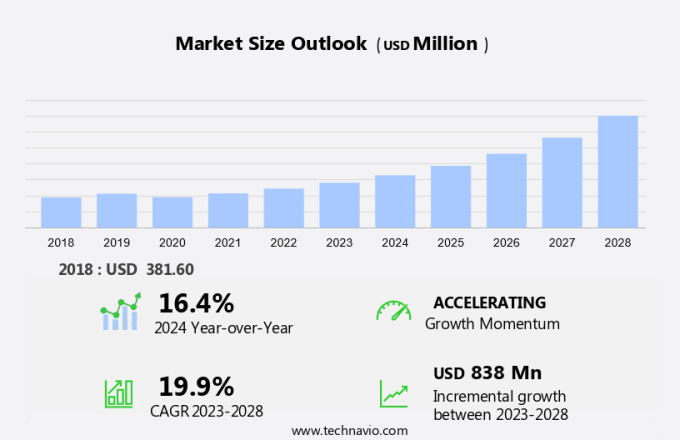

Ingestible Sensors Market Size 2024-2028

The ingestible sensors market size is forecast to increase by USD 838 million, at a CAGR of 19.9% between 2023 and 2028.

- The market is experiencing significant growth, driven by the increasing prevalence of chronic disorders and the rising demand for sensor-enabled pills. These sensors, which can monitor various health parameters and transmit data to healthcare providers in real-time, offer immense potential for improving patient outcomes and enabling proactive healthcare interventions. However, the market faces challenges, including stringent government regulations, which necessitate rigorous clinical trials and approvals before these sensors can be commercially available.

- As the healthcare industry continues to evolve, companies must navigate these challenges while capitalizing on the opportunities presented by this innovative technology. Strategic partnerships, continuous research and development, and robust regulatory compliance strategies will be crucial for market success.

What will be the Size of the Ingestible Sensors Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market is characterized by its continuous evolution and dynamic nature, driven by advancements in technology and increasing applications across various sectors. Real-time data transmission enables instant insights into vital health indicators, with biomarker detection systems offering accurate PH sensor readings and glucose concentration sensors. Data storage capacity and signal processing techniques ensure efficient data management, while sensor packaging technology and data security measures maintain integrity and confidentiality. Sensor miniaturization techniques, such as wireless capsule endoscopy, facilitate non-invasive monitoring in various parts of the body. Data encryption algorithms and sensor network architecture optimize wireless communication protocols, while power management circuits extend battery lifetime.

Temperature sensor calibration and biodegradable sensor casings ensure biocompatibility and environmental sustainability. Sensor calibration methods and optical sensor technology enable precise measurements, while intestinal transit time monitoring and remote patient monitoring expand the reach of healthcare applications. Pressure sensor sensitivity and ingestible sensor arrays provide comprehensive health data, with electrochemical sensor arrays and microfluidic sensor design offering enhanced accuracy. Biocompatible sensor materials and data analytics platforms facilitate advanced diagnostic capabilities. Magnetic sensor technology and low-power electronics design continue to drive innovation, enabling miniaturization and extended battery life. Gastric motility monitoring and diagnostic imaging integration offer new possibilities for disease detection and management.

The market remains a vibrant and evolving landscape, with ongoing research and development shaping the future of healthcare and beyond.

How is this Ingestible Sensors Industry segmented?

The ingestible sensors industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Component

- Sensors

- Data recorders

- Software

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Component Insights

The sensors segment is estimated to witness significant growth during the forecast period.

Ingestible sensors, comprising miniaturized wireless systems, are revolutionizing healthcare by enabling real-time monitoring of various health parameters within the body. These sensors, designed as capsules, incorporate advanced technologies such as pH sensors for measuring acidity levels, glucose concentration sensors for diabetes management, and temperature sensors for tracking body temperature. Biomarker detection systems, including pressure sensors and electrochemical arrays, offer insights into digestive issues, food poisoning, and ulcers. Sensor packaging technology ensures the protection of these delicate devices, while data security measures and encryption algorithms safeguard the transmitted information. Sensor miniaturization techniques enable the creation of smaller, more efficient devices, and wireless communication protocols facilitate seamless data transmission.

