Janitorial Cleaning Equipment And Supplies Market Size 2025-2029

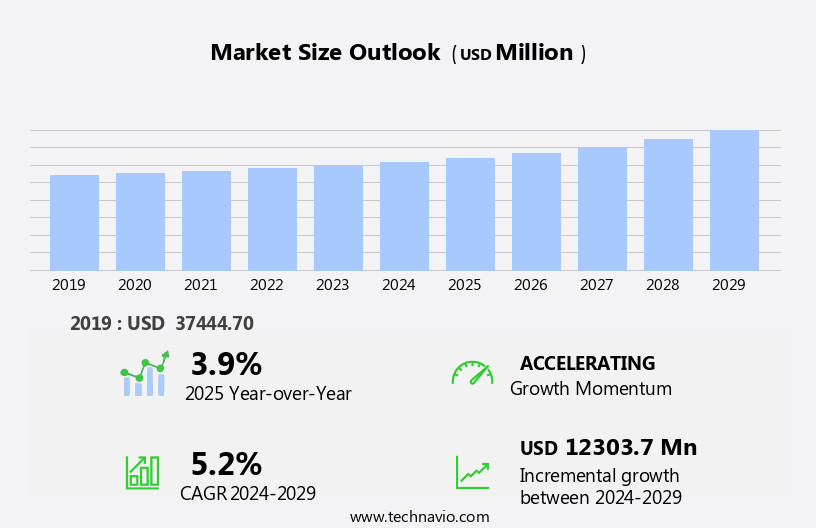

The janitorial cleaning equipment and supplies market size is forecast to increase by USD 12.3 billion, at a CAGR of 5.2% between 2024 and 2029.

- The market is shaped by three key drivers and challenges. Firstly, stringent regulatory requirements related to hygiene and safety continue to influence market dynamics. As health and sanitation become increasingly prioritized, demand for advanced cleaning technologies and supplies that adhere to regulatory standards is on the rise. Vacuum cleaners are indispensable for maintaining cleanliness in both residential and commercial settings. The market also includes janitorial supplies like wipes, gloves, trash bags, and chemicals. Secondly, there is a growing trend towards eco-friendly products. With heightened awareness of environmental concerns, companies are responding by introducing more sustainable cleaning solutions. This shift not only appeals to eco-conscious consumers but also aligns with evolving regulatory frameworks.

- However, the market also faces challenges. companies grapple with growing concerns over product recalls. Ensuring product quality and safety is essential to maintain brand reputation and customer trust. As the market becomes more competitive, addressing these challenges effectively will be crucial for companies seeking to capitalize on opportunities and stay ahead of the competition.

What will be the Size of the Janitorial Cleaning Equipment And Supplies Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, shaped by various economic conditions and regulatory standards. Carpet extractors, steam cleaners, and automatic scrubbers are essential tools for maintaining cleanliness in diverse sectors, from office spaces to residential properties. Sustainability trends are driving demand for eco-friendly solutions, such as natural products and AI integration, in janitorial services, diagnostic equipment, and janitorial supplies. Price sensitivity and data analytics influence purchasing decisions, while disinfection services and eco-friendly practices gain prominence due to health concerns and environmental issues. Building activity and consumer electronics create new opportunities for floor equipment and electric vehicle components.

Tariff barriers and government subsidies impact production costs, affecting the manual workforce and the adoption of sustainable products. The ongoing unfolding of market activities reveals the integration of carpet shampooers, vacuum cleaners, pressure washers, maintenance services, and floor buffers into the industry. Trade restrictions and the rise of green products contribute to the continuous dynamism of this market, shaping its future trajectory.

How is this Janitorial Cleaning Equipment And Supplies Industry segmented?

The janitorial cleaning equipment and supplies industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product Type

- Equipment

- Carts and tools

- Floor care supplies

- Disposables

- End-user

- Commercial

- Residential

- Distribution Channel

- Online

- Offline

- Distributors

- Direct Sales

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

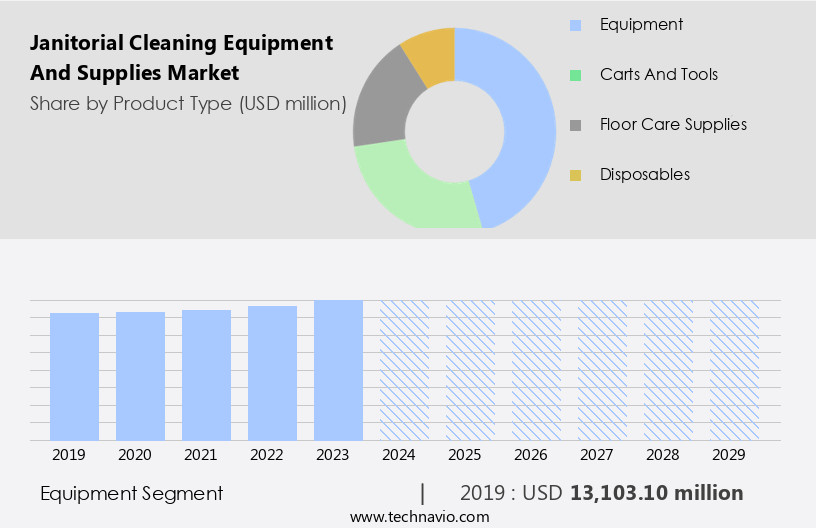

By Product Type Insights

The equipment segment is estimated to witness significant growth during the forecast period.

The market is shaped by various factors, including economic conditions and regulatory standards. In commercial and industrial settings, high-performance cleaning machines and tools are in high demand. These products, which make up the equipment segment, include vacuum cleaners, floor scrubbers, pressure washers, and steam cleaners. Vacuum cleaners, available in upright, canister, and robotic models, are essential for maintaining cleanliness in both commercial and residential spaces. Floor scrubbers, a must-have for large commercial areas like malls, airports, and hospitals, facilitate deep cleaning. Sustainability trends are influencing the market, with an increasing preference for eco-friendly practices and green products.

This shift is reflected in the growing popularity of natural cleaning solutions and the integration of data analytics for optimizing cleaning processes. Disinfection services, crucial in the wake of health concerns, are also gaining traction. Price sensitivity is a significant factor, with many businesses seeking cost-effective solutions. This trend is driving the adoption of automated machines and electric vehicle components, such as pressure washers and floor buffers, which reduce labor costs. Building activity and environmental concerns are also contributing to market growth, with the demand for janitorial equipment increasing in new constructions and renovations. Regulatory standards, such as those related to disinfection and waste management, are shaping the market.

Tariff barriers and trade restrictions can impact the availability and cost of certain cleaning supplies. Additionally, government subsidies and incentives for sustainable practices can influence market dynamics. Innovations in technology, such as AI integration and diagnostic equipment, are transforming the industry. Maintenance services and carpet equipment, including carpet extractors and carpet shampooers, are also key components of the market. Trash bags and janitorial supplies are essential consumables, while production costs and the manual workforce continue to be critical factors.

The Equipment segment was valued at USD 13.10 billion in 2019 and showed a gradual increase during the forecast period.

