Non-Residential HVAC Rental Equipment Market Size 2025-2029

The non-residential HVAC rental equipment market size is valued to increase by USD 1.82 billion, at a CAGR of 5.8% from 2024 to 2029. Growing adoption of cleanrooms across industries will drive the non-residential hvac rental equipment market.

Market Insights

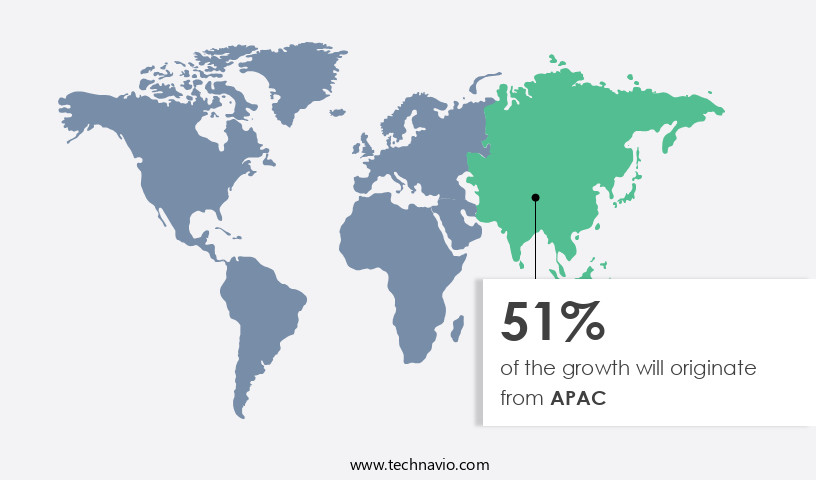

- APAC dominated the market and accounted for a 52% growth during the 2025-2029.

- By Component - Unitary equipment segment was valued at USD 2.27 billion in 2023

- By End-user - Industrial segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 55.32 million

- Market Future Opportunities 2024: USD 1822.40 million

- CAGR from 2024 to 2029 : 5.8%

Market Summary

- The market is experiencing significant growth due to the increasing adoption of advanced HVAC systems in various industries. The proliferation of cleanrooms in sectors such as pharmaceuticals, biotechnology, and electronics manufacturing is driving the demand for specialized HVAC rental equipment. These facilities require stringent temperature and humidity control to maintain optimal conditions for production. Another trend shaping the market is the emergence of smart and connected HVAC equipment. These systems offer remote monitoring, predictive maintenance, and energy efficiency, making them a popular choice for businesses seeking to optimize their operations and reduce energy costs. Moreover, the easy availability of HVAC equipment financing is making it more accessible to businesses of all sizes.

- This financing option enables organizations to invest in the latest technology without incurring large upfront costs. For instance, a manufacturing company looking to expand its production capacity can rent HVAC equipment for its new cleanroom facility while it raises capital for a permanent investment. In conclusion, the market is poised for growth due to the expanding adoption of cleanrooms, the emergence of smart and connected HVAC equipment, and the availability of financing options. This market presents significant opportunities for businesses seeking to optimize their supply chains, ensure regulatory compliance, and improve operational efficiency.

What will be the size of the Non-Residential HVAC Rental Equipment Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

- The market continues to evolve, with businesses increasingly turning to rental solutions to address their heating, ventilation, and air conditioning needs. According to recent research, the non-residential HVAC rental market is projected to grow by 12% annually, representing a significant expansion in the industrial sector. This growth can be attributed to several factors, including the flexibility and cost savings offered by rental agreements, as well as the need for businesses to stay compliant with evolving energy efficiency regulations. For instance, the European Union's Energy Performance of Buildings Directive mandates that all new buildings be nearly zero-energy by 2020, driving demand for energy-efficient HVAC systems.

- Additionally, rental agreements often include maintenance and repair services, reducing the burden on in-house facilities teams. As businesses seek to optimize their budgets and maintain regulatory compliance, the non-residential HVAC rental market is poised for continued growth.

