North America Road Construction And Maintenance Market Size 2025-2029

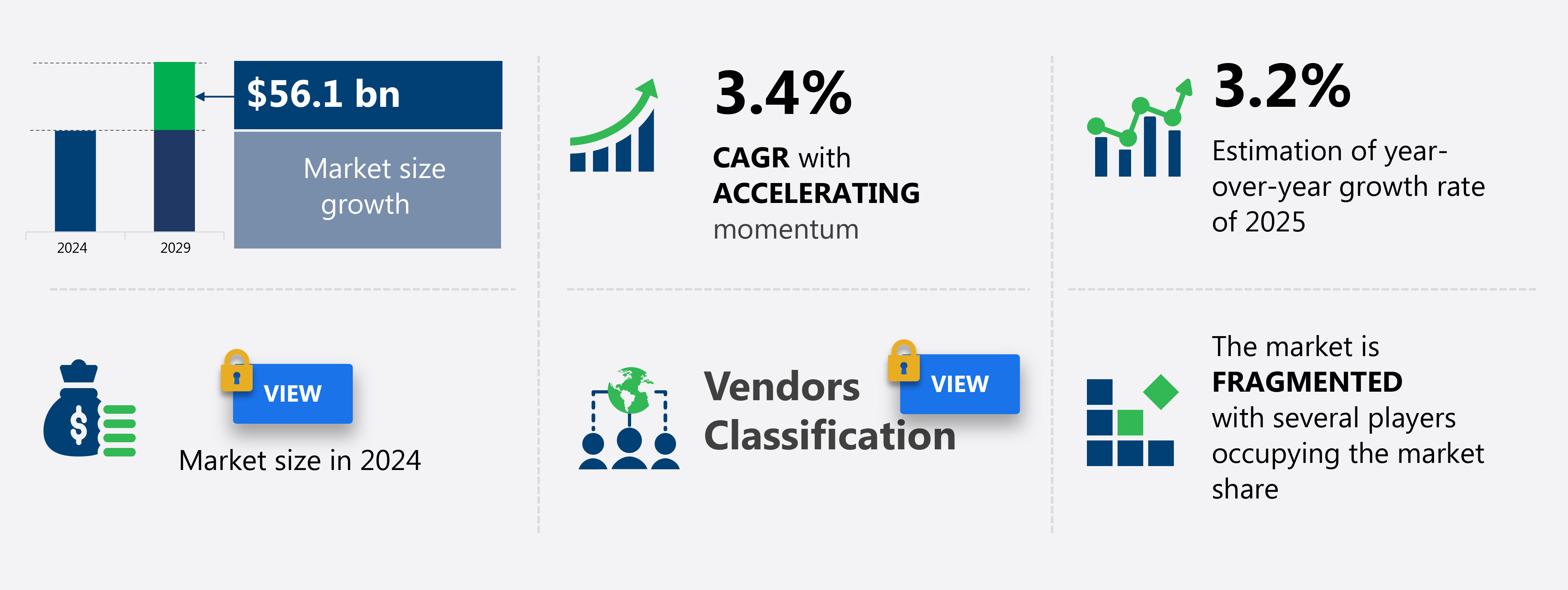

The North America road construction and maintenance market size is valued to increase by USD 56.1 billion, at a CAGR of 3.4% from 2024 to 2029. Investments in road infrastructure projects will drive the North America road construction and maintenance market.

Major Market Trends & Insights

- By Application - New construction segment was valued at USD billion in

- By Type - Highway segment accounted for the largest market revenue share in

- CAGR from 2024 to 2029 : 3.4%

Market Summary

- The North American road construction and maintenance market is a critical component of the region's infrastructure, with significant investments allocated to ensure the safety and efficiency of transportation networks. According to recent data, the market is valued at over USD100 billion, reflecting the substantial scale and importance of this sector. Key drivers for this market include increasing traffic volumes, the need for infrastructure upgrades, and the growing focus on improving road safety. Trends such as the adoption of innovative materials and technologies, like asphalt recycling and smart pavement systems, are shaping the industry's evolution. Despite these opportunities, challenges persist, including rising construction costs and the need for ongoing maintenance to address the deterioration of existing infrastructure.

