Memory Cards Market Size 2025-2029

The memory cards market size is forecast to increase by USD 571.8 million at a CAGR of 1.2% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by the increasing requirement for high-capacity storage solutions in cameras and camcorders. This trend is expected to continue as consumers demand higher resolution images and videos. Additionally, the rise in the use of cloud storage is fueling the need for larger memory capacities, enabling users to store and access their media files from anywhere. However, this market is not without challenges. Competition from alternative storage solutions, such as external hard drives and solid-state drives, presents a significant threat.

- Furthermore, the rapid pace of technological advancements and decreasing prices of these devices could potentially impact profitability for market participants. Companies seeking to capitalize on this market's opportunities must focus on offering innovative solutions that cater to the evolving needs of consumers, while also addressing the challenges presented by competition and technological advancements.

What will be the Size of the Memory Cards Market during the forecast period?

- The market for advanced data technology, including ultra high-speed micro SD cards, is experiencing significant growth in various industries. Aerospace manufacturers are integrating high-capacity micro SD cards into in-flight entertainment systems for storing and delivering high-resolution content. Delkin Devices and other leading companies are innovating with micro SDXC and SD memory cards to meet the demands of high-definition cameras and smart technology. In the realm of digital storage, intelligent monitoring systems and safety innovations are driving the adoption of compact storage devices in various sectors. ATP Electronics and APacer Technology are among the companies offering micro SDHC cards for connectivity solutions.

- Cactus Technologies and other players in the market are focusing on developing fire-resistant materials for storage devices to cater to the increasing need for reliable and secure data storage. The integration of micro SD cards into various applications, from cameras to in-flight entertainment systems, is transforming the way businesses handle and transfer data. UHD content and smart technology are key drivers for the market's growth, with micro SD cards offering high-speed data transfer and large storage capacity. The use of micro SD cards in various applications, from cameras to connectivity solutions, is a testament to their versatility and importance in today's data-driven business landscape.

- companies are continuously innovating to meet the evolving needs of businesses, with ATP Electronics, APacer Technology, and other leading players focusing on delivering high-performance and reliable micro SD cards for various applications. The future of the market looks promising, with a growing emphasis on advanced data technology and the integration of micro SD cards into various industries.

How is this Memory Cards Industry segmented?

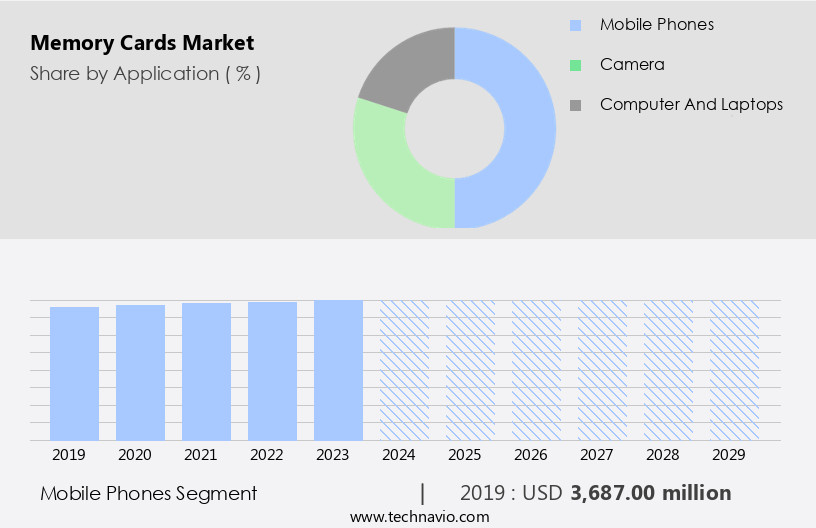

The memory cards industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Mobile phones

- Camera

- Computer and laptops

- Type

- SD card

- Compact flash

- Memory stick

- Multimedia card

- Capacity

- 16 GB

- 8 GB

- 4 GB

- 2 GB

- Others

- Geography

- APAC

- China

- India

- Japan

- South Korea

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- South America

- Brazil

- Middle East and Africa

- APAC

By Application Insights

The mobile phones segment is estimated to witness significant growth during the forecast period.

The expanding use of mobile phones and the proliferation of the Internet have led to an increase in the generation of high-capacity data. In 2023, approximately 6.84 billion smartphones were in circulation worldwide, driving the demand for memory cards. Social media platforms, such as Facebook, WhatsApp, and Instagram, are popular among users, leading to the creation of vast amounts of audio, video, and text data. These companies rely on memory cards for data storage. Moreover, the Internet of Things (IoT) and aerospace manufacturers are integrating memory cards into their devices for data processing and transfer. High-resolution content, such as UHD, is increasingly being used in digital content creation and in-flight entertainment, necessitating high-capacity and ultra-high-speed memory cards.

Safety innovations and intelligent monitoring systems are being incorporated into various industries, including healthcare, transportation, and manufacturing, further fueling the demand for memory cards. Micro-SD, SDHC, and SDXC cards from leading companies, such as Delkin Devices, ADATA Technology, Apacer Technology, PNY Technologies, and Transcend Information, cater to this growing market. NAND flash memory, such as Micro SD and CFast cards, offers high-capacity storage and fast data transfer speeds, making it an essential component of digital storage solutions. Edge computing and connectivity solutions, including those from Micron Technology and Cactus Technologies, also rely on memory cards for data processing and transfer.

Price volatility and promotions are key factors influencing the market dynamics. Fire-resistant materials and other safety features are also being incorporated into memory cards to address the growing need for secure data storage. Future developments in smart technology and compact storage devices are expected to further expand the market.

Get a glance at the market report of share of various segments Request Free Sample

The Mobile phones segment was valued at USD 3687.00 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 41% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

In the APAC region, particularly in countries like China, India, Japan, South Korea, and Southeast Asian nations, technological adoption and digital transformation have been rapid. The increasing reliance on digital devices such as smartphones, tablets, laptops, and cameras necessitates the need for memory cards to expand storage capacity and house digital content. With the growing affordability and advanced features of smartphones, consumers in these markets are capturing an escalating amount of photos, videos, and multimedia content. As a result, demand for memory cards, including Micro SD, CF, and SD, is surging to accommodate and manage this digital content.

Leading companies, such as Delkin Devices, ADATA Technology, Apacer Technology, PNY Technologies, Transcend Information, and Cactus Technologies, are innovating to meet this demand. They are introducing high-capacity memory cards with ultra-high-speed data transfer rates, intelligent monitoring systems, safety innovations, and fire-resistant materials. These advancements cater to various sectors, including aerospace manufacturers, in-flight entertainment, digital content creation, and mobile phones. Moreover, the Internet of Things (IoT) is fueling the growth of memory cards, as they are integral components of connectivity solutions and edge computing. NAND flash memory, such as Micro SDHC, Micro SDXC, and CFast cards, is at the heart of these applications, enabling seamless data transfer and storage.

Price volatility and promotions are key factors influencing the market. companies are offering competitive pricing and promotional schemes to attract customers and maintain profitability. Despite these challenges, the market for memory cards is expected to witness future developments, as the demand for high-resolution content, UHD content, and compact storage devices continues to grow.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Memory Cards Industry?

- Requirement for storage devices in cameras and camcorders is the key driver of the market.

- The global memory card market is witnessing substantial growth due to the escalating demand for storage solutions in digital imaging devices and content creation. With the rise of high-resolution imaging technologies, such as 4K and 8K video recording, burst mode photography, and RAW image capture, modern cameras and camcorders generate vast amounts of data. This necessitates the use of reliable and high-capacity memory cards. Moreover, the proliferation of digital content creation, fueled by social media platforms and content-sharing websites, has intensified the demand for memory cards.

- Professional photographers, videographers, and content creators require high-performance memory cards to efficiently store and transfer their high-definition media files. The increasing adoption of these advanced technologies across various industries, including media and entertainment, healthcare, and education, is further driving the market growth.

What are the market trends shaping the Memory Cards Industry?

- Increasing need for high-capacity solutions is the upcoming market trend.

- The global market for digital memory cards is experiencing significant growth due to the increasing popularity of photography and videography. With the proliferation of social media platforms such as Snapchat, Instagram, Facebook, and Twitter, people are becoming more engaged in sharing high-quality visual content. This trend is driving the demand for high-pixel digital cameras and camcorders, which require larger storage capacities. As the number of pixels in a camera increases, so does the need for more memory space to store the resulting high-definition images and videos.

- While some devices offer in-built memory, many consumers opt for external memory cards to expand their storage capacity. This market dynamic is expected to continue as technology advances and the demand for better image and video quality persists.