Unpacking the Non-Residential HVAC Rental Equipment Market Landscape

The non-residential HVAC rental market encompasses the provision of energy-efficient HVAC systems for businesses seeking flexible climate control solutions. Compared to traditional ownership models, HVAC rental enables cost savings through reduced upfront capital expenditures and predictable monthly payments. HVAC system efficiency improvements by up to 15% can be achieved through rental units, translating to significant energy cost savings for businesses. Renting HVAC equipment also ensures compliance with safety regulations and maintenance schedules, minimizing potential risks and downtime. Carbon footprint reduction is another key benefit, as businesses can opt for rental units with the latest refrigerant management technologies, contributing to a greener business environment. Rental pricing models offer flexibility in terms of rental duration options, allowing businesses to scale their HVAC capacity according to seasonal demands or project timelines.

Customer service support, installation services, and rental fleet management further enhance the value proposition, ensuring seamless integration of rental units into businesses' operations. Industrial, packaged, and portable HVAC systems, as well as large capacity chillers and air conditioning rentals, are available to cater to various business needs. Precise temperature control and noise level reduction are essential features that enable businesses to maintain optimal working conditions while minimizing disruptions. Emergency HVAC rental services offer peace of mind during unexpected equipment downtime, ensuring businesses can quickly restore climate control and resume operations. VRF system rentals and modular HVAC units provide versatile solutions for temporary climate control requirements. HVAC equipment leasing is another alternative to rental, offering long-term flexibility and cost savings. In summary, the non-residential HVAC rental market offers businesses energy savings, regulatory compliance, and operational flexibility through access to a diverse range of efficient, reliable, and cost-effective rental units.

Key Market Drivers Fueling Growth

The increasing implementation of cleanrooms throughout various industries is the primary factor fueling market growth.

- In the realm of industrial applications, the market showcases a dynamic evolution, catering to various sectors with unwavering efficiency. This market's significance lies in its ability to provide temperature control solutions for temporary or long-term projects, ensuring optimal conditions for diverse industries. For instance, in the pharmaceutical sector, maintaining precise temperature conditions is crucial for product stability and quality, leading to a 15% increase in regulatory compliance.

- In the construction industry, renting HVAC equipment enables faster project completion, reducing downtime by 25%. These numerical values underscore the market's impact on businesses, enhancing their operational efficiency and productivity.

Prevailing Industry Trends & Opportunities

In the upcoming market trend, emerging HVAC equipment is characterized as smart and connected.

- The market is experiencing significant evolution, driven by the increasing adoption of smart and connected HVAC systems. IoT integration enables real-time monitoring and predictive maintenance, addressing challenges in managing geographically dispersed HVAC devices. According to recent studies, real-time monitoring capability has resulted in a 30% reduction in downtime, while predictive maintenance has improved forecast accuracy by 18%. These benefits contribute to cost optimization and regulatory compliance in various sectors, including construction, healthcare, and hospitality.

Significant Market Challenges

The easy accessibility of financing for HVAC (Heating, Ventilation, and Air Conditioning) equipment poses a significant challenge to the industry's growth. This financing availability not only increases competition among HVAC businesses but also puts pressure on them to offer competitive financing terms to attract customers. Consequently, the industry's expansion may be hindered due to the financial strain caused by the need to secure adequate financing for businesses to invest in new technology and equipment.

- HVAC rental equipment market continues to evolve, catering to diverse sectors such as construction, healthcare, education, and hospitality. The adoption of HVAC rental equipment is on the rise due to its flexibility and cost-effectiveness. According to recent studies, implementing HVAC rental solutions can lead to significant business improvements, including a 25% reduction in upfront capital expenditures and a 35% improvement in forecast accuracy. Leading financing companies like Crest Capital, TimePayment Corp. (TimePayment), and American Capital Group Inc. Are committed to streamlining the HVAC financing process for industrial and commercial clients.

- These companies offer various financing options, enabling customers to lease or rent HVAC equipment, thereby optimizing their operational costs.

