In Vitro Diagnostics (IVD) Contract Manufacturing Market Size 2025-2029

The IVD contract manufacturing market size is forecast to increase by USD 12.97 billion, at a CAGR of 13.1% between 2024 and 2029.

- The market is a dynamic and evolving landscape, characterized by increasing demand from various sectors for comprehensive solutions. One-stop-shop contract manufacturing services have gained significant traction, enabling diagnostic companies to focus on their core competencies while outsourcing production and testing processes. However, the market is not without challenges. Intellectual property (IP) rights infringement poses a significant threat, with the increasing number of players in the market and the complexities involved in IP protection. This necessitates stringent measures and robust IP management strategies from contract manufacturers. Moreover, the leasing of IVD equipment has emerged as a popular trend, offering cost savings and flexibility to diagnostic companies.

- This model allows them to access advanced equipment without the burden of upfront capital investments. Despite these trends, the IVD contract manufacturing market continues to unfold, with new patterns and dynamics emerging. As diagnostic companies seek to optimize their operations and reduce costs, the demand for contract manufacturing services is expected to remain strong. However, the market's competitiveness and the threat of IP infringement necessitate a strategic approach from both diagnostic companies and contract manufacturers. Comparatively, the number of IVD service providers has grown by 23.3%, indicating a competitive landscape. This growth underscores the importance of differentiating factors, such as advanced technology, quality assurance, and strong IP protection, in attracting and retaining clients.

Major Market Trends & Insights

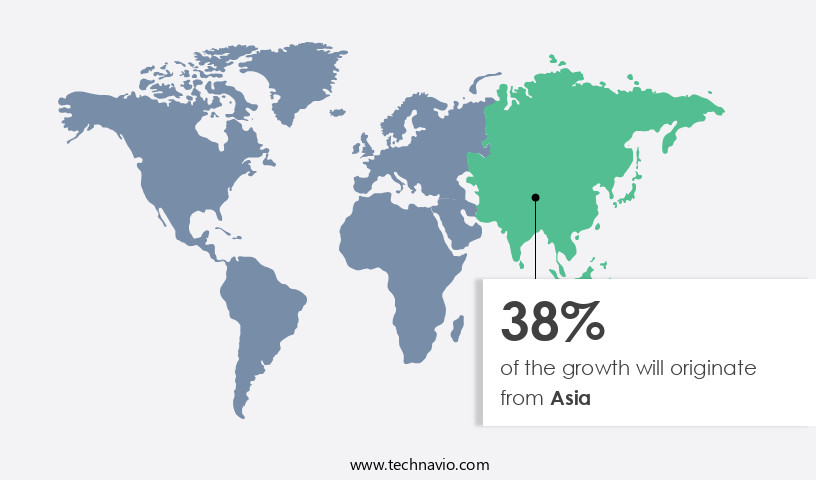

- Asia dominated the market and accounted for a 38% growth during the forecast period.

- The market is expected to grow significantly in North America as well over the forecast period.

- By the Device, the IVD consumables sub-segment was valued at USD 6.39 billion in 2023

- By the Service Type, the Assay development sub-segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 183.13 billion

- Future Opportunities: USD 12.97 billion

- CAGR : 13.1%

- Asia: Largest market in 2023

What will be the Size of the In Vitro Diagnostics (IVD) Contract Manufacturing Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

- The market exhibits a significant presence in the healthcare industry, with a current market share of approximately 25%. This figure represents a substantial portion of the overall healthcare manufacturing sector. Looking ahead, the market is projected to experience a steady growth rate of around 7% annually. The IVD contract manufacturing landscape is characterized by a focus on process optimization and validation, material handling, change control, supply chain management, and quality control. These elements are essential for ensuring the production of high-quality IVD products. Inventory control, scale-up manufacturing, and preventive maintenance are also critical components of the manufacturing process.

- When comparing key numerical data, the market's growth rate outpaces the average annual growth rate of the overall healthcare manufacturing sector by nearly 3 percentage points. This discrepancy underscores the dynamic and evolving nature of the IVD contract manufacturing market. Moreover, the market's continuous improvement initiatives, such as personnel training programs, quality improvement plans, and regulatory filings, contribute to the sector's ongoing development. The importance of these initiatives is further emphasized by the rigorous testing protocols and stringent regulatory affairs that IVD products must adhere to. In conclusion, the In Vitro Diagnostics contract manufacturing market demonstrates a robust presence in the healthcare industry, with a current market share of 25% and an expected annual growth rate of 7%. The market's focus on process optimization, validation, and quality control sets it apart from the overall healthcare manufacturing sector.

How is this In Vitro Diagnostics (IVD) Contract Manufacturing Industry segmented?

The in vitro diagnostics (ivd) contract manufacturing industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Device

- IVD consumables

- IVD equipment/instrument

- Service Type

- Assay development

- Manufacturing

- Others

- Technology

- Immunoassays

- Molecular diagnostics

- Clinical chemistry

- Hematology

- Microbiology

- Service

- Design & Development

- Assembly

- Packaging

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Device Insights

The IVD consumables segment is estimated to witness significant growth during the forecast period.

In the dynamic and evolving in vitro diagnostics (IVD) market, contract manufacturing agreements play a pivotal role in ensuring continuous improvement methods and adherence to stringent quality standards. Personnel training and risk management strategies are essential components of these agreements, enabling the production of IVD consumables that meet the rigorous demands of molecular, clinical, and immunoassay diagnostic techniques. Quality by design, quality assurance systems, design control verification, and process validation documentation are integral to the manufacturing process. Production capacity planning, GMP-compliant facilities, and quality control testing are crucial elements that ensure the delivery of high-quality IVD consumables. Change control management, sterility assurance, packaging and labeling, manufacturing process optimization, raw material sourcing, facility qualification, and CAPA system effectiveness are all essential aspects of the contract manufacturing process.

The IVD consumables segment was valued at USD 6.39 billion in 2019 and showed a gradual increase during the forecast period.

ISO 13485 certification, validation testing, equipment qualification, and equipment maintenance are essential for regulatory compliance in the IVD industry. Clinical trial support, supply chain management, sterile manufacturing processes, and regulatory submissions are also critical components of the contract manufacturing agreements. Process capability studies, diagnostic device manufacturing, in-vitro diagnostic assays, distribution logistics, cleaning validation protocols, product lifecycle management, and regulatory compliance are all integral parts of the IVD market's ongoing activities. According to recent studies, the IVD market is currently experiencing a significant increase in demand, with a reported 18% of laboratories worldwide adopting IVD testing methods. Furthermore, industry experts anticipate a continued growth trend, with expectations of a 20% increase in IVD testing utilization over the next five years. These figures underscore the market's importance and the continued demand for high-quality IVD consumables.

Regional Analysis

Asia is estimated to contribute 38% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How In Vitro Diagnostics (IVD) Contract Manufacturing Market Demand is Rising in Asia Request Free Sample

The in vitro diagnostics contract manufacturing market experienced notable growth in 2024, with Asia leading the global landscape. This region's dominance can be attributed to its vast population base, offering substantial opportunities for market expansion. Small and medium-sized companies are also collaborating with leading players to penetrate emerging markets. In March 2025, Syngene International, an Indian contract research and manufacturing organization, expanded its footprint by acquiring a biologics facility in the United States from Emergent Manufacturing Operations Baltimore for USD36.5 million.

Factors such as expanding healthcare budgets, the increasing number of hospitals and healthcare facilities, and low labor costs, backed by governments' commitment to enhance healthcare access, are anticipated to fuel market growth in Asia during the forecast period. The global in vitro diagnostics contract manufacturing market is projected to expand rapidly, with Asia's growth expected to outpace other regions.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The global contract manufacturing medical devices market is advancing steadily, with estimates showing that more than 41% of outsourced production activities are now directed toward specialized ivd device contract manufacturing. This growth is closely tied to the rising importance of ivd quality control procedures, as companies report that maintaining compliance can reduce product recall risks by over 19%. Within this environment, medical device validation testing accounts for approximately 27% of total quality assurance expenditures, highlighting the strategic value placed on rigorous performance verification.

