Industrial Wireline Networking Market Size 2025-2029

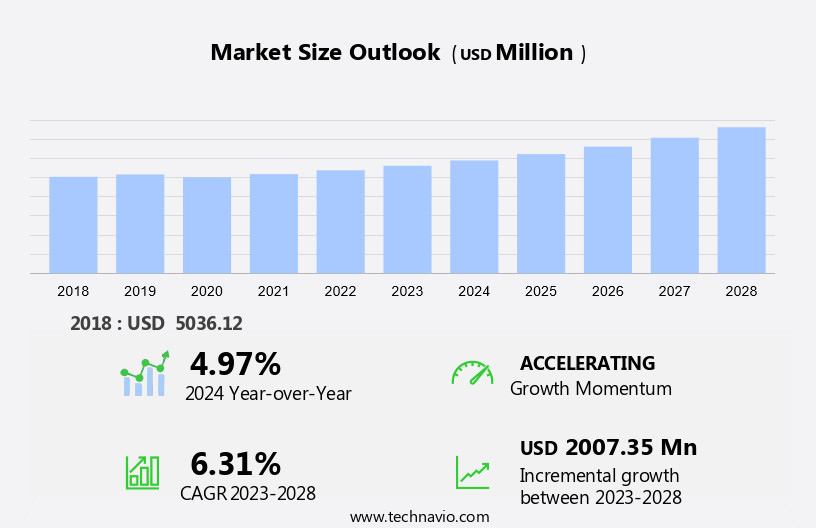

The industrial wireline networking market size is forecast to increase by USD 1.79 billion, at a CAGR of 5.5% between 2024 and 2029.

- The market is experiencing significant growth and transformation, driven by the increasing benefits of industrial Ethernet and the emergence of single pair Ethernet cabling. Industrial Ethernet's ability to offer high-speed data transfer, real-time communication, and improved automation is fueling its adoption across various industries. Furthermore, single pair Ethernet cabling's cost-effectiveness and ease of installation are making it a popular choice for industrial applications. However, the market also faces challenges, including the need for robust cybersecurity measures to protect against potential data breaches and the increasing preference for wireless communication. The integration of Industry 4.0 and the Internet of Things (IoT) is leading to an increased focus on securing industrial networks against cyber threats.

- Additionally, the growing popularity of wireless communication technologies, such as Wi-Fi and Bluetooth, may pose a challenge to the growth of industrial wireline networking. Companies in this market must address these challenges by investing in advanced security solutions and offering flexible, hybrid networking options that cater to both wireline and wireless communication needs.

What will be the Size of the Industrial Wireline Networking Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by the ever-increasing demand for reliable and high-performing networks in various sectors. Ethernet switches and network infrastructure form the backbone of these networks, enabling seamless data transfer and efficient network design. TCP/IP and other network protocols ensure data integrity, while network management software facilitates optimization, configuration, and troubleshooting. Industrial automation systems and data acquisition systems rely on these networks for real-time monitoring and control. Network segmentation and industrial gateways ensure secure communication between different network segments and external systems. Network implementation requires careful planning and network certification to ensure compliance with industry standards and network security protocols.

Network performance monitoring and network hardening are critical for maintaining network uptime and reliability. Fiber optic cabling and mesh networking provide high-bandwidth, low-latency solutions for industrial applications. Network capacity planning and network migration to cloud-based management systems enable scalability and flexibility. Network optimization, network forensics, network access control, and network security are ongoing concerns, with intrusion detection systems and network vulnerability assessments playing crucial roles in maintaining network security. Virtual private networks and wireless network protocols offer secure connectivity options for remote management and network support. Overall, the market is characterized by continuous innovation and adaptation to meet the evolving needs of various industries.

Network design, network configuration, and network troubleshooting are ongoing processes that require expertise and a deep understanding of network dynamics and applications.

How is this Industrial Wireline Networking Industry segmented?

The industrial wireline networking industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Industrial ethernet

- Fieldbus

- Deployment

- On-premises

- Cloud

- Platform

- Local area network (LAN)

- Wide area network (WAN)

- Industrial Internet of Things (IIoT) networks

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Application Insights

The industrial ethernet segment is estimated to witness significant growth during the forecast period.

The Industrial Ethernet market is experiencing significant growth due to the increasing adoption of industrial automation systems in various sectors. Industrial Ethernet, which connects devices such as programmable logic controllers (PLCs), local and distributed I/O, servo controllers, and drives, offers several advantages over traditional fieldbus systems. Its cost-effectiveness, higher bandwidth, and ease of scalability have made it a preferred choice for end-users. Network redundancy and performance monitoring are crucial in industrial settings to ensure network uptime and minimize downtime. Industrial sensors and data acquisition systems generate vast amounts of data, necessitating network optimization and bandwidth management.

Network hardening and security are essential to protect against intrusion and data breaches. Network standards and protocols such as TCP/IP and Ethernet switches facilitate seamless communication between devices. SCADA systems and remote management enable real-time monitoring and control of industrial processes. Network certification and compliance are necessary to ensure network reliability and data integrity. Network migration to cloud-based management and virtual private networks (VPNs) offers flexibility and cost savings. Wireless LAN and mesh networking provide connectivity in hard-to-reach areas. Network troubleshooting and forensics are essential for identifying and resolving network issues. Network access control, network segmentation, and intrusion detection systems are critical for network security.

Network capacity planning and network security protocols ensure network performance and protection against cyber threats. Network training and education are vital to maintain a skilled workforce and keep up with evolving technologies. Industrial ethernet's ability to meet the demands of industrial automation systems while addressing the challenges of network reliability, security, and performance makes it a key driver of the market's growth.

The Industrial ethernet segment was valued at USD 2.75 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

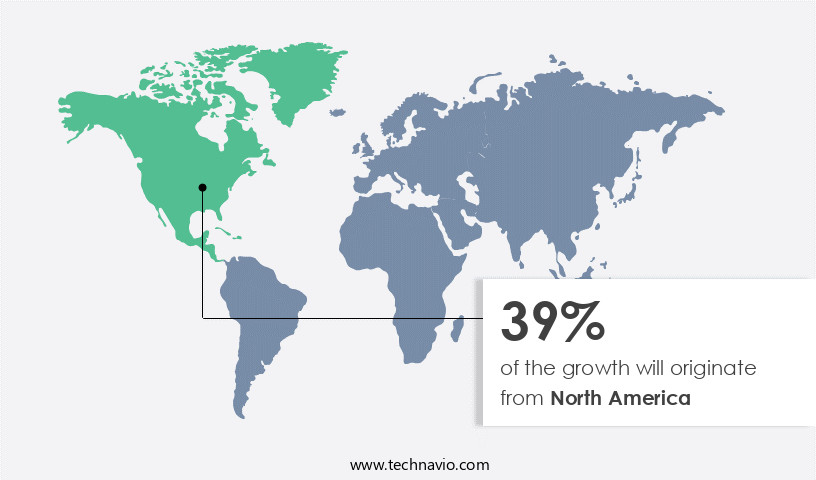

North America is estimated to contribute 39% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is currently leading the global market, driven by the expansion of end-user industries, particularly oil and gas, food and beverage, and automotive. In the oil and gas sector, wireline networks are extensively used for applications such as gas flow measurement, flow rate indication, and discharge rate measurement. Traditionally, fieldbus was the preferred communication protocol; however, the advantages of industrial ethernet are encouraging a transition. The North American oil and gas industry's growth during the forecast period is significant due to increased investments in the upstream sector. Industrial ethernet's benefits, including higher bandwidth, lower latency, and improved network reliability, are increasingly recognized in this industry.

Network redundancy and performance monitoring are crucial for maintaining network uptime and ensuring data integrity. Fiber optic cabling, network optimization, and hardening are essential for network security and compliance. Industrial sensors, SCADA systems, PLC controllers, and data acquisition systems require robust networks for remote management and network configuration. Network certification, network management software, and network implementation are essential for network migration and troubleshooting. Network security protocols, intrusion detection systems, and network capacity planning are vital for maintaining network reliability and data throughput. Virtual private networks and wireless network protocols are essential for high availability and network vulnerability assessment.

Network training is crucial for maintaining network expertise and addressing network access control.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Industrial Wireline Networking Industry?

- The significant advantages of Industrial Ethernet are the primary catalyst fueling market growth.

- The market has experienced significant growth over the past decade, driven by advancements in bandwidth, speed, and network reliability. Industrial ethernet, a key technology in communication systems, has emerged as the core of industrial networks due to its versatility in handling various industrial applications. With the ability to support multiple protocols, industrial ethernet caters to a broad range of industrial communication needs, from I/O communications and plantwide communications to more recent applications like video display on operator screens. Network redundancy, performance monitoring, and optimization are crucial factors driving the market's growth. Fiber optic cabling and mesh networking have become essential components of industrial networks to ensure network uptime and data integrity.

- Network hardening, a critical aspect of industrial networking, focuses on securing the network against potential cyber threats. Network standards and protocols continue to evolve, ensuring interoperability and ease of implementation. Wireless LAN is also gaining popularity in industrial applications, providing flexibility and mobility while maintaining the required network performance. Overall, the market is expected to continue its growth trajectory, driven by the increasing demand for efficient, reliable, and secure industrial communication networks.

What are the market trends shaping the Industrial Wireline Networking Industry?

- Single pair Ethernet cabling is gaining popularity as the next market trend. This emerging technology offers several advantages, including cost-effectiveness and ease of installation, making it an attractive option for organizations seeking to upgrade their networking infrastructure.

- The market is experiencing significant growth due to the increasing adoption of IoT and automation in various industries. Traditional ethernet wiring and application standards have limitations, such as packet loss and latency issues, which can hinder the connection of devices exceeding the 100-meter distance restriction of twisted-pair ethernet cables. To address these challenges, the IEEE 802.3cg standard was introduced, enabling longer reach twisted-pair cabling for industrial applications. Network migration to next-generation cable systems is essential to support increasing network bandwidth requirements and ensure network compliance and encryption. Cloud-based management and remote management solutions are becoming increasingly popular for network support and reducing operational costs.

- SCADA systems, PLC controllers, and other automation protocols demand robust network infrastructure to minimize downtime and optimize performance. Network certification and network encryption are crucial aspects of industrial wireline networking, ensuring data security and regulatory compliance. In conclusion, the market is evolving to cater to the growing demands of industrial automation, offering cost-effective, secure, and high-performance networking solutions.

What challenges does the Industrial Wireline Networking Industry face during its growth?

- The increasing demand for wireless communication is a significant factor influencing the expansion of the industry.

- The market is experiencing significant changes due to the increasing adoption of wireless communication networks. While ethernet switches continue to form the backbone of industrial network infrastructure, the advantages of wireless networks, such as cost savings from eliminating wiring, greater accessibility and adaptability, and wider operating areas, are driving their use in various end-user industries. However, the rise of wireless networks poses a challenge to the market, as they account for approximately 8% of the global communication networks market and offer advantages that are increasingly compelling. Network design, configuration, management, segmentation, and troubleshooting remain crucial aspects of both wireline and wireless industrial networks, with TCP/IP, industrial automation systems, data acquisition systems, network gateways, and network management software playing essential roles.

- As the industrial networking landscape evolves, it is crucial for businesses to understand the dynamics of both wireline and wireless networks to make informed decisions regarding network implementation and optimization.

Exclusive Customer Landscape

The industrial wireline networking market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the industrial wireline networking market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, industrial wireline networking market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ABB Ltd. - The company specializes in industrial wireline networking solutions, featuring advanced ethernet interfaces MTQ22 and PDQ22. These interfaces deliver high-performance connectivity, enhancing operational efficiency and data transfer capabilities in various industrial applications. By implementing these innovative technologies, businesses can optimize their industrial networks, ensuring seamless communication and improved productivity. The company's commitment to cutting-edge research and development enables it to offer superior networking solutions that cater to the evolving needs of modern industries.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB Ltd.

- Analog Devices Inc.

- Balluff GmbH

- BCE Inc.

- Beckhoff Automation

- Belden Inc.

- Cisco Systems Inc.

- Cyient Ltd.

- Emerson Electric Co.

- Hans Turck GmbH and Co. KG

- Hitachi Ltd.

- HMS Networks AB

- Huawei Technologies Co. Ltd.

- Industrial Networking Solutions

- Mitsubishi Electric Corp.

- Moxa Inc.

- Nexans SA

- Rockwell Automation Inc.

- Siemens AG

- Signamax Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Industrial Wireline Networking Market

- In February 2024, Huawei Technologies Co. Ltd., a leading global ICT solutions provider, unveiled its new 5G industrial Ethernet solution, aiming to revolutionize industrial wireline networking by integrating 5G technology with industrial Ethernet (Source: Huawei Press Release). This technological advancement is expected to significantly enhance network performance, reliability, and flexibility in industrial applications.

- In May 2024, Schneider Electric, a major energy management and automation company, announced a strategic partnership with Nokia to provide integrated industrial communication solutions, combining Schneider Electric's EcoStruxure architecture with Nokia's industrial-grade wireless and wireline networking technologies (Source: Schneider Electric Press Release). This collaboration is expected to create a comprehensive, end-to-end solution for industrial customers, addressing their connectivity needs.

- In August 2024, TE Connectivity, a global industrial technology leader, completed the acquisition of Wurth Elektronik's Wireless Business Unit, expanding its wireless and wireline connectivity portfolio (Source: TE Connectivity Press Release). The acquisition is expected to strengthen TE Connectivity's position in the industrial networking market and provide new opportunities for growth.

- In November 2025, the European Union approved the Horizon Europe research and innovation program, which includes a significant focus on industrial networking and digitalization, with a dedicated budget of â¬95.5 billion (Source: European Commission Press Release). This investment is expected to boost the development and deployment of advanced industrial networking technologies, creating new opportunities for market growth and innovation.

Research Analyst Overview

- The market is experiencing significant growth, driven by the increasing adoption of data analytics and network lifecycle management in industrial processes. Network incident response and process control systems are being enhanced with big data and real-time communication capabilities, enabling machine-to-machine communication and smart manufacturing. Industrial IoT and time-sensitive networking are transforming factory automation, leading to the emergence of edge computing and network compliance audits.

- Network vulnerability management and remote monitoring are essential for network performance optimization, while deterministic networking and network infrastructure management ensure network reliability engineering. Network technology trends include data visualization, network penetration testing, and network cost optimization, all aimed at improving industrial networking efficiency and security.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Industrial Wireline Networking Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

220 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.5% |

|

Market growth 2025-2029 |

USD 1794.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.8 |

|

Key countries |

US, China, Canada, Germany, Japan, UK, India, France, South Korea, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Industrial Wireline Networking Market Research and Growth Report?

- CAGR of the Industrial Wireline Networking industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the industrial wireline networking market growth of industry companies

We can help! Our analysts can customize this industrial wireline networking market research report to meet your requirements.