Hydraulic Hose And Fittings Market Size 2025-2029

The hydraulic hose and fittings market size is forecast to increase by USD 581.3 million, at a CAGR of 4.7% between 2024 and 2029.

- The market is driven by the mechanization of agriculture and the growth in the agriculture machinery market. The increasing adoption of advanced farming equipment, such as tractors and harvesters, relies heavily on hydraulic systems for efficient operation. This trend is expected to fuel the demand for hydraulic hoses and fittings. Another significant driver is the expansion of unconventional exploration and production projects, particularly in the oil and gas industry. These projects often require specialized hydraulic equipment to drill and extract resources from challenging terrains. As a result, the demand for robust and reliable hydraulic hoses and fittings is on the rise.

- However, the market faces challenges due to the fluctuations in raw material prices of hydraulic hoses and fittings. The volatility in the prices of rubber, steel, and other essential raw materials can impact the profitability of hydraulic hose and fitting manufacturers. Additionally, stringent regulations regarding the safety and quality of hydraulic components can add to the manufacturing costs. Companies must navigate these challenges by implementing cost-effective production strategies and adhering to regulatory requirements to remain competitive in the market.

What will be the Size of the Hydraulic Hose And Fittings Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market exhibit a dynamic and evolving landscape, shaped by various factors. Hose systems play a crucial role in fluid power applications, powering diverse industries such as construction, agriculture, manufacturing, and transportation. Temperature ratings of hoses are a significant consideration, as they impact performance and safety in high-heat environments. Crawler cranes, for instance, require hoses capable of withstanding extreme temperatures. Hose routing is another critical factor, as efficient designs minimize pressure drops and prevent hose damage. Fluid power, the driving force behind numerous industrial processes, relies on hoses and fittings for efficient transmission of power. Hose clamps ensure secure connections, while hose repair services extend hose life.

Hose chemical resistance is essential for applications involving corrosive fluids. Mobile hydraulics, a key segment, demands lightweight, flexible hoses for optimal maneuverability. Hydraulic pumps, hose distribution networks, and hose testing are integral components of hydraulic systems, ensuring optimal performance and longevity. Hydraulic safety standards, hose material selection, hose maintenance, and hose replacement are ongoing concerns for hose manufacturers and end-users. Rubber hoses, nylon hoses, steel hoses, and Teflon hoses each offer unique advantages, necessitating careful consideration. Hydraulic systems' design, hose life analysis, and troubleshooting are continuous processes, requiring a deep understanding of hose dynamics. Hydraulic hoses' flexibility, abrasion resistance, and burst pressure ratings are essential factors influencing their selection.

Hydraulic valves, lubrication, hose reels, hose assemblies, hydraulic cylinders, hydraulic oil, and heavy-duty trucks are other applications where hydraulic hoses and fittings play essential roles. The market continues to unfold, with ongoing advancements in hose technology and evolving industry requirements shaping its future.

How is this Hydraulic Hose And Fittings Industry segmented?

The hydraulic hose and fittings industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Construction machinery

- Agricultural machinery

- Material handling machinery

- Others

- Distribution Channel

- Offline

- Online

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By End-user Insights

The construction machinery segment is estimated to witness significant growth during the forecast period.

The market cater to various industries, including construction equipment, manufacturing machinery, agriculture equipment, and heavy-duty trucks. Hydraulic hoses are essential components in these industries, ensuring efficient fluid power transmission in machinery such as hydraulic pumps, valves, cylinders, and motors. The market's growth is driven by the increasing demand for industrial hydraulics, with temperature ratings and pressure requirements varying depending on the application. Crawler cranes and mobile hydraulics, for instance, require high-performance hoses with excellent hose burst pressure and abrasion resistance. Hose routing and maintenance are crucial factors in ensuring hose longevity and safety. Hose clamps, repair services, and certification play a significant role in maintaining hose integrity.

Hose material, such as rubber, nylon, and steel, influences hose flexibility, chemical resistance, and hose flow rate. Hose testing and safety standards ensure hose performance and reliability. Hose manufacturers focus on producing hoses with improved hose design, burst pressure, and flexibility to meet the evolving demands of various industries. Hydraulic systems' overall efficiency relies on the proper functioning of hoses and fittings. Hose reels, assemblies, and distribution networks facilitate seamless hose implementation and replacement. Hydraulic oil and lubrication are essential for maintaining hose performance and longevity. The construction industry's growth, driven by infrastructure development and increasing demand for residential, commercial, and industrial projects, fuels the market's expansion.

Agriculture and manufacturing sectors also contribute significantly to the market's growth due to their reliance on heavy machinery and hydraulic systems. In conclusion, the market's growth is influenced by various factors, including the increasing demand for industrial hydraulics, hose material properties, hose design, and safety standards. The market's continuous evolution reflects the industries' growing reliance on hydraulic systems for efficient and reliable machinery operations.

The Construction machinery segment was valued at USD 645.10 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

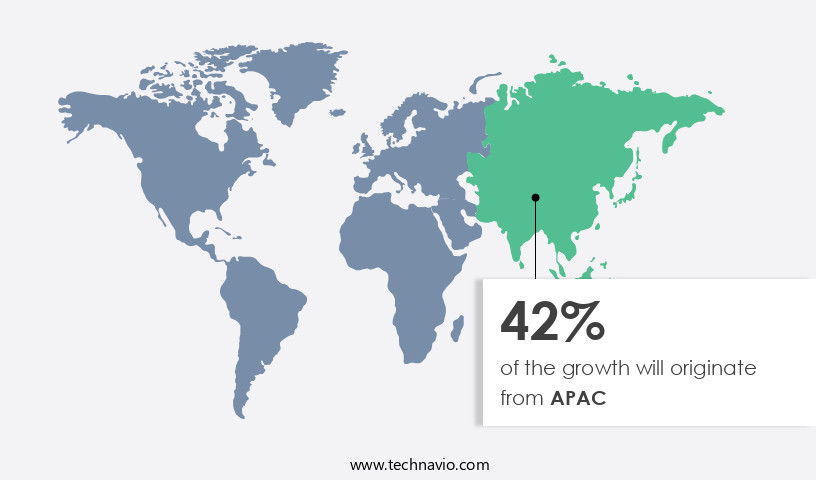

APAC is estimated to contribute 42% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in Asia Pacific is experiencing significant growth due to the region's rapid industrialization and urbanization. Key countries, including China, India, and Japan, are driving market expansion in response to increasing investments in construction, agriculture, and automotive industries. The expanding middle class population in these nations is fueling demand for heavy-duty machinery and equipment, which rely on hydraulic systems for optimal performance. Additionally, countries such as Thailand, South Korea, and Indonesia are emerging as significant markets due to their high number of construction projects. Hose manufacturers are focusing on producing hoses with superior temperature ratings, chemical resistance, and flexibility to cater to the diverse requirements of various industries.

Hose clamps, repair services, and certification are essential components of the market, ensuring safety and reliability in hydraulic systems. Mobile hydraulics, hose distribution, and hose reels are also gaining popularity due to their convenience and efficiency. Hydraulic pumps, valves, motors, and actuators are integral components of hydraulic systems, and their demand is expected to remain strong. Hose maintenance, replacement, and lubrication are crucial for prolonging hose life and ensuring optimal system performance. Hose assemblies, made from materials like rubber, nylon, and steel, cater to various industries' unique requirements. Hydraulic hoses and fittings are essential for heavy-duty machinery, including crawler cranes, construction equipment, and agriculture machinery, and their demand is expected to remain robust in the foreseeable future.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Hydraulic Hose And Fittings Industry?

- The mechanization of agriculture, characterized by the expansion of agriculture machinery markets, serves as a primary catalyst for market growth.