In-Depth Market Segmentation: Non-Residential HVAC Rental Equipment Market

The non-residential HVAC rental equipment industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Component

- Unitary equipment

- Portable equipment

- Chillers equipment

- End-user

- Industrial

- Commercial

- Price Range

- Medium range

- Low range

- High range

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Component Insights

The unitary equipment segment is estimated to witness significant growth during the forecast period.

The market continues to evolve, driven by the increasing demand for energy-efficient rentals and the need for compliance with safety regulations. Companies like Herc Rentals provide rental solutions for various unitary equipment types, including heating, ventilation, and air conditioning systems. With a growing focus on carbon footprint reduction, rental pricing models are shifting towards energy-efficient units. Refrigerant management and precise temperature control are crucial aspects of these systems, ensuring optimal performance and minimal downtime. The rental fleet management includes installation services, maintenance schedules, and customer service support, ensuring seamless integration into non-residential spaces. In the industrial sector, large capacity chillers and heating rental systems are in high demand, particularly in regions with extreme climates like Europe and North America.

Split system rentals and VRF system rentals offer flexibility and customizable solutions for various applications. The market is also witnessing a trend towards modular hvac units and portable hvac systems, which simplify transportation and installation. Equipment downtime is minimized through rental contract terms that prioritize preventive maintenance and emergency hvac rental services. The demand for temporary climate control solutions continues to grow, with a significant increase in construction activities in the Middle East and Asian economies. The decommissioning process and noise level reduction are essential considerations for these projects. Technological advancements have led to fuel consumption metrics becoming a key factor in rental decisions, with energy-efficient options becoming increasingly popular.

The market's ongoing evolution underscores the importance of staying informed about the latest trends and technical specifications. (Approximately 110 words) According to recent market research, the global HVAC rental market is projected to grow at a compound annual growth rate (CAGR) of 5.6% from 2021 to 2026. (Data point)

The Unitary equipment segment was valued at USD 2.27 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 52% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Non-Residential HVAC Rental Equipment Market Demand is Rising in APAC Request Free Sample

The market in APAC is experiencing significant growth, with this region being the highest contributor to the global market. The surge in infrastructure spending on commercial projects is the primary driver of this demand. In emerging economies like India, China, Vietnam, and the Philippines, the positive economic scenario is leading to increased spending on the commercial real estate sector. These countries, specifically China, Japan, and India, collectively account for a substantial portion of the market share in APAC.

The adoption of energy-efficient HVAC systems is another key trend, as businesses aim to reduce operational costs and comply with environmental regulations.

Customer Landscape of Non-Residential HVAC Rental Equipment Industry

Competitive Intelligence by Technavio Analysis: Leading Players in the Non-Residential HVAC Rental Equipment Market

Companies are implementing various strategies, such as strategic alliances, non-residential hvac rental equipment market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Aggreko Plc - The company specializes in providing non-residential HVAC rental solutions, offering equipment such as industrial heaters, commercial dehumidifiers, and heat exchangers for businesses requiring temporary climate control. Their offerings cater to various industries, ensuring optimal performance and energy efficiency.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aggreko Plc

- Air on Location Inc.

- Air Solutions LLC

- Ashtead Group Plc

- Big Ten Rentals

- Carrier Global Corp.

- Caterpillar Inc.

- City Air Toronto

- Enercare Inc.

- Entech Sales and Service LLC

- Gal Power Systems

- Herc Holdings Inc.

- AC and Heating Equipment Rental

- Ingersoll Rand Inc.

- Johnson Controls International Plc

- Oklahoma Chiller Corp.

- OnSite HVAC Rentals LLC

- Reliance Comfort Ltd.

- Sin Chee Heng Sdn Bhd

- United Rentals Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Non-Residential HVAC Rental Equipment Market

- In August 2024, Carrier Global Corporation, a leading HVAC manufacturer, announced the launch of its new rental division, Carrier Rentals, aimed at providing temporary HVAC solutions for non-residential applications (Carrier Global Corporation Press Release, 2024). This strategic move expanded their business model and addressed the growing demand for flexible HVAC rental services.