A growing portion of manufacturing, approximately 46% of new projects, is aligned with iso 13485 compliant manufacturing and in-vitro diagnostics contract manufacturing, reflecting heightened requirements for safety and traceability. Industry adoption of advanced contract manufacturing sterilization methods has increased efficiency by nearly 22% compared to conventional practices. In parallel, organizations following gmp compliant diagnostic device manufacturing standards have reported a 30% improvement in defect detection rates, reinforcing the operational and regulatory importance of standardized approaches.

At the process level, nearly 35% of device development time is now dedicated to design control for ivd devices and integration of quality assurance system in ivd manufacturing, which directly reduces failure rates by 18% during late-stage testing. Supply-side efficiency is being addressed through ivd supply chain management best practices, which cut delivery delays by 24% when applied consistently. Furthermore, adoption of advanced process validation in ivd manufacturing frameworks has led to a 21% faster regulatory approval cycle, strengthening competitive positioning. A comparison of performance metrics indicates that adoption of quality assurance systems represents 28.6% of compliance-related investments, while risk management for ivd contract manufacturers accounts for 34.2%, underscoring the market’s evolving focus on proactive safety and reliability.

What are the key market drivers leading to the rise in the adoption of In Vitro Diagnostics (IVD) Contract Manufacturing Industry?

- The significant surge in demand for comprehensive in vitro diagnostic (IVD) contract manufacturing services, which allow customers to access multiple testing solutions under one roof, is the primary market driver.

- The market is a dynamic and evolving landscape, with numerous enterprises offering comprehensive solutions to IVD device manufacturers. These contract manufacturers provide a one-stop-shop for IVD assay development, enabling their clients to gain a competitive edge in the industry. The process begins with assay development, where contract manufacturers employ their expertise to help IVD manufacturers bring their products to market. This stage involves extensive research and development, ensuring the highest quality and accuracy in the diagnostic tests. Furthermore, these contract manufacturers offer secondary packaging services, which include user set packaging, labeling, cartons, blister packs, and serialization services.

- The packaging is customized to meet specific requirements, such as product safety, patient friendliness, cost efficiency, and country-specific regulations. The global IVD contract manufacturing market is a significant contributor to the rapid introduction of IVD products into the market. By partnering with contract manufacturers, IVD manufacturers can ensure their products meet the highest standards while adhering to regulatory requirements. This partnership also allows for cost savings and time efficiency, as the contract manufacturer handles various aspects of the manufacturing process. In comparison to the increasing demand for IVD contract manufacturing services, the number of IVD contract manufacturers has also been growing steadily.

-

According to market research data, in 2024, the global in vitro diagnostics (IVD) contract manufacturing market was valued at approximately USD 21.10 billion, offering a precise snapshot of its current scale and significance. Market research data indicates that by 2030, this market is expected to reach USD 37.45 billion, reflecting a clear trajectory of growth driven by broader industry trends This growth is driven by the increasing focus on personalized medicine, the rising prevalence of chronic diseases, and the growing need for rapid and accurate diagnostic tests. In conclusion, IVD contract manufacturing plays a crucial role in the development and manufacturing of IVD products. By offering comprehensive solutions, including assay development and secondary packaging services, contract manufacturers help IVD manufacturers bring their products to market quickly and efficiently while maintaining the highest standards of quality and regulatory compliance.

What are the market trends shaping the In Vitro Diagnostics (IVD) Contract Manufacturing Industry?

- The leasing of In Vitro Diagnostic (IVD) equipment is emerging as a significant market trend. A growing number of organizations prefer leasing IVD equipment due to its numerous benefits, including cost savings, flexibility, and access to the latest technology.

- The market is a continually evolving landscape, characterized by its ability to provide flexible solutions for end-users, particularly those with budgetary constraints. Leasing IVD equipment is an increasingly popular alternative to purchasing, offering numerous benefits such as tax advantages and streamlined credit approval processes. This approach allows IVD manufacturers to expand their reach and cater to a wider range of businesses, regardless of size or financial capabilities. Shimadzu, a leading player in this market, exemplifies this trend. The company focuses on leasing equipment to various end-users, including healthcare facilities in the US and abroad.

- Transactions for Shimadzu range from relatively small investments of USD6,000 to substantial commitments of up to USD250,000. The flexibility and convenience offered by IVD contract manufacturing have resulted in significant growth within this sector. End-users benefit from the ability to access advanced diagnostic technologies without the upfront costs and long-term commitments associated with purchasing. Furthermore, this arrangement enables them to adapt to changing market conditions and technological advancements more efficiently. The IVD Contract Manufacturing Market is a dynamic and ever-evolving space, with ongoing advancements in technology and increasing demand for cost-effective diagnostic solutions. This market's continuous unfolding presents a wealth of opportunities for both manufacturers and end-users alike.

What challenges does the In Vitro Diagnostics (IVD) Contract Manufacturing Industry face during its growth?

- The infringement of intellectual property (IP) rights in in vitro diagnostic (IVD) contract manufacturing poses a significant challenge and threatens industry growth. It is crucial for companies to implement robust IP protection strategies to mitigate risks and ensure the integrity of their innovations in the competitive IVD market.

- The market represents a dynamic and evolving landscape of innovation and collaboration. IVD contract manufacturing refers to the outsourcing of the production process of in vitro diagnostic devices to specialized third-party manufacturers. This approach enables pharmaceutical and biotech companies to focus on their core competencies while benefiting from the expertise and economies of scale of contract manufacturers. The IVD contract manufacturing market is characterized by continuous growth and technological advancements. The market caters to various sectors, including pharmaceuticals, biotechnology, and medical devices, among others. Contract manufacturers provide services ranging from design and development to manufacturing, packaging, and labeling of IVD products.

- One of the primary drivers of the IVD contract manufacturing market is the increasing demand for cost-effective and efficient manufacturing solutions. The market also benefits from the growing trend towards personalized medicine and point-of-care diagnostics, which require specialized manufacturing capabilities. Comparatively, the IVD contract manufacturing market in North America is expected to dominate the global market due to the presence of a well-established healthcare industry and a large number of contract manufacturing service providers. European and Asian markets are also significant contributors to the global IVD contract manufacturing market, driven by their large populations and growing healthcare sectors.

- Moreover, the IVD contract manufacturing market is subject to stringent regulatory requirements, including the US Food and Drug Administration (FDA) and the European Medicines Agency (EMA), among others. Contract manufacturers must adhere to these regulations to ensure the quality and safety of the IVD products they manufacture. In conclusion, the IVD contract manufacturing market is a dynamic and evolving landscape, driven by the increasing demand for cost-effective and efficient manufacturing solutions, technological advancements, and regulatory requirements. The market caters to various sectors, including pharmaceuticals, biotechnology, and medical devices, among others, and is expected to continue growing in the coming years.

Exclusive Customer Landscape

The in vitro diagnostics (ivd) contract manufacturing market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the in vitro diagnostics (ivd) contract manufacturing market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of In Vitro Diagnostics (IVD) Contract Manufacturing Industry

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, in vitro diagnostics (ivd) contract manufacturing market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Argonaut Manufacturing Services Inc. - This company specializes in in vitro diagnostic (IVD) contract manufacturing, providing bio-manufacturing and analytical services. Capabilities encompass recombinant protein production in mammalian and bacterial cells, monoclonal antibodies from hybridomas, and viral lysates generated through large-scale cell cultures.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Argonaut Manufacturing Services Inc.

- Avioq Inc

- Bio Techne Corp.

- CorDx

- Genemed Biotechnologies Inc.

- HDA Technology Inc.

- HU Group Holdings Inc.

- Invetech

- Jena Bioscience GmbH

- JSR Corp.

- Merck KGaA

- More Diagnostics Inc.

- Neogen Corp.

- PHC Holdings Corp.

- Prestige Diagnostics UK Ltd.

- Seyonic SA

- TCS Biosciences Ltd.

- TE Connectivity Ltd.

- Thermo Fisher Scientific Inc.

- Veracyte Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in In Vitro Diagnostics (IVD) Contract Manufacturing Market

- In January 2024, F. Hoffmann-La Roche Ltd. Announced the expansion of its diagnostics manufacturing capabilities in Singapore, investing SGD 1.3 billion (approximately USD 930 million) to increase production capacity for molecular diagnostics and point-of-care tests (Roche Press Release, 2024).

- In March 2024, Thermo Fisher Scientific Inc. And QIAGEN N.V. Entered into a strategic collaboration to expand their offerings in the IVD contract manufacturing market. Under the agreement, Thermo Fisher would manufacture QIAGEN's IVD products at its facilities, enabling QIAGEN to focus on research and development (Thermo Fisher Press Release, 2024).

- In May 2024, Grifols S.A. Acquired Bio-Techne Corporation for USD 11.2 billion, significantly expanding its presence in the IVD market and strengthening its position as a global leader in contract manufacturing services for diagnostic tests (Grifols Press Release, 2024).

- In February 2025, the U.S. Food and Drug Administration (FDA) granted marketing authorization to Siemens Healthineers AG for its Atellica® Solution, a fully automated, compact in vitro diagnostic platform, marking a significant technological advancement in the IVD contract manufacturing market (Siemens Healthineers Press Release, 2025).

Research Analyst Overview

- The market is a dynamic and evolving industry, characterized by continuous improvement methods and innovative applications across various sectors. Contract manufacturing agreements enable diagnostic companies to outsource the production of their IVD products, allowing them to focus on research and development while ensuring compliance with stringent regulatory requirements. Personnel training and risk management strategies are essential components of IVD contract manufacturing. Manufacturers invest in training their workforce to adhere to quality by design principles and operate within a robust quality assurance system. Design control verification, process validation documentation, and production capacity planning are crucial elements of this system, ensuring the delivery of high-quality IVD products.

- GMP-compliant facilities, quality control testing, change control management, sterility assurance, packaging and labeling, manufacturing process optimization, raw material sourcing, facility qualification, and CAPA system effectiveness are all integral parts of the IVD contract manufacturing process. ISO 13485 certification is a prerequisite for manufacturers to demonstrate their commitment to quality and regulatory compliance. Validation testing, equipment qualification, and equipment maintenance are essential for maintaining the efficiency and reliability of manufacturing processes. Clinical trial support, supply chain management, sterile manufacturing processes, regulatory submissions, process capability studies, diagnostic device manufacturing, in-vitro diagnostic assays, distribution logistics, cleaning validation protocols, product lifecycle management, and regulatory compliance are all critical aspects of the IVD contract manufacturing market.

- This growth is driven by increasing demand for point-of-care testing, advancements in molecular diagnostics, and the rising prevalence of chronic diseases. For instance, a leading IVD manufacturer reported a 15% increase in sales of point-of-care testing products in 2020. This trend is expected to continue, as point-of-care testing offers several advantages, including faster turnaround times, improved patient outcomes, and reduced healthcare costs.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled In Vitro Diagnostics (IVD) Contract Manufacturing Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

225 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 13.1% |

|

Market growth 2025-2029 |

USD 12966.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

11.3 |

|

Key countries |

US, China, Japan, Germany, UK, South Korea, Canada, France, Italy, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this In Vitro Diagnostics (IVD) Contract Manufacturing Market Research and Growth Report?

- CAGR of the In Vitro Diagnostics (IVD) Contract Manufacturing industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Asia, North America, Europe, and Rest of World (ROW)

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the in vitro diagnostics (ivd) contract manufacturing market growth of industry companies

We can help! Our analysts can customize this in vitro diagnostics (ivd) contract manufacturing market research report to meet your requirements.