- The global market for hydraulic hoses and fittings is experiencing significant growth due to the increasing demand for mechanized agriculture and manufacturing machinery. Hydraulic systems are essential components in these applications, powering various equipment such as hydraulic motors, hydraulic filters, hydraulic actuators, and hydraulic hoses. The longevity of these systems relies on the quality and performance of the hydraulic hoses. Hose flexibility and abrasion resistance are crucial factors in ensuring hose life. Hose troubleshooting and failure analysis are essential to maintain optimal hydraulic system performance and prevent costly downtime. Hose certification is also vital to ensure safety and reliability in various industries, including agriculture and manufacturing.

- The increasing demand for food production globally necessitates the use of mechanized agriculture, which relies heavily on hydraulic systems. The implementation of these systems can significantly influence the total factor productivity (TFP) in agriculture, leading to increased productivity and efficiency. Similarly, in manufacturing industries, hydraulic systems enable the operation of heavy machinery and equipment, contributing to increased productivity and output. In conclusion, the market for hydraulic hoses and fittings is expected to grow due to the increasing demand for mechanized agriculture and manufacturing machinery. The importance of hose flexibility, abrasion resistance, hose life, hose certification, and hose troubleshooting cannot be overstated in ensuring optimal hydraulic system performance and preventing costly downtime.

- The implementation of hydraulic systems in agriculture and manufacturing can significantly influence productivity and output, making them indispensable components in these industries.

What are the market trends shaping the Hydraulic Hose And Fittings Industry?

- Unconventional exploration and production projects are experiencing significant growth, representing the latest market trend in the energy sector. This trend reflects the industry's ongoing efforts to innovate and adapt to new challenges and opportunities.

- The market is experiencing significant growth due to the increasing demand for fluid power systems in various industries, including construction and manufacturing. Temperature ratings and chemical resistance are crucial factors in selecting hydraulic hoses and fittings for diverse applications. In mobile hydraulics, hose routing and hose flow rate are essential considerations. Hose repair services and hose clamps are vital for maintaining the functionality and longevity of hydraulic systems. The market is driven by the rising use of hydraulic pumps and the growing popularity of crawler cranes. The development of unconventional resources, such as tight oil and shale gas, has further fueled market growth.

- Deep-water and ultra-deep-water projects, particularly in regions like Brazil and the Gulf of Mexico, are increasing due to the presence of large oil reservoirs. Hose distribution is a significant aspect of the market, ensuring the availability of high-quality hoses and fittings for various industries. Hose testing is essential to ensure the safety and efficiency of hydraulic systems. Overall, the market is expected to continue its growth trajectory, driven by the increasing demand for hydraulic systems in various industries.

What challenges does the Hydraulic Hose And Fittings Industry face during its growth?

- The hydraulic hoses and fittings industry faces significant challenges due to the volatile pricing of raw materials, which can negatively impact industry growth.

- The market is influenced by the price fluctuations of raw materials, primarily rubber and steel. The global rubber market experiences demand-supply imbalances, leading to significant price variations. These price changes impact production costs and erode companies' profit margins in the hydraulic hose and fittings industry. Steel, another essential raw material, also influences market dynamics. The hydraulic systems rely on hoses and fittings made from these materials, ensuring hose safety standards are met. Hose material selection depends on various factors, including hose burst pressure, hydraulic lubrication, hose maintenance, and hose replacement requirements.

- Hose retailers and wholesalers play a crucial role in the market, ensuring the availability of high-quality hoses and fittings. Despite these challenges, the market continues to grow, driven by the increasing demand for hydraulic systems in various industries.

Exclusive Customer Landscape

The hydraulic hose and fittings market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the hydraulic hose and fittings market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, hydraulic hose and fittings market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AB Volvo - The company specializes in providing high-performance hydraulic hoses and fittings, including the Volvo VOE series. These hydraulic solutions ensure long-term leak-free performance, enhancing operational efficiency and reliability. Our product range caters to diverse industries, delivering superior quality and durability. The Volvo VOE series hoses, in particular, are renowned for their resistance to abrasion, pressure, and temperature extremes. By implementing advanced manufacturing processes and utilizing top-tier materials, we ensure our hydraulic hoses and fittings meet the highest industry standards. Our commitment to innovation and excellence drives us to continually improve our offerings, providing our clients with unparalleled value and peace of mind.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AB Volvo

- Bailey International LLC

- Bridgestone Corp.

- Caterpillar Inc.

- Continental AG

- Dyna Flex Inc

- Eaton Corp.

- Emerson Electric Co.

- Enerpac Tool Group Corp.

- Gates Industrial Corp. Plc

- Komatsu Ltd.

- Kurt Manufacturing Co

- Manuli Hydraulics Group

- Nitta Industries Europe GmbH

- NRP Jones

- Parker Hannifin Corp.

- RYCO Hydraulics Pty Ltd.

- Transfer Oil Spa

- Wipro Ltd.

- Yokohama Rubber Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Hydraulic Hose And Fittings Market

- In March 2024, Parker Hannifin Corporation, a leading hydraulic hose and fittings manufacturer, announced the launch of its new line of high-pressure hoses, the Hannifin HyDraulic X-tra series. These hoses offer increased durability and resistance to abrasion, making them suitable for heavy-duty industrial applications (Parker Hannifin Corporation, 2024).

- In June 2025, Eaton Corporation, another significant player in the market, entered into a strategic partnership with Bosch Rexroth to expand their joint hydraulic components product offerings. This collaboration aims to strengthen their market position by providing a more comprehensive range of hydraulic solutions to their customers (Eaton Corporation, 2025).

- In October 2024, Samson AG, a German hydraulic hose manufacturer, completed the acquisition of Hosemaster, a UK-based hose assembly specialist. This acquisition is expected to enhance Samson's market presence in Europe and expand its hose assembly capabilities (Samson AG, 2024).

- In January 2025, the European Union (EU) introduced new regulations for hydraulic hoses and fittings, requiring them to meet stricter safety and environmental standards. These regulations aim to reduce the risk of hydraulic hose failures and minimize the environmental impact of hydraulic fluids (European Union, 2025).

Research Analyst Overview

- The market encompasses a range of components essential to hydraulic system design and functionality. Hydraulic system efficiency is a critical factor driving market growth, with the integration of hydraulic system automation and optimization playing a significant role. Flange fittings, o-ring fittings, quick disconnect fittings, and hose end fittings are key components in this regard, ensuring seamless connections and minimal leakage. Hose inspection, wear indicators, and testing equipment are crucial for maintaining hydraulic system reliability. Hose replacement guidelines and safety measures are also vital in preventing system failures. Hydraulic component selection involves considering factors such as pressure, temperature, and application-specific requirements.

- High-pressure hoses, medium-pressure hoses, and low-pressure hoses are available in various materials, including synthetic and wire braid options. Hose repair kits and crimping machines are essential tools for on-site maintenance. Hydraulic fluid analysis is another crucial aspect of system maintenance, ensuring optimal performance and longevity. Hose swaging machines and spiral hoses are essential for high-pressure applications, while hose maintenance procedures are vital for prolonging the life of hydraulic systems. Synthetic hoses and braided hoses offer advantages in terms of flexibility, durability, and resistance to various environmental conditions. Market trends include the development of advanced hose materials and the increasing adoption of hydraulic system integration to improve overall system performance and efficiency.

- Hydraulic system troubleshooting and safety remain top priorities for businesses to minimize downtime and ensure the safe operation of their systems.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Hydraulic Hose And Fittings Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

209 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.7% |

|

Market growth 2025-2029 |

USD 581.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.4 |

|

Key countries |

US, China, Germany, Japan, Canada, India, France, UK, UAE, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Hydraulic Hose And Fittings Market Research and Growth Report?

- CAGR of the Hydraulic Hose And Fittings industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the hydraulic hose and fittings market growth of industry companies

We can help! Our analysts can customize this hydraulic hose and fittings market research report to meet your requirements.