Induced Pluripotent Stem Cells Production Market Size 2024-2028

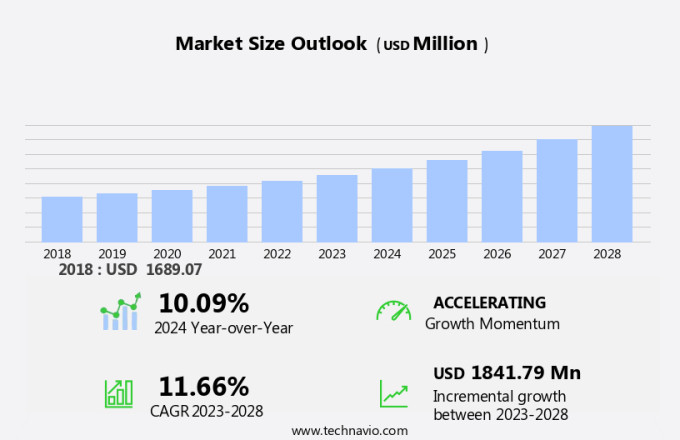

The induced pluripotent stem cells production market size is forecast to increase by USD 1.84 billion at a CAGR of 11.66% between 2023 and 2028.

- Induced pluripotent stem cells (iPSCs) have emerged as a promising solution in the biotechnology industry for the production of various cell types, including hepatocytes, fibroblasts, and keratinocytes, for therapeutic applications. The market for iPSCs is experiencing significant growth due to the increasing prevalence of chronic disorders and the advancements in cell characterization and engineering techniques.

- However, the high costs associated with cell reprogramming remain a challenge for the market. Hospitals and clinics are increasingly adopting iPSCs for disease modeling, drug discovery, and cell therapy. The production of iPSCs involves the reprogramming of adult cells, such as fibroblasts, into pluripotent cells, which have the ability to differentiate into any cell type in the body.

What will be the Induced Pluripotent Stem Cells Production Market Size During the Forecast Period?

- Induced pluripotent stem cells (iPSCs) are a type of pluripotent stem cells that can be generated from adult cells, such as skin or blood cells, through a reprogramming process. This innovative technology has gained significant attention in the scientific community due to its potential applications in various fields, including regenerative medicine, drug discovery, and toxicology studies. The iPSCs production market has witnessed substantial growth in recent years, driven by the increasing demand for alternative sources of pluripotent stem cells to embryonic stem cells. IPSCs offer several advantages, including ethical considerations, reduced immunogenicity, and the ability to generate cells from a patient's own tissue. Automated platforms and consumables and kits are essential components of iPSCs production.

- The market for these technologies is expected to grow significantly due to the increasing demand for iPSCs and the need for standardization and automation in stem cell research. Toxicology studies represent a significant application area for iPSCs. These studies involve the use of iPSCs-derived cells, such as hepatocytes, fibroblasts, keratinocytes, neurons, and others, to assess the safety and efficacy of drugs and chemicals. The ability of iPSCs to differentiate into various cell types that closely mimic human cells makes them an ideal model system for toxicity testing. The increasing number of clinical trials and animal models using iPSCs is expected to drive the growth of the iPSCs production market.

- In conclusion, the iPSCs production market is poised for significant growth due to the increasing demand for alternative sources of pluripotent stem cells and the potential applications of iPSCs in various fields, including regenerative medicine, drug discovery, and toxicology studies. The market for automated platforms and consumables and kits is expected to grow significantly due to the need for standardization and automation in stem cell research. The ability of iPSCs to differentiate into various cell types makes them an ideal model system for toxicity testing and a promising source of cells for cell therapy applications.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Hospitals

- Research institutes

- Biotechnology companies

- Others

- Product

- Consumable and kits

- Instrument

- Services and others

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- Asia

- China

- Rest of World (ROW)

