Liquorice Market Size 2025-2029

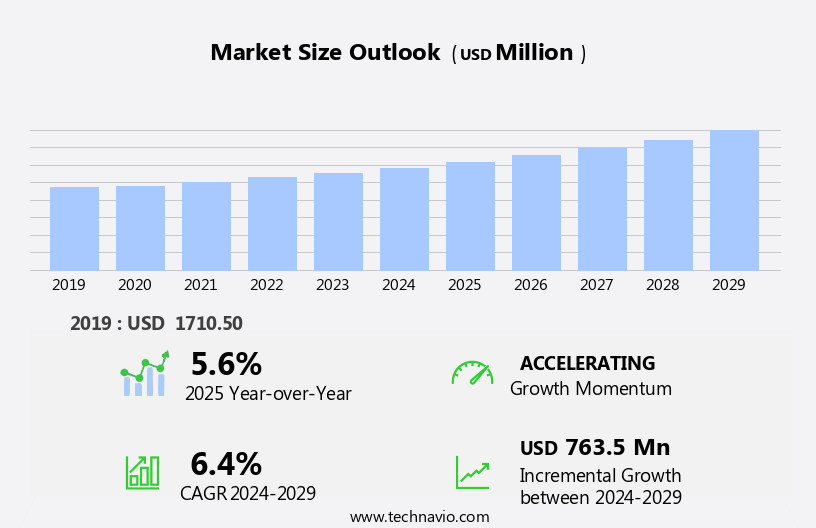

The liquorice market size is forecast to increase by USD 763.5 million, at a CAGR of 6.4% between 2024 and 2029.

- The market is witnessing significant growth due to the increasing consumer preference for organic food and beverages containing herbal ingredients. The immunity-boosting properties of herbal extracts, such as those found in liquorice, are driving demand in various end-use industries. Companies focusing on providing high-quality herbal products are well-positioned to capitalize on this trend. However, challenges persist in the form of stringent regulations regarding the use of certain herbal ingredients in food and beverages, which may limit innovation and product development. Additionally, ensuring sustainable sourcing and ethical production practices is crucial to maintain consumer trust and meet evolving market expectations.

- To succeed in this market, companies must navigate these challenges by staying informed of regulatory changes and implementing robust supply chain management systems. By delivering high-quality, herbal products that cater to consumer health trends, businesses can effectively capitalize on the growth opportunities presented in the market.

What will be the Size of the Liquorice Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, shaped by dynamic market forces and emerging trends. Liquorice, derived from the root of the Glycyrrhiza plant, offers a diverse range of applications across various sectors. In the realm of cosmetics, liquorice's bioactive compounds, including glycyrrhizic acid and flavonoids, are increasingly sought after for their skin-soothing properties. Post-harvest handling techniques and powder processing methods are continually refined to optimize the extraction and preservation of these valuable components. The food industry also remains a significant market for liquorice, with ongoing innovation in product development and flavor profiles. Liquorice's unique aroma and saponin content contribute to its widespread use in confectionery, baked goods, and beverages.

Storage conditions play a crucial role in maintaining the quality and value of liquorice, with temperature, humidity, and protective packaging all critical factors. Plant breeding programs are also advancing, with a focus on improving yield, disease resistance, and sustainability practices. Consumer demand for liquorice continues to grow, driven by its medicinal properties and versatility. Regulatory compliance and price volatility are ongoing challenges, requiring efficient cultivation techniques and soil requirements to ensure a consistent supply. The liquorice industry is characterized by ongoing research and development, with a focus on extract standardization, purification, and value-added products. The future of the market is shaped by these evolving trends and the continuous unfolding of market activities.

How is this Liquorice Industry segmented?

The liquorice industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Grade Type

- Food grade

- Feed grade

- Pharmaceutical grade

- Application

- Food and beverages

- Pharmaceuticals

- Tobacco

- Others

- Product Type

- Fruit flavored licorice

- Original black licorice

- Distribution Channel

- Supermarkets

- Online sales

- Convenience stores

- End-user

- Individual consumers

- Industrial users

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- Italy

- Spain

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

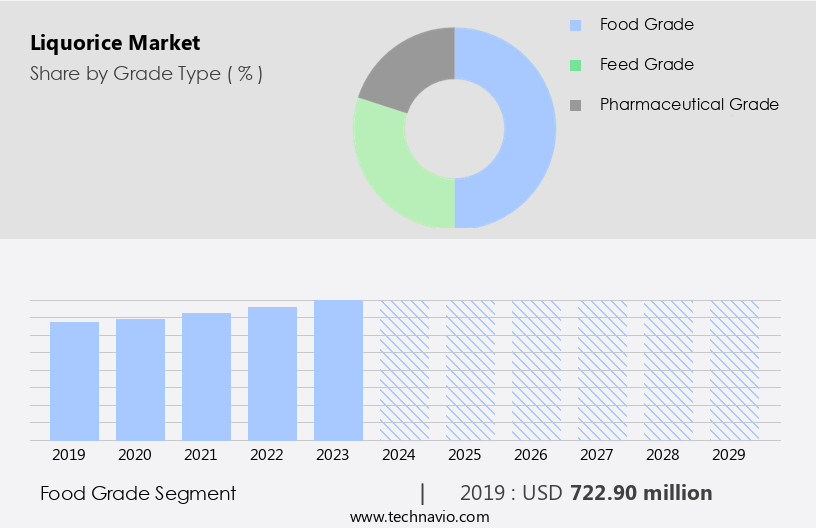

By Grade Type Insights

The food grade segment is estimated to witness significant growth during the forecast period.

The Food grade segment was valued at USD 722.90 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 34% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in Asia Pacific is experiencing moderate growth due to increasing consumer awareness of the side effects of allopathic medicines and the therapeutic benefits of herbal products, including liquorice. This awareness has led to a higher demand for herbal extracts and dietary supplements in the region. Moreover, the rise in obesity and the prevalence of cardiovascular and other nutrient-deficiency related diseases in countries like China and India are driving the use of liquorice extracts in food and beverage products. Liquorice root morphology and cultivation techniques play a significant role in optimizing yield and improving processing efficiency. Irrigation management and sustainability practices are essential to maintain soil requirements and ensure regulatory compliance.

Liquorice extract standardization and purification techniques are crucial to ensure the quality of the final product. The market segmentation includes various applications, such as food, pharmaceuticals, cosmetics, and dietary supplements. Liquorice's chemical composition, including bioactive compounds like glycyrrhizic acid, flavonoids, and saponins, contributes to its medicinal properties and value-added products. The market trends include the development of new liquorice-based products, such as cosmetics and functional foods, and the optimization of post-harvest handling and powder processing techniques. Consumer demand for liquorice remains strong due to its unique aroma profile and medicinal properties.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The global liquorice market size and forecast projects growth, driven by liquorice market trends 2025-2029. B2B liquorice supply solutions leverage natural extract technologies for quality. Liquorice market growth opportunities 2025 include liquorice for confectionery and liquorice for health supplements, meeting demand. Liquorice supply chain software optimizes operations, while liquorice market competitive analysis highlights key suppliers. Sustainable liquorice practices align with eco-friendly ingredient trends. Liquorice regulations 2025-2029 shapes liquorice demand in Asia 2025. High-purity liquorice solutions and premium liquorice insights boost adoption. Liquorice for beverages and customized liquorice products target niches. Liquorice market challenges and solutions address sourcing, with direct procurement strategies for liquorice and liquorice pricing optimization enhancing profitability. Data-driven liquorice market analytics and natural sweetener trends drive innovation.

What are the key market drivers leading to the rise in the adoption of Liquorice Industry?

- The surging market trend is driven primarily by the increasing consumer preference for food and beverage products infused with herbal ingredients.

- The market for liquorice-based products is experiencing significant growth due to increasing consumer preference for natural ingredients in food and beverages. With a rise in health consciousness, there is a growing demand for herbal extracts, including liquorice, which are free from gluten, artificial flavors, and preservatives. Liquorice extracts offer numerous benefits, such as a unique aroma profile and medicinal properties, which are driving their adoption in various industries. Manufacturers of value-added products, such as herbal teas, are leveraging the benefits of liquorice to cater to the needs of health-conscious consumers. Liquorice flavonoids analysis and liquorice saponin content are crucial factors in the production of standardized and purified liquorice extracts.

- The focus on liquorice extract standardization and purification is essential to ensure consistency and quality in the final product. The natural liquorice flavor compounds are gaining popularity due to their ability to provide a harmonious and immersive taste experience. The market dynamics are driven by the increasing demand for natural ingredients and the growing awareness of the adverse effects of synthetic chemicals used in food and beverages. The demand for liquorice extracts is expected to continue to surge as consumers seek out natural alternatives to synthetic ingredients.

What are the market trends shaping the Liquorice Industry?

- The trend in the market is leaning towards herbal extracts and their immunity-boosting properties The market has witnessed significant growth due to the increasing consumer demand for immunity-boosting herbal products. The enzymes found in liquorice plant roots contribute to the production of lymphocytes and macrophages, which are essential for the body's natural defense against microbes, pollutants, and allergens. In developed countries, including the US, Canada, and the UK, the consumption of herbal supplements is prevalent due to rising health concerns among consumers. Obesity and other inflammatory health conditions are common in these countries, leading health-conscious consumers to opt for functional food and beverage options that enhance immunity.

