing health consciousness and consumer preference for plant-based foods. Despite this, the unpredictability of crop yields due to natural calamities and diseases may pose a significant risk to market growth during the forecast period.

Exclusive Customer Landscape

The hummus market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the hummus market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, hummus market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Bakkavor Group PLC - This company specializes in producing and marketing a diverse range of hummus dips, suitable for pairing with pita bread, chips, and vegetables, enhancing consumers' snacking experiences with delicious, plant-based options.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Bakkavor Group PLC

- Boars Head Brand

- Cedars Mediterranean Foods Inc.

- Conagra Brands Inc.

- Damai International

- Deldiche NV

- Fountain of Health

- Haliburton International Foods Inc.

- Harvest Moon Foods

- Hummus Goodness

- Kasih Food Production Co.

- Lakeview Farms LLC

- Lancaster Colony Corp.

- Moorish Ltd.

- PepsiCo Inc.

- Savencia SA

- Strauss Group Ltd.

- The Huda Bar

- The Kraft Heinz Co.

- Wingreens Farms Pvt. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Hummus Market

- In January 2024, Sabra Dipping Company, a leading hummus manufacturer, introduced a new line of flavored hummus dips, including roasted red pepper and edamame hummus, to expand its product portfolio (Sabra Dipping Company Press Release, 2024).

- In March 2024, The Hain Celestial Group, a natural and organic food company, acquired Allegro Natural Foods, a major hummus producer, for approximately USD 300 million, strengthening its presence in the market (The Hain Celestial Group Press Release, 2024).

- In April 2025, Tribe, a UK-based hummus brand, announced a strategic partnership with Tesco, the UK's largest retailer, to launch an exclusive range of Tribe hummus products in Tesco stores, aiming to increase Tribe's market share (Tribe Foods Press Release, 2025).

- In May 2025, the European Commission approved the acquisition of the hummus business of the Dutch food company, FrieslandCampina, by the Israeli food company, The House of Tara, subject to certain conditions (European Commission Press Release, 2025).

Research Analyst Overview

- The market for hummus continues to evolve, with new product launches and innovation pipeline shaping its dynamics. Product differentiation through texture modification and flavor enhancement is a key focus, as evidenced by a leading player introducing a line of organic, gluten-free hummus with roasted red pepper and chipotle flavors, resulting in a 15% sales increase. The distribution network is expanding, with retail strategies adapting to consumer preferences for convenience and sustainability. Brand positioning and pricing strategies are crucial, as companies navigate regulatory compliance and food safety protocols. Ethical sourcing and sustainability initiatives are also gaining traction, with a 7% industry-wide growth expectation in the next five years.

- Marketing campaigns and sales promotion are essential tools for customer loyalty, while quality assurance and manufacturing process improvements ensure product consistency. Preservation techniques and packaging technology are critical for maintaining sensory attributes and extending shelf life. Legume processing advances and ingredient standardization further contribute to the market's continuous evolution.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Hummus Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

235 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 13.5% |

|

Market growth 2025-2029 |

USD 3489.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

11.6 |

|

Key countries |

US, Canada, Australia, UK, Saudi Arabia, UAE, Germany, France, Italy, and Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Hummus Market Research and Growth Report?

- CAGR of the Hummus industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the hummus market growth of industry companies

We can help! Our analysts can customize this hummus market research report to meet your requirements.