What challenges does the Memory Cards Industry face during its growth?

- Rise in use of cloud storage is a key challenge affecting the industry growth.

- Memory cards have long been a popular solution for storing and transporting digital data. However, the rise of cloud storage as a more optimized and convenient alternative is posing a challenge to the growth of the market. With cloud storage, data is stored online in the cloud and can be accessed from multiple connection points, providing users the flexibility to retrieve their information from anywhere with an internet connection. This convenience, coupled with the ability to archive and recover data in case of disasters, is leading some users to opt for cloud storage solutions over physical memory cards, particularly for storing large amounts of data such as photos, videos, and documents.

- As a result, the increasing popularity of cloud storage may hinder the demand for memory cards in the market.

Exclusive Customer Landscape

The memory cards market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the memory cards market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, memory cards market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ADATA Technology Co. Ltd. - The company provides a range of memory card solutions, including High Endurance microSDXC, Premier ONE microSDXC UHS-II U3 Class 10, and Premier Pro microSDXC, catering to various applications with enhanced durability, read and write speeds, and data transfer rates. These memory cards undergo rigorous testing to ensure optimal performance and reliability.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ADATA Technology Co. Ltd.

- Apacer Technology Inc.

- Cactus Technologies Ltd.

- Delkin Devices Inc.

- Integral Memory Plc

- KINGMAX Technology Inc.

- Kingston Technology Co. Inc.

- Lexar Co. Ltd.

- Magic Ram Inc.

- Micron Technology Inc.

- Panasonic Holdings Corp.

- Samsung Electronics Co. Ltd.

- Sony Group Corp.

- Toshiba Corp.

- Western Digital Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The memory card market continues to evolve, driven by advancements in technology and the growing demand for high-resolution content across various industries. Micro SD cards have gained significant traction due to their compact size and high storage capacity, making them a popular choice for cameras, mobile phones, and other digital devices. Major companies in the market, such as Delkin Devices and Adata Technology, are focusing on safety innovations and intelligent monitoring systems to enhance the reliability and performance of their memory cards. These systems enable real-time data monitoring and error detection, ensuring data integrity and customer satisfaction.

The use of micro SD cards extends beyond consumer electronics. In the aerospace industry, these cards are employed in in-flight entertainment systems and connectivity solutions, providing reliable storage for high-definition content and critical data. Similarly, in the industrial sector, micro SD cards are used in digital content creation and edge computing applications, where high-speed data transfer and large storage capacity are essential. CF cards and Cfast cards are other types of memory cards that cater to the needs of high-performance applications, such as professional cameras and camcorders. These cards offer ultra-high-speed data transfer rates and large storage capacities, making them indispensable for capturing and storing high-definition video and image content.

Nand flash memory technology underpins the development of these memory cards, enabling faster data transfer speeds and higher storage capacities. Leading companies, including Apacer Technology and PNY Technologies, are investing in research and development to push the boundaries of what is possible with memory cards. The Internet of Things (IoT) is another area where memory cards play a crucial role. These devices generate vast amounts of data, and memory cards provide the necessary storage capacity to capture, process, and transmit this data in real-time. Price volatility and promotions are common market trends, with companies offering discounts and bundles to attract customers.

High-capacity storage devices, such as electrical inserts and PCIe Express cards, are also gaining popularity, providing larger storage capacities and faster data transfer speeds for data-intensive applications. Future developments in the memory card market include the integration of smart technology, fire-resistant materials, and Magic Ram technology, which offers improved data protection and faster data access. These innovations are expected to drive growth in the market and cater to the evolving needs of various industries. In , the memory card market is a dynamic and innovative space, driven by advancements in technology and the growing demand for high-resolution content across various industries.

Micro SD cards, CF cards, and Cfast cards, among others, offer different solutions to meet the diverse needs of consumers and businesses, with a focus on reliability, performance, and cost-effectiveness. The future of the memory card market looks promising, with ongoing research and development and the integration of new technologies.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

230 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 1.2% |

|

Market growth 2025-2029 |

USD 571.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

1.1 |

|

Key countries |

US, China, Japan, UK, India, Germany, Brazil, Canada, France, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Memory Cards Market Research and Growth Report?

- CAGR of the Memory Cards industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the memory cards market growth of industry companies

We can help! Our analysts can customize this memory cards market research report to meet your requirements.