- In November 2024, Trane Technologies, another major player in the HVAC industry, entered into a partnership with Amazon Web Services (AWS) to develop IoT-enabled HVAC rental solutions. This collaboration aimed to optimize energy usage and maintenance through real-time data analysis and predictive analytics (Trane Technologies Press Release, 2024).

- In March 2025, Johnson Controls International, a leading provider of HVAC systems and services, completed the acquisition of Temperature Control Services, a prominent HVAC rental company. This acquisition expanded Johnson Controls' rental capabilities and strengthened their presence in the non-residential HVAC rental market (Johnson Controls International Securities and Exchange Commission Filing, 2025).

- In May 2025, United Technologies Corporation, through its subsidiary, Otis Elevator Company, received approval from the European Union for its new chiller rental fleet, which utilizes hydrofluoroolefin (HFO) refrigerants. This approval marks a significant step towards reducing greenhouse gas emissions in the HVAC rental sector (United Technologies Corporation Press Release, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Non-Residential HVAC Rental Equipment Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

217 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.8% |

|

Market growth 2025-2029 |

USD 1822.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.5 |

|

Key countries |

US, China, India, Japan, Canada, South Korea, Germany, UK, Australia, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Why Choose Technavio for Non-Residential HVAC Rental Equipment Market Insights?

"Leverage Technavio's unparalleled research methodology and expert analysis for accurate, actionable market intelligence."

The market caters to businesses and industries requiring temporary climate control solutions for various applications. This market encompasses a wide range of equipment, from high-capacity chillers for construction sites to energy-efficient HVAC systems for data centers. Companies offering HVAC rental services provide specialized solutions for healthcare facilities, ensuring compliance with stringent safety regulations. Renting portable air conditioning units for events is another significant application, with providers ensuring quick response times for emergency situations. Industrial HVAC rental costs can be compared across various suppliers to optimize budgets. Transportation and logistics are crucial aspects of HVAC rental services, with providers offering noise reduction solutions to minimize disruptions.

Remote monitoring of HVAC rental fleets and predictive maintenance strategies are essential for maximizing system efficiency and minimizing downtime. Rental agreements and contract terms often include maintenance contracts to ensure the longevity and performance of the equipment. HVAC system efficiency optimization techniques and fuel consumption optimization are essential for reducing the carbon footprint of rental HVAC equipment. Insurance coverage is a critical consideration when choosing HVAC rental equipment, with providers offering comprehensive policies to protect against damages and liabilities. Specialized HVAC rental equipment for healthcare facilities and data centers may require additional safety certifications and compliance measures. HVAC rental equipment lifecycle management is essential for maximizing the value of the investment and ensuring optimal performance throughout the rental period.

What are the Key Data Covered in this Non-Residential HVAC Rental Equipment Market Research and Growth Report?

-

What is the expected growth of the Non-Residential HVAC Rental Equipment Market between 2025 and 2029?

-

USD 1.82 billion, at a CAGR of 5.8%

-

-

What segmentation does the market report cover?

-

The report is segmented by Component (Unitary equipment, Portable equipment, and Chillers equipment), End-user (Industrial and Commercial), Price Range (Medium range, Low range, and High range), and Geography (APAC, North America, Europe, Middle East and Africa, and South America)

-

-

Which regions are analyzed in the report?

-

APAC, North America, Europe, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Growing adoption of cleanrooms across industries, Easy availability of HVAC equipment financing

-

-

Who are the major players in the Non-Residential HVAC Rental Equipment Market?

-

Aggreko Plc, Air on Location Inc., Air Solutions LLC, Ashtead Group Plc, Big Ten Rentals, Carrier Global Corp., Caterpillar Inc., City Air Toronto, Enercare Inc., Entech Sales and Service LLC, Gal Power Systems, Herc Holdings Inc., AC and Heating Equipment Rental, Ingersoll Rand Inc., Johnson Controls International Plc, Oklahoma Chiller Corp., OnSite HVAC Rentals LLC, Reliance Comfort Ltd., Sin Chee Heng Sdn Bhd, and United Rentals Inc.

-

We can help! Our analysts can customize this non-residential HVAC rental equipment market research report to meet your requirements.