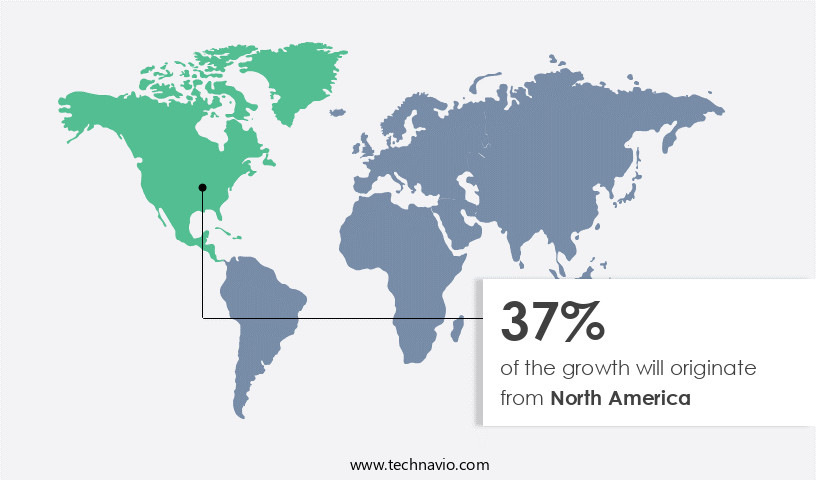

Regional Analysis

North America is estimated to contribute 37% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing significant growth, fueled by increased investment in the construction sector and the demand for specialized cleaning solutions across various industries. In the US alone, construction spending reached an impressive USD1.6 trillion in 2023, according to the US Census Bureau, with investments coming from both private and public sectors. This surge in construction activities has resulted in a heightened need for janitorial cleaning equipment to ensure cleanliness and hygiene in newly built and renovated spaces. Regulatory standards play a crucial role in the market, with a growing emphasis on sustainability trends and eco-friendly practices.

Consequently, there is a rising demand for green products and automated machines, such as carpet shampooers, vacuum cleaners, automatic scrubbers, and steam cleaners. Additionally, disinfection services and diagnostic equipment are gaining popularity due to health concerns and the increasing importance of data analytics in the industry. Price sensitivity is another significant factor influencing market dynamics, with consumers and businesses seeking cost-effective solutions. Natural products and eco-friendly practices are also becoming increasingly important, as are tariff barriers and trade restrictions. In response, many janitorial services are integrating artificial intelligence and machine learning to optimize their operations and reduce manual workforce requirements.

The market also caters to various sectors, including office spaces, residential properties, and consumer electronics, among others. Floor equipment, such as carpet extractors and floor buffers, are essential for maintaining cleanliness and longevity in these spaces. Furthermore, government subsidies and incentives are driving the adoption of electric vehicle components and other sustainable products in the market. Environmental concerns and building activity continue to shape the market, with a growing emphasis on reducing production costs and minimizing waste. Despite these challenges, the market remains dynamic and innovative, with new technologies and solutions emerging to meet the evolving needs of consumers and businesses.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the dynamic the market, businesses and institutions prioritize maintaining clean, healthy environments for their employees and patrons. This demand fuels the continuous innovation and expansion of this sector. Janitorial cleaning companies invest in advanced technology, such as microfiber mops and vacuums, HEPA filters, and automated scrubbers, to enhance their services. Meanwhile, suppliers offer a wide range of eco-friendly and cost-effective cleaning solutions, including reusable cloths, green chemicals, and energy-efficient equipment. The market also caters to diverse industries, including healthcare, education, food service, and commercial offices, with specialized products like disinfectants, floor care machines, and waste management systems. Effective inventory management and logistics are crucial for janitorial businesses to meet their clients' needs efficiently. The market is a thriving, essential sector that ensures the cleanliness and safety of various establishments.

What are the key market drivers leading to the rise in the adoption of Janitorial Cleaning Equipment And Supplies Industry?

- Strict regulatory requirements, particularly those pertaining to hygiene and safety, serve as the primary catalyst for market growth.

- The market is influenced by various factors, with regulatory standards being a significant driver. Strict regulations, particularly in sectors where hygiene and safety are crucial, necessitate the adoption of high-quality cleaning equipment and supplies. For instance, in the healthcare sector, regulations such as the Centers for Disease Control and Prevention (CDC) guidelines in the US mandate stringent cleaning protocols to prevent the spread of infectious diseases. Hospitals and clinics are required to use certified disinfectants and advanced cleaning tools to maintain sterile environments. Similarly, the European Union Biocidal Products Regulation (BPR) ensures that cleaning chemicals meet stringent safety and efficacy standards, driving demand for compliant products.

- Moreover, sustainability trends are gaining momentum in the market, with an increasing focus on natural products and data analytics to optimize cleaning processes. Price sensitivity is another factor influencing market dynamics, with companies offering cost-effective solutions to cater to budget-conscious customers. Disinfection services are also becoming increasingly popular, as businesses prioritize maintaining a clean and healthy environment for employees and customers. In conclusion, the market is driven by regulatory requirements, sustainability trends, price sensitivity, and the growing demand for disinfection services. companies must stay abreast of these trends and regulatory standards to offer innovative and compliant solutions to meet the evolving needs of their customers.

What are the market trends shaping the Janitorial Cleaning Equipment And Supplies Industry?

- The increasing preference for eco-friendly products represents a significant market trend. This growing demand signifies a notable shift towards sustainable consumer choices.

- The market is experiencing a notable transition towards eco-friendly solutions, driven by regulatory requirements and consumer preferences. This trend is reflected in the increasing adoption of biodegradable chemicals, reusable tools, and energy-efficient cleaning equipment. For instance, CloroxPro expanded its product line on August 6, 2024, with the introduction of EcoClean Disinfecting Wipes in the US. These wipes cater to the janitorial needs of various sectors, including schools, offices, and government buildings, with a 100% plant-based substrate and citric acid as the active ingredient.

- Certified by the Environmental Protection Agency (EPA) Design for the Environment and Safer Choice programs, these wipes align with the growing demand for sustainable cleaning solutions. Other equipment, such as steam cleaners, pressure washers, carpet extractors, and diagnostic equipment, are also being developed with energy efficiency and reduced environmental impact in mind. This shift towards eco-friendly janitorial services is expected to continue shaping the market dynamics.

What challenges does the Janitorial Cleaning Equipment And Supplies Industry face during its growth?

- The escalating apprehensions among companies regarding product recalls poses a significant challenge to the industry's growth trajectory.

- The market faces significant challenges due to product recalls, which can negatively impact a company's reputation, financial stability, and customer trust. For instance, in February 2024, Bissell recalled over 150,000 Multi Reach Hand and Floor Vacuum Cleaners due to a potential fire hazard caused by the battery pack overheating and smoking. This recall affected approximately 155,000 units in North America. Such incidents pose safety risks and result in substantial financial losses and brand damage. Eco-friendly practices are increasingly important in the janitorial industry, with consumers and governments prioritizing environmental concerns. Tariff barriers and building activity can also influence market dynamics.

- For residential properties, floor equipment is a crucial investment, and consumer electronics companies are expanding their offerings in this space. Government subsidies and incentives may further propel the market forward. Despite these opportunities, companies must remain vigilant about product safety and quality to mitigate recalls and maintain customer trust.

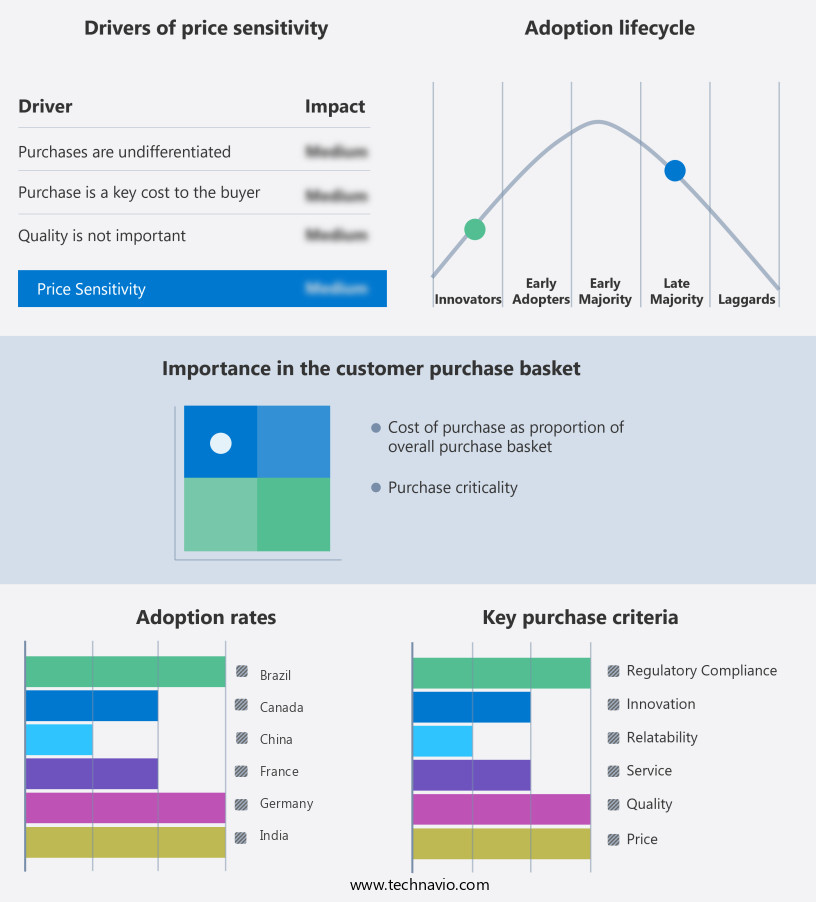

Exclusive Customer Landscape

The janitorial cleaning equipment and supplies market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the janitorial cleaning equipment and supplies market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, janitorial cleaning equipment and supplies market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ABM Industries Inc. - The company specializes in providing top-tier janitorial cleaning equipment and supplies. Notable offerings include the Scotch-Brite Professional 2-in-1 Trapezoid Mop Frame, Scotch-Brite Professional Standard Flat Mop, and 3M Doodleduster Cloth. These solutions cater to the demands of commercial and industrial cleaning applications, ensuring optimal results and durability.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABM Industries Inc.

- Alfred Kärcher SE & Co. KG

- Betco Corporation

- Cleanstar

- Diversey Holdings, Ltd.

- Ecolab Inc.

- Georgia-Pacific LLC

- GOJO Industries, Inc.

- Hostess Brands, Inc.

- Jani-King International, Inc.

- Nilfisk A/S

- Procter & Gamble

- RB Hygiene Home

- Sanmar Group

- SCA Tissue North America

- Tennant Company

- The Clorox Company

- The Hill and Griffith Company

- Unilever PLC

- Zep Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Janitorial Cleaning Equipment And Supplies Market

- In January 2024, Tennant Company, a leading provider of sustainable cleaning solutions, launched the AeroSCS QuadFlex Auto-Scrubber, a new innovative product that combines four cleaning technologies in one machine. This new offering aims to enhance productivity and efficiency in large facilities (Tennant Company Press Release).

- In March 2024, ISS Facility Services, a global total facility management company, announced a strategic partnership with Diversey, a leading manufacturer of cleaning and hygiene solutions. This collaboration aims to provide integrated cleaning and hygiene services to enhance customer experiences and drive operational excellence (ISS Facility Services Press Release).

- In May 2024, Nilfisk, a global leader in professional cleaning equipment, completed the acquisition of Vikan, a leading manufacturer of cleaning tools and systems. This strategic move is expected to strengthen Nilfisk's position in the market and expand its product portfolio (Nilfisk Press Release).

- In April 2025, the U.S. Environmental Protection Agency (EPA) approved the use of electrolyzed water as a disinfectant in the janitorial cleaning industry. This approval opens up new opportunities for companies offering electrolyzed water-based cleaning solutions, as it is a more sustainable and cost-effective alternative to traditional disinfectants (U.S. Environmental Protection Agency Press Release).

Research Analyst Overview

- The market encompasses a diverse range of products and services, including floor care, green cleaning, and sanitation solutions for various industries. School services and office services utilize janitorial equipment and supplies to maintain clean, healthy learning and working environments. Green certification and sustainable practices are increasingly important trends, driving demand for eco-friendly floor care products, green carpet, and DIY solutions. Equipment repair and maintenance are crucial for ensuring the longevity and efficiency of commercial equipment. Safety tips and protocols are essential for both professionals and DIY users, as is proper use of disinfection services, surface disinfectants, and hand sanitizer.

- Industry events, training programs, and customer service are key components of the janitorial services sector, with professional services and equipment distributors playing a vital role in facilitating industry trends. Building services, hotel services, and facility management require specialized equipment and supplies, such as industrial supplies, building construction materials, air purifiers, and equipment rental. Cost analysis and safety considerations are critical factors in the decision-making process for facility maintenance and hygiene solutions. Equipment manufacturers and suppliers continue to innovate, offering advanced technologies and solutions to meet the evolving needs of the market.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Janitorial Cleaning Equipment And Supplies Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

214 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.2% |

|

Market growth 2025-2029 |

USD 12.3 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.9 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Janitorial Cleaning Equipment And Supplies Market Research and Growth Report?

- CAGR of the Janitorial Cleaning Equipment And Supplies industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the janitorial cleaning equipment and supplies market growth of industry companies

We can help! Our analysts can customize this janitorial cleaning equipment and supplies market research report to meet your requirements.