Hybrid Electric Vehicle Conversion Kit Market Size 2024-2028

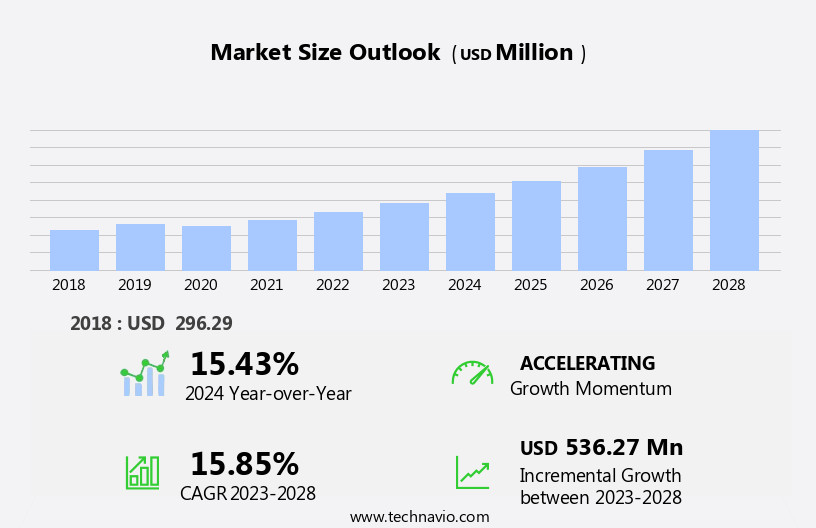

The hybrid electric vehicle conversion kit market size is forecast to increase by USD 536.27 million at a CAGR of 15.85% between 2023 and 2028.

- The market is experiencing significant growth, driven by increasing regulations enforcing the adoption of more efficient and eco-friendly transportation solutions. These regulations are propelling the demand for conversion kits that enable the transformation of conventional vehicles into hybrid electric ones. Moreover, the continuous development of low-cost conversion kits is making these automotive technologies more accessible to a broader consumer base. However, challenges persist in this market. One such challenge is the limited mile range of converted hybrid vehicles, which may not meet the expectations of consumers accustomed to longer distances on a single charge. Another obstacle is the battery performance of these vehicles, which can impact their overall efficiency and appeal to potential buyers.

- Companies seeking to capitalize on market opportunities and navigate challenges effectively must focus on addressing these issues through technological advancements and innovative solutions. By doing so, they can differentiate themselves in a competitive landscape and meet the evolving demands of environmentally-conscious consumers.

What will be the Size of the Hybrid Electric Vehicle Conversion Kit Market during the forecast period?

- The market continues to evolve, driven by the growing demand for eco-friendly transportation solutions and the ongoing advancements in vehicle electrification technologies. Industry-wide standards play a crucial role in ensuring compatibility and reliability, guiding conversion processes for various vehicle models, including the Lexus RX4. Rebates and subsidies offer financial incentives for individuals and businesses seeking to reduce their carbon footprint through hybrid conversions. Performance expectations and reliability issues are key considerations for those opting for Hybrid vehicle conversion kits. Budget constraints and safety concerns also influence market dynamics, driving the development of scalable conversion kits and modular solutions.

- The hybrid electric vehicle landscape encompasses a wide range of applications, from passenger cars like the Toyota Prius to commercial vehicles and even classic cars. Government incentives and grants further fuel the growth of the market, with an increasing focus on sustainable transportation infrastructure, including ultra-fast charging stations and e-buses. Fuel efficiency and energy storage systems are essential components of the conversion process, with electric travel offering a more sustainable alternative to traditional gasoline engines. The conversion kit industry is not without challenges, including inefficiencies in charging infrastructure and the need for standardized procedures and control systems.

How is this Hybrid Electric Vehicle Conversion Kit Industry segmented?

The hybrid electric vehicle conversion kit industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Passenger cars

- Commercial vehicles

- Vehicle Type

- Mid priced

- Luxury

- Component Specificity

- Battery Systems

- Electric Motors

- Controllers

- Charging Systems

- Conversion Type

- Plug-in Hybrid

- Full Hybrid

- Mild Hybrid

- Distribution Channel

- OEM

- Aftermarket

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- The Netherlands

- UK

- Middle East and Africa

- UAE

- APAC

- Australia

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Application Insights

The passenger cars segment is estimated to witness significant growth during the forecast period.

The hybrid vehicle market is experiencing significant growth due to the increasing focus on eco-friendly transportation and stricter emission regulations. Hybrid Electric Vehicle (HEV) conversion kits are gaining popularity as a cost-effective solution for vehicle electrification. These kits enable the conversion of traditional Internal Combustion Engine (ICE) vehicles into hybrid electric vehicles. The conversion process involves integrating an electric motor, control systems, and energy storage systems into the vehicle. Industry-wide standards ensure compatibility and reliability of these conversion kits. For instance, modular conversion kits can be easily installed in various vehicle models, including the Lexus RX4, Toyota Highlander, and Toyota Prius.

Rebates, subsidies, and tax credits offer financial incentives for consumers to adopt these sustainable transportation solutions. Performance expectations and safety concerns are critical factors influencing the market. Hybrid conversions offer improved fuel efficiency and reduced carbon footprint. However, reliability issues and budget constraints can hinder the adoption of these technologies. Automakers are addressing these concerns by offering Plug-in Hybrid Electric Vehicle (PHEV) conversion kits and ultra-fast charging stations. E-buses and electric commercial vehicles are also adopting these solutions to enhance their fuel efficiency and reduce their environmental impact. Electric travel offers several advantages, including zero emissions and reduced dependence on fossil fuels.

However, the inefficiency of electric vehicles during long-distance travel and the need for a robust charging infrastructure remain challenges. Sustainable transportation infrastructure, including home charging solutions and public charging stations, is crucial for the widespread adoption of hybrid electric vehicles. Standardized procedures and motor configurations ensure the seamless integration of these technologies into various vehicle models. Government incentives and consumer confidence are driving the market forward. Four-wheelers, passenger cars, luxury vehicles, and even classic cars are undergoing hybrid conversions to reduce their environmental impact and enhance their efficiency. In conclusion, the hybrid vehicle conversion market is evolving rapidly, with a focus on efficiency, reliability, and sustainability.

The integration of electric motors, energy storage systems, and charging infrastructure is transforming the automotive industry and offering consumers a more eco-friendly and cost-effective transportation solution.

The Passenger cars segment was valued at USD 151.11 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

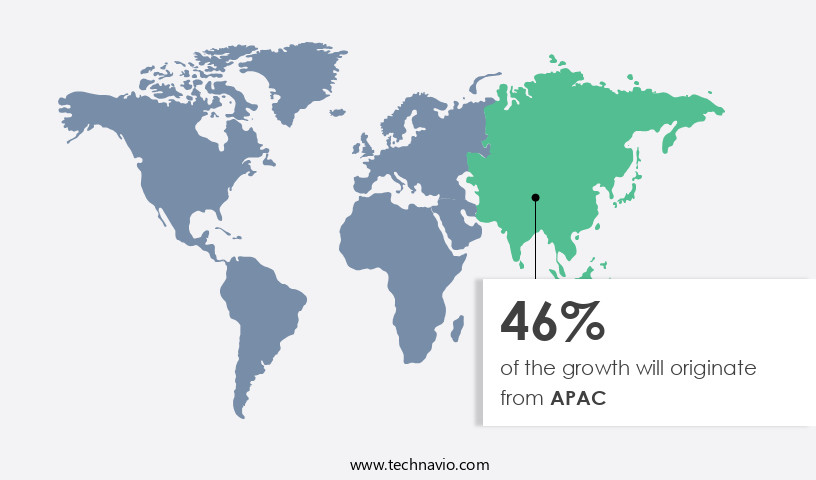

APAC is estimated to contribute 46% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in APAC is experiencing significant growth, with Japan and China leading the way. These countries' rapid market expansion and high adoption of hybrid conversion kits, particularly in India, are driving the region's market growth. APAC's dominance in the market is due to its prominent automotive industries in China and Japan. Emerging markets, such as India, are also contributing to the increasing demand for automobiles in the region. The presence of the world's fastest-growing economies, including China, India, Thailand, Indonesia, and South Korea, creates a favorable environment for the market in APAC. The market's growth is fueled by various factors, including government incentives, such as rebates and subsidies, for eco-friendly transportation solutions.

Performance expectations and reliability concerns are addressed through industry-wide standards and standardized conversion procedures. Budget constraints are met through scalable conversion kits and various charging options, including home charging solutions and public charging stations. Safety concerns are addressed through motor configurations, control systems, and charging infrastructure. The market caters to various vehicle types, including passenger cars, luxury vehicles, commercial vehicles, trucks, and classic cars. Fuel efficiency, carbon footprint reduction, and sustainable transportation infrastructure are key benefits of hybrid electric vehicle conversion kits. The market also offers plug-in hybrid conversion kits and ultra-fast charging stations for electric vehicles and e-buses. Energy storage systems and battery capacities are essential components of these conversion kits.

