Material Handling Equipment In Biomass Power Plant Market Size 2024-2028

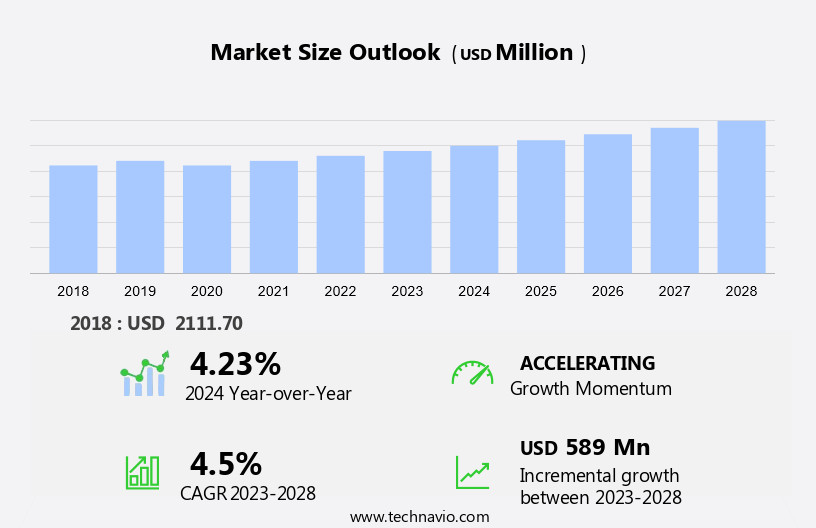

The material handling equipment in biomass power plant market size is forecast to increase by USD 589 million at a CAGR of 4.5% between 2023 and 2028.

- The market witnessed an upward trend In the adoption of equipment due to their ability to enhance the efficiency of the combustion process. With the increasing focus on managing municipal solid waste, the demand is expected to grow. Logistics infrastructure, including cranes and lifting equipment, are integral to the positioning and handling of large biomass cargo. Moreover, the underdeveloped supply chain and market for biomass in several countries create opportunities for market growth. Effective material handling is crucial for the smooth functioning of biomass power plants, as it ensures the timely and efficient transfer of biomass from the storage area to the boiler. This not only improves the overall performance of the power plant but also reduces operational costs. In summary, the market is driven by the need for increased efficiency, waste management, and supply chain development.

What will be the Size of the Material Handling Equipment In Biomass Power Plant Market During the Forecast Period?

- The market relies heavily on equipment to regulate the flow of cargo and ensure efficient energy production. Mechanical equipment, including transportation, positioning, and cargo shaping systems, are essential for the movement and manipulation of biomass materials. Storage equipment and warehouse management systems play a critical role in regulating biomass consumption and disposal. Fully automated facilities are increasingly popular In the biomass power industry to enhance productivity and worker safety. The growing trend towards e-commerce and online shopping platforms has also increased the demand for advanced solutions In the biomass power sector.

- Industries such as pharmaceutical, industrial equipment, machinery, wholesaling, consumer goods, semiconductor, and mining also rely on equipment for the transportation and storage of their products. Continuous handling equipment, such as conveyor belts and industrial trucks, are commonly used to streamline the process and optimize production. Overall, the market is dynamic and evolving, driven by the need for increased efficiency, productivity, and safety.

How is this Industry segmented and which is the largest segment?

The research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Digestors

- Feeder systems

- Silos and storage tanks

- Chippers

- Grinders

- Geography

- Europe

- Germany

- France

- APAC

- China

- India

- North America

- US

- South America

- Middle East and Africa

- Europe

By Product Insights

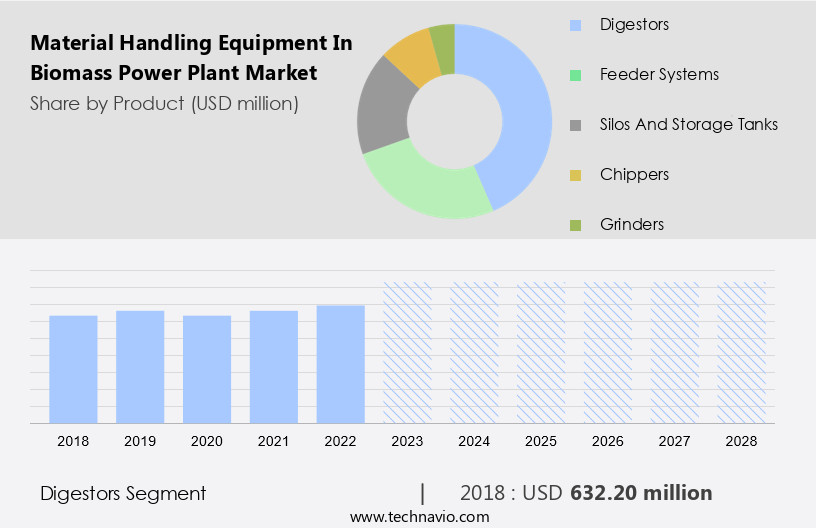

- The digestors segment is estimated to witness significant growth during the forecast period.

Biomass power plants convert organic matter into biogas, such as methane, to increase the calorific value and generate more power. Due to the high moisture content in most biomass sources, their energy content is often insufficient for self-sustained combustion. To address this, biomass is decomposed through digester processes to produce methane, which has a higher calorific value and can sustain combustion. This approach prevents heat loss due to biomass moisture, thereby enhancing power generation from a given biomass quantity. Key equipment In these processes includes transport, positioning, and lifting equipment, such as cranes and industrial trucks, as well as cargo shaping and storage equipment.

The logistics infrastructure, including warehouse management and last-mile delivery systems, is also crucial. The market is significant, with applications spanning various industries, including consumer goods, semiconductor, mining, robotics, pharmaceutical, food retail, and industrial equipment manufacturing. The growth of e-commerce and online shopping platforms further increases the demand for efficient material handling solutions.

Get a glance at the Material Handling Equipment In Biomass Power Plant Industry report of share of various segments Request Free Sample

The digestors segment was valued at USD 632.20 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

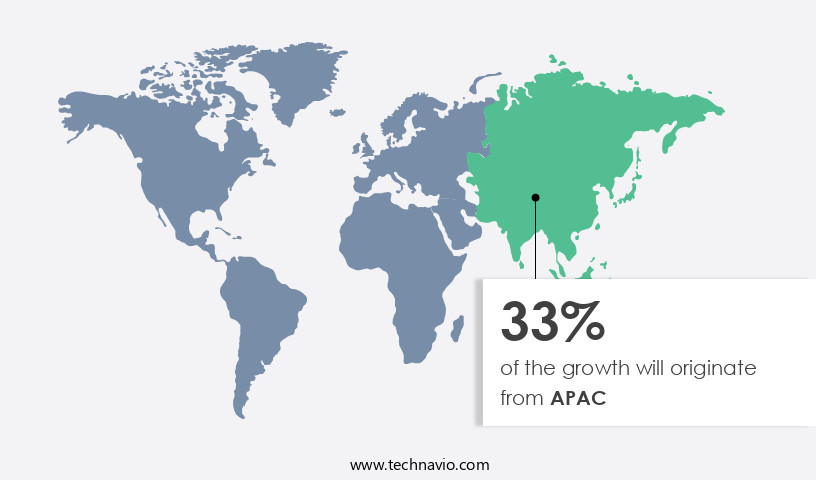

- APAC is estimated to contribute 33% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The European biomass power generation industry is led by Germany, the UK, Sweden, and Italy. Biomass power plants In these countries primarily use wood-based biomass or biogas derived from organic matter for electricity production. The growth of the market is driven by the increasing use of solid biomass, such as wood pellets and biogas. This trend is influenced by the Renewable Energy Directive of Europe, which was issued in 2009. Equipment types, including transport, positioning, cargo shaping, and storage equipment, are essential for the efficient handling of biomass in power plants. Additionally, the rise of e-commerce and online shopping platforms necessitates advanced logistics infrastructure, last-mile delivery, and automated mobile robots for the seamless movement of consumer goods. The biomass power sector also encompasses industries such as semiconductor, mining, robotics, pharmaceutical, food retail, and wholesaling, all requiring specialization. Worker safety and fully automated facilities are paramount considerations In the industry.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Material Industry?