- The market's future direction will depend on the ability of stakeholders to balance these factors and effectively allocate resources to meet the evolving needs of transportation systems. In conclusion, the North American road construction and maintenance market represents a significant investment opportunity, with a robust focus on innovation and a pressing need for infrastructure upgrades. As traffic volumes continue to grow and the demand for safer, more efficient transportation networks increases, this market will remain a vital component of the region's economic development.

What will be the Size of the North America Road Construction And Maintenance Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Road Construction And Maintenance in North America Market Segmented ?

The road construction and maintenance in North America industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- New construction

- Reconstruction

- Repair

- Type

- Highway

- Street

- Bridge

- Material

- Asphalt

- Concrete

- Bitumen

- Gravel

- Others

- End-User

- Government

- Private Sector

- Geography

- North America

- US

- Canada

- Mexico

- North America

By Application Insights

The new construction segment is estimated to witness significant growth during the forecast period.

The market is experiencing continuous evolution, with the new construction segment projected to expand significantly during the forecast period. This growth is attributed to escalating vehicular traffic and substantial investments in transportation infrastructure. With the increasing number of passenger and commercial vehicles, the demand for new roads is surging, putting pressure on existing networks. Concurrently, both public and private entities are increasing their focus on infrastructure development, prioritizing the expansion and modernization of roadways. Urbanization and the emergence of new economic zones further necessitate improved connectivity, leading to the construction of new road networks. Pavement management systems, concrete pavement repair, and asphalt pavement design are key areas of focus, alongside traffic flow optimization, drainage infrastructure design, and construction waste management.

Advanced techniques such as soil stabilization, bridge maintenance strategies, and structural health monitoring are also gaining traction. Notably, the market is witnessing a shift towards sustainable road construction and environmental impact assessment, with intelligent transportation systems and traffic simulation software playing increasingly important roles. A recent study indicates that the road construction and maintenance industry in North America is projected to grow at a CAGR of 4.5% from 2021 to 2026.

The New construction segment was valued at USD billion in 2019 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The North American road construction and maintenance market is a critical sector, with infrastructure playing a pivotal role in economic growth and mobility. With the impact of climate change increasingly felt in the region, innovative pavement materials and advanced techniques for repairing potholes have become essential. Sustainable methods for road construction, such as using recycled materials, are gaining traction due to their environmental benefits and cost savings. The importance of improving efficiency in road maintenance is paramount, with the latest techniques for bridge maintenance and implementing preventative measures being key areas of focus. Technology plays a significant role in enhancing road asset management.

The integration of smart technologies in road networks enables real-time monitoring, optimizing traffic flow, and reducing congestion. Using data analytics in pavement management and implementing best practices for construction quality control are essential for maintaining infrastructure and ensuring safety. The role of technology extends to road construction, with automation and remote sensing technologies being adopted to minimize environmental impact and improve safety in work zones. Advanced techniques for bridge maintenance, such as using drones for inspection, have proven effective in identifying issues before they become major concerns. The benefits of using recycled materials in road construction are not only environmental but also economic.

For instance, recycled asphalt pavement (RAP) can reduce the overall cost of construction by up to 25%, making it a popular choice among contractors. Adoption rates of advanced techniques for road construction and maintenance in North America are significantly higher than in other regions, reflecting the sector's proactive approach to infrastructure development and maintenance. This proactive stance is further emphasized by the increasing use of technology in road networks and the importance placed on effective strategies for reducing road accidents. In conclusion, the North American road construction and maintenance market is at the forefront of innovation, with a focus on sustainability, efficiency, and safety.

The integration of technology, the use of recycled materials, and the implementation of advanced techniques are driving growth and setting new standards in the sector.

What are the key market drivers leading to the rise in the adoption of Road Construction And Maintenance in North America Industry?

- The significant investment in road infrastructure projects serves as the primary catalyst for market growth.

- The market is experiencing significant growth due to the expansion of transportation infrastructure. The United States, Canada, and Mexico are leading the investment in road and highway projects. For example, Nova Scotia province in Canada announced a USD498.5 million investment for a five-year highway improvement plan. This investment reflects the trend of increasing spending on road infrastructure projects to upgrade and develop existing roads. Large-scale highway projects are expected to boost the demand for road construction and maintenance services during the forecast period.

- The US Federal Highway Administration also plans to invest billions in road and bridge projects to enhance the country's transportation network. The market's continuous evolution is driven by the need for improved transportation infrastructure to support economic growth and population expansion in North America.

What are the market trends shaping the Road Construction And Maintenance in North America Industry?

- The rising number of road accidents represents a significant trend in the market. A growing incidence of road accidents signifies a notable market development.

- Road traffic accidents are a significant concern in the United States, with human errors such as overspeeding, drunk driving, and noncompliance with traffic rules being major contributing factors. Additionally, the condition of infrastructure facilities plays a significant role in road accidents. In 2025, the American Society of Civil Engineers (ASCE) published an Infrastructure Report Card, revealing that 6.8% of the nation's bridges remain in poor condition. These structures, which are structurally deficient and potentially hazardous, necessitate urgent maintenance or replacement.

- Furthermore, nearly half of all bridges are rated as being in only fair condition, indicating their aging state and susceptibility to further deterioration without timely intervention. This situation underscores the importance of ongoing investment in infrastructure maintenance and improvement to ensure public safety.

What challenges does the Road Construction And Maintenance in North America Industry face during its growth?

- The escalating costs of construction present a significant challenge that can hinder industry growth. In order to maintain profitability and competitiveness, businesses must carefully manage these rising expenses. This issue is particularly pressing given the current economic climate and increasing demand for infrastructure development. Effective cost management strategies, such as leveraging technology and implementing efficient project management techniques, can help mitigate these challenges and support the industry's continued growth.

- The construction industry relies on various inputs, including raw materials like concrete, steel, cement, and asphalt, land, labor, and utilities. Recent trends indicate a rise in the prices of raw materials, particularly concrete and steel, which has negatively affected the industry's profit margins. The cost increase is leading companies to pass on these expenses to their clients. However, the prices of cement and asphalt, fundamental components in construction, have been steadily climbing.

- This pattern is unsustainable, especially for the construction sector, as high prices may deter demand in the long term. The fluctuating nature of raw material prices necessitates continuous adaptation and cost management strategies for industry players.

Exclusive Technavio Analysis on Customer Landscape

The North America road construction and maintenance market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the North America road construction and maintenance market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Road Construction And Maintenance in North America Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, North America road construction and maintenance market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Acciona SA - This company specializes in advanced road construction and maintenance solutions, shaping the future of intelligent transportation systems through innovative technologies and sustainable practices. Their services contribute significantly to the development of modern, efficient motorways and roads.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Acciona SA

- ACS Actividades de Construccion Y Servicios SA

- Aecon Group Inc.

- Bechtel Corp.

- Clark Construction Group LLC

- EllisDon

- Ferrovial SA

- Fluor Corp.

- Graham Management Services LP

- Granite Construction Inc.

- GRUPO INDI SA DE CV

- Kiewit Corp.

- Kokosing Inc.

- Ledcor IP Holdings Ltd.

- MasTec Inc.

- Obayashi Corp.

- Rieth Riley Construction Co. Inc.

- Skanska AB

- The Walsh Group

- Tutor Perini Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Road Construction And Maintenance Market In North America

- In January 2024, Skanska USA Civil, a leading construction firm, announced the completion of a USD120 million highway expansion project in Texas, marking a significant milestone in the North American road construction market (Skanska USA Civil Press Release, 2024).

- In March 2024, LafargeHolcim, a global construction materials company, entered into a strategic partnership with WSP, a leading engineering and professional services consultancy, to offer integrated road construction and maintenance solutions in the United States and Canada (LafargeHolcim Press Release, 2024).

- In April 2025, Vulcan Materials Company, a major producer of construction materials, announced the successful deployment of its new asphalt paving technology, which reduces emissions by up to 50%, in a road construction project in California (Vulcan Materials Company Press Release, 2025).