The market's evolution is influenced by automakers' increasing focus on vehicle electrification solutions and the growing consumer confidence in electric travel. Despite challenges such as inefficiency and reliability issues, the market's potential for reducing emissions and promoting sustainable transportation makes it an attractive option for businesses and individuals alike.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Hybrid Electric Vehicle Conversion Kit Industry?

- Compliance with regulations drives the market's adoption of efficient conversion kits through the enforcement of regulations. This mandatory process propels the market forward by incentivizing the use of these kits for achieving regulatory compliance, ultimately promoting market growth and efficiency.

- Hybrid vehicle conversion kits have gained traction as eco-friendly transportation solutions for those seeking to reduce emissions and enhance fuel efficiency. However, the industry-wide adoption of these kits faced challenges due to concerns over conversion processes and warranty issues. Original Equipment Manufacturers (OEMs) were hesitant about the modifications required for conversion kits, leading to voided warranties for customers undergoing the conversion. This posed a significant hurdle for the market growth, particularly in the context of emission control and fuel economy. To address these challenges, regulatory bodies imposed industry-wide standards for conversion kits, ensuring they meet specific safety and performance expectations.

- These standards instructed OEMs to maintain their warranties on certified conversion kits, paving the way for their effective adoption. Budget constraints and reliability issues are other factors influencing the market dynamics. To cater to various vehicle models and budgets, modular conversion kits have emerged as viable solutions. These kits offer flexibility and affordability, enabling the electrification of a wide range of Hybrid Electric Vehicles (HEVs), including the Lexus RX4. Despite these advancements, safety concerns remain a critical consideration in the market. The industry continues to innovate, offering vehicle electrification solutions that prioritize both performance and safety. Rebates and subsidies from governments and organizations further incentivize the adoption of hybrid conversions, making them an attractive option for businesses and individuals alike.

What are the market trends shaping the Hybrid Electric Vehicle Conversion Kit Industry?

- The growing demand for affordable conversion kits is a notable trend in the current market. Low-cost conversion kit development is a significant focus for many industries.

- The Hybrid Electric Vehicle (HEV) Conversion Kit market is witnessing significant growth due to the increasing demand for sustainable transportation solutions. With the rising awareness of reducing carbon footprints and improving fuel efficiency, there is a growing need for hybrid electric vehicles (HEVs). This trend is putting pressure on Original Equipment Manufacturers (OEMs) to offer affordable hybrid variants, resulting in a decreasing price gap between conventional and hybrid vehicles. This price reduction is driving the demand for HEV conversion kits, particularly in emerging markets where price-sensitive consumers dominate. Moreover, the government's push towards the adoption of alternative fuel vehicles is further boosting the market.

- In regions where the infrastructure for electric vehicles (EVs) is not yet fully developed, HEVs offer a viable solution. The reliability and energy storage capabilities of HEV conversion kits make them an attractive option for businesses and individuals seeking to reduce their carbon footprint while maintaining the convenience of traditional internal combustion engine (ICE) vehicles. The market also benefits from advancements in technology, such as plug-in hybrid systems and ultra-fast charging stations, which enhance the efficiency and practicality of HEVs. Furthermore, the development of energy storage systems is addressing concerns regarding the inefficiency of HEVs, making them a more viable and sustainable transportation option.Overall, the HEV Conversion Kit market is poised for growth as it offers a cost-effective and practical solution to the increasing demand for sustainable transportation infrastructure.

What challenges does the Hybrid Electric Vehicle Conversion Kit Industry face during its growth?

- The conversion of vehicles into hybrids presents significant challenges for the industry, particularly with regard to mile range and battery performance. These issues are crucial factors limiting the growth and widespread adoption of hybrid technology.

- The Hybrid Electric Vehicle (HEV) Conversion Kit Market is experiencing significant growth due to the increasing demand for eco-friendly transportation solutions. Motor configurations, including series and parallel hybrid systems, are utilized in these conversion kits to optimize fuel efficiency and reduce emissions. Control systems are essential for managing the interaction between the gasoline engine and electric motor, as well as the regenerative braking system. The market's growth is further propelled by the expanding charging infrastructure, with both private and public charging stations becoming more accessible. Grants and incentives offered by governments and organizations are also encouraging the adoption of PHEV conversion kits.

- Compatibility between various conversion kits and industry-wide standards is crucial to ensure seamless integration and scalability. However, challenges persist, such as battery performance and replacement costs. Although battery packs in converted hybrid vehicles come with a warranty, factors like charge cycles, depletion rate, charging and discharging durations, and humidity can impact battery life. Replacing a battery can cost over USD1,000. Despite these challenges, the market's growth is driven by the desire to reduce carbon emissions and the increasing availability of charging infrastructure.