Material handling equipment increases efficiency of combustion process in a biomass power plant is the key driver of the market.

- Biomass power plants utilize mechanical equipment for transporting, regulating, protecting, and disposing of biomass material. Transportation equipment, such as conveyor belts and automated mobile robots, move biomass from storage areas to processing units. Positioning equipment, including cranes and lifting equipment, are essential for accurately placing biomass into power generation systems. Cargo shaping equipment, like grinders and shredders, prepare biomass for efficient consumption. Storage equipment, including silos and warehouses, maintain biomass until it is ready for processing. Warehouse management and logistics infrastructure are crucial for ensuring a consistent supply of biomass to power plants. E-commerce growth and last-mile delivery require advanced equipment, such as industrial trucks and continuous handling equipment, to efficiently transport biomass from the power plant to distribution centers.

- In various industries, including consumer goods, semiconductor, mining, robotics, pharmaceutical, food retail, and wholesaling, biomass power plants provide industrial equipment and machinery with a sustainable energy source. Baggage handling systems in airports and baggage handling in warehouses also benefit from the use. The market is continually evolving, with a focus on fully automated facilities and worker safety. Automated mobile robots and continuous handling equipment are increasingly being adopted to reduce labor costs and improve efficiency. The integration of robotics and automation in plants enhances productivity and lowers operational costs. In summary, biomass power plants play a vital role In the energy sector by providing a sustainable and renewable energy source. Mechanical handling equipment, including transportation, positioning, cargo shaping, storage, and warehouse management equipment, are essential components of biomass power plants. The market is growing, driven by the increasing demand for sustainable energy sources and the adoption of advanced handling equipment.

What are the market trends shaping the Material Handling Equipment In Biomass Power Plant Industry?

The increasing requirement of managing municipal solid waste is the upcoming market trend.

- Material handling equipment plays a crucial role In the market, facilitating the transport, regulation, protection, and disposal of cargo. Mechanical equipment, such as cranes and lifting equipment, are essential for positioning and moving heavy components within the power plant. Transportation equipment, including conveyor belts and automated mobile robots, streamline the transportation of biomass materials. Cargo shaping equipment ensures the uniform shape and size of biomass before it enters the power plant. Storage equipment, including silos and warehouses, are integral to the plant's logistics infrastructure. Warehouse management systems and e-commerce growth require efficient last-mile delivery solutions, making industrial trucks and baggage handling systems valuable additions to the material handling equipment landscape.

- The mining, semiconductor, pharmaceutical, food retail, and industrial sectors heavily rely on material handling equipment to maintain their operations. Robotics and worker safety are critical considerations in fully automated facilities. E-commerce and online shopping platforms have accelerated the demand for efficient material handling equipment, particularly In the last-mile delivery sector. The relationship between waste generation and income level is significant, with developing countries producing the majority of the world's waste due to increasing consumption. Income level changes influence waste generation differently at various income levels, with low-income countries initially experiencing a reduction in waste generation before a faster increase. Material handling equipment is indispensable in various industries, including plants, where it ensures the efficient and safe transport, regulation, protection, and disposal of biomass materials. The growing demand for e-commerce and last-mile delivery solutions further focuses on the importance of material handling equipment In the logistics sector.

What challenges does the Material Handling Equipment In Biomass Power Plant Industry face during its growth?

Underdeveloped supply chain and markets for biomass in various countries are key challenges affecting the industry's growth.

- These plants utilize various types of mechanical equipment for transporting, regulating, protecting, and disposing of biomass material. Transportation equipment, such as conveyor belts and trucks, move the biomass from the point of delivery to the power plant. Positioning equipment, including cranes and lifting equipment, are used to lift and maneuver heavy biomass into place. Cargo shaping equipment, like grinders and shredders, prepare the biomass for consumption by converting it into a consistent size and shape. Storage equipment, such as silos and bunkers, hold the biomass until it's ready to be burned. Warehouse management and logistics infrastructure are crucial for efficiently handling and organizing the biomass.

