IoT Managed Services Market Size 2025-2029

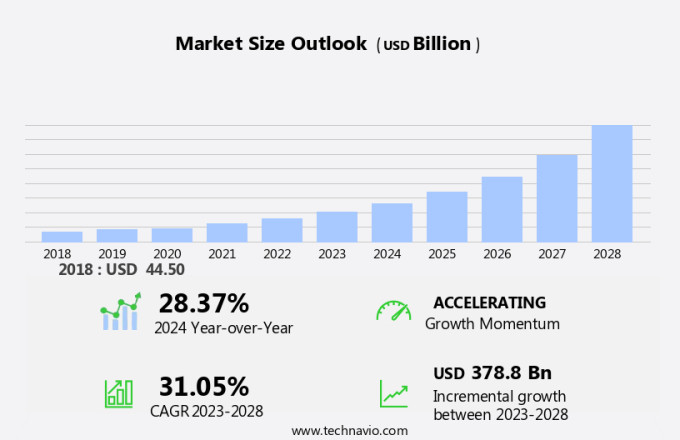

The iot managed services market size is forecast to increase by USD 538.5 billion, at a CAGR of 33.1% between 2024 and 2029.

- The Internet of Things (IoT) Managed Services Market is experiencing significant growth, driven by the increased adoption of IoT solutions across various industries. Companies are recognizing the potential of IoT to optimize operations, enhance productivity, and improve customer experiences. One key application area is predictive maintenance in manufacturing, where IoT data is leveraged to anticipate equipment failures and schedule maintenance proactively. However, the market also faces challenges. Despite the numerous benefits, there is a lack of awareness regarding efficient management of IoT initiatives and investments. Companies need to address this issue to ensure they maximize the value of their IoT projects.

- Additionally, managing the complexities of IoT deployments, including security concerns and data integration, presents significant challenges that must be addressed to ensure successful implementation and adoption. Companies seeking to capitalize on the opportunities in the market must focus on addressing these challenges and providing comprehensive, end-to-end solutions that simplify IoT management and deliver measurable business value.

What will be the Size of the IoT Managed Services Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The Internet of Things (IoT) managed services market continues to evolve, driven by the increasing adoption of IoT devices and the need for efficient data management and analysis. Cloud connectivity plays a crucial role in enabling seamless integration of these devices, while data governance ensures compliance with industry regulations and standards. AI-powered analytics and machine learning algorithms are transforming the way data is processed and insights are derived, leading to improved operational efficiency and enhanced decision-making capabilities. Sensor integration and real-time tracking are essential for various sectors, including manufacturing, healthcare, and transportation. Network security and access control are paramount in safeguarding IoT systems against cyber threats.

Technical documentation and support services are essential for ensuring smooth deployment and management of IoT solutions. Edge computing and big data are also gaining traction, enabling faster processing of data at the source and reducing latency. Deployment models, including public, private, and hybrid cloud, offer flexibility and scalability to businesses. IoT platforms are providing integrated solutions for device management, data analytics, and network infrastructure management. Cellular networks and wireless communication are enabling remote monitoring and management of IoT devices. Ongoing developments in IoT technologies include advancements in sensor integration, system integration, and managed services pricing models. Industry regulations continue to evolve, requiring ongoing training programs and adherence to compliance standards.

Data encryption, data visualization, and deep learning are also emerging trends in the IoT landscape. In the constantly evolving IoT market, businesses must stay abreast of the latest trends and technologies to remain competitive. IoT managed services providers are offering comprehensive solutions, including network security, device management, and technical support, to help businesses navigate the complexities of IoT deployments. The integration of APIs into IoT systems is ensuring seamless data flow and enabling real-time insights, further enhancing the value of IoT solutions.

How is this IoT Managed Services Industry segmented?

The iot managed services industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Network management services

- Security management services

- Infrastructure management services

- Data management services

- Device management services

- Deployment

- On-premises

- Cloud

- Sector

- SMEs

- Large enterprises

- End-user

- Healthcare

- Manufacturing

- BFSI

- Retail

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Type Insights

The network management services segment is estimated to witness significant growth during the forecast period.

The Internet of Things (IoT) managed services market is experiencing steady growth, driven by the increasing adoption of IoT devices and the need for effective data governance, cloud connectivity, and AI-powered analytics. Compliance with industry regulations and robust training programs are essential for businesses implementing IoT solutions. Wireless communication and network security are critical components, ensuring sensor integration, access control, real-time tracking, and remote monitoring. IoT platforms are increasingly leveraging cellular networks and deep learning for advanced data analytics and edge computing. Industry regulations mandate stringent security protocols and data encryption, while managed services pricing models cater to various business needs.

Machine learning and API integrations facilitate system integration and big data processing. Network infrastructure and support services play a vital role in ensuring seamless deployment and management of IoT solutions. The market is witnessing a shift towards edge computing and real-time data processing, with a growing emphasis on device management, remote monitoring, and technical documentation. The market is expected to see increased competition, with new players offering tailored solutions for various industries, including IT and telecom, focusing on SD-WAN and RAN optimization.

The Network management services segment was valued at USD 19.20 billion in 2019 and showed a gradual increase during the forecast period.

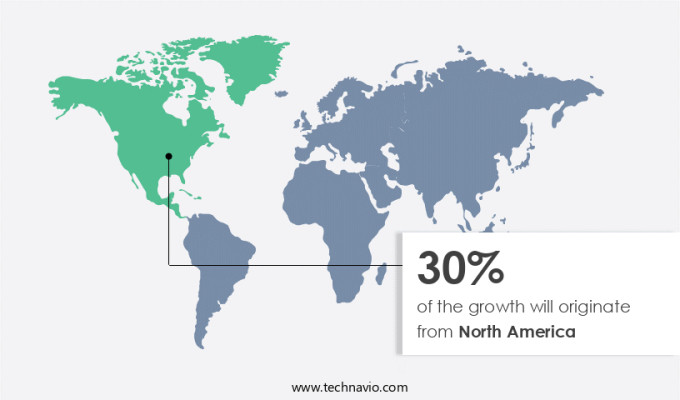

Regional Analysis

APAC is estimated to contribute 31% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the dynamic landscape of IoT managed services, North America stands out as a significant market due to its early adoption of advanced technologies and the presence of leading economies. The region's industries, such as manufacturing, retail, and BFSI, are embracing IoT solutions for data processing, outsourcing, and infrastructure development. The integration of cloud-based services, automation solutions, and artificial intelligence (AI) into operational and supply chain processes is driving innovation in IoT managed services. IoT devices are a crucial component of this market, requiring robust network security, wireless communication, and sensor integration. Compliance with industry regulations and data governance are essential, ensuring data encryption, access control, and real-time tracking.

IoT platforms facilitate device management, remote monitoring, and technical documentation. Cellular networks and edge computing are essential for IoT managed services, enabling big data processing and system integration. Machine learning and deep learning algorithms are increasingly being used for data analytics, while API integrations streamline the process. The market's growth is underpinned by a strong focus on network infrastructure, security protocols, and support services. Managed services pricing is competitive, with deployment models catering to various business needs. IoT managed services are transforming industries by providing valuable insights through data visualization and enabling predictive maintenance, enhancing overall efficiency and productivity.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a dynamic and evolving landscape, encompassing a range of solutions designed to optimize and manage IoT devices and networks. IoT service providers offer comprehensive, end-to-end services, including device connectivity, data management, analytics, security, and support. These services enable businesses to leverage IoT technologies for improved operational efficiency, enhanced customer experiences, and new revenue streams. IoT managed services providers employ advanced technologies such as AI, machine learning, and predictive analytics to derive valuable insights from vast amounts of data. Additionally, they ensure seamless integration with various IoT platforms and protocols, ensuring interoperability and ease of use. IoT managed services also prioritize security, implementing robust measures to safeguard against cyber threats and data breaches. Overall, the market is a vital component of the digital transformation journey for businesses, offering a comprehensive solution for IoT deployment and management.

What are the key market drivers leading to the rise in the adoption of IoT Managed Services Industry?

- The significant growth in the implementation of Internet of Things (IoT) technologies is the primary catalyst fueling market expansion.

- The Internet of Things (IoT) is a network of interconnected devices and systems that communicate and exchange data in real-time. This technology is revolutionizing various industries by enabling smart environments, such as smart homes, transportation, healthcare, and retail. IoT managed services play a crucial role in building end-to-end infrastructure for these applications. IoT managed services offer communication services and managed mobility services (MMS) for machine-to-machine communication (M2M). These services ensure secure and reliable data transmission between devices using technologies like data encryption and cellular networks. IoT platforms provide data analytics capabilities using techniques such as deep learning and data analytics to gain insights from the vast amount of data generated by smart sensors.

- Industry regulations require stringent data security measures, making data encryption a critical component of IoT managed services. IoT managed services also help ensure network infrastructure reliability and availability, ensuring uninterrupted communication between devices. Deep learning algorithms enable predictive maintenance and real-time anomaly detection, enhancing the overall efficiency and performance of IoT systems. IoT managed services are essential for businesses seeking to leverage the power of IoT technology while complying with industry regulations and ensuring data security.

What are the market trends shaping the IoT Managed Services Industry?

- Predictive maintenance, which involves utilizing manufacturing data to anticipate equipment failures and schedule maintenance accordingly, is currently a significant market trend. By implementing data-driven predictive maintenance strategies, organizations can minimize downtime, reduce maintenance costs, and enhance overall operational efficiency.

- The Internet of Things (IoT) managed services market is experiencing significant growth due to the increasing demand for data collection and analysis to optimize complex maintenance tasks. IoT-enabled devices, such as wireless acoustic transmitters and steam trap monitors, are increasingly being used in industries to monitor plant operations. By leveraging data from machines and systems, industrial operators can compare efficiency and performance levels, enabling them to plan maintenance activities effectively and minimize unplanned downtime caused by machine failures. Predictive maintenance is a key focus area for end-users, as it enhances operational efficiency and reduces production downtime.

- Industries with a large number of automation control solutions and instruments stand to benefit significantly from IoT-enabled devices. Security protocols are a critical consideration in IoT managed services to ensure data privacy and protection. Support services, deployment models, edge computing, big data, system integration, managed services pricing, and machine learning are essential components of IoT managed services.

What challenges does the IoT Managed Services Industry face during its growth?

- The lack of awareness and efficient management of Internet of Things (IoT) initiatives and investments is a significant challenge impeding industry growth.

- The Industrial Internet of Things (IoT) market is experiencing significant growth as more enterprises integrate connected devices into their operations. However, managing, securing, and optimizing these IoT investments poses a challenge for industries. One of the primary tasks is implementing IoT in industrial facilities, followed by employee training to effectively utilize the platform. The scarcity of skilled workers proficient in IoT systems is a major hurdle for end-users. Without adequate training and understanding of these complex systems, the full potential of IoT remains untapped. To address this issue, IoT managed services have emerged as a viable solution. These services offer expertise in managing and securing IoT systems, enabling businesses to focus on their core competencies.

- IoT managed services provide a range of benefits, including improved operational efficiency, enhanced security, and reduced costs. By outsourcing IoT management, businesses can save on the costs of hiring and training in-house staff. Additionally, managed services providers offer advanced capabilities and up-to-date knowledge of the latest IoT technologies, ensuring that businesses stay competitive in the market. In conclusion, the adoption of IoT in industries is increasing, but managing and optimizing these investments remains a challenge. IoT managed services offer a cost-effective and efficient solution, providing expertise and advanced capabilities to help businesses fully leverage the potential of IoT.

