Military Laser Rangefinder Market Size and Trends

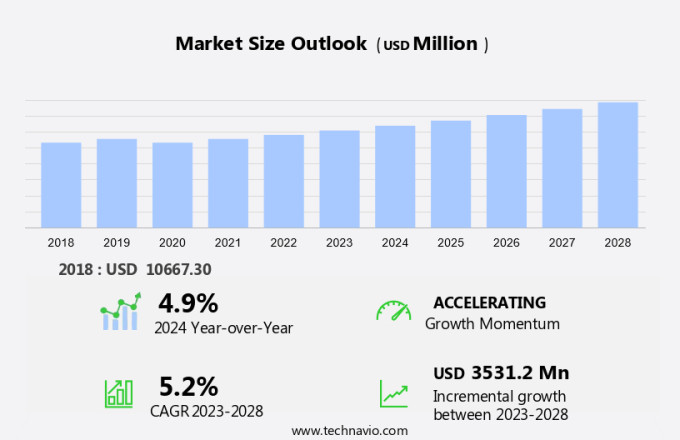

The military laser rangefinder market size is forecast to increase by USD 3.53 billion, at a CAGR of 5.2% between 2023 and 2028. The market is driven by the increasing demand for high-precision weapons and the integration of laser detection technology in military applications, such as military laser designators and UAVs. The use of drones and UAVs in military operations has significantly increased the need for accurate rangefinding capabilities. Furthermore, the integration of artificial intelligence (AI) and machine learning algorithms in military systems enhances the functionality and efficiency of laser rangefinders. However, the market faces challenges, including potential hazards associated with laser operations and the need for advanced security measures to prevent unauthorized access to laser technology. The market is expected to witness steady growth in the coming years due to these factors.

The market plays a significant role in the defense sector, providing essential equipment for military personnel in various applications. These devices are integral components of military equipment, enabling accurate distance measurement and aim correction in diverse scenarios. Military laser rangefinders are increasingly being integrated into vehicle-mounted warfare systems and surveillance systems. The integration of technology-aided warfare in defense applications has led to the adoption of these devices in both ground and aerial platforms. UAVs and drones are prime examples of aerial platforms utilizing laser rangefinders for navigation, surveying, and weapon guidance. Laser detection technology, a critical component of military laser rangefinders, has seen significant advancements in recent years. Miniaturized laser rangefinders and lightweight portable devices have become increasingly popular due to their ease of use and versatility. These devices offer high-speed clock functionality, ensuring precise measurements even in low-light conditions.

Military modernization programs worldwide have led to a growing demand for advanced military laser designators. These devices enable accurate targeting and engagement of enemy targets, enhancing the overall effectiveness of military operations. The integration of artificial intelligence (AI) and digital warfare technologies further increases the capabilities of military laser rangefinders. Military laser rangefinders are not limited to military applications alone. They find extensive use in sports, commerce, and other industries requiring precise distance measurement. The versatility and accuracy of these devices make them indispensable tools for various sectors. In conclusion, the military laser rangefinder market continues to evolve, driven by technological advancements and diverse applications in the defense sector. The integration of AI and miniaturization trends will further expand the market's potential, offering significant opportunities for growth.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018 - 2022 for the following segments.

- Product Type

- Handheld equipment

- Observation systems

- Geography

- North America

- Canada

- Mexico

- US

- Europe

- Germany

- UK

- France

- APAC

- China

- India

- Japan

- South America

- Middle East and Africa

- North America

By Product Type Insights

The handheld equipment segment is estimated to witness significant growth during the forecast period. The military laser rangefinder market encompasses advanced handheld equipment, engineered for durability and functionality, catering to the unique demands of military applications. These devices, including laser rangefinder monoculars, binoculars, and multifunctional units, are designed to perform optimally in extreme environmental conditions.

Get a glance at the market share of various segments Download the PDF Sample

The handheld equipment segment was valued at USD 6.07 billion in 2018. These devices enable precise long-range designation, targeting, and range-finding, available in short, medium, and long ranges. Military laser designators, powered by laser detection technology, are increasingly being integrated with UAVs and drones, as well as artificial intelligence (AI) and machine learning systems, to enhance military capabilities.

Regional Analysis

For more insights on the market share of various regions Download PDF Sample now!

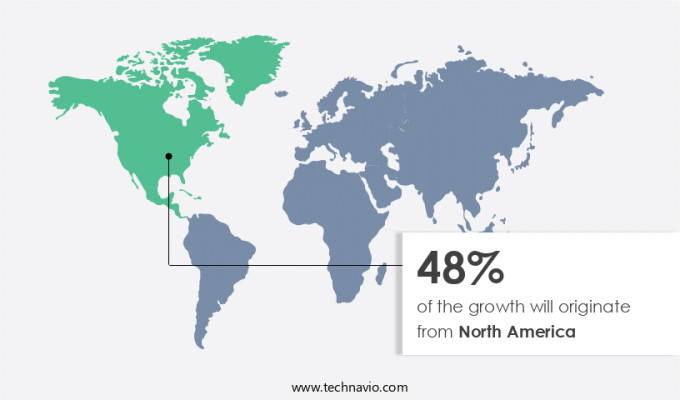

North America is estimated to contribute 48% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. The North American market holds a significant share in the military laser rangefinder industry, with the United States being a key contributor due to its substantial defense budget and ongoing modernization programs in the field of directed energy weapons. The US military continues to prioritize investments in advanced technology for applications such as offensive, defensive, and support roles, as well as training personnel to enhance their capabilities. Government agencies in North America provide crucial support to companies specializing in the production of sensors and technologies utilized in electronic warfare. This backing is anticipated to expedite the advancement and proliferation of upgraded military technologies, including laser rangefinders, within the region. Vehicle-mounted military laser rangefinders and miniaturized, lightweight systems are gaining popularity due to their versatility and ease of use in various military applications. These rangefinders are essential for aim correction and navigation purposes, making them indispensable tools for military forces.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Military Laser Rangefinder Market Driver

The need for highly precise weapons is notably driving market growth. In the defense sector, the need for high-precision weapons has fueled the expansion of the global military laser rangefinder market. Military operations necessitate exceptional accuracy to reduce collateral damage and ensure mission accomplishment. Laser rangefinders deliver precise distance measurements, which are vital for targeting systems integrated into various weapon systems, such as artillery, missiles, and small arms. These devices amplify the efficacy of precision-guided munitions by facilitating accurate target acquisition and engagement, even under challenging conditions. The incorporation of advanced technologies, including GPS and inertial navigation systems, enhances the accuracy and dependability of laser rangefinders. As defense agencies globally focus on modernizing their arsenals with cutting-edge technology, the utilization of highly precise laser rangefinders is anticipated to increase.

Laser rangefinders play a pivotal role in the surveying industry, offering distance measurement solutions for professionals in various sectors. In sports, these portable devices enable athletes to gauge distances accurately, improving performance and training efficiency. In commerce, laser rangefinders assist in measuring distances for construction projects, land surveying, and other applications, boosting productivity and reducing errors. The integration of high-speed clocks in these devices ensures precise and reliable measurements, making them indispensable tools across diverse industries. Thus, such factors are driving the growth of the market during the forecast period.

Military Laser Rangefinder Market Trends

The growing application of C4ISR is the key trend in the market. The Military Laser Rangefinder market plays a significant role in the defense sector, as military equipment continues to evolve with technology-aided warfare. Trained military personnel utilize these advanced systems for various applications, including vehicle-mounted warfare and surveillance systems. Electro-optic systems, such as laser rangefinders, are increasingly being adopted for command, control, communications, computer, intelligence, surveillance, and reconnaissance (C4ISR) purposes. Border protection forces employ electro-optic equipment for monitoring and preventing unauthorized intrusions. These systems, which include electro-optic infrared technology, serve as valuable complements to radar systems on water and land platforms.

In land-based applications, electro-optic systems have proven effective in detecting and tracking low-observable targets, such as stealth aircraft and missiles. Modern military systems, such as the Medium Extended Air Defense System (MEADS), incorporate advanced electro-optic technology. The MEADS consists of a tactical operations center (TOC), two battle management commands, control, communication, computers, and intelligence (BMC4I) units, and beyond-line-of-sight (BLOS) engagements. By enabling maximum protection of supported forces through longer-range engagements, these systems underscore the importance of electro-optic technology in military applications Thus, such trends will shape the growth of the market during the forecast period.

Military Laser Rangefinder Market Challenge

Hazards associated with laser operations is the major challenge that affects the growth of the market. Laser rangefinders, a type of laser system, emit high-energy pulses that can deliver significant power, equivalent to that of 200 grams of high explosive. While low-energy laser systems can pose risks to human vision, even causing disruption, high-power laser systems can inflict more severe damage, including eye injuries such as retina, cornea, and lens damage, and skin damage for class 3B (5-500 mW) and class 4 (500 mW plus) systems.

These hazards underscore the importance of adhering to maximum permissible exposure (MPE) levels to mitigate potential harm. In the context of military applications, laser rangefinders serve crucial functions, including low-light measuring, weapon guidance, and detection. As the demand for lightweight rangefinders continues to increase, addressing health concerns remains a priority for manufacturers and users alike. Hence, the above factors will impede the growth of the market during the forecast period.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Elbit Systems Ltd. - The company offers Compact Integrated Laser that is a compact lightweight laser rangefinder, that offers an eye-safe high repetition rate.

The market research and growth report also includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Jenoptik AG

- LAP GmbH Laser Applikationen

- Leonardo S.p.A.

- Lockheed Martin Corp.

- Northrop Grumman Corp.

- Rafael Advanced Defense Systems Ltd.

- Rheinmetall AG

- RTX Corp.

- Saab AB

- Safran SA

- Teledyne FLIR LLC

- Thales Group

- The Boeing Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

The market is a significant segment of the defense sector, catering to the demand for advanced military equipment. These devices play a crucial role in technology-aided warfare, enabling trained military personnel to measure distances accurately during vehicle-mounted warfare and surveillance systems. Laser detection technology is at the core of military laser rangefinders, allowing for precise measurements even in challenging environments. UAVs and drones are increasingly utilizing laser rangefinders for airborne surveillance, offering enhanced capabilities in offense systems. Military laser designators use laser technology to mark targets for precision strikes.

Artificial intelligence (AI) and machine learning (ML) are being integrated into military laser rangefinders to improve accuracy and efficiency. Regulations and restrictions govern the use of military laser rangefinders to prevent misuse in non-military applications. Both man-portable and vehicle-mounted systems are available, catering to various defense needs. Lightweight rangefinders and miniaturized laser rangefinders are gaining popularity due to their ease of use and portability. Military modernization programs worldwide are driving the demand for advanced laser rangefinders, with applications including weapon guidance, navigation, surveying, and aim correction.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

161 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.2% |

|

Market Growth 2024-2028 |

USD 3.53 billion |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

4.9 |

|

Regional analysis |

North America, Europe, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

North America at 48% |

|

Key countries |

US, Russia, China, Germany, India, Canada, Japan, France, Mexico, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Elbit Systems Ltd., Jenoptik AG, LAP GmbH Laser Applikationen, Leonardo S.p.A., Lockheed Martin Corp., Northrop Grumman Corp., Rafael Advanced Defense Systems Ltd., Rheinmetall AG, RTX Corp., Saab AB, Safran SA, Teledyne FLIR LLC, Thales Group, and The Boeing Co. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for market forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch