Loyalty Management Market Size 2025-2029

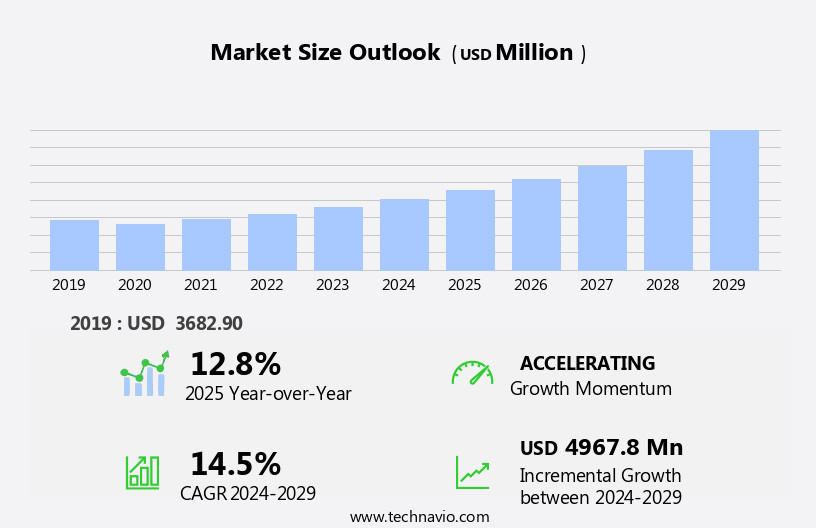

The loyalty management market size is forecast to increase by USD 4.97 billion at a CAGR of 14.5% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing customer preference for personalized solutions. This trend is driven by the desire for tailored experiences that cater to individual preferences and needs. Furthermore, the application of artificial intelligence in loyalty management is revolutionizing the industry, enabling innovative solutions such as predictive analytics and automated rewards. However, the market faces challenges from stringent government regulations, which may hinder the adoption of loyalty programs in certain sectors. These regulations require companies to adhere to strict data privacy and security standards, adding complexity to the implementation process.

- To capitalize on market opportunities and navigate challenges effectively, companies must stay informed of regulatory changes and invest in advanced technologies to deliver personalized experiences that meet evolving customer expectations.

What will be the Size of the Loyalty Management Market during the forecast period?

- In the dynamic and evolving the market, entities continually adapt to meet the changing needs of businesses and consumers. Co-branded loyalty programs, for instance, have gained traction as a strategic tool for enhancing customer engagement and driving revenue growth. Loyalty surveys and tiered structures enable businesses to gather valuable customer insights and personalize offerings. Predictive analytics and machine learning algorithms help identify customer churn risks and tailor loyalty campaigns to prevent it. Frequent flyer programs and loyalty alliances offer unique value propositions for customers in various sectors, including financial services and travel. Loyalty management software integrates with CRM systems, enabling businesses to streamline loyalty initiatives and deliver personalized experiences.

- Behavioral targeting and e-commerce integration are essential components of modern loyalty marketing, ensuring seamless redemption options and enhancing customer lifetime value. Loyalty certification and partnerships further strengthen a brand's loyalty strategy, while loyalty portals provide a centralized platform for managing rewards and customer interactions. Customer retention remains a top priority, with loyalty campaigns and membership programs designed to foster brand advocacy and deepen customer engagement. Subscription services and artificial intelligence are increasingly being adopted to optimize loyalty strategies and deliver data-driven customer insights. The loyalty landscape is continually unfolding, with new trends and technologies shaping the market.

- Staying informed and adaptable is crucial for businesses seeking to maximize the value of their loyalty programs and foster long-term customer relationships.

How is this Loyalty Management Industry segmented?