- E-commerce growth and last-mile delivery have led to an increased demand for automated mobile robots and other handling equipment In the industry. Consumer goods, semiconductor, mining, robotics, pharmaceutical, food retail, and other industries rely on industrial equipment and machinery for their operations. Continuous handling equipment, including conveyor belts and industrial trucks, streamline the production process. Baggage handling systems are essential in transportation hubs to move large volumes of luggage efficiently. Worker safety is a top priority, leading to the adoption of fully automated facilities and advanced safety features in handling equipment. The industry is constantly evolving to meet the demands of various sectors, from e-commerce to industrial production.

Exclusive Customer Landscape

The material handling equipment in plant market forecasting report includes the adoption lifecycle of the market, market growth and forecasting, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, material handling equipment in biomass power plant market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amandus Kahl GmbH and Co. KG

- Andritz AG

- Astec Industries Inc

- Babcock and Wilcox Enterprises Inc.

- Dust Solutions Inc.

- Evoqua Water Technologies LLC

- General Kinematics Corp.

- MAX Automation SE

- RUD Ketten Rieger and Dietz GmbH u Co. KG

- Schenck Process Holding GmbH

- Terex Corp.

- ZE ENERGY Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

In the realm of biomass power generation, the role of material handling equipment is paramount in ensuring the efficient and effective conversion of biomass into electricity. This critical infrastructure facilitates the transport, regulation, protection, and disposal of biomass cargo, enabling the smooth operation of power plants. Material handling equipment encompasses a diverse range of machinery, including transportation equipment, positioning equipment, and cargo shaping equipment. These essential components facilitate the movement and manipulation of biomass within the power generation process. Transportation equipment plays a pivotal role In the logistics infrastructure of biomass power plants. It includes trucks, trains, and ships, which transport raw biomass from various sources to the power plant. This equipment must be strong and reliable, capable of handling the unique challenges posed by biomass cargo. Positioning equipment, such as cranes and lifting equipment, are utilized to accurately place biomass into the power generation process. Continuous handling equipment, including conveyor belts and pneumatic systems, ensure a steady flow of biomass throughout the facility. Storage equipment is another crucial aspect of material handling in biomass power generation.

Proper storage solutions are necessary to maintain the quality and integrity of the biomass until it is ready for processing. Warehouse management systems and automated mobile robots optimize the storage and retrieval process, maximizing efficiency and minimizing labor costs. The growth of e-commerce and online shopping platforms has led to increased demand for material handling equipment in various industries, including consumer goods, semiconductor manufacturing, mining, and pharmaceuticals. Robotics and automation have become increasingly prevalent In these sectors, enhancing worker safety and productivity. In fully automated facilities, material handling equipment operates in a seamless, integrated system. Industrial trucks, forklifts, and baggage handling systems work in harmony to transport and position cargo, ensuring the smooth flow of goods throughout the facility. The food retail sector also relies heavily on material handling equipment for the efficient movement and storage of perishable goods.

Proper handling and temperature control are essential to maintaining product quality and reducing waste. Machinery and industrial equipment manufacturers continue to innovate, developing new solutions to meet the evolving demands of various industries. Wholesaling and distribution channels have adapted to these advancements, ensuring that material handling equipment remains a vital component of the global supply chain. In summary, material handling equipment plays a vital role in the biomass power generation industry, enabling the efficient and effective conversion of biomass into electricity. The diverse range of equipment, including transportation, positioning, and storage solutions, ensures the smooth operation of power plants and the optimization of logistics infrastructure across various industries. As technology continues to evolve, material handling equipment will remain a critical component of the global supply chain, driving innovation and productivity In the biomass power generation sector and beyond.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

156 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 589 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Key countries |

US, Germany, China, France, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Material Handling Equipment In Biomass Power Plant Market Research and Growth Report?

- CAGR of the Material Handling Equipment In Biomass Power Plant industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, APAC, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the material handling equipment in biomass power plant market growth of industry companies

We can help! Our analysts can customize this material handling equipment in biomass power plant market research report to meet your requirements.