Temperature sensor calibration and biodegradable sensor casings ensure patient safety and comfort. Sensor networks, powered by power management circuits, enable the collection and analysis of data from multiple sensors. Data analytics platforms process this information, providing valuable insights for healthcare professionals. Diagnostic imaging integration and magnetic sensor technology offer enhanced capabilities, while low-power electronics design and gastric motility monitoring extend battery lifetime. The integration of optical sensor technology and microfluidic sensor design allows for the detection of various biomarkers, further expanding the capabilities of these devices. Biocompatible sensor materials ensure the safety and compatibility of these sensors with the human body.

Ingestible sensor arrays, including pressure and temperature sensors, offer a comprehensive solution for remote patient monitoring.

The Sensors segment was valued at USD 198.80 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 41% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing significant growth in 2023, driven by advanced healthcare infrastructure and substantial healthcare spending. Technological advancements in microelectromechanical systems (MEMS) and wireless technologies have led to the creation of smaller, more precise sensors. These innovations enable the monitoring of various gastrointestinal health parameters, drug delivery, and nutrition management. The prevalence of chronic conditions like diabetes and cardiovascular diseases fuels demand for continuous health monitoring solutions. Real-time data from ingestible sensors aids effective disease management. Ingestible sensors employ biomarker detection systems, PH sensor accuracy, glucose concentration sensors, data storage capacity, signal processing techniques, and sensor packaging technology for enhanced functionality.

Data security measures, sensor miniaturization techniques, wireless capsule endoscopy, data encryption algorithms, sensor network architecture, power management circuits, wireless communication protocols, temperature sensor calibration, biodegradable sensor casing, sensor calibration methods, optical sensor technology, intestinal transit time, remote patient monitoring, pressure sensor sensitivity, ingestible sensor array, electrochemical sensor array, microfluidic sensor design, biocompatible sensor materials, data analytics platform, battery lifetime extension, diagnostic imaging integration, magnetic sensor technology, and low-power electronics design are all integral to the market's evolution.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Ingestible Sensors Industry?

- The increasing prevalence of chronic disorders serves as the primary driver for market growth in this sector.

- The market is experiencing significant growth due to the rising prevalence of chronic diseases, particularly cancer, cardiovascular diseases, and neurological conditions. Early disease diagnosis and continuous patient monitoring are crucial for effective treatment and improved patient care. According to recent research, the number of new cancer cases has been on the rise, leading to an increase in surgical procedures and the subsequent demand for ingestible sensors. Furthermore, the aging population, with approximately 16.9% of Americans being 65 years old or older in 2020, and this percentage projected to reach 22% by 2050, will also contribute to market expansion.

- Ingestible sensors, which include biocompatible sensor materials, data analytics platforms, magnetic sensor technology, low-power electronics design, and gastric motility monitoring, offer numerous benefits, such as extended battery lifetime and diagnostic imaging integration. These advancements are expected to fuel market growth during the forecast period.

What are the market trends shaping the Ingestible Sensors Industry?

- The trend in the market is characterized by a rising demand for sensor-enabled pills. This emerging development signifies a significant shift in healthcare technology.

- The market is experiencing significant growth due to the increasing demand for digital medicine and regulatory support for the development of advanced health monitoring technologies. These sensors, which are embedded in pills, transmit real-time data to wearable patches upon ingestion. The patches then transmit the information to a mobile application or web-based portal for data storage and analysis. One crucial aspect of ingestible sensors is their accuracy, particularly in biomarker detection systems such as pH sensors and glucose concentration sensors. These sensors employ signal processing techniques and sophisticated sensor packaging technology to ensure precise measurements.

- Data security measures are also essential to protect sensitive patient information. The market's expansion is driven by the potential for remote patient monitoring and improved healthcare outcomes. Patients can share their data with caregivers and physicians, enabling proactive interventions and more personalized treatment plans. As digital medicine continues to evolve, the market is poised for continued growth and innovation.

What challenges does the Ingestible Sensors Industry face during its growth?

- The strict implementation of government regulations poses a significant challenge to the expansion of the industry.