The loyalty management industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Deployment

- Cloud-based

- On-premises

- Type

- Large enterprises

- Small and medium enterprises (SMEs)

- Program Type

- Points-Based

- Tier-Based

- Subscription-Based

- Coalition

- Component

- Software

- Services

- Geography

- North America

- US

- Mexico

- Europe

- France

- Germany

- Italy

- Spain

- UK

- Middle East and Africa

- UAE

- APAC

- Australia

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Deployment Insights

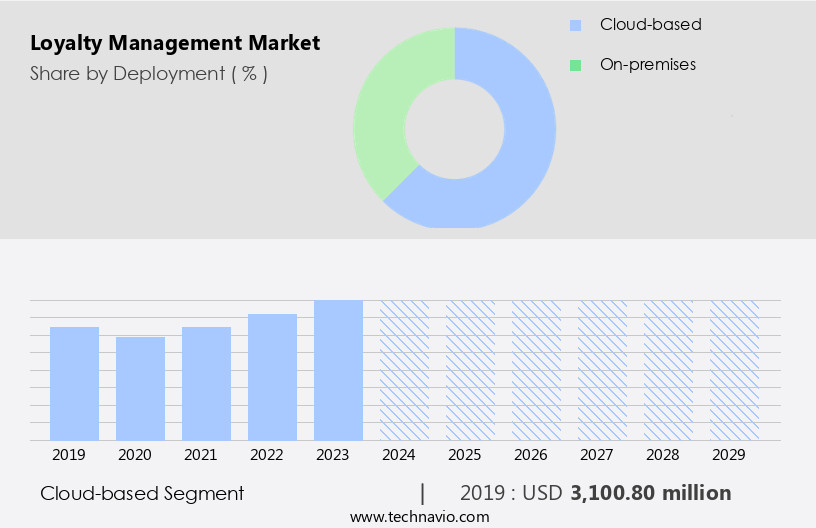

The cloud-based segment is estimated to witness significant growth during the forecast period.

In today's business landscape, customer loyalty is a critical differentiator for enterprises seeking to build long-term relationships with their clients. Cloud-based loyalty management solutions are gaining popularity due to their ability to provide a unified, accessible platform for managing loyalty programs, automating rewards, and analyzing customer data. These solutions enable real-time updates and personalized experiences, fostering brand advocacy and customer engagement. Customer journey mapping and segmentation are essential components of effective loyalty strategies. Loyalty consultants help businesses design and implement these initiatives, from loyalty surveys and tiered programs to predictive analytics and machine learning. Loyalty marketing agencies utilize behavioral targeting and CRM integration to deliver customized campaigns, while loyalty portals and apps offer convenient redemption options and real-time rewards tracking.

Co-branded loyalty programs, frequent flyer programs, and subscription services are just a few examples of the various types of loyalty initiatives. Artificial intelligence and machine learning are increasingly being used to analyze customer data and provide valuable insights, enhancing the overall customer experience. E-commerce integration and mobile app loyalty enable seamless engagement across multiple channels, ensuring that businesses can cater to their clients' evolving needs. Customer feedback and data analytics are crucial for measuring the success of loyalty programs and improving customer retention. Loyalty metrics, such as customer lifetime value and churn rate, provide essential insights into the effectiveness of loyalty strategies.

Certification programs and partnerships with financial services and hotel chains further expand the reach and impact of loyalty initiatives. In conclusion, the market is witnessing significant growth as businesses recognize the importance of customer loyalty in driving long-term success. Cloud-based solutions offer a flexible, scalable, and cost-effective way to manage loyalty programs, automate rewards, and analyze customer data, enabling enterprises to build stronger, more engaged relationships with their clients.

The Cloud-based segment was valued at USD 3.1 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 49% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the dynamic business landscape of North America, loyalty management is a burgeoning area of focus for companies across various industries. The IT and telecom, healthcare, BFSI, manufacturing, retail, and e-commerce sectors are leading the charge in this domain, driven by the increasing need to deliver personalized experiences and retain customers. Loyalty management software, which employs predictive analytics, machine learning, and customer segmentation, plays a pivotal role in this regard. By analyzing customer behavior, purchasing patterns, and historical data, the software enables businesses to offer targeted incentives, such as reward points, coupons, and discounts, to customers.