Exclusive Customer Landscape

The iot managed services market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the iot managed services market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, iot managed services market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Accenture PLC - The company specializes in managing Internet of Things (IoT) technologies, delivering IT infrastructure services and innovative solutions. Our expertise encompasses seamless integration and optimization of connected devices, ensuring optimal performance and security. By leveraging advanced analytics and automation tools, we enable clients to gain actionable insights and streamline operations. Our IoT managed services empower businesses to transform their digital landscapes, enhancing efficiency and competitiveness.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Accenture PLC

- Alphabet Inc.

- Amazon.com Inc.

- AT and T Inc.

- Cisco Systems Inc.

- Cognizant Technology Solutions Corp.

- HCL Technologies Ltd.

- Hewlett Packard Enterprise Co.

- Infosys Ltd.

- Intel Corp.

- International Business Machines Corp.

- Itron Inc.

- KORE Group Holdings Inc.

- Microsoft Corp.

- Oracle Corp.

- Pelion IOT Ltd.

- Qualcomm Inc.

- Tech Mahindra Ltd.

- Verizon Communications Inc.

- Wipro Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in IoT Managed Services Market

- In January 2024, IBM announced the acquisition of SignificantTech, a leading IoT managed services provider, to strengthen its IoT portfolio and expand its managed services offerings (IBM Press Release). In March 2024, Microsoft and Amazon Web Services (AWS) formed a strategic partnership to integrate Microsoft's Azure IoT Hub with AWS's Greengrass, enabling seamless bi-directional data transfer between edge and cloud environments (Microsoft News Center).

- In May 2024, Cisco Systems launched a new IoT Managed Services suite, providing end-to-end management of IoT networks, devices, and applications, aiming to help businesses optimize their IoT deployments (Cisco Press Release). In February 2025, Siemens and Google Cloud signed a multi-year agreement to integrate Siemens' MindSphere IoT operating system with Google Cloud Platform, enabling advanced analytics and AI capabilities for industrial IoT applications (Siemens Press Release). These developments underscore the growing importance of IoT managed services in driving digital transformation across industries, with major players investing in acquisitions, partnerships, and new offerings to meet the increasing demand.

Research Analyst Overview

- The market is witnessing significant growth, driven by the increasing adoption of IoT technologies in various industries. Risk management and predictive modeling are crucial aspects of IoT services, ensuring business continuity and optimizing operational efficiency. Hybrid and public cloud computing solutions offer cost reduction and scalability, while compliance auditing and regulatory compliance ensure data security. Data storage, aggregation, and backup are essential for effective IoT data management. Anomaly detection and root cause analysis help identify and address issues in real-time, enhancing system performance and reliability. M2M communication and IoT gateways facilitate seamless data exchange between devices and systems.

- Industrial IoT (IIoT) applications, such as energy management, smart cities, and supply chain optimization, are driving market growth. Hybrid and private cloud solutions cater to specific business requirements, offering cost-effective and secure data processing. Open source platforms and proprietary systems provide flexibility and customization. Cost reduction and operational efficiency are key benefits of IoT managed services, with remote diagnostics and asset tracking enabling proactive maintenance and reducing downtime. Business intelligence (BI) tools provide valuable insights, enabling data-driven decision-making. Disaster recovery and energy management solutions offer business continuity and cost savings.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled IoT Managed Services Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

244 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 33.1% |

|

Market growth 2025-2029 |

USD 538.5 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

29.6 |

|

Key countries |

US, UK, China, South Korea, Canada, Germany, France, Japan, Italy, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this IoT Managed Services Market Research and Growth Report?

- CAGR of the IoT Managed Services industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the iot managed services market growth of industry companies

We can help! Our analysts can customize this iot managed services market research report to meet your requirements.