Exclusive Customer Landscape

The hybrid electric vehicle conversion kit market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the hybrid electric vehicle conversion kit market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, hybrid electric vehicle conversion kit market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

XL Fleet Corp. - This company specializes in hybrid electric vehicle conversion solutions, including retrofit electric drive kits. These innovative kits enable the transformation of delivery vans with diesel engines into hybrid vehicles, capable of operating solely on electric power. By integrating advanced technology, we enhance fuel efficiency and reduce emissions, contributing to a more sustainable transportation sector. Our offerings prioritize originality, ensuring that clients benefit from cutting-edge solutions tailored to their unique requirements.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- XL Fleet Corp.

- EV West

- Electro Automotive

- Canadian Electric Vehicles Ltd.

- EV Source LLC

- Zero EV Ltd.

- Stealth EV

- EVDrive Inc.

- NetGain Motors Inc.

- HPEVS (High Performance Electric Vehicle Systems)

- A123 Systems LLC

- Eaton Corporation Plc

- Bosch Automotive Service Solutions Inc.

- Magna International Inc.

- Continental AG

- Denso Corporation

- Delphi Technologies

- Hitachi Automotive Systems Ltd.

- ZF Friedrichshafen AG

- BorgWarner Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Hybrid Electric Vehicle Conversion Kit Market

- In February 2024, Magna International, a leading automotive supplier, introduced its new Hybrid Electric Vehicle Conversion Kit, which enables the retrofitting of conventional internal combustion engine vehicles with hybrid electric technology. This innovative solution aims to reduce carbon emissions and improve fuel efficiency (Magna International Press Release, 2024).

- In July 2025, Caterpillar Inc., a major industrial machinery manufacturer, announced a strategic partnership with XL Fleet, a leading provider of vehicle electrification solutions. The collaboration focuses on integrating Caterpillar's engine technologies with XL Fleet's electric powertrains, expanding their hybrid electric vehicle conversion kit offerings to the construction and off-road industries (Caterpillar Inc. Press Release, 2025).

- In October 2024, GreenPower Motor Company, a leading manufacturer of electric buses and commercial vehicles, secured a significant investment of USD100 million from Sustainable Development Technology Canada. This funding will support the production of their EV Star and EV Star Cassia buses, as well as the development of their hybrid electric vehicle conversion kits for medium and heavy-duty commercial vehicles (GreenPower Motor Company Press Release, 2024).

- In March 2025, the European Union passed the Fit for 55 package, which includes new regulations to reduce greenhouse gas emissions from the transport sector. One of the measures is the Alternative Fuels Infrastructure Regulation, which aims to increase the deployment of alternative fuel infrastructure, including charging and hydrogen refueling stations. This initiative is expected to boost the demand for hybrid electric vehicle conversion kits in Europe (European Commission Press Release, 2025).

Research Analyst Overview

The hybrid electric vehicle conversion market encompasses various segments, including DIY hybrid conversion, municipal fleet electrification, and vintage car upgrades. This market is driven by green transportation initiatives and the future outlook of alternative fuel vehicles. Hybrid car customization extends to EV conversion boats, motorcycles, and off-road vehicles. Industry standards ensure safety and cost-effectiveness in the evolving EV industry. Zero-emission transportation solutions, such as sustainable mobility solutions and the evolving EV charging network, fuel the adoption of electric vehicles. The environmental impact of EVs and eco-friendly vehicle upgrades attract consumers, while hybrid EV retrofitting and DIY EV conversion offer affordable options.

PHEV conversion kits and standardized components enable commercial fleet electrification, addressing evolving business needs. EV technology advancements, including battery technology and conversion technology, continue to drive innovation. The evolving EV infrastructure development addresses range anxiety and supports the growth of renewable energy vehicles. Sustainable transportation solutions and the shift towards zero-emission transportation are key trends in the market. EV consumer behavior and safety standards continue to shape the industry, with conversion components and evolving EV conversion technology catering to diverse needs.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Hybrid Electric Vehicle Conversion Kit Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

159 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 15.85% |

|

Market growth 2024-2028 |

USD 536.27 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

15.43 |

|

Key countries |

US, China, Germany, Japan, UK, India, Canada, Brazil, UAE, Australia, Saudi Arabia, France, South Korea, Mexico, and The Netherlands |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Hybrid Electric Vehicle Conversion Kit Market Research and Growth Report?

- CAGR of the Hybrid Electric Vehicle Conversion Kit industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the hybrid electric vehicle conversion kit market growth of industry companies

We can help! Our analysts can customize this hybrid electric vehicle conversion kit market research report to meet your requirements.