Industrial Food And Beverage Filtration Systems Market Size 2024-2028

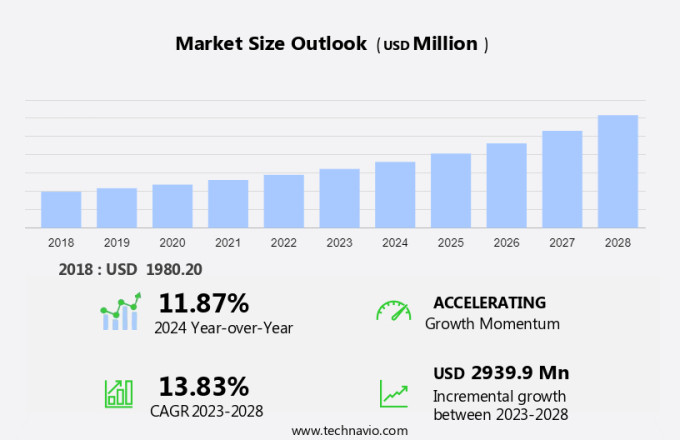

The industrial food and beverage filtration systems market size is forecast to increase by USD 2.94 billion at a CAGR of 13.83% between 2023 and 2028.

-

The market is experiencing significant growth due to the increasing focus on food safety and contamination prevention. One of the key trends driving market growth is the introduction of advanced filtration technologies such as microfiltration, ultrafiltration, nanofiltration, and reverse osmosis. These filtration systems effectively remove particles, microorganisms, and contaminants from organic food and beverage products, ensuring their purity and safety. Moreover, there is a rising trend towards the use of substitute methods for traditional filter media like sand and activated carbon. Membrane-based filtration systems, such as microfiltration and ultrafiltration, offer superior filtration efficiency and are increasingly being adopted in the production of syrups, processed foods, and beverages. The market is expected to continue growing as these advanced filtration technologies become more accessible and cost-effective. However, challenges remain, including the high initial investment costs and the need for regular maintenance and replacement of membranes. Despite these challenges, the benefits of improved food safety and product quality are driving the adoption of industrial food and beverage filtration systems. Key industrial filtration technologies to watch include microfiltration, ultrafiltration, nanofiltration, reverse osmosis, and activated carbon filtration.

What will be the Size of the Industrial Food And Beverage Filtration Systems Market During the Forecast Period?

- The food and beverage industry is a significant contributor to the US economy, generating substantial revenue and employment. However, ensuring the quality and safety of products remains a top priority for food processors. Industrial filters play a crucial role in maintaining the shelf life and purity of various food and beverage products, including water, juices, beer, wine, and other beverages. Impurities and contaminants in food and beverages can lead to chronic health problems such as heart disease, diabetes, and obesity. Airborne germs and odors can negatively impact the taste and quality of these products.

- Industrial filters help mitigate these issues by removing impurities and contaminants from both air and liquids. In the context of food production, advanced filtration solutions are essential for removing odors and impurities from the air. These systems ensure that the production environment remains clean and free from contaminants, contributing to the overall safety and quality of the final product. Similarly, in beverage production, industrial filters are used to remove impurities and contaminants from water and other liquids. Water is a critical ingredient in various food and beverage products, and its purity is essential for maintaining the desired taste and quality.

How is this Industrial Food And Beverage Filtration Systems Industry segmented and which is the largest segment?

The industrial food and beverage filtration systems industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Liquid filtration systems

- Air filtration systems

- Application

- Beverages

- Dairy

- Food and ingredients

- Geography

- Europe

- Germany

- France

- APAC

- China

- India

- North America

- US

- South America

- Middle East and Africa

- Europe

By Product Insights

- The liquid filtration systems segment is estimated to witness significant growth during the forecast period.

Industrial food and beverage liquid filtration systems play a crucial role in the production of various food and beverage products by removing insoluble particles and impurities. The global food and beverage industry's expansion is driving the market growth for these systems. Liquid filtration is achieved by passing a suspension through a porous material, utilizing forces such as vacuum, centrifugation, or pressure. Advanced filtration technologies, including ceramic membranes and nanofiltration membranes, are gaining popularity due to their ability to provide higher filtration efficiencies and better product quality. These systems offer benefits such as clarification, stabilization, and sterilization for food and beverage products.

Furthermore, the food and beverage industry encompasses a wide range of products, including beer, wine, soft drinks, juices, dairy products, baby foods, chocolates, and gelatin. Industrial filtration systems are essential for processing these products, ensuring their purity and consistency. Petroleum refineries and petrochemical plants also utilize liquid filtration systems for emissions and waste treatment. Real-time monitoring and maintenance are essential to ensure optimal system performance and product quality.

Get a glance at the Industrial Food And Beverage Filtration Systems Industry report of share of various segments Request Free Sample

The Liquid filtration systems segment was valued at USD 1.15 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- Europe is estimated to contribute 31% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The European market has experienced expansion due to the rising application of filtration technology in processing various food and beverage products. Fruit and vegetable juices, juice concentrates, dairy products, beer, and wine are among the major food and beverage categories that utilize filtration systems. Europe is a significant exporter of juice concentrates, with countries like the UK, Romania, and Ukraine contributing to the global market. The increasing preference for fruit juices in Europe, particularly in countries such as Germany, France, the UK, Spain, and Italy, has resulted in a rise in production. Key European producers include the Netherlands, Germany, Poland, Belgium, Spain, and Romania.