- Ingestible sensors, a subset of wearable health technology, are revolutionizing healthcare through wireless capsule endoscopy and other applications. Miniaturization techniques enable the creation of small, unobtrusive sensors that can be ingested and transmit data wirelessly. This data, which can include temperature readings, requires robust power management circuits and wireless communication protocols for efficient transmission. Data encryption algorithms ensure patient privacy, while sensor network architecture facilitates data integration and analysis. Temperature sensor calibration is crucial for accurate readings, and biodegradable sensor casings minimize environmental impact.

- Operating standards and regulations, such as those in the European Union, ensure the safety and efficacy of these devices. Regulations vary based on the intended use, with stricter requirements for commercial devices compared to investigational ones. This dynamic market continues to evolve, driven by advancements in technology and the growing demand for personalized healthcare solutions.

Exclusive Customer Landscape

The ingestible sensors market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the ingestible sensors market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, ingestible sensors market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AdhereTech LLC - This company specializes in advanced gas-sensing technology, producing capsules that collect real-time data for the gastrointestinal system. Their innovative product design offers valuable insights into digestive processes.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AdhereTech LLC

- Atmo Biosciences Ltd

- CapsoVision Inc.

- Check-Cap Ltd.

- etectRx

- General Electric Co.

- HQ Inc.

- IntroMedic Co. Ltd.

- Jinshan Science and Technology Group Co. Ltd.

- KARL STORZ SE and Co. KG

- Medidata

- Medtronic Plc

- Olympus Corp.

- Otsuka Pharmaceutical Co. Ltd.

- RF Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Ingestible Sensors Market

- In January 2024, Medtronic plc, a global healthcare solutions company, announced the FDA approval of its MiniMed⢠MiniMed⢠780G with SmartGuard⢠Technology, an advanced insulin pump system featuring an integrated continuous glucose sensor (CGS). This approval marked a significant leap in the market, as the MiniMed system's CGS is smaller and more discreet than previous options (Medtronic Press Release, 2024).

- In March 2024, IBM Watson Health and Proteus Digital Health, a leader in digital medicines, entered into a strategic partnership to develop and commercialize ingestible sensors for remote monitoring of medication adherence and health outcomes. This collaboration aimed to improve patient care and reduce healthcare costs by enabling real-time monitoring and analysis of patient medication intake (IBM Watson Health, 2024).

- In May 2024, the European Investment Bank (EIB) committed â¬100 million to support the development and production of ingestible sensors and other advanced medical devices in Europe. This investment was expected to create thousands of jobs and boost the European Union's competitiveness in the global medical technology market (European Investment Bank, 2024).

- In February 2025, Abbott Laboratories, a global healthcare company, announced the acquisition of CeQur, a Swiss medical technology company specializing in wearable insulin delivery systems and ingestible sensors. This acquisition expanded Abbott's portfolio in the diabetes care market and strengthened its position in the rapidly growing ingestible sensors segment (Abbott Laboratories, 2025).

Research Analyst Overview

- The market is experiencing significant advancements, driven by the integration of energy harvesting techniques and the deployment of sensors for various applications. Data visualization tools facilitate the interpretation of sensor data, while sensor reliability testing ensures accuracy and consistency. Biofilm monitoring sensors and gastric acid detection sensors are among the innovations addressing health concerns. The device biodegradation rate, long-term data storage, and secure data transmission are crucial considerations for regulatory compliance. Data analytics algorithms and signal noise reduction enhance the value of the collected data.

- Sensor data interpretation, clinical trial validation, and wearable sensor integration are key trends in precision medicine applications. Device sterilization methods, device miniaturization, and cost-effective manufacturing are essential for mass production. Drug elution sensors, manufacturing process optimization, remote diagnostics capabilities, sensor lifespan improvement, sensor biocompatibility studies, and patient comfort improvement are ongoing areas of research and development.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Ingestible Sensors Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

160 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 19.9% |

|

Market growth 2024-2028 |

USD 838 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

16.4 |

|

Key countries |

US, Canada, Germany, China, UK, Japan, France, Italy, India, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Ingestible Sensors Market Research and Growth Report?

- CAGR of the Ingestible Sensors industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the ingestible sensors market growth of industry companies

We can help! Our analysts can customize this ingestible sensors market research report to meet your requirements.