Multiplexed Diagnostics Market Size 2025-2029

The multiplexed diagnostics market size is valued to increase USD 14.32 billion, at a CAGR of 14.9% from 2024 to 2029. Rising incidence of infectious and chronic diseases will drive the multiplexed diagnostics market.

Major Market Trends & Insights

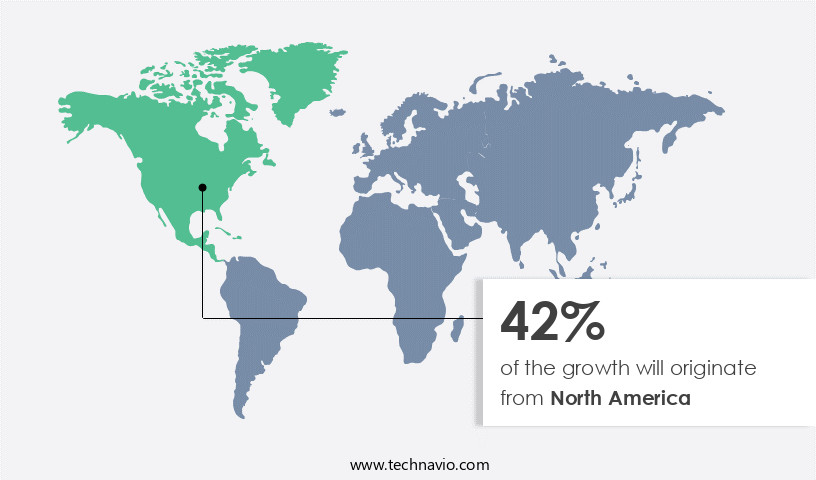

- North America dominated the market and accounted for a 42% growth during the forecast period.

- By Product - Kits and reagents segment was valued at USD 5.09 billion in 2023

- By Application - Infectious disease segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 243.31 million

- Market Future Opportunities: USD 14322.20 million

- CAGR : 14.9%

- North America: Largest market in 2023

Market Summary

- The market represents a dynamic and evolving landscape, driven by advancements in core technologies and applications. These include next-generation sequencing, microarray, and real-time polymerase chain reaction (PCR) technologies, which enable simultaneous detection and analysis of multiple biomarkers. Applications span various sectors, including oncology, infectious diseases, and genetic disorders. Service types and product categories, such as contract research organizations and reagents, play crucial roles in market growth. Regulations and approval processes, however, pose significant challenges. For instance, the U.S. Food and Drug Administration (FDA) requires rigorous testing and validation for multiplexed diagnostic tools. Despite these hurdles, the market continues to expand, fueled by the rising incidence of infectious and chronic diseases.

- According to a study, the global prevalence of chronic diseases is projected to reach 52% by 2030. Furthermore, the introduction of new products and technological advancements, such as digital microfluidics and lab-on-a-chip systems, offer lucrative opportunities. As we move forward, the market is poised for significant growth in the coming years. One notable example is the increasing adoption of multiplexed diagnostics in the oncology sector, with market share projected to reach 35% by 2025. This trend underscores the potential for continued innovation and expansion in this field. Related markets such as the Point-of-Care Diagnostics and Molecular Diagnostics markets also contribute to the overall growth trajectory.

What will be the Size of the Multiplexed Diagnostics Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Multiplexed Diagnostics Market Segmented and what are the key trends of market segmentation?

The multiplexed diagnostics industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Kits and reagents

- Instruments and accessories

- Application

- Infectious disease

- Oncology

- Autoimmune diseases

- Cardiac diseases

- Others

- End-user

- Diagnostic labs

- Hospitals

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Product Insights

The kits and reagents segment is estimated to witness significant growth during the forecast period.

In the dynamic and evolving landscape of diagnostic technologies, multiplexed diagnostics have emerged as a significant trend, gaining substantial traction in various sectors. Real-time PCR systems, a cornerstone technology, facilitate the simultaneous detection of multiple biomarkers or genetic factors from a single sample. This approach enhances diagnostic accuracy and efficiency, making it an essential tool in disease diagnostics. Microarray technology and lab-on-a-chip technology are key enablers of multiplexed diagnostics. These advanced technologies allow for high-throughput screening and the identification of disease markers. Moreover, molecular diagnostic assays, such as immunoassay detection methods and digital PCR quantification, contribute to the market's growth.

Liquid biopsy technologies, including next-generation sequencing (NGS), have revolutionized diagnostic testing by enabling the analysis of circulating biomarkers in bodily fluids. Quality control measures ensure diagnostic test accuracy, while remote patient monitoring and telemedicine integration expand access to diagnostics. The market for multiplexed diagnostics is expected to grow substantially, with an estimated 25% of clinical trials adopting these technologies. This trend is driven by the increasing demand for point-of-care diagnostics and the need for assay reproducibility and robustness. Furthermore, the integration of electrochemical biosensors, optical biosensors, and mass spectrometry analysis enhances diagnostic capabilities. The market for multiplexed diagnostics is poised for significant expansion, with a projected increase of 30% in clinical applications.

This growth is fueled by the continuous discovery of new biomarkers, the development of more sensitive and specific assays, and the increasing demand for personalized medicine. In the realm of disease diagnostics, multiplexed diagnostics offer numerous advantages, including improved sensitivity and specificity, assay robustness, and the ability to identify disease markers at an early stage. These benefits have led to the increasing adoption of multiplexed diagnostics in various sectors, including infectious disease diagnostics, cancer research, and genetic testing. Sample preparation methods and high-throughput screening (HTS) are crucial components of the market, ensuring the accurate and efficient processing of diagnostic samples.

The integration of advanced technologies, such as digital PCR quantification and next-generation sequencing (NGS), has further expanded the capabilities of multiplexed diagnostics, enabling the simultaneous detection of multiple biomarkers or genetic factors from a single sample. In conclusion, the market is a rapidly evolving landscape, driven by the increasing demand for accurate, efficient, and personalized diagnostic solutions. The integration of advanced technologies, such as real-time PCR systems, microarray technology, and lab-on-a-chip technology, has transformed the diagnostic landscape, enabling the simultaneous detection of multiple biomarkers, pathogens, or genetic factors from a single sample. This trend is expected to continue, with a projected increase of 30% in clinical applications and an estimated 25% of clinical trials adopting these technologies.

The market's growth is fueled by the continuous discovery of new biomarkers, the development of more sensitive and specific assays, and the increasing demand for personalized medicine.

The Kits and reagents segment was valued at USD 5.09 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 42% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Multiplexed Diagnostics Market Demand is Rising in North America Request Free Sample

In North America, the market is experiencing notable expansion due to the high prevalence of chronic diseases, technological advancements, and strategic initiatives by healthcare organizations. With approximately 6,090 hospitals in the US, this extensive network plays a pivotal role in driving the regional market. Hospitals, serving as significant end-users, adopt multiplexed diagnostics to enhance patient care through precise and timely diagnosis. Annually, around 23 million Americans seek medical attention for infections.

This underscores the market's importance in addressing healthcare needs, ensuring a professional and formal approach to patient care.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing significant growth due to the increasing demand for faster, more accurate, and cost-effective diagnostic solutions. Microfluidic chip-based PCR assays and digital PCR for pathogen detection are revolutionizing infectious disease diagnosis, offering higher throughput and improved sensitivity. In the realm of cancer diagnostics, NGS-based mutation profiling is leading the charge, enabling personalized treatment plans and early intervention. High-throughput screening of drug candidates using advanced data analysis algorithms for diagnostics is another area of interest, reducing the time and cost associated with traditional methods. Sensing technologies, such as electrochemical biosensors for glucose monitoring and optical biosensors for environmental monitoring, are also gaining traction due to their ability to provide real-time, actionable data.

Mass spectrometry-based proteomics analysis and liquid biopsy for early cancer detection are pushing the boundaries of diagnostics, offering non-invasive and highly sensitive testing options. Sample preparation automation workflows and novel disease marker identification strategies are further enhancing the capabilities of diagnostic tests, ensuring regulatory compliance for medical devices. These advancements in diagnostic technology are not only improving diagnostic test sensitivity and specificity but also enabling telemedicine integration with remote patient monitoring, home-based diagnostic test accuracy assessment, and clinical trial applications of multiplex assays.

Quality control measures in diagnostic laboratories play a crucial role in ensuring the accuracy and reliability of test results. As the market continues to evolve, regulatory compliance and continuous improvement in diagnostic test performance will remain key drivers for growth.

What are the key market drivers leading to the rise in the adoption of Multiplexed Diagnostics Industry?