- Liquorice cosmetic ingredients and post-harvest handling techniques have gained importance to ensure the quality and purity of the product. Liquorice powder processing methods have been refined to maintain the flavor and nutritional value of the root. Liquorice food applications have expanded beyond traditional confectionery uses to include baked goods, beverages, and functional foods. Proper storage conditions are crucial to preserve the liquorice plant's properties and ensure its efficacy. Plant breeding and research continue to focus on improving the yield, quality, and resistance to diseases and pests. The market's growth is driven by these factors and the increasing consumer awareness of the health benefits associated with the use of liquorice.

What challenges does the Liquorice Industry face during its growth?

- Ensuring the production and provision of high-quality herbal products is a critical requirement for the industry's growth, as consumer trust and regulatory compliance heavily depend on it.

- The market encompasses the production and sale of liquorice and its derived products. The primary raw material for these products is the liquorice root, derived from the Glycyrrhiza glabra plant. However, ensuring the quality and safety of these products poses challenges. The extraction of glycyrrhizic acid, a key bioactive compound in liquorice, can be complex due to the plant's morphology and the need for precise irrigation management. Contamination is also a concern, as the conditions under which the root is grown and harvested can impact the final product's quality.

- To address these challenges, companies are focusing on innovations in liquorice product development and implementing sustainability practices. These efforts include improving cultivation methods, optimizing irrigation, and implementing rigorous quality control measures to ensure the production of safe and effective liquorice products.

Exclusive Customer Landscape

The liquorice market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the liquorice market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, liquorice market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

HARIBO GmbH & Co. KG - This company specializes in the production and supply of high-quality liquorice products, including Licorice Extract Block and Powder, catering to various industries and applications. Their offerings undergo rigorous quality control processes to ensure consistency and purity.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- HARIBO GmbH & Co. KG

- Mondelez International Inc.

- Nestlé S.A.

- Perfetti Van Melle Group B.V.

- Mars Incorporated

- Cloetta AB

- Katjes International GmbH

- August Storck KG

- Gustaf's Licorice

- Ricola Group Ltd.

- Yildiz Holding A.S.

- Hershey Company

- Ferrara Candy Company

- Switzer's Licorice

- RJ's Licorice Ltd.

- Toms Group A/S

- Lakrids by Bülow

- Darrell Lea Confectionery Co. Pty Ltd

- Amarelli Fabbrica di Liquirizia

- Panda Licorice

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Liquorice Market

- In January 2024, Ferrara Candy Company, a leading confectionery manufacturer, announced the launch of its new line of Black Forest Liquorice gummies, expanding its product offerings in the market (Ferrara Candy Company Press Release).

- In March 2024, Nestle and Ferrero, two major players in the food industry, entered into a strategic partnership to co-manufacture and distribute Ferrero's liquorice products in Europe, aiming to strengthen their market presence and optimize production costs (Bloomberg).

- In May 2025, the European Commission approved the acquisition of the Swedish liquorice manufacturer, Salmiakki-Kauppa Oy, by the Finnish candy company, Fazer Group, for â¬150 million, marking Fazer's entry into the market and increasing its presence in the Nordic region (Fazer Group Press Release).

- In May 2025, the Food and Drug Administration (FDA) in the United States granted GRAS (Generally Recognized as Safe) status to natural licorice extract, allowing its use as a flavoring agent in food and beverages, potentially boosting demand for liquorice products in the US market (FDA Press Release).

Research Analyst Overview

- In the dynamic the market, various aspects influence the production and consumption of this ancient sweet root. Authentication methods and quality assessment play a crucial role in ensuring consumer trust, while flavour enhancement and product formulation cater to evolving taste preferences. Sustainability initiatives, such as waste management and by-product utilization, are essential for the industry's economic impact and social responsibility. Liquorice's drying methods and genetic diversity impact its phytochemical profile, affecting therapeutic uses and health benefits. Phytochemistry research uncovers new applications for glycyrrhetinic acid derivatives.

- Brand positioning and marketing strategies rely on consumer sensory evaluation and packaging solutions to differentiate products. Processing technology advancements enable traceability systems, ensuring product authenticity and reducing adulteration risks. Liquorice cultivation regions and traditional medicine practices add to the market's rich history. Extraction solvents and sustainability initiatives contribute to the industry's progress, shaping the future of this versatile market.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Liquorice Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

248 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.4% |

|

Market growth 2025-2029 |

USD 763.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.6 |

|

Key countries |

US, China, Germany, Canada, India, South Korea, France, Japan, Italy, Brazil, UAE, UK, Spain, and Mexico |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Liquorice Market Research and Growth Report?

- CAGR of the Liquorice industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the liquorice market growth of industry companies

We can help! Our analysts can customize this liquorice market research report to meet your requirements.