Hydraulic Equipment For Mobile Applications Market Size 2024-2028

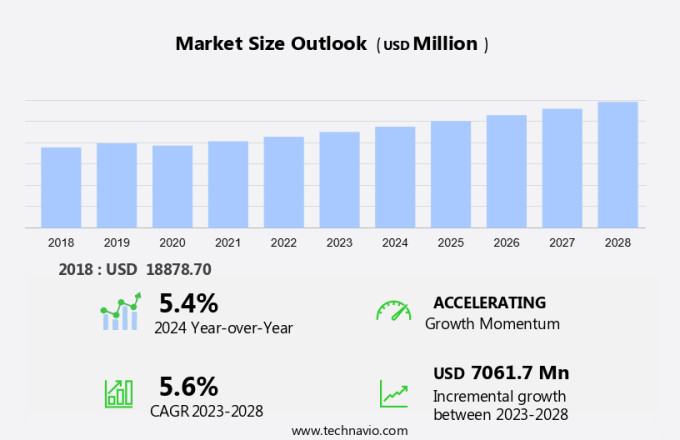

The hydraulic equipment for mobile applications market size is forecast to increase by USD 7.06 billion at a CAGR of 5.6% between 2023 and 2028.

- The hydraulic equipment market for mobile applications is experiencing significant growth, driven by several key trends. Increased government investment in infrastructure projects in North America is fueling the demand. Additionally, there is a rising adoption of eco-friendly hydraulic fluids to reduce the environmental impact of these systems. Manufacturers are focusing on developing oil-based hydraulic fluids with wear-resistant characteristics to enhance the durability of hydraulic pumps, electric motors, valves, and hydraulic cylinders. However, fluctuating raw material prices used in the production pose a challenge to market growth. Producers must balance the cost of raw materials with the need to maintain product quality and competitiveness. Overall, the market is expected to continue expanding due to these factors and the ongoing demand for mobile hydraulic equipment in various industries.

What will be the Size of the Hydraulic Equipment For Mobile Applications Market During the Forecast Period?

- The hydraulic equipment market for mobile applications In the United States continues to experience strong growth, driven by the increasing demand for fluid power solutions in various industries. Hydraulic systems, based on Pascal's Law, utilize incompressible liquids as a medium to transmit force and mechanical energy. The working principle relies on the pressure exerted on a confined liquid in a vessel, which in turn acts upon a piston or a hydraulic cylinder. Hydraulic equipment, including presses, lifts, cranes, brakes, and drive systems, are integral components of mobile machinery.

- Additionally, these applications leverage the advantages of hydraulic systems, such as high power output, accuracy, energy conservation, and ease of repair, particularly under high power conditions. Hydraulic tubes and pneumatic machines are essential components, with hydraulic fluids, such as brake fluid, playing a crucial role in ensuring efficient system performance. The physics behind hydraulic systems, including the Atwood machine, further enhances our understanding of the underlying principles that drive this market's continued success. The test series for hydraulic components ensures the highest standards of quality and reliability.

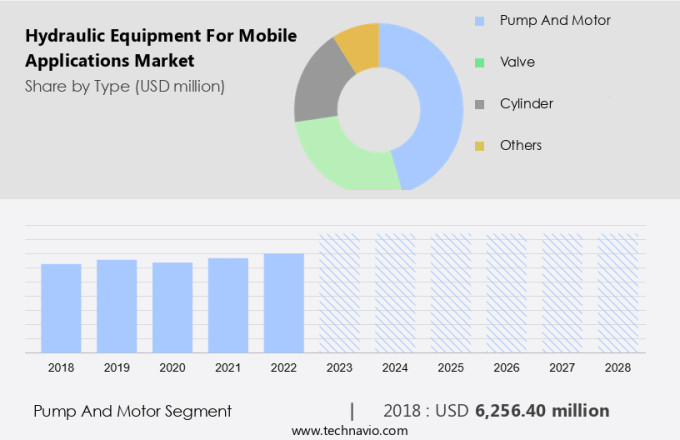

How is this Hydraulic Equipment For Mobile Applications Industry segmented and which is the largest segment?

The hydraulic equipment for mobile applications industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Pump and motor

- Valve

- Cylinder

- Others

- End-user

- Construction

- Agriculture

- Mining

- Material handling

- Others

- Geography

- APAC

- China

- India

- Japan

- South Korea

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Middle East and Africa

- South America

- Brazil

- APAC

By Type Insights

- The pump and motor segment is estimated to witness significant growth during the forecast period.

Mobile hydraulic equipment is essential for powering heavy machinery in various industries, such as construction, agriculture, mining, and material handling. Hydraulic pumps and motors are the primary components, converting mechanical energy into hydraulic energy and vice versa. Hydraulic pumps come in three categories: gear, vane, and piston. Gear pumps are known for their simplicity and durability, suitable for low-pressure tasks. Vane pumps offer efficient solutions for medium-pressure applications. Piston pumps excel in high-pressure, precision-demanding scenarios.

Additionally, hydraulic equipment includes hydraulic presses, lifts, cranes, brakes, and drives. Hydraulic presses apply force by using hydraulic energy, while hydraulic lifts and cranes lift heavy loads. Hydraulic brakes use hydraulic pressure to apply force, and brake fluid transmits this pressure. Fluid pressure and flow are crucial factors in selecting the appropriate hydraulic pump type. Hydraulic drives transmit mechanical force through hydraulic energy. In summary, hydraulic equipment plays a vital role in mobile applications, providing the necessary force and precision for heavy machinery operations.

Get a glance at the Hydraulic Equipment For Mobile Applications Industry report of share of various segments Request Free Sample

The pump and motor segment was valued at USD 6.26 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- APAC is estimated to contribute 40% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in Asia Pacific is experiencing significant growth due to the region's thriving economic activities, particularly in countries like China, India, and Australia. China is at the forefront of this growth, with its expanding construction and manufacturing sectors requiring hydraulic systems for various applications. In 2024, the Chinese government allocated a USD4 trillion budget, representing a 3.8% increase from the previous year.

Additionally, a substantial portion of this budget, USD 173 billion, was invested in transport infrastructure projects, while USD 19.6 billion was allocated for railway infrastructure projects In the Yangtze River Delta region. Shanghai also initiated 24 projects with a combined investment of USD 5 billion. Incompressible fluids, used as energy transfer mediums in hydraulic systems, are essential components In these applications. The demand in construction applications is driven by their ability to operate at high-pressure levels and provide thermal stability and chemical corrosion resistance.

Market Dynamics

Our market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Hydraulic Equipment For Mobile Applications Industry?

Increased government investment in infrastructure projects is the key driver of the market.

- The hydraulic equipment market for mobile applications experiences growth due to the increasing infrastructure development in various sectors such as transportation, energy, and utilities. This investment in infrastructure projects leads to a significant demand for mobile hydraulic machinery in construction and civil engineering. The principles of fluid power, including Pascal's law and fluid flow, are essential In the functioning of hydraulic systems. These systems utilize incompressible fluids, such as hydraulic fluids, as an energy transfer medium. Components like hydraulic pumps, electric motors, valves, hydraulic cylinders, and actuators, including rotary and linear actuators, convert mechanical energy into hydraulic energy. The advantages include energy conservation under high power conditions, accuracy, and ease of repair. Hydraulic equipment is used in various applications, such as hydraulic lifts, hydraulic cranes, hydraulic brakes, and power steering.

- Additionally, the hydraulic drive system, which includes gear pumps, ensures the smooth transfer of hydraulic energy. Hydraulic fluids, which are oil-based or fire-resistant, provide thermal stability, hydrolytic stability, and long lifespan with wear-resistant characteristics. The hydraulic system's components, including the reservoir, hydraulic pump, and hydraulic cylinder, work together to convert mechanical motion into linear or angular displacement, torque, or linear force. The system pressure is regulated to maintain optimal flow and pressure levels. Infrastructure development projects, such as the USD 1.8 billion investment by the Biden-Harris Administration through the RAISE program, contribute to the growth of the market for mobile applications. These projects require reliable and efficient hydraulic systems to ensure the successful completion of construction and civil engineering projects.

What are the market trends shaping the Hydraulic Equipment For Mobile Applications Industry?

The rising adoption of eco-friendly hydraulic fluids is the upcoming market trend.

- The hydraulic equipment market for mobile applications is driven by the widespread use of fluid power technology in various industries. Fluid power systems, which operate based on Pascal's law, utilize compressible and incompressible fluids, such as hydraulic fluids, to transmit mechanical energy. Hydraulic tubes carry pressurized fluids from the reservoir to the components, including pistons in hydraulic presses, hydraulic lifts, hydraulic cranes, hydraulic brakes, and pneumatic machines. Hydraulic systems offer advantages like accurate force and energy conservation under high power conditions. They are also easy to repair and maintain. The working principle of these systems involves the transfer of energy from an electric motor to hydraulic fluids, which then apply force through actuators like rotary and linear actuators.

- Additionally, the fluid pressure drives the dynamic components, such as hydraulic cylinders, to generate mechanical motion. Environmental concerns and regulations have led to the adoption of eco-friendly hydraulic fluids, which are biodegradable and derived from renewable resources. These fluids provide advantages like thermal stability, chemical corrosion resistance, hydrolytic stability, and a long lifespan with wear-resistant characteristics. Oil-based and fire-resistant hydraulic fluids are also widely used due to their high performance and safety benefits. Components of hydraulic systems include hydraulic pumps, valves, and hydraulic cylinders. Hydraulic energy is used in various applications, such as power steering, gear pumps, and hydraulic drives. The advantages of hydraulic systems include their ability to provide high torque and angular displacement with linear force, as well as precise flow regulation and system pressure control.

What challenges does the Hydraulic Equipment For Mobile Applications Industry face during its growth?