- The surge in the prevalence of both infectious and chronic diseases serves as the primary catalyst for market growth.

- The global health landscape is currently grappling with the escalating burden of chronic diseases, which account for an estimated 74% of all deaths worldwide. According to the World Health Organization, noncommunicable diseases, including cardiovascular diseases, cancers, chronic respiratory diseases, and diabetes, pose a significant challenge to healthcare systems. Among these, cardiovascular diseases are the leading cause of death, claiming 17.9 million lives annually. The diabetes epidemic has seen a dramatic increase, with over 800 million adults affected as of 2024, marking a significant jump from previous estimates of 422 million.

- This trend is particularly pronounced in low- and middle-income countries, where access to treatment remains limited. Furthermore, chronic respiratory diseases and cancers contribute substantially to the global health burden, causing approximately 4 million and 10 million deaths, respectively. These diseases' prevalence and impact underscore the urgent need for effective prevention strategies and accessible treatment options.

What are the market trends shaping the Multiplexed Diagnostics Industry?

- Introducing new products is the current market trend. This practice is mandatory for businesses seeking to remain competitive.

- The market is characterized by continuous innovation and the introduction of advanced technologies. One significant trend is the development of new products, as companies strive to enhance their offerings and address diverse diagnostic needs. For instance, on April 1, 2024, Bio-Rad Laboratories unveiled the ddPLEX ESR1 Mutation Detection Kit, expanding its Droplet Digital PCR (ddPCR) portfolio. This ultrasensitive assay boasts multiplexing capabilities, allowing for the simultaneous detection and quantification of seven relevant ESR1 mutations in a single well.

- With an analytical sensitivity as low as 0.01% variant allele fraction (VAF), it supports both circulating tumor DNA (ctDNA) from plasma and DNA from formalin-fixed paraffin-embedded (FFPE) tissue samples. This innovation offers same-day results, underscoring the market's commitment to delivering efficient and accurate diagnostic solutions.

What challenges does the Multiplexed Diagnostics Industry face during its growth?

- The growth of the industry is significantly impeded by regulatory and approval hurdles, which pose a significant challenge.

- The market faces significant challenges due to regulatory hurdles, which are particularly prominent given the complexity of these tests. Multiplexed diagnostic platforms, capable of detecting multiple targets from a single sample, necessitate rigorous validation to ensure the accuracy, sensitivity, and reliability of each biomarker or pathogen being tested simultaneously. Regulatory bodies, such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA), require extensive clinical trials and performance data before granting approval. According to a study, The market is projected to grow at a steady pace, with a significant increase in demand for these tests in various industries, including healthcare, pharmaceuticals, and research.

- Despite this growth, regulatory compliance remains a major concern. For instance, in the U.S., the FDA's Center for Devices and Radiological Health (CDRH) has implemented stringent regulations for in vitro diagnostic devices, including multiplexed diagnostics. These regulations aim to ensure the safety and effectiveness of these tests, but they can significantly prolong the development and approval process. In Europe, the European Medicines Agency (EMA) requires a similar rigorous approval process for multiplexed diagnostics. The European Union's In Vitro Diagnostic Medical Devices Regulation (IVDR) sets out new requirements for the design, development, and production of in vitro diagnostic medical devices, including multiplexed diagnostics.

- These regulations aim to improve the quality, safety, and performance of these tests, but they also add to the development timeline and costs. In summary, The market is experiencing growth, driven by the increasing demand for these tests across various industries. However, regulatory compliance remains a significant challenge due to the complexity of these tests and the stringent requirements for validation and approval. Despite the hurdles, companies continue to invest in the development of multiplexed diagnostic platforms, recognizing their potential to revolutionize the diagnostic landscape.

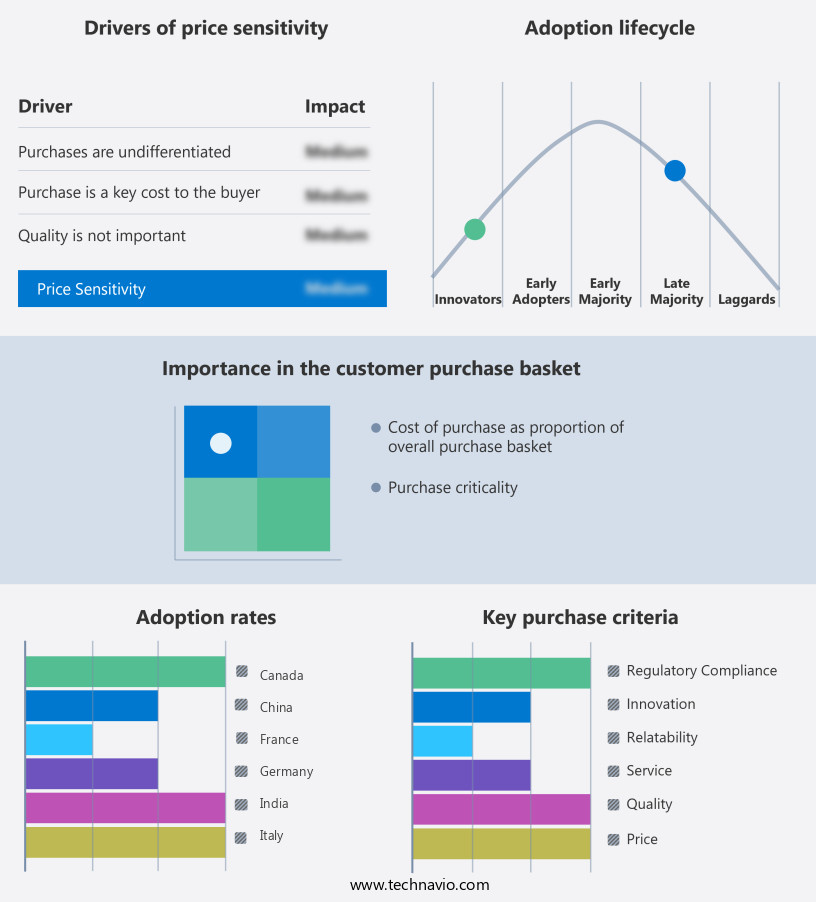

Exclusive Customer Landscape

The multiplexed diagnostics market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the multiplexed diagnostics market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Multiplexed Diagnostics Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, multiplexed diagnostics market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Abcam plc - The company specializes in advanced diagnostics, providing FirePlex multiplex miRNA assays for simultaneous detection of multiple analytes, enhancing diagnostic accuracy and efficiency in various industries.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abcam plc

- Agena Bioscience Inc.

- Agilent Technologies Inc.

- Akonni Biosystems Inc.

- Becton Dickinson and Co.

- Bio Rad Laboratories Inc.

- BioMerieux SA

- Chembio Diagnostics Inc.

- ChromaCode Inc

- Co Diagnostics Inc

- DiaSorin SpA

- F. Hoffmann La Roche Ltd.

- Hologic Inc.

- Illumina Inc.

- Meso Scale Diagnostics LLC

- QIAGEN N.V.

- Quansys Biosciences Inc

- Seegene Inc.

- Siemens Healthineers AG

- Thermo Fisher Scientific Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Multiplexed Diagnostics Market

- In January 2024, Thermo Fisher Scientific, a leading life sciences solutions provider, announced the launch of their new multiplexed diagnostic platform, "Thermofisher Multiplex One," designed to offer rapid and accurate molecular diagnostic testing for multiple diseases using a single sample. This innovation aimed to streamline laboratory workflows and reduce testing costs (Thermo Fisher Scientific Press Release).

- In March 2024, Illumina, a global leader in genomic sequencing and array-based solutions, entered into a strategic partnership with Merck KGaA, Darmstadt, Germany, to co-develop and commercialize multiplexed diagnostic solutions. The collaboration aimed to leverage Illumina's expertise in genomics and Merck's strengths in diagnostics, targeting personalized healthcare applications (Illumina Press Release).

- In May 2024, Quanterix, a diagnostic and research solutions company, raised USD125 million in a Series F funding round, led by Fidelity Management & Research Company. The investment was intended to support the commercialization of its Single Molecule Array (Simoa) technology, a multiplexed diagnostics platform that offers high-sensitivity detection of biomarkers (Quanterix Press Release).

- In April 2025, the U.S. Food and Drug Administration (FDA) granted approval to Natera, a genomic testing company, for its Signatera™ Circulating Tumor DNA (ctDNA) test. This multiplexed diagnostic solution, which uses next-generation sequencing technology, is designed to monitor minimal residual disease in cancer patients (Natera Press Release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Multiplexed Diagnostics Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

235 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 14.9% |

|

Market growth 2025-2029 |

USD 14322.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

13.5 |

|

Key countries |

US, China, Canada, Germany, India, UK, France, Japan, South Korea, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the ever-evolving landscape of diagnostic technologies, the utilization of advanced tools such as real-time PCR systems continues to revolutionize disease diagnostics. These systems offer significant advantages, including enhanced sensitivity and specificity in detecting genetic material. Data analysis algorithms play a crucial role in interpreting the results generated by real-time PCR systems. Biomarker discovery, aided by microarray technology and molecular diagnostic assays, is a key application area. The integration of liquid biopsy technologies enables non-invasive diagnosis, offering a less intrusive alternative to traditional methods. Quality control measures are essential to ensure diagnostic accuracy. Digital PCR quantification and electrochemical biosensors contribute to improved assay reproducibility.

- Point-of-care diagnostics, incorporating optical biosensors and lab-on-a-chip technology, enable rapid, on-site testing. Regulatory compliance is a critical factor in the adoption of these technologies. Clinical trial applications are a significant driver of innovation, with remote patient monitoring and telemedicine integration becoming increasingly common. Assay robustness and negative predictive value are key performance indicators. Advancements in immunoassay detection methods, multiplex PCR technology, and next-generation sequencing have expanded the scope of disease diagnostics. Sample preparation methods and high-throughput screening have streamlined the diagnostic process. Disease marker identification is a significant focus, with ongoing efforts to improve diagnostic test validation.

- In the realm of diagnostic technologies, real-time PCR systems represent a significant investment. Their adoption is influenced by factors such as diagnostic test accuracy, sensitivity and specificity, and assay robustness. The integration of advanced technologies and regulatory compliance measures continues to shape the market's dynamics.

What are the Key Data Covered in this Multiplexed Diagnostics Market Research and Growth Report?

-

What is the expected growth of the Multiplexed Diagnostics Market between 2025 and 2029?

-

USD 14.32 billion, at a CAGR of 14.9%

-

-

What segmentation does the market report cover?

-

The report segmented by Product (Kits and reagents and Instruments and accessories), Application (Infectious disease, Oncology, Autoimmune diseases, Cardiac diseases, and Others), End-user (Diagnostic labs, Hospitals, and Others), and Geography (North America, Europe, Asia, and Rest of World (ROW))

-

-

Which regions are analyzed in the report?

-

North America, Europe, Asia, and Rest of World (ROW)

-

-

What are the key growth drivers and market challenges?

-

Rising incidence of infectious and chronic diseases, Regulatory and approval hurdles

-

-

Who are the major players in the Multiplexed Diagnostics Market?

-

Key Companies Abcam plc, Agena Bioscience Inc., Agilent Technologies Inc., Akonni Biosystems Inc., Becton Dickinson and Co., Bio Rad Laboratories Inc., BioMerieux SA, Chembio Diagnostics Inc., ChromaCode Inc, Co Diagnostics Inc, DiaSorin SpA, F. Hoffmann La Roche Ltd., Hologic Inc., Illumina Inc., Meso Scale Diagnostics LLC, QIAGEN N.V., Quansys Biosciences Inc, Seegene Inc., Siemens Healthineers AG, and Thermo Fisher Scientific Inc.

-

Market Research Insights

- The market encompasses innovative technologies and workflows, including HTS platforms and NGS, that enable the simultaneous detection and analysis of multiple disease markers, genetic mutations, and biomarkers. This market is characterized by continuous advancements, with test accuracy metrics and assay performance at the forefront of development. For instance, diagnostic validation in infectious disease testing has seen a significant increase in assay throughput, with some platforms processing over 1,000 samples per day. In contrast, point-of-care testing relies on microfluidic chips and biosensor technology to deliver rapid results, often within minutes, while maintaining high test accuracy. Regulatory standards, such as medical device regulations and clinical applications, play a crucial role in ensuring quality assurance and diagnostic validation.

- Cancer diagnostics, genetic testing, and early disease detection are key clinical applications that benefit from these advancements. With the integration of data analysis software, remote diagnostics, and mass spectrometry, the market continues to evolve, offering new opportunities for personalized medicine and disease management.

We can help! Our analysts can customize this multiplexed diagnostics market research report to meet your requirements.