Furthermore, filtration systems are essential in the production of these food and beverage items, ensuring the removal of impurities and enhancing product quality. The food and beverage industry's reliance on filtration technology extends to other sectors, including power generation, pulp and paper, electronics, oil and gas, and industrial water treatment. Metal, filter paper, and nonwoven fabric are common filtration media used in these applications. The industrial filtration systems market's growth is driven by the increasing demand for high-quality, safe, and efficient filtration solutions.

Market Dynamics

Our industrial food and beverage filtration systems market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Industrial Food And Beverage Filtration Systems Industry?

The rise in focus on the prevention of food contamination is the key driver of the market.

- In the food and beverage industry, contamination is a significant concern that can lead to foodborne illnesses and chronic health issues such as heart disease, diabetes, and obesity. Contamination often results from the presence of airborne germs, odors, and microorganisms in food and beverage products. The dairy industry, in particular, faces challenges due to the contact of process fluids like water with wet surfaces, leading to the spread of bacteria and other microorganisms. To mitigate contamination risks, various food processing industries follow guidelines set by Hazard Analysis Critical Control Point (HACCP). HACCP recommends the implementation of filtration systems for contamination control.

- Industrial filters, such as membrane filtration systems, play a crucial role in detecting and eliminating microbial contaminants from food products. These systems ensure the production of safe and high-quality food and beverage products, thereby enhancing consumer safety and trust. By investing in advanced filtration technologies, food processors can prevent contamination and reduce the risk of foodborne illnesses, ultimately contributing to a healthier population.

What are the market trends shaping the Industrial Food And Beverage Filtration Systems Industry?

The introduction of new food and beverage filtration systems is the upcoming trend in the market.

- The market in the United States is witnessing significant advancements as major players introduce innovative products to gain a competitive edge. For example, Eaton's filtration division in Edina, MN, has launched the LOFTREX Nylon filter cartridge, which complies with the FDA 21CFR regulations, making it suitable for the food and beverage sector.

- New filtration systems, incorporating technologies like microfiltration, ultrafiltration, nanofiltration, reverse osmosis, and membrane filtration, will drive the growth of the market. These systems effectively remove particles and microorganisms, ensuring the production of high-quality syrups and processed foods. Filter media, such as activated carbon and sand, are also essential components of these systems, enhancing their efficiency. The adoption of advanced filtration technologies will continue to shape the future of the market.

What challenges does Industrial Food And Beverage Filtration Systems Industry face during its growth?

The rise in the use of substitute methods is a key challenge affecting the industry's growth.

- Industrial food and beverage filtration systems play a crucial role in removing impurities and contaminants from various raw materials, such as liquids, water, juice, beer, wine, cooking oils, and sauces. These systems ensure the production of high-quality products free from impurities. However, some companies may prefer alternative methods, like decanters and centrifuges, due to their cost-effectiveness and time efficiency.

- Decantation is a process of separating mixtures by removing a clear liquid layer. In the case of liquid mixtures, the denser liquid settles at the bottom, while the lighter one remains at the top. For solid and liquid mixtures, solids settle at the bottom, leaving the liquid above. Though these alternatives have their advantages, industrial filtration systems continue to be the preferred choice for ensuring the highest level of product purity in the food and beverage industry.

Exclusive Customer Landscape

The industrial food and beverage filtration systems market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry. The industrial food and beverage filtration systems industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- AJR Filtration Inc.

- Albert Handtmann Holding GmbH and Co. KG

- Alfa Laval AB

- American Air Filter Co. Inc.

- Camfil AB

- Compositech Products Manufacturing Inc.

- Critical Process Filtration Inc.

- Donaldson Co. Inc.

- Eaton Corp. Plc

- Filter Concept Pvt. Ltd.

- Freudenberg and Co. KG

- GEA Group AG

- Graver Technologies LLC

- Krones AG

- MORI TEM srl

- Mott Corp.

- Parker Hannifin Corp.

- Russell Finex Ltd.

- Schenck Process Holding GmbH

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Industrial filters play a crucial role in ensuring the quality and safety of various products in the food and beverage industry. These filtration systems help extend shelf life by removing impurities, odors, and airborne germs from water, juice, beer, wine, cooking oils, sauces, syrups, and other beverages. The health of consumers is a top priority, and industrial filters help mitigate the risk of chronic health problems such as heart disease, diabetes, obesity, and high cholesterol by removing contaminants and impurities. Industrial filters are also essential in other industries like petroleum refineries, petrochemical plants, and power generation. In these industries, filters help remove particles and microorganisms from liquids, ensuring the production of high-quality petroleum products like crude oil, gasoline, diesel, jet fuel, and petrochemicals such as plastics.

Furthermore, new filtration technologies like microfiltration, ultrafiltration, nanofiltration, reverse osmosis, and advanced filtration solutions are constantly being developed to meet the evolving needs of various industries. Filter media, such as ceramic membranes and nanofiltration membranes, are used to enhance the filtration process. Filter maintenance, repairs, monitoring, and replacement are essential aspects of industrial filtration systems. Proper filter condition assessment, pressure drop, flow rate, and filter replacement are critical to maintaining optimal filtration performance. Recycling options for filter products are also gaining popularity as a sustainable solution for reducing waste. Industrial filters are used in various industries, including food and beverages, chemicals, metals and mining, power generation, oil and gas, and industrial water treatment. Filter media types include fiberglass, activated carbon, filter paper, and metal, among others.

|

Industrial Food And Beverage Filtration Systems Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

171 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 13.83% |

|

Market growth 2024-2028 |

USD 2.94 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

11.87 |

|

Key countries |

US, China, Germany, France, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the Industrial Food And Beverage Filtration Systems industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Europe, APAC, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch