Indonesia System Integration Market Size 2025-2029

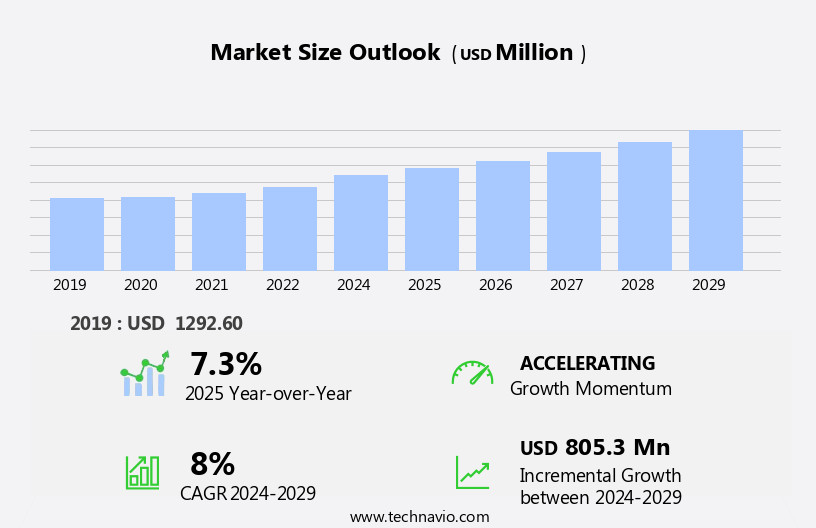

The Indonesia system integration market size is forecast to increase by USD 805.3 million at a CAGR of 8% between 2024 and 2029.

- The System Integration Market is experiencing significant growth, driven by the exponential increase in data generation resulting from the widespread adoption of Internet of Things (IoT) devices. This data deluge necessitates seamless integration of various systems to ensure efficient data flow and processing. Furthermore, the emergence of Industry 4.0 and digitalization in various industries is fueling the demand for system integration solutions. However, the market faces challenges, including regulatory hurdles impacting adoption and supply chain inconsistencies that temper growth potential. Despite these obstacles, substantial investments are required for implementing and maintaining system integration solutions to capitalize on the market opportunities.

- Companies seeking to navigate these challenges effectively and capitalize on market opportunities should focus on offering flexible, scalable, and cost-effective system integration solutions while ensuring regulatory compliance and addressing supply chain inconsistencies. By doing so, they can differentiate themselves and capture a larger market share in the dynamic and evolving system integration landscape. Cloud integration, including hybrid cloud solutions, is a significant trend, as businesses seek to leverage the benefits of cloud computing while maintaining control over their data and applications.

What will be the size of the Indonesia System Integration Market during the forecast period?

- The system integration market is characterized by the adoption of advanced technologies and solutions to address integration challenges in today's complex business landscapes. Data integration platforms enable seamless data flow between systems, while workflow automation streamlines business processes. Integration governance ensures compliance and consistency, and service-oriented architecture (SOA) facilitates modular and flexible system design. Integration monitoring and security are critical components, mitigating risks and safeguarding data. Integration best practices and frameworks, such as data modeling and business process modeling, promote efficient integration. Big data and cloud computing have fueled the demand for integration tools and providers, offering scalable and cost-effective solutions.

- Hybrid integration platforms, integration services, and API management cater to diverse integration needs. Integration optimization strategies, testing, and integration roadmaps ensure continuous improvement and alignment with business goals. Data visualization and analytics platforms provide valuable insights, enhancing decision-making capabilities. Cloud integration platforms and integration partners collaborate to deliver comprehensive integration solutions, addressing the intricacies of modern integration landscapes. Integration solutions cater to various industries and use cases, with integration services and consulting offering expert guidance. Despite these advancements, integration remains a complex endeavor, requiring careful planning and execution.

How is this market segmented?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Service Type

- Infrastructure integration services

- System integration consulting services

- ALM and application integration services

- End-user

- BFSI

- Government

- Telecom

- Retail

- Others

- Customer Type

- Large enterprises

- Small and medium enterprises

- Geography

- APAC

- Indonesia

- APAC

By Service Type Insights

The infrastructure integration services segment is estimated to witness significant growth during the forecast period.

The infrastructure integration market is experiencing significant growth as businesses across various industries modernize their IT systems to accommodate emerging technologies. Digital transformation initiatives, including cloud computing, big data analytics, IoT, and artificial intelligence, are driving the demand for infrastructure integration services. These services facilitate the seamless integration of new technologies with existing hardware, software, networks, and systems, ensuring compatibility, scalability, and performance optimization. Data governance and management play crucial roles in this process, as businesses prioritize data quality and security during digital transformations. Agile development and change management practices are also essential for successful infrastructure integration projects.

Furthermore, managed services, machine learning, and AI are increasingly being integrated into infrastructure to enhance efficiency and productivity. Cost reduction and process optimization are significant benefits of infrastructure integration, making it an attractive solution for businesses looking to streamline their IT operations. Network management, project management, and data analytics are integral components of infrastructure integration, as businesses seek to gain insights from their data and optimize their IT infrastructure for the digital age. Data warehousing, data migration, and data center strategies are also key considerations for businesses undergoing infrastructure integration.

Legacy systems and enterprise applications require specialized attention during infrastructure integration, as businesses seek to ensure continuity and compatibility with new technologies. Business intelligence and IT infrastructure are also essential elements of infrastructure integration, as businesses seek to gain insights from their data and optimize their IT operations for the future.

Get a glance at the market share of various segments Request Free Sample

The Infrastructure integration services segment was valued at USD 622.40 million in 2019 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of System Integration in Indonesia Industry?

- The exponential growth in data generation, primarily driven by the increasing utilization of Internet of Things (IoT) devices, is a significant market trend. The System Integration Market is experiencing significant growth due to the increasing need for process optimization and data integration in the face of expanding enterprise applications and business intelligence (BI) requirements. IoT proliferation is a key driver, as businesses seek to manage, analyze, and derive insights from the vast volumes of data generated by IoT devices. In Indonesia, for instance, the deployment of IoT sensors and devices in smart city initiatives has created a demand for system integration services. These solutions enable the integration of diverse data sources into a unified platform, streamlining city management and decision-making processes.

- IoT applications extend beyond smart cities, influencing various industries such as manufacturing, healthcare, and logistics, further fueling the demand for system integration services. As IT infrastructure evolves, edge computing is gaining traction, necessitating seamless integration of edge devices with enterprise systems. System integration plays a crucial role in ensuring the efficient and effective operation of enterprise applications and BI tools, making it an essential component of modern IT strategies.

What are the market trends shaping the System Integration in Indonesia Industry?

- Industry 4.0 and digitalization are becoming the dominant trends in various sectors, marking the emergence of a new era in manufacturing and business processes. This shift towards advanced technology integration is mandatory for staying competitive in today's market. The market is witnessing substantial growth due to the digitalization trend across various industries, including manufacturing, logistics, energy, and BFSI. The emergence of Industry 4.0, characterized by advanced technologies like IoT, AI, big data analytics, and automation, is driving the demand for system integration services. Manufacturers are adopting smart factory solutions that necessitate the integration of cyber-physical systems to optimize production processes, monitor machine performance, and enable predictive maintenance. Businesses are also focusing on data management and business intelligence (BI) to gain insights from their data and make informed decisions. Data warehousing, data migration, and machine learning (ML) are essential components of this digital transformation journey.

- Software licensing and managed services are becoming increasingly popular as businesses seek to minimize IT infrastructure costs and focus on core competencies. System integration plays a crucial role in connecting and orchestrating diverse technologies, processes, and data effectively, thereby facilitating business transformation. The market dynamics are influenced by factors such as the increasing adoption of cloud-based solutions, the growing importance of data security, and the need for interoperability between different systems and applications.

What challenges does the System Integration in Indonesia Industry face during its growth?

- The significant investment required for implementing and maintaining system integrations poses a substantial challenge to the industry's growth trajectory. System integration is a significant investment for businesses and organizations, requiring strategic planning and financial commitment to streamline and optimize operations. The integration of various systems, such as cloud, hardware, and software, involves network management, change management, and systems analysis. The cost of system integration can range from USD 50,000 to millions of dollars, depending on the type of integration, features, and support quality. For instance, API integration can cost between USD 50,000 and USD 150,000 per year, including personnel and partnership fees. SaaS platforms offer subscription packages for API integration services, with monthly costs ranging from USD 50 to a few thousand dollars.

- Agile development and process optimization are essential components of system integration, leading to improved productivity and efficiency. Additionally, edge computing plays a crucial role in integrating data processing at the source, reducing latency and increasing security. Overall, system integration is a critical investment for businesses seeking to stay competitive in today's digital landscape. Such factors will hinder the growth of the market forecast report.

Exclusive Customer Landscape

The system integration market in Indonesia forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the system integration market in Indonesia report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, system integration market in Indonesia forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Adventus Pte Ltd. - The company offers system integration solutions such as Hybrid Cloud Integration, Cybersecurity Integration, and Unified Communications Solutions.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Adventus Pte Ltd.

- Alita.id

- Amazon.com Inc.

- GITS Indonesia

- HCL Technologies Ltd.

- Kemana

- Kitameraki

- Nocola IoT Solution

- NTT DATA Corp.

- PACKET SYSTEMS

- PT Autojaya Idetech and PT Solusi Periferal

- PT Hager Electro Indonesia

- PT Sysnesia Teknologi Semesta

- PT XVAutomation Indonesia

- PT. Delta Solusi Nusantara

- PT. IIJ Global Solutions Indonesia

- PT. Infosys Solusi Terpadu

- PT. MAGNA SOLUSI Indonesia

- PT. Network Data Sistem

- Zettagrid

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in System Integration Market In Indonesia

- In February 2024, Schneider Electric, a global leader in energy management and automation, announced the launch of its Open EcoStruxure IoT-enabled system integration solution, enabling interoperability between various industrial IoT applications and systems (Schneider Electric Press Release, 2024). This development signified a significant technological advancement in the system integration market, facilitating seamless data exchange and improved operational efficiency for industrial clients.

- In June 2025, Honeywell International and Microsoft Corporation unveiled a strategic partnership to integrate Microsoft Azure IoT and Honeywell's Forge platform, offering advanced industrial IoT solutions to clients (Microsoft News Center, 2025). This collaboration represented a major strategic move, combining Microsoft's cloud capabilities with Honeywell's expertise in industrial automation and control systems.

- In September 2024, Siemens AG completed the acquisition of Sensia, a leading system integrator in the process automation industry, expanding its presence in the system integration market (Siemens AG Press Release, 2024). This acquisition brought Siemens approximately 2,500 new employees and strengthened its ability to provide end-to-end solutions for industrial clients.

- In November 2025, the European Union published the European Green Deal, a comprehensive plan to make Europe carbon neutral by 2050, which included significant investments in digitalization and system integration for industrial processes (European Commission, 2020). This initiative represented a key regulatory approval and government initiative, creating a substantial market opportunity for system integration solutions in the European industrial sector.

Research Analyst Overview

The system integration market continues to evolve, driven by the ever-changing landscape of technology and business needs. Data warehousing and business intelligence (BI) solutions are increasingly being integrated with machine learning (ML) and data management systems to optimize data analytics and improve productivity. Business transformation initiatives require seamless integration of software licensing, data migration, and managed services, enabling organizations to adapt to the digital age. Cloud integration, change management, and network management play crucial roles in ensuring the successful implementation of these solutions. Agile development and process optimization are essential components of modern system integration projects, leading to increased efficiency and cost reduction.

Edge computing and hybrid cloud solutions are gaining traction, requiring new approaches to data center management and security integration. Artificial intelligence (AI) and legacy systems are being integrated to enhance business capabilities and improve data quality. The StartFragment System Integration Market in Indonesia is expanding, driven by increasing demand for efficient IT solutions. Businesses rely on market research and growth strategies, supported by comprehensive market research reports, to understand industry trends. Accurate market growth and forecasting and market forecasting aid organizations in decision-making, ensuring they align with evolving technologies. Regular market report and precise market forecasts highlight new opportunities in integration.

The sector demands strategic hardware procurement and meticulous requirements gathering to support robust systems. Companies invest in analytics platforms for data-driven insights, collaborating with leading integration providers to refine integration strategies and mitigate integration risks. Ensuring integration security is crucial to protecting enterprise data, alongside rigorous integration testing for reliability. With the rise of cloud technology, businesses adopt cloud integration platforms alongside data integration platforms to enhance connectivity. The growing preference for hybrid integration platforms balances flexibility and efficiency, while enterprises increasingly leverage enterprise integration platforms for operational scalability. A well-structured integration architecture supports seamless workflows, backed by a standardized integration framework to maintain consistency. The development of an effective integration blueprint provides a foundation for future improvements, ensuring long-term adaptability through a clear integration roadmap. As Indonesia's market advances, system integration remains a critical enabler of digital transformation.

EndFragment

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled System Integration Market in Indonesia insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

174 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8% |

|

Market growth 2025-2029 |

USD 805.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.3 |

|

Key countries |

Indonesia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this System Integration Market in Indonesia Research and Growth Report?

- CAGR of the System Integration in Indonesia industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Indonesia

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the system integration market in Indonesia growth of industry companies

We can help! Our analysts can customize this system integration market in Indonesia research report to meet your requirements.