Fluctuating raw material prices used in hydraulic equipment production is a key challenge affecting the industry growth.

- The hydraulic equipment market for mobile applications relies heavily on fluid power technology, which operates based on Pascal's law, converting mechanical energy into fluid pressure. This market encompasses various applications, including hydraulic presses, lifts, cranes, brakes, and drive systems. The working principle involves the transfer of energy through pressurized liquids, such as incompressible fluids, within hydraulic tubes. Pneumatic machines serve as alternatives, but hydraulic systems offer advantages like accurate force and energy conservation, especially under high power conditions. Hydraulic components, such as pumps, valves, cylinders, and reservoirs, are essential parts of these systems.

- Additionally, hydraulic fluids, which function as energy transfer media, must exhibit thermal stability, chemical corrosion resistance, hydrolytic stability, and long lifespan. Fluctuating raw material prices, primarily for steel, aluminum, and hydraulic components, pose significant challenges for manufacturers. The World Bank forecasts a 2% increase in aluminum prices in 2024, followed by a 4% rise in 2025. These price fluctuations can significantly impact production costs, potentially leading to increased end-user prices or reduced producer profit margins. Trade policies, tariffs, and import/export restrictions further influence raw material prices, adding complexity to the market landscape.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry. The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Bosch Rexroth AG

- Bucher Hydraulics GmbH

- CASAPPA SpA

- Caterpillar Inc.

- Danfoss AS

- Eaton Corp plc

- Enerpac Tool Group Corp.

- HANNON HYDRUALICS LLC

- HAWE Hydraulik SE

- HYDAC International GmbH

- Kawasaki Heavy Industries Ltd.

- KYB Corp.

- Linde Hydraulics GmbH & Co. KG

- Moog Inc.

- Pacoma GmbH

- PARKER HANNIFIN CORP.

- SMC Corp.

- Texas Hydraulics Inc.

- WEBER HYDRAULIK GmbH

- Wipro Infrastructure Engineering

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Hydraulic equipment plays a pivotal role in powering various mobile applications, transforming mechanical energy into fluid pressure to generate force and motion. This equipment relies on the principles of fluid mechanics, specifically Pascal's Law, which states that an increase in pressure applied to an incompressible fluid in a confined space results in an equal increase in pressure applied to every part of the fluid's surface. The hydraulic system's primary components include vessels, hydraulic tubes, pumps, pistons, and cylinders. These components work together to transfer energy from an external power source, such as an electric motor, to the working components of the mobile application. The hydraulic pump, driven by the motor, pressurizes the incompressible fluid withIn the system. The fluid, under pressure, then flows through the hydraulic tubes to the cylinder, where it acts upon the piston, generating force. This force can be used to power a range of mobile applications, from hydraulic lifts and cranes to brakes and power steering systems. The advantages are numerous. Hydraulic systems offer accurate energy transfer, making them suitable for high power conditions. They are also easy to repair, as components can be replaced without disrupting the entire system.

Furthermore, hydraulic equipment is known for its energy conservation, as it only uses the energy required to generate the desired force and motion. Hydraulic fluids, the energy transfer medium withIn these systems, play a crucial role in ensuring the longevity and efficiency of the equipment. These fluids must exhibit thermal stability, chemical corrosion resistance, and hydrolytic stability to withstand the harsh operating conditions of mobile applications. Oil-based hydraulic fluids and fire-resistant hydraulic fluids are commonly used due to their wear-resistant characteristics and long lifespan. Dynamic components, such as rotary actuators and linear actuators, are essential in hydraulic systems. These components convert fluid pressure into mechanical motion, enabling the equipment to perform its intended functions. The actuators' torque, angular displacement, and linear force can be precisely controlled through flow regulation, ensuring system pressure remains consistent. The physics behind hydraulic equipment is intricately linked to fluid flow, pressure levels, and energy transfer. The principles of simple machines, such as the Atwood machine, can be applied to understand the mechanics of hydraulic systems.

However, it is important to note that perpetual motion, as described In the context of simple machines, is not achievable in real-world hydraulic systems. In summary, hydraulic equipment plays a vital role in powering mobile applications, converting mechanical energy into fluid pressure to generate force and motion. The system's components, including pumps, cylinders, and fluids, work together to transfer energy efficiently and accurately. The advantages of hydraulic equipment, such as energy conservation and ease of repair, make it a preferred choice for various mobile applications.

|

Hydraulic Equipment For Mobile Applications Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

219 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.6% |

|

Market growth 2024-2028 |

USD 7.06 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.4 |

|

Key countries |

US, China, Germany, India, France, Japan, Canada, UK, South Korea, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Hydraulic Equipment For Mobile Applications Market Research and Growth Report?

- CAGR of the Hydraulic Equipment For Mobile Applications industry during the forecast period

- Detailed information on factors that will drive the Hydraulic Equipment For Mobile Applications growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the hydraulic equipment for mobile applications market growth of industry companies

We can help! Our analysts can customize this hydraulic equipment for mobile applications market research report to meet your requirements.