This not only fosters customer engagement and loyalty but also contributes to business growth, sales, and wealth generation. The BFSI, hotels, retail, media, and entertainment industries are anticipated to significantly increase their investments in customer loyalty solutions, further propelling the market forward. Loyalty programs, co-branded initiatives, loyalty surveys, and loyalty tiers are some of the strategies being adopted to enhance customer retention and brand advocacy. Credit card rewards, membership programs, and subscription services are also popular loyalty offerings. Artificial intelligence and rewards programs are being integrated with financial services, mobile applications, e-commerce platforms, and customer relationship management systems to provide seamless redemption options and real-time customer insights.

Overall, the North American the market is poised for significant growth, as businesses continue to prioritize customer experience, data analytics, and loyalty metrics to drive business success.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The Global Loyalty Management Market grows with AI-driven loyalty programs and loyalty management for e-commerce. Loyalty management market trends 2025 highlight personalized loyalty rewards and cloud-based loyalty platforms. Loyalty programs for retail and customer retention loyalty solutions drive engagement, per loyalty management market forecast. Blockchain-based loyalty programs enhance loyalty management for hospitality, while loyalty programs for airlines boost retention. Loyalty management for financial services and gamified loyalty programs increase participation. Loyalty programs for SMEs, real-time loyalty analytics, and loyalty management for subscription services optimize strategies. Loyalty programs for healthcare, sustainable loyalty management solutions, loyalty management for omnichannel retail, advanced loyalty program software, loyalty management market supply chain, and loyalty programs for customer engagement fuel growth through 2029.

What are the key market drivers leading to the rise in the adoption of Loyalty Management Industry?

- The increasing demand for customized offerings from customers serves as the primary catalyst for market growth. The markets have evolved significantly over the past few decades, shifting from traditional reward systems based on in-store purchases to more sophisticated programs that offer instant gratification and personalized experiences. Today's customers expect to earn and redeem rewards in real-time, both online and offline, and they seek optimal engagement with brands before and after purchases. According to recent research, customer loyalty programs are becoming a crucial growth factor for businesses, with shoppers expressing a preference for brands that offer such programs to enhance engagement. These programs go beyond financial services and now include mobile loyalty, e-commerce integration, and data analytics to provide valuable customer insights.

- Redemption options have expanded to include a variety of rewards, such as discounts, exclusive offers, and personalized experiences. Customer feedback is also an essential component of these programs, allowing businesses to improve the customer experience and tailor offerings to individual preferences. Moreover, loyalty metrics, such as customer retention rates and repeat purchase behavior, are closely monitored to measure the success of these programs. Overall, the markets are poised for growth as businesses recognize the importance of providing a seamless and rewarding customer experience to build long-term relationships.

What are the market trends shaping the Loyalty Management Industry?

- The increasing adoption of artificial intelligence (AI) for innovative solutions is a significant market trend. This development reflects the growing recognition of AI's potential to enhance efficiency and productivity across various industries.

- Loyalty management is a critical aspect of customer relationship management, with customer experience playing a pivotal role. Advanced technologies such as artificial intelligence and machine learning are transforming loyalty management systems. These technologies offer merchants insights to enhance customer interactions, improve experiences, and boost sales. By analyzing customer data, these technologies can forecast consumer behavior and trends, enabling targeted marketing efforts. For instance, Hugo Boss's innovative loyalty program, launched in June 2024, leverages these technologies to create a more engaging customer experience. The advent of big data has led to the emergence of sophisticated loyalty strategies. Loyalty automation, customer segmentation, and loyalty marketing are some key initiatives.

- Loyalty consultants help businesses implement these strategies effectively, while loyalty APIs facilitate seamless integration with existing systems. Brand advocacy is a significant benefit of successful loyalty programs, leading to increased customer retention and sales growth. A loyalty app is an essential tool for managing and tracking customer interactions, providing a personalized experience. In conclusion, the future of loyalty management lies in leveraging technology to create immersive, harmonious customer experiences that drive brand loyalty.

What challenges does the Loyalty Management Industry face during its growth?

- The strict implementation of government regulations poses a significant challenge to the expansion of loyalty programs within the industry. This mandatory compliance may hinder the widespread adoption and growth of such initiatives.

- Loyalty management is a crucial aspect for businesses aiming to differentiate themselves from competitors, particularly when price differentiation is minimal. Loyalty programs, such as co-branded schemes and frequent flyer programs, play a significant role in engaging customers and ensuring profitable utilization of merchandise and services. These initiatives foster customer retention, enhance brand recall, and create opportunities for deeper relationships with clients. However, the implementation of loyalty programs is influenced by regional regulations. Predictive analytics, loyalty surveys, and machine learning are essential tools for designing effective loyalty tiers and loyalty campaigns.

- Loyalty alliances and a loyalty portal further strengthen customer engagement. By focusing on customer satisfaction and retention, businesses can reap the benefits of increased income and profitability. Effective loyalty management strategies are essential for businesses seeking to maintain a harmonious and immersive relationship with their clients.

Exclusive Customer Landscape

The loyalty management market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the loyalty management market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, loyalty management market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- SAP

- Oracle

- IBM

- Salesforce

- Annex Cloud

- Bond Brand Loyalty

- Comarch

- Epsilon

- Five Stars

- Kobie Marketing

- LoyaltyLion

- Maritz Motivation

- Paytronix

- Smile.io

- TIBCO Software

- Yotpo

- Zinrelo

- Antavo

- Capillary Technologies

- CrowdTwist

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Loyalty Management Market

- In February 2023, Mastercard announced the expansion of its Mastercard Loyalty Platform, enabling merchants to offer customized rewards and experiences to customers through partnerships with various loyalty programs (Mastercard Press Release). This expansion represents a significant strategic move to strengthen Mastercard's position in the market.

- In May 2024, Starbucks Corporation revealed the launch of its advanced loyalty program, Starbucks Rewards 2.0, which includes personalized offers, contactless ordering, and mobile payment capabilities (Starbucks Press Release). This new program demonstrates the growing importance of technology in enhancing the customer experience and increasing loyalty.

- In August 2024, Marriott International completed its acquisition of LiveNinja, a leading provider of AI-powered chatbot solutions for the hospitality industry (Marriott International Press Release). This acquisition is expected to bolster Marriott's loyalty program, Bonvoy, by offering more personalized and efficient customer interactions.

- In November 2024, Amazon Business unveiled its Business Prime Rewards Visa Signature Card, offering businesses rewards on eligible purchases, including a percentage back on Amazon Business purchases (Amazon Press Release). This new card represents a strategic move by Amazon to attract and retain more business customers, further expanding its presence in the market.

Research Analyst Overview

In today's competitive business landscape, loyalty program implementation plays a crucial role in customer retention and advocacy. By analyzing customer behavior through data-driven marketing efforts, businesses can design effective loyalty programs that cater to individual preferences and optimize the customer journey. Leveraging technology such as personalization engines and predictive modeling enables more efficient loyalty program management and churn prevention. Customer satisfaction is a key driver of loyalty, and companies are increasingly focusing on digital marketing channels like email and social media to engage customers. The future of loyalty programs lies in innovation, with trends such as mobile marketing and optimization of the customer experience.

Effective loyalty program design requires a balance between cost and return on investment (ROI). Customer relationship management and evaluation are essential components of loyalty program management, ensuring that businesses maintain a positive brand image and build customer advocacy. As competition intensifies, companies must continuously optimize their loyalty programs to stay ahead. This may involve implementing new technologies, refining customer segmentation models, and adopting new engagement strategies to enhance the overall customer experience.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Loyalty Management Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

184 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 14.5% |

|

Market growth 2025-2029 |

USD 4967.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

12.8 |

|

Key countries |

US, China, Germany, Japan, UK, Australia, India, France, Brazil, UAE, Rest of World (ROW), Saudi Arabia, France, South Korea, Mexico, Italy, and Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Loyalty Management Market Research and Growth Report?

- CAGR of the Loyalty Management industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the loyalty management market growth of industry companies

We can help! Our analysts can customize this loyalty management market research report to meet your requirements.