- North America

By End-user Insights

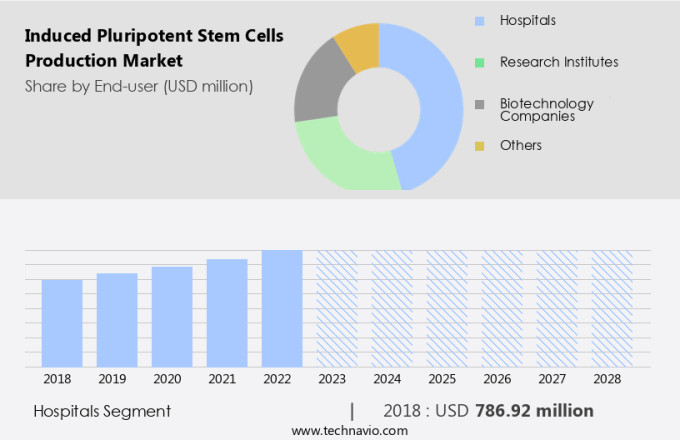

- The hospitals segment is estimated to witness significant growth during the forecast period.

In the United States, hospitals serve as a significant customer base for the Induced Pluripotent Stem Cells (iPSCs) production market. IPSCs are utilized extensively in hospitals for various applications in the fields of regenerative medicine, drug development, and tissue engineering. Neurological disorders, cardiovascular diseases, and genetic conditions are among the many disease areas where iPSCs and iPSC-derived therapies are being explored for innovative treatment options. These personalized treatments cater to the unique genetic makeup and disease characteristics of individual patients, thereby revolutionizing healthcare. Hospitals are instrumental in translating iPSC-based therapies into clinical applications through conducting clinical studies and offering advanced treatments to patients.

This clinical translation process is expected to fuel the growth of the hospitals segment within the US iPSCs production market.

Get a glance at the market report of share of various segments Request Free Sample

The Hospitals segment was valued at USD 786.92 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- North America is estimated to contribute 34% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In North America, the market for Induced Pluripotent Stem Cells (iPSCs) production holds a significant share due to the presence of prominent players such as Fate Therapeutics Inc. And Applied StemCell. These companies offer a comprehensive range of analytical testing services to biopharmaceutical companies, aiding them in various stages of drug discovery, development, and manufacturing. According to the Centers for Disease Control and Prevention (CDC), cancer and heart disease are leading causes of death in the US, with over 500,000 and 610,000 fatalities, respectively, each year. Biopharmaceutical companies are continually seeking innovative treatments for diseases with limited options. These potential therapies must undergo rigorous testing to meet regulatory requirements, ensuring safety, efficacy, and quality.

IPSCs, derived from adult cells, offer a promising avenue for stem cell-based therapies and regenerative medicine, including cell therapy. Automated platforms, consumables, and kits are essential tools for the production and manipulation of iPSCs. The demand for these technologies is increasing due to their potential to revolutionize oncology and other fields in healthcare. Biopharmaceutical companies rely on these solutions to advance their research and development efforts, ultimately bringing new treatments to the market. The iPSCs production market is poised for growth as the demand for advanced testing solutions continues to rise.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Induced Pluripotent Stem Cells Production Market?

Rising prevalence of several chronic disorders is the key driver of the market.

- In the realm of healthcare and life sciences, chronic diseases such as cardiovascular disorders, neurodegenerative conditions, and diabetes continue to pose significant challenges. These conditions, which include cardiovascular diseases (CVDs), cancer, chronic obstructive pulmonary disease, and type 2 diabetes, are predominantly caused by factors such as high blood pressure, high cholesterol levels, overweight, physical inactivity, unhealthy diet, and tobacco use. The global prevalence of these diseases has risen due to changing lifestyle patterns. Induced Pluripotent Stem Cells (iPSCs) have emerged as a promising solution for disease modeling, drug discovery, and cell-based therapies. Researchers can generate patient-specific cell models using iPSCs, enabling the development of personalized treatments tailored to individual disease profiles.

Toxicology studies play a crucial role in ensuring the safety and efficacy of these innovative therapies. Clinical trials using animal models are underway to assess the potential of iPSCs in disease intervention. Fate Therapeutics, a leading company in the field, is at the forefront of this research. This advancement in healthcare holds immense potential for improving patient outcomes and addressing the global burden of chronic diseases.

What are the market trends shaping the Induced Pluripotent Stem Cells Production Market?

Advancements in cell reprogramming techniques is the upcoming trend in the market.

