New Zealand Traffic Management Market Size 2025-2029

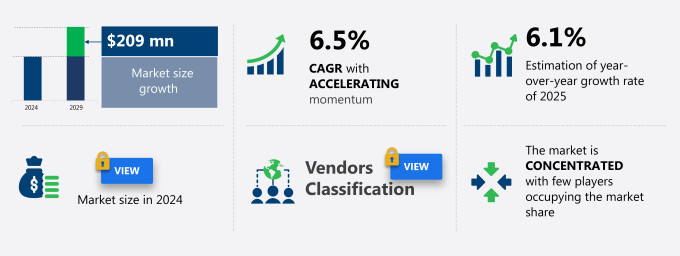

The New Zealand traffic management market size is forecast to increase by USD 209 million at a CAGR of 6.5% between 2024 and 2029.

- The market is experiencing significant growth due to several key factors. Urbanization and population growth are major drivers, as cities continue to expand and infrastructure strains under the increased demand for transportation. New product launches by companies are also contributing to market growth, as companies introduce innovative solutions to address the challenges of managing traffic in densely populated areas. However, data privacy and data security concerns are becoming increasingly important in the traffic management industry. To mitigate these challenges, intelligent traffic management systems are being implemented. As cities implement smart traffic management systems, ensuring the security and privacy of sensitive data is crucial to maintaining public trust and compliance with regulations.

What will be the Size of the Market During the Forecast Period?

- The market is a critical aspect of modern infrastructure development, focusing on optimizing the movement of vehicles, pedestrians, and cyclists in urban and suburban areas. This market encompasses various solutions and technologies aimed at enhancing parking facility construction, traffic flow optimization, parking availability, safety, and fuel efficiency. One of the primary drivers in the market is the increasing demand for parking technology. Advanced parking systems, such as parking guidance and reservation, help manage parking facilities more efficiently, reducing congestion and improving accessibility. These systems utilize big data analytics to provide real-time information on parking availability, enabling drivers to make informed decisions and reducing the time spent searching for parking spots.

- Another significant trend in the market is the integration of cyclist and pedestrian detection systems. These technologies contribute to promoting sustainable transportation and reducing traffic congestion. Cyclist detection systems ensure the safety of cyclists by recognizing their presence at intersections and adjusting traffic signals accordingly. Pedestrian detection systems, on the other hand, help improve traffic flow and ensure the safety of pedestrians by detecting their presence and prioritizing their movement. Safety is a crucial factor in the market. Safety training programs for traffic enforcement personnel and the implementation of traffic calming measures are essential components of a comprehensive traffic management strategy.

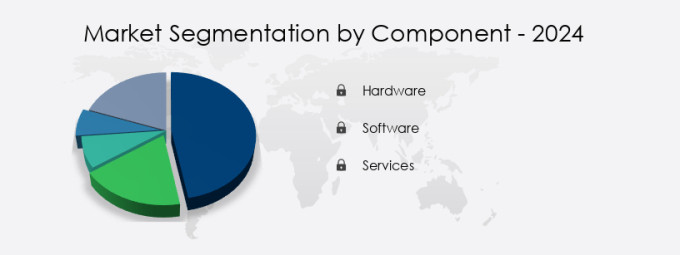

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Component

- Hardware

- Software

- Services

- Type

- Urban traffic management and control

- Adaptive traffic control system

- Journey time management system

- Dynamic traffic management system

- Others

- Deployment

- On-premises

- Cloud

- Geography

- New Zealand

By Component Insights

- The hardware segment is estimated to witness significant growth during the forecast period.

The hardware plays a pivotal role in addressing traffic congestion and ensuring optimal connectivity in urban areas such as Auckland, Wellington, and Christchurch. A key component of modern traffic systems is traffic signals and controllers. Traffic signals are essential for managing the movement of vehicles and pedestrians at intersections. Advanced, adaptive traffic signals can dynamically adjust timings based on real-time traffic conditions, thereby reducing congestion during peak hours and improving overall traffic flow. Traffic signal controllers are crucial for coordinating signals at multiple intersections, creating synchronized traffic networks that boost efficiency. The integration of smart mobility solutions, including AI and real-time data analysis, further enhances the capabilities of traffic management systems, addressing safety concerns and ensuring seamless transportation.

Get a glance at the market report of share of various segments Request Free Sample

Market Dynamics

Our market researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of the New Zealand Traffic Management Market?

Urbanization and population growth is the key driver of the market.

- The market is experiencing significant growth due to urbanization and population expansion. The population influx puts immense pressure on existing traffic infrastructure, necessitating advanced traffic management solutions. With more people moving to cities, the demand for efficient transportation systems increases. The resulting increase in vehicle ownership leads to heightened traffic congestion. These systems utilize real-time data, traffic analytics, and AI technology to optimize traffic signal control, parking facilities, and route guidance.

Additionally, digital parking solutions, such as GPS and smart parking spaces, are becoming increasingly popular. Specialized training for traffic operations personnel and the use of hardware like vehicle identification sensors and smart cameras are also essential components of these systems. Furthermore, traffic management services are adopting recession-resilient strategies, including bidding strategies, price increases, and operational cost optimization. The market is also focusing on reducing carbon emissions and improving road safety through green splits, smart mobility solutions, and traffic signal timing adjustments. Overall, the market is crucial for ensuring reliable transportation systems, reducing travel time, and maintaining safety concerns in the face of urbanization and population growth.

What are the market trends shaping the New Zealand Traffic Management Market?

New launches by companies is the upcoming trend in the market.

- The market is experiencing notable progress, driven by the integration of advanced technologies to optimize traffic monitoring and ensure safety. With benefits including health, safety, and efficiency enhancements, quick installation, and superior accuracy exceeding 98% in road trials, these sensors are constructed from strong military-grade materials. They are low-maintenance and capable of capturing comprehensive traffic data, such as vehicle type, speed, direction, and distance, across diverse environments. Inflation and recession-resilient sectors, including parking facilities and transportation infrastructure, are investing in these innovative solutions to address labor shortages, operational costs, and population growth.

- Intelligent speed adaptation, traffic signal control, and real-time traffic management systems are gaining traction, incorporating AI technology, GPS, and smart mobility solutions to minimize delay, reduce congestion, and improve road safety. Traffic analytics, digital parking, and smart cameras are essential components of these systems, providing data insights, risk prediction analytics, and real-time traffic behavior information. The market dynamics are influenced by factors like parking tariffs, reputation, and government policies, with 5G technology and project lead times playing a significant role in shaping the future of traffic management. Carbon emission concerns and the need for free movement are further driving the demand for eco-friendly, reliable, and efficient traffic management systems.

What challenges does the New Zealand Traffic Management Market face during the growth?

Data privacy and security concerns is a key challenge affecting the market growth.

- The market is experiencing significant growth due to the increasing need for intelligent transportation systems. Inflation and recession-resilient sectors have driven the demand for traffic management services, including resident parking schemes, parking tariffs, and parking facilities. Advanced technologies, such as traffic signal control, real-time data, and traffic analytics, are essential components of modern traffic management systems. However, data privacy and security concerns present challenges, as these systems collect and process sensitive information, including vehicle identification sensors, license plate numbers, and personal details. Ensuring data privacy and security is crucial to maintaining public trust and regulatory compliance.

- Operational costs, labor shortages, and fuel mix are also critical factors influencing market dynamics. Specialized training, bidding strategies, price increases, and AI technology are key elements shaping the market landscape. Smart mobility solutions, such as digital parking, GPS, and real-time traffic management, are becoming increasingly important in addressing traffic congestion and improving road safety. Urbanization, population growth, and the adoption of 5G technology are expected to further fuel market growth. Traffic management systems play a vital role in transportation infrastructure, ensuring free movement, reducing travel time, and improving safety concerns, such as carbon emissions, road accidents, and traffic signal timings.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast , partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Alliance Solutions - The company offers radar systems, smart radars, and other enforcement technology to assure traffic law compliance.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alliance Solutions

- Downer EDI Ltd.

- Dynamixx Traffic Services

- Evolution Traffic Management Ltd.

- Fulton Hogan Ltd.

- Independent Traffic Control Ltd.

- Kiwi Traffic Solutions

- Traffic Management NZ

- Traffic Management Solutions

- Traffic Safe NZ

- TSL GROUP Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to various factors influencing the market's dynamics. Intelligent speed adaptation technology is one such factor gaining traction in the market. This technology enables vehicles to adjust their speed according to the traffic conditions, ensuring smooth traffic flow and reducing congestion. The implementation of this technology contributes to the overall efficiency of these systems, making it a valuable investment for transportation infrastructure. Another crucial factor impacting the market is inflation. Rising inflation rates can increase operational costs for traffic management services, including labor, hardware, and maintenance.

As a result, parking tariffs may increase to cover these costs, affecting residents and commuters. However, several services that offer recession-resilient solutions and efficient cost management strategies can mitigate the impact of inflation on their operations. Reputation plays a significant role in the market. Providing reliable and efficient services is essential for maintaining a positive reputation and attracting new customers. Companies that invest in specialized training for their staff and utilize advanced technologies, such as real-time data analysis and smart mobility solutions, can enhance their reputation and differentiate themselves from competitors. The labor shortage is a challenge for the market.

Furthermore, to address this issue, companies are focusing on attracting and retaining talent through competitive wages, benefits, and professional development opportunities. Additionally, partnerships with educational institutions and industry organizations can help traffic management companies build a strong talent pipeline. Traffic signal control is another critical aspect of traffic management. Advanced technologies, such as AI and smart cameras, enable real-time traffic management and improve traffic signal timing. These technologies can help reduce congestion, improve travel time, and enhance road safety. Moreover, the integration of GPS systems and vehicle identification sensors can provide valuable data insights, enabling traffic management systems to optimize their operations and make data-driven decisions.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

171 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.5% |

|

Market Growth 2025-2029 |

USD 209 million |

|

Market structure |

Concentrated |

|

YoY growth 2024-2025(%) |

6.1 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across New Zealand

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch