Laser Land Levelers Market Size 2024-2028

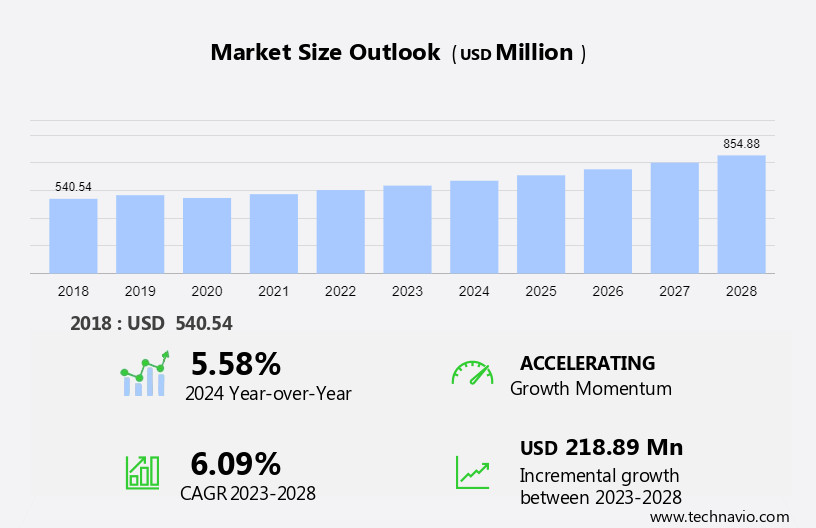

The laser land levelers market size is forecast to increase by USD 218.89 million at a CAGR of 6.09% between 2023 and 2028.

- The market is experiencing significant growth due to several key trends. The increasing demand for water-saving technologies in agriculture is one such trend, as laser land levelers offer precise leveling, reducing water waste and improving irrigation efficiency. Another trend is the rising demand for climate-smart practices in agriculture, with laser land levelers contributing to sustainable farming by ensuring optimal soil moisture and reducing greenhouse gas emissions. With the proliferation of edge data centers, customer experience has become a top priority for data center managers. Laser land levelers offer lower latency, making them ideal for big data processing and cloud services, including streaming services. Furthermore, the adoption of alternative land leveling methods, such as laser land levelers, is on the rise due to their accuracy, efficiency, and ability to reduce labor costs. These factors are expected to drive the growth of the market In the coming years.

What will be the Size of the Laser Land Levelers Market During the Forecast Period?

- The market is experiencing significant growth due to the increasing demand for high-performance, cost-effective solutions in various industries. The market is also driven by the need for local management in mission-critical applications, such as autonomous vehicles, smart cities, manufacturing, financial institutions, telemedicine, augmented reality (AR), and AI virtual assistants. Additionally, laser land levelers find use cases in video monitoring, gaming, content delivery, remote management, data center health, asset management, business intelligence, and more. Their small footprint and ability to process data in real-time make them a valuable tool for industries that require real-time data processing and analysis.

How is this Laser Land Levelers Industry segmented and which is the largest segment?

The laser land levelers industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Rotary laser

- Plain level laser

- Dot laser

- Application

- Agriculture

- Construction

- Landscapping

- Others

- Geography

- APAC

- China

- India

- North America

- Canada

- US

- Europe

- Germany

- South America

- Middle East and Africa

- APAC

By Type Insights

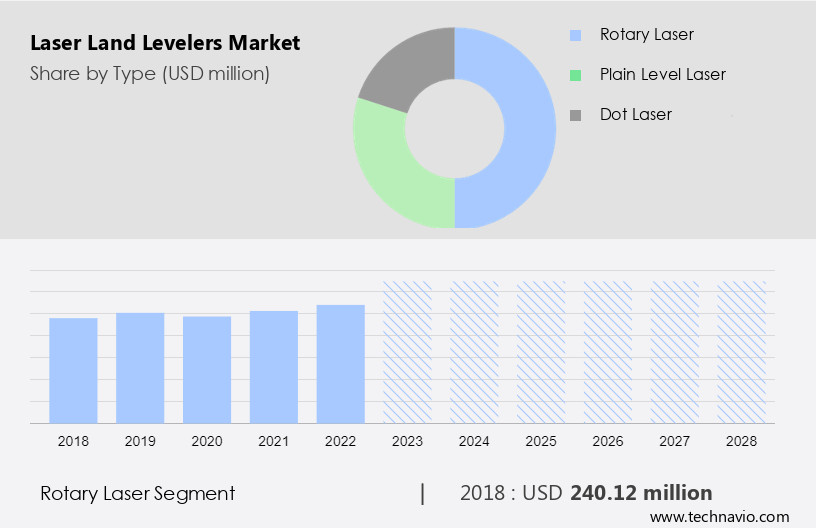

- The rotary laser segment is estimated to witness significant growth during the forecast period.

Laser land levelers with rotary leveling technology offer 360-degree laser lines, making them suitable for large-scale indoor and outdoor land-leveling projects. Compared to other models, these levelers are heavier and larger in size. They cater to the needs of data center managers, manufacturing industries, financial institutions, and telemedicine sectors, among others. Use cases include mission-critical applications, autonomous vehicles, smart cities, and next-generation applications. Key features include lower latency, higher security, greater control, and cost-effectiveness. These levelers support public, private, and on-premise data centers, as well as customizable infrastructure like micro-data centers, network edge, and tower edge. Prominent companies providing rotary laser land levelers include TOPCON and Celec Enterprises. This technology enhances data processing capabilities, ensuring high performance for big data, cloud services, streaming services, and content delivery.

Get a glance at the market report of share of various segments Request Free Sample

The Rotary laser segment was valued at USD 240.12 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

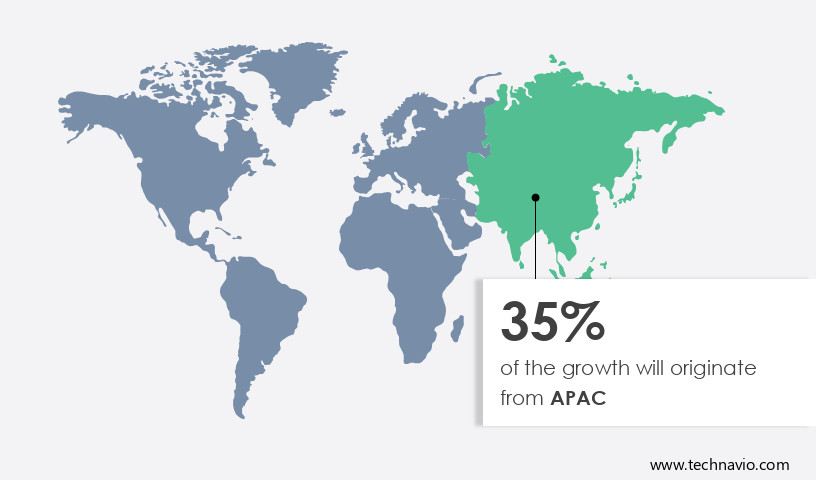

- APAC is estimated to contribute 35% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

In South Asia, a substantial portion of the land is utilized for agriculture, with irrigation being a vital input for crop production. The region faces water scarcity challenges, leading to the necessity of implementing effective management practices. This trend is expected to propel the growth of the laser land leveler market in South Asia during the forecast period. Notable companies in this sector include Mahindra, John Deere, and Hexagon. The agriculture sector in South Asia is witnessing several mechanization initiatives to enhance productivity and efficiency. Key applications of laser land levelers include irrigation management, soil preparation, and land leveling, which are essential for optimal crop growth.

These technologies offer advantages such as lower latency, higher security, greater control, and cost-effectiveness, making them increasingly popular among data center managers, financial institutions, telemedicine providers, and other industries. Additionally, laser land levelers support next-generation applications, including autonomous vehicles, smart cities, manufacturing, and cloud services, among others. These solutions enable data processing, business intelligence, and data center health monitoring, ensuring scalability, cooling, and power efficiency.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Laser Land Levelers Industry?

Growing demand for water-saving technologies in agriculture is the key driver of the market.

- In the rapidly evolving digital landscape, data centers play a pivotal role in delivering high-performance, cost-effective solutions for various industries, including customer experience-driven sectors like edge data centers, cloud services, streaming services, and mission-critical applications. As next-generation applications continue to emerge, the demand for lower latency and greater control is escalating. Laser land levelers are increasingly being adopted to address these challenges, offering significant benefits for data center managers in terms of local management, small footprint, and data processing efficiency. Use cases for laser land levelers span across various industries, including autonomous vehicles, smart cities, manufacturing, financial institutions, telemedicine, augmented reality (AR), AI virtual assistants, video monitoring, gaming, content delivery, remote management, data center health, asset management, business intelligence, and more.

- For instance, In the context of telecoms networks, laser land levelers can be employed at aggregation points, central offices, mobile core, and regional data centers to optimize network performance and improve scalability. As the market for data centers continues to grow, infrastructure companies are investing in hyperscale data centers, public cloud, hyperscalers, on-premise data centers, private cloud, and customizable infrastructure, including micro-data centers, network edge, tower edge, last mile, and colocation. These investments necessitate the adoption of advanced technologies, such as laser land levelers, to ensure higher security, cooling, power, and operations efficiency. Laser land levelers represent a valuable investment for data center managers seeking to enhance their infrastructure's performance, efficiency, and cost-effectiveness.

- By addressing latency concerns and enabling real-time data processing, these solutions contribute to a superior customer experience and support the growth of various industries, from connected cars and cloud gaming to financial institutions and manufacturing.

What are the market trends shaping the Laser Land Levelers Industry?

Rising demand for climate-smart practices in agriculture is the upcoming market trend.

- The market plays a crucial role in optimizing data center infrastructure for various industries, including customer experience-focused sectors like Edge Data Centers, and mission-critical applications such as Big Data, Cloud Services, Streaming Services, and High-Performance Computing. With the increasing adoption of next-generation applications, there is a growing demand for cost-effective, local management solutions that offer lower latency and greater control. These industries require real-time data processing and high-security infrastructure to ensure data center health and asset management.

- Moreover, the scalability and customizability cater to various deployment models, including Public Cloud, Hyperscalers, On-premise data centers, Private Cloud, and Micro-data centers. The network edge, tower edge, last mile, telecoms networks, connected cars, cloud gaming, aggregation points, central offices, mobile core, and regional data centers all benefit from the advanced features of Laser Land Levelers. Infrastructure companies and hyperscale data centers leverage Laser Land Levelers for their cooling, power, and operations requirements, ensuring higher security and business intelligence. The market's growth is driven by the need for cost-effective, high-performance, and secure solutions that cater to the diverse needs of various industries.

What challenges does the Laser Land Levelers Industry face during its growth?

The rising adoption of alternative land leveling methods is a key challenge affecting the industry growth.

- In the realm of data center infrastructure, they play a pivotal role in ensuring optimal performance and cost-effectiveness. These advanced tools enable data center managers to level and shape the physical environment, reducing latency and enhancing customer experience. Edge data centers, a critical component of next-generation applications, particularly benefit due to their small footprint and local management capabilities. Big Data, Cloud Services, and Streaming Services rely heavily on high-performance, mission-critical infrastructure. They facilitate the creation of such environments by providing a level surface for efficient data processing. Use cases to extend beyond traditional data centers, reaching autonomous vehicles, smart cities, manufacturing, financial institutions, telemedicine, augmented reality (AR), AI virtual assistants, video monitoring, gaming, content delivery, remote management, data center health, asset management, business intelligence, and more.

- They contribute to the scalability and cooling requirements of hyperscale data centers. They are also essential In the deployment of public, private, and customizable infrastructure, including micro-data centers, network edge, tower edge, last mile, telecoms networks, connected cars, cloud gaming, aggregation points, central offices, mobile core, and regional data centers. Colocation, internet exchange, and private peering further expand the application areas for laser land levelers. Infrastructure companies and hyperscalers prioritize lower latency, higher security, and greater control In their data center operations. Laser land levelers enable these objectives by providing a smooth, level surface for efficient data processing and network connectivity.

- Power and operations management are also crucial aspects of data center infrastructure, and laser land levelers contribute to these areas by ensuring a stable foundation for the installation and maintenance of critical equipment.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AgriPak

- Beri Udyog Pvt Ltd

- CANAMEK

- Celec Enterprises

- DASMESH Mechanical Works Pvt. Ltd.

- Deere and Co.

- DESHWAR INDUSTRIES

- Hexagon AB

- Jaycee Strips and Fasteners Pvt. Ltd.

- KS Agrotech Pvt. Ltd

- Machino Agriculture Implements Pvt. Ltd.

- Mahindra and Mahindra Ltd.

- Mara Srl

- MITSUI and CO. LTD.

- MOBA Mobile Automation AG

- Osaw Udyog Pvt. Ltd.

- PDC Agro Works

- Raj Hydraulics

- Rajasthan Mechanical Works Ltd.

- Saron Mechanical Works

- TOPCON CORP.

- Trimble Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The laser land leveling market encompasses innovative technologies designed to optimize the process of leveling land surfaces with high precision and efficiency. This market caters to various industries, including manufacturing, financial institutions, telemedicine, and others, where level land is essential for mission-critical operations.They offer several advantages over traditional methods. They provide lower latency, enabling real-time data processing for next-generation applications. This is particularly important for industries that rely on big data and cloud services, such as streaming services, autonomous vehicles, smart cities, and augmented reality (AR). Moreover, they are cost-effective and offer a small footprint, making them an attractive option for businesses seeking local management and greater control over their operations.

They are also suitable for use cases where higher security is required, such as in financial institutions and telemedicine. They are increasingly being adopted in various applications, including data center health and asset management, business intelligence, and data processing. In the context of data centers, these technologies enable colocation, internet exchange, and private peering, providing hyperscalers, infrastructure companies, and other businesses with customizable infrastructure and scalability. The market is dynamic and evolving, with ongoing advancements in cooling and power technologies driving innovation. Micro-data centers, network edge, tower edge, last mile, telecoms networks, connected cars, cloud gaming, and aggregation points are among the areas being deployed to optimize performance and reduce costs.

Central offices, mobile core, and regional data centers are also benefiting from laser land leveling technologies. These technologies enable higher security, greater control, and improved data processing capabilities, making them an essential component of modern infrastructure. The laser land leveling market represents a significant opportunity for businesses seeking to optimize their operations and gain a competitive edge. With their ability to provide lower latency, cost-effectiveness, and scalability, they are poised to transform various industries, from manufacturing and finance to telemedicine and data centers.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

174 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.09% |

|

Market growth 2024-2028 |

USD 218.89 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.58 |

|

Key countries |

US, Canada, China, India, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Laser Land Levelers Market Research and Growth Report?

- CAGR of the Laser Land Levelers industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the laser land levelers market growth of industry companies

We can help! Our analysts can customize this laser land levelers market research report to meet your requirements.