- The global market for Induced Pluripotent Stem Cells (iPSCs) production is experiencing significant growth due to advancements in cell characterization and engineering techniques. These innovations enable the transformation of adult cells, such as fibroblasts and keratinocytes, into iPSCs, which can differentiate into various cell types, including hepatocytes. This development has accelerated the use of iPSCs in research and therapeutic applications, including drug discovery and regenerative medicine. Key players in the biotechnology industry, like Cellular Dynamics International (CDI), a subsidiary of FUJIFILM Corporation, have contributed significantly to the field by producing human iPSC-derived cells and tissues for numerous applications. The availability of reliable and efficient methods for iPSCs production is expected to further fuel market growth.

What challenges does Induced Pluripotent Stem Cells Production Market face during the growth?

High costs associated with reprogramming of cells is a key challenge affecting the market growth.

- Producing Induced Pluripotent Stem Cells (iPSCs) from adult cells is a complex process that involves several intricate steps, such as introducing reprogramming factors, maintaining cell culture, and implementing quality control assessments. These procedures necessitate the use of specialized equipment, reagents, and expertise, leading to substantial expenses. Furthermore, stringent quality control measures are essential to ensure the genetic stability and safety of iPSC-derived cells, which adds to the overall cost. Consequently, researchers, academic institutions, and biotechnology companies face significant financial hurdles in establishing and operating iPSC production facilities and executing large-scale reprogramming projects. The estimated cost of producing iPSCs in a dedicated academic facility using the current transfection method is around USD 15,000.

This financial barrier can be mitigated by employing advanced reprogramming methods, such as the Mantarray platform, which utilizes non-viral reprogramming techniques, reducing the risk of chromosomal and genetic instability associated with retroviruses. By adopting innovative approaches, the cost of iPSC production can be optimized while maintaining the highest standards of safety and quality.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Allele Biotechnology and Pharmaceuticals Inc.

- ALSTEM

- Applied Biological Materials Inc.

- Applied StemCell

- ATCC

- Axol Biosciences Ltd.

- Becton Dickinson and Co.

- Bio Techne Corp.

- Board of Regents of the University of Wisconsin System

- Creative Biolabs

- Cyagen Biosciences

- Cynata Therapeutics Ltd.

- Evotec SE

- Fate Therapeutics Inc.

- FUJIFILM Corp.

- Hitachi Ltd.

- LIFE and BRAIN GmbH

- Lonza Group Ltd.

- Ncardia Services B.V.

- REPROCELL Inc.

- Sartorius AG

- STEMCELL Technologies Inc.

- Takara Bio Inc.

- Thermo Fisher Scientific Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Induced pluripotent stem cells (iPSCs) have revolutionized the field of regenerative medicine and cell therapy. These cells, derived from somatic cells, can be reprogrammed to a pluripotent state, enabling them to differentiate into various cell types, including hepatocytes, fibroblasts, keratinocytes, neurons, and more. IPSCs hold immense potential for disease intervention, particularly in areas such as oncology and cancer research, where they can be used for toxicology studies, drug development, and clinical trials. The production of iPSCs involves several stages, including cell culture, cell characterization, and engineering. Various reprogramming methods, such as the use of retroviruses, have been employed, although concerns regarding chromosomal and genetic instability persist.

Automated platforms and consumables and kits have streamlined the production process, making it more efficient and cost-effective. IPSCs have applications in various healthcare and life sciences sectors, including hospitals and clinics. They have shown promise in the treatment of psychiatric diseases, wound healing, and type 2 diabetes. Research collaborations and license agreements have been crucial in advancing the field, with government funding playing a significant role. Ethical concerns surrounding the use of iPSCs continue to be a topic of debate. In the mesoderm subgroup, iPSCs have shown potential in the regeneration of ischemic tissues, including blood vessels. The Mantarray platform, a novel technology for the production of iPSCs, has gained attention for its ability to generate high-quality cells.

The future of iPSCs lies in their ability to provide personalized medicines and contribute to the development of car-T cell treatment for various diseases.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

169 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 11.66% |

|

Market growth 2024-2028 |

USD 1.84 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

10.09 |

|

Key countries |

US, Canada, UK, Germany, and China |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch