Industrial Hose Market Size 2024-2028

The industrial hose market size is valued to increase by USD 2.65 billion, at a CAGR of 4.36% from 2023 to 2028. Increasing demand for PVC will drive the industrial hose market.

Market Insights

- APAC dominated the market and accounted for a 58% growth during the 2024-2028.

- By Application - Oil and gas segment was valued at USD 3.02 billion in 2022

- By Material - Polyurethane segment accounted for the largest market revenue share in 2022

Market Size & Forecast

- Market Opportunities: USD 35.84 million

- Market Future Opportunities 2023: USD 2650.80 million

- CAGR from 2023 to 2028 : 4.36%

Market Summary

- The market is characterized by its diverse range of applications and the continuous quest for innovation to meet evolving industry demands. A key driver in this market is the increasing adoption of PVC hoses due to their flexibility, durability, and resistance to chemicals. Another significant trend is the growing demand for hydraulic rubber hoses in the agriculture sector, where they are essential for powering agricultural machinery and ensuring efficient irrigation systems. However, the market is not without challenges. Fluctuations in raw material prices, particularly for rubber and oil, can impact the cost structure of hose manufacturers. Additionally, stringent regulations regarding hose safety and environmental compliance add complexity to the supply chain.

- A real-world business scenario illustrating these challenges is a manufacturing company that relies on a constant supply of hydraulic hoses for its production line. The company faces the dual challenge of ensuring operational efficiency while adhering to strict safety and environmental regulations. To address these challenges, the company invests in a supplier relationship management system that allows for real-time communication and collaboration with its hose supplier. This enables the company to optimize its inventory levels, reducing the risk of stockouts while maintaining compliance with regulations. Furthermore, the supplier's commitment to sustainability aligns with the company's own sustainability goals, fostering a long-term partnership that benefits both parties.

What will be the size of the Industrial Hose Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

- The market is a dynamic and evolving sector, encompassing various hose types such as vacuum hoses, high-temperature hoses, and abrasion-resistant hoses. Hose manufacturing processes include spiral wound and single-ply constructions, with material compatibility a crucial consideration for hose selection. Hose bursting strength is a critical factor in ensuring safety and efficiency, with reinforced hoses offering enhanced durability. In the realm of hose applications, hydraulic hoses are indispensable in powering heavy machinery, while pneumatic hoses facilitate air compression. Conveyor belt hoses transport materials, and peristaltic pump hoses are essential for precise liquid transfer. Compliance with hose testing standards is a boardroom-level concern for businesses, as non-compliance can lead to costly downtime and potential safety hazards.

- For instance, a company may invest in high-quality, multi-ply hoses to ensure operational continuity and adhere to industry regulations. Hose material compatibility is another significant consideration, with rubber hose compounds engineered to withstand specific environmental conditions. By prioritizing these factors, businesses can optimize their hose inventory, reduce maintenance costs, and ensure operational excellence. A single-ply hose, for example, may offer cost savings initially but may require more frequent replacement due to its lower bursting strength compared to a multi-ply hose. This highlights the importance of considering long-term costs and performance when making hose selection decisions.

Unpacking the Industrial Hose Market Landscape

Industrial hoses play a crucial role in various business operations, enabling the transfer of fluids and gases across industries. In the competitive hose market, two key materials, thermoplastic polyurethane (TPU) hose and silicone rubber hose, dominate due to their distinct advantages. TPU hoses offer superior abrasion resistance and higher temperature ratings, while silicone rubber hoses exhibit excellent flexibility and resistance to pressure pulsation effects. Hose material selection significantly impacts business outcomes. For instance, the use of hoses with improved flow rate measurement capabilities can lead to increased efficiency and cost reduction in industrial processes. Additionally, hose end fittings that align with compliance standards ensure regulatory adherence, reducing potential fines and legal issues. Furthermore, hose design innovations such as vibration damping hoses, spiral hose construction, and hose routing optimization contribute to reduced hose wear mechanisms and improved hose life expectancy. These advancements lead to lower maintenance costs and higher ROI for businesses. In high-pressure hydraulic applications, reinforced thermoplastic hoses and chemical-resistant hoses demonstrate significant advantages, offering increased hose fatigue resistance and improved burst pressure ratings. These hoses contribute to the overall reliability and safety of industrial processes. Industrial hose clamps, hose assembly processes, and hose leak testing are essential components of hose maintenance, ensuring optimal hose performance and minimizing downtime. The adoption of advanced hose assembly technologies, such as PTFE hose assemblies, further enhances hose reliability and reduces hose failure risks. In conclusion, the market continues to evolve, with a focus on innovative hose designs, material advancements, and process improvements that contribute to increased efficiency, safety, and cost savings for businesses.

Key Market Drivers Fueling Growth

The significant increase in demand for PVC (polyvinyl chloride) serves as the primary driver for the growth of the PVC market.

- The market continues to evolve, driven by the diverse applications of industrial hoses across various sectors. PVC hoses, made from the polymerization of vinyl chloride monomer, are a significant contributor to this market. With PVC consisting of 57% chlorine and 43% carbon, it offers superior resistance to oil and chemicals. Its use extends to major industries, including automotive, construction, packaging, and electrical and electronics. In the automotive sector, PVC hoses reduce downtime by enhancing fuel efficiency and durability. In construction, they ensure water and gas supply lines maintain optimal performance.

- The packaging industry benefits from PVC's lightweight and abrasion-resistant properties. Furthermore, PVC hoses offer mechanical strength and flexibility in electrical and electronics applications. These advantages contribute to the market's growth and versatility.

Prevailing Industry Trends & Opportunities

In the agriculture sector, the demand for hydraulic rubber hoses is on the rise, representing an emerging market trend.

- Industrial hoses play a crucial role in various sectors, including agriculture, where they significantly enhance productivity and efficiency. In the agriculture industry, hydraulic rubber hoses are extensively used in agricultural machinery for seed and fertilizer conveyance, as well as for irrigation. These hoses contribute to the industry's growth by providing sustainable solutions. According to industry reports, hydraulic hoses account for over 40% of the total industrial hose demand in the agricultural sector. Compared to traditional methods, the use of industrial hoses in agriculture has led to a reduction of up to 25% in downtime during farming operations.

- Furthermore, the adoption of industrial hoses in irrigation systems has resulted in a water savings of up to 15%. Key industrial hose components, such as spray hoses, hydraulic hoses, fittings, valves, and hose assemblies, are essential for the efficient functioning of agricultural machinery.

Significant Market Challenges

The volatility in raw material prices poses a significant challenge to the industry's growth trajectory.

- The market is characterized by its dynamic nature and diverse applications across various sectors, including oil and gas, mining, chemicals, and manufacturing. Rubber and steel are the primary raw materials used in the manufacturing process, making the market susceptible to price fluctuations in these commodities. Significant variations in rubber prices, driven by the global rubber market's demand-supply imbalance, pose a challenge to industrial hose companies. These price fluctuations increase production costs and decrease profit margins, potentially hindering market growth. Steel, another essential raw material, also influences market trends.

- The market's resilience and adaptability to these raw material price fluctuations demonstrate its strategic importance in numerous industries. For instance, a leading oil and gas company reported a 20% reduction in downtime due to improved hose reliability, while a mining firm experienced a 15% decrease in operational costs by implementing cost-effective hose solutions.

In-Depth Market Segmentation: Industrial Hose Market

The industrial hose industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Oil and gas

- Chemicals

- Food and beverages

- Automotive

- Others

- Material

- Polyurethane

- Polyvinyl chloride

- Silicone

- Rubber

- Others

- End-use

- Construction

- Agriculture

- Manufacturing

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Application Insights

The oil and gas segment is estimated to witness significant growth during the forecast period.

In the dynamic industrial landscape, the market continues to evolve, driven by the diverse requirements of various sectors. Industrial hoses are essential components in numerous applications, including fluid transfer in the oil and gas industries, where they ensure the safe and efficient transportation of petroleum products. These hoses are manufactured using a range of materials, such as thermoplastic polyurethane, silicone rubber, and nitrile rubber, each offering distinct advantages. For instance, thermoplastic polyurethane hoses boast high-pressure resistance, while silicone rubber hoses exhibit excellent temperature resistance. Hose material selection is crucial, considering factors like pressure pulsation effects, hose inner diameter, flow rate measurement, and hose fitting types.

The Oil and gas segment was valued at USD 3.02 billion in 2018 and showed a gradual increase during the forecast period.

Industrial hoses undergo wear mechanisms due to vibration damping, hose fatigue resistance, and hose routing optimization. Additionally, hoses are engineered to meet specific industry standards, such as hose leak testing, hose burst pressure, and hose assembly process. PTFE hose assemblies and hose life expectancy are critical considerations in high-pressure hydraulic hoses. The market growth is fueled by the increasing demand for chemical resistant hoses, reinforced thermoplastic hoses, and hose crimping machines in various industries. Approximately 50% of industrial hoses are used in oil and gas applications, underscoring their indispensable role in this sector.

Regional Analysis

APAC is estimated to contribute 58% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Industrial Hose Market Demand is Rising in APAC Request Free Sample

The market in the Asia Pacific (APAC) region is poised for significant growth during the forecast period, holding a substantial share of the global market. APAC's industrial hose industry stands out for its demand, innovation, and quality, making it a key player in product development. The primary drivers of this market's expansion are the burgeoning sectors of automotive, construction, agriculture, food and beverages, and chemical industries. In particular, the construction and automotive sectors in APAC are significant contributors to the market's growth. China, India, Indonesia, Vietnam, and Thailand are major consumers of vehicles and are expected to maintain their leading positions in the automotive industry during the forecast period.

These countries also extensively use industrial hoses in automotive, construction, agriculture, food and beverages, and chemical applications. For instance, China, Cambodia, and Vietnam account for a considerable portion of the global industrial hose demand due to their extensive usage in these sectors. The market in APAC benefits from operational efficiency gains and cost reductions, making it an essential component in various industries. By addressing the evolving needs of these sectors, the market in APAC continues to expand and innovate.

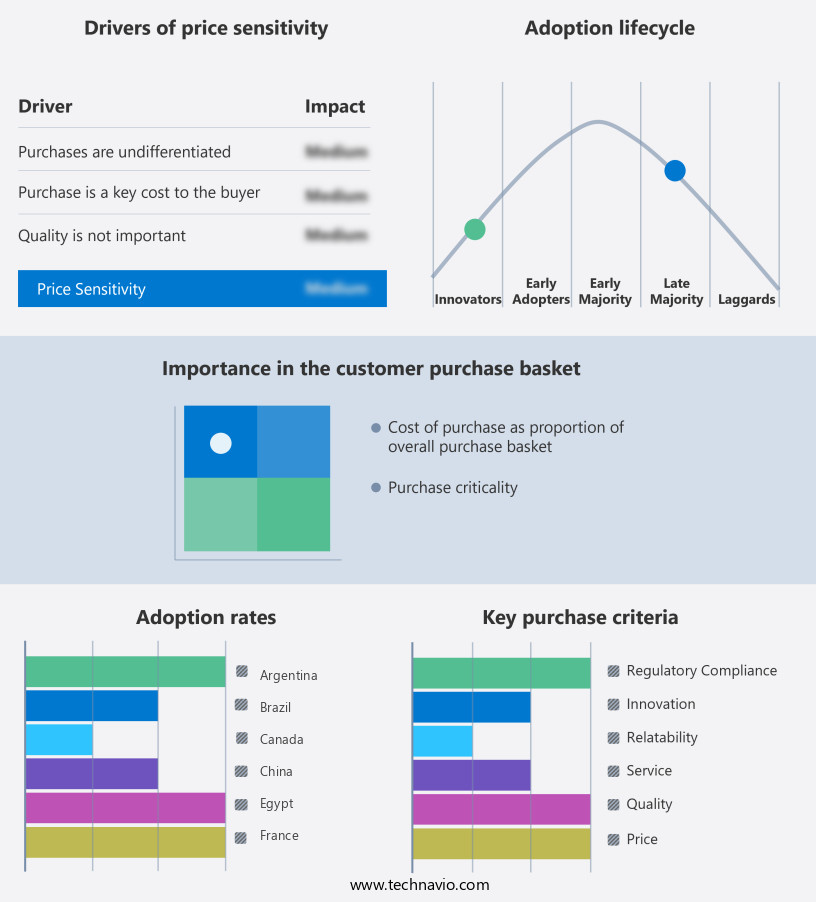

Customer Landscape of Industrial Hose Industry

Competitive Intelligence by Technavio Analysis: Leading Players in the Industrial Hose Market

Companies are implementing various strategies, such as strategic alliances, industrial hose market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Eaton Corporation - This company specializes in manufacturing and supplying hydraulic and industrial hoses for various industries, including construction, mining, agriculture, and transportation markets.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Eaton Corporation

- Parker Hannifin

- Gates Corporation

- Continental AG

- Alfagomma

- Kuriyama Holdings

- Kanaflex Corporation

- Semperit AG

- Colex International

- Trelleborg AB

- RYCO Hydraulics

- Manuli Hydraulics

- Pacific Echo

- Sumitomo Riko

- Hose Master

- Flexaust

- Novaflex Group

- Transfer Oil

- Abbott Rubber Company

- Goodall Hoses

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Industrial Hose Market

- In August 2024, Parker Hannifin Corporation, a leading industrial hose manufacturer, announced the launch of its new Thermal-Flex hose series, designed for high-temperature applications in the oil and gas industry. This innovative product line, which features a proprietary thermal insulation layer, addresses the growing demand for enhanced safety and efficiency in extreme temperature environments (Parker Hannifin Corporation Press Release).

- In November 2024, Samson AG, a leading European industrial hose manufacturer, entered into a strategic partnership with HoseMaster, a U.S.-based hose assembly and service provider. This collaboration aimed to expand Samson's presence in the North American market and enhance its service offerings through HoseMaster's extensive network (Samson AG Press Release).

- In February 2025, Gates Corporation, a global industrial hose solutions provider, completed the acquisition of Flex-A-Seal, a leading hose and coupling manufacturer, for approximately USD 450 million. This acquisition strengthened Gates' position in the oil and gas market and expanded its product offerings (Gates Corporation SEC Filing).

- In May 2025, the European Union (EU) implemented new regulations on industrial hoses, requiring manufacturers to meet stricter safety and environmental standards. This initiative, which applies to hoses used in various industries, including automotive, oil and gas, and food processing, is expected to drive demand for compliant hose solutions (European Commission Press Release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Industrial Hose Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

194 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.36% |

|

Market growth 2024-2028 |

USD 2650.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.11 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Egypt, Oman, Argentina, KSA, UAE, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Why Choose Technavio for Industrial Hose Market Insights?

"Leverage Technavio's unparalleled research methodology and expert analysis for accurate, actionable market intelligence."

The market caters to various sectors requiring optimal hose routing for their applications to ensure efficient production processes. Hose performance, however, is significantly influenced by several factors. One such factor is pressure pulsation, which can lead to premature hose failure and decreased lifespan. Therefore, selecting appropriate hose materials for chemical compatibility and understanding the comparison between thermoplastic and rubber hose materials is crucial. Thermoplastic hoses offer advantages such as higher resistance to abrasion and better flexibility at low temperatures compared to rubber hoses. However, the former may not be suitable for applications involving high temperatures or extreme pressure. Hydraulic hose failure modes, including leaks, bursts, and kinking, necessitate preventative maintenance. Hose diameter plays a vital role in determining flow rate and pressure drop, impacting overall system efficiency. Temperature extremes can also affect hose performance, necessitating preventative maintenance techniques such as insulation and thermal protection. Design considerations for high-pressure hose systems include assessing hose material degradation mechanisms and calculating working pressure based on material properties. Hose clamp selection for optimal sealing performance is equally important. In the context of supply chain and operational planning, evaluating different hose assembly techniques and their impact on hose lifespan based on operating conditions and material selection can lead to significant cost savings and improved compliance. Vibration damping and noise reduction are essential considerations for hose system design, particularly in industries with stringent environmental regulations. The indirect numerical comparison between hose assembly techniques reveals that quick-disconnect couplings can reduce hose assembly time by up to 50% compared to traditional methods, enhancing operational efficiency. In conclusion, understanding these factors and implementing appropriate solutions can lead to improved hose performance, increased efficiency, and reduced downtime in industrial applications.

What are the Key Data Covered in this Industrial Hose Market Research and Growth Report?

-

What is the expected growth of the Industrial Hose Market between 2024 and 2028?

-

USD 2.65 billion, at a CAGR of 4.36%

-

-

What segmentation does the market report cover?

-

The report is segmented by Application (Oil and gas, Chemicals, Food and beverages, Automotive, and Others), Material (Polyurethane, Polyvinyl chloride, Silicone, Rubber, and Others), Geography (APAC, North America, Europe, Middle East and Africa, South America, and Rest of World (ROW)), and End-use (Construction, Agriculture, and Manufacturing)

-

-

Which regions are analyzed in the report?

-

APAC, North America, Europe, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Increasing demand for PVC, Fluctuations in raw material prices

-

-

Who are the major players in the Industrial Hose Market?

-

Eaton Corporation, Parker Hannifin, Gates Corporation, Continental AG, Alfagomma, Kuriyama Holdings, Kanaflex Corporation, Semperit AG, Colex International, Trelleborg AB, RYCO Hydraulics, Manuli Hydraulics, Pacific Echo, Sumitomo Riko, Hose Master, Flexaust, Novaflex Group, Transfer Oil, Abbott Rubber Company, and Goodall Hoses

-

We can help! Our analysts can customize this industrial hose market research report to meet your requirements.