- In May 2025, the Federal Highway Administration (FHWA) approved a USD2 billion grant for the construction and maintenance of rural roads in the United States, marking the largest federal investment in rural infrastructure in over a decade (Federal Highway Administration Press Release, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled North America Road Construction And Maintenance Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

199 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.4% |

|

Market growth 2025-2029 |

USD 56.1 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.2 |

|

Key countries |

US, Canada, and Mexico |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In North America, the road construction and maintenance sector continues to evolve, driven by a myriad of factors. Pavement management systems play a pivotal role, enabling proactive maintenance through predictive analytics and real-time data. Concrete pavement repair and asphalt pavement design are key focus areas, with innovative techniques such as pavement distress detection and crack sealing gaining traction. Bridge maintenance strategies and roadway lighting systems are other critical components, ensuring safety and longevity. Soil stabilization techniques and drainage infrastructure design are essential for sustainable road construction, mitigating the environmental impact. Construction scheduling software and traffic flow optimization streamline projects, reducing delays and enhancing efficiency.

- Moreover, the integration of intelligent transportation systems and structural health monitoring has revolutionized road asset management. Noise pollution mitigation and geotechnical engineering roads ensure compliance with environmental regulations. Deterioration modeling and material testing procedures ensure the durability of road surfaces, while road safety audits and project cost estimation provide valuable insights. Heavy equipment maintenance and construction quality control are integral to maintaining high standards and minimizing downtime. Pothole repair methods have advanced, with traffic simulation software and pavement preservation strategies offering cost-effective alternatives to complete reconstruction. According to the Federal Highway Administration, approximately 61% of the total highway mileage in the United States is in poor or mediocre condition.

- This underscores the significant need for continuous investment in road construction and maintenance. By embracing innovative technologies and strategies, North America's road infrastructure can overcome these challenges and deliver safer, more efficient transportation networks.

What are the Key Data Covered in this North America Road Construction And Maintenance Market Research and Growth Report?

-

What is the expected growth of the North America Road Construction And Maintenance Market between 2025 and 2029?

-

USD 56.1 billion, at a CAGR of 3.4%

-

-

What segmentation does the market report cover?

-

The report is segmented by Application (New construction, Reconstruction, and Repair), Type (Highway, Street, and Bridge), Material (Asphalt, Concrete, Bitumen, Gravel, and Others), and End-User (Government and Private Sector)

-

-

Which regions are analyzed in the report?

-

North America

-

-

What are the key growth drivers and market challenges?

-

Investments in road infrastructure projects, Rise in cost of construction

-

-

Who are the major players in the Road Construction And Maintenance Market in North America?

-

Acciona SA, ACS Actividades de Construccion Y Servicios SA, Aecon Group Inc., Bechtel Corp., Clark Construction Group LLC, EllisDon, Ferrovial SA, Fluor Corp., Graham Management Services LP, Granite Construction Inc., GRUPO INDI SA DE CV, Kiewit Corp., Kokosing Inc., Ledcor IP Holdings Ltd., MasTec Inc., Obayashi Corp., Rieth Riley Construction Co. Inc., Skanska AB, The Walsh Group, and Tutor Perini Corp.

-

Market Research Insights

- The market encompasses a wide range of activities, from road design and resurfacing to earthworks processes, culvert inspection, and drainage system maintenance. A significant portion of this market involves the production and application of bituminous materials, such as asphalt and tar, for pavement rehabilitation and new construction. Annual spending on road construction and maintenance in North America exceeds USD100 billion, with a substantial portion allocated to pavement cracking repairs and resurfacing. In contrast, preventative maintenance, including deflection testing and traffic management plans, accounts for approximately 20% of the total expenditure.

- The use of precast concrete elements, geosynthetics, and other advanced materials in road construction continues to grow, contributing to improved load bearing capacity and reduced pavement rutting. Safety remains a top priority, with stringent construction safety protocols and traffic control devices implemented to minimize risks for workers and motorists alike.

We can help! Our analysts can customize this North America road construction and maintenance market research report to meet your requirements.