Online Photography Education in Higher Education Market Size 2024-2028

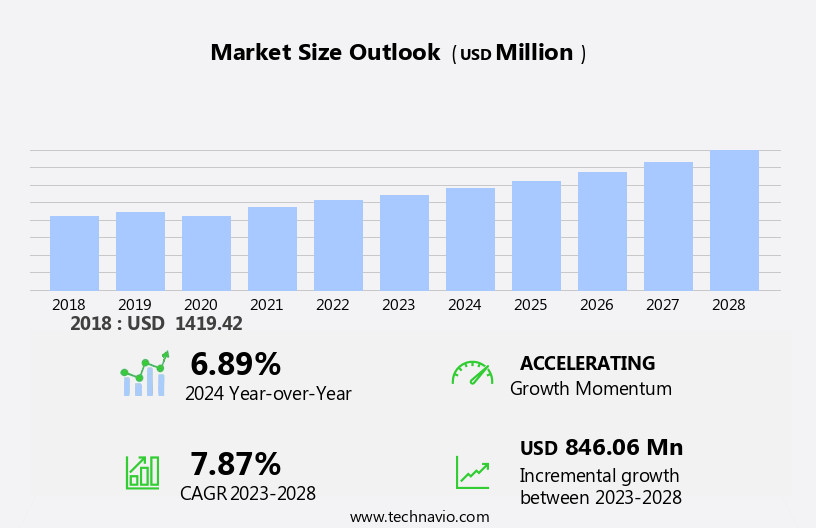

The online photography education in higher education market size is forecast to increase by USD 846.06 million at a CAGR of 7.87% between 2023 and 2028.

- The growing advantages of e-learning, such as flexibility, accessibility, and affordability, are the key drivers of the online photography education market in higher education. As more students seek flexible, remote learning opportunities, online platforms offer an ideal solution for learning photography skills at their own pace, with access to a wide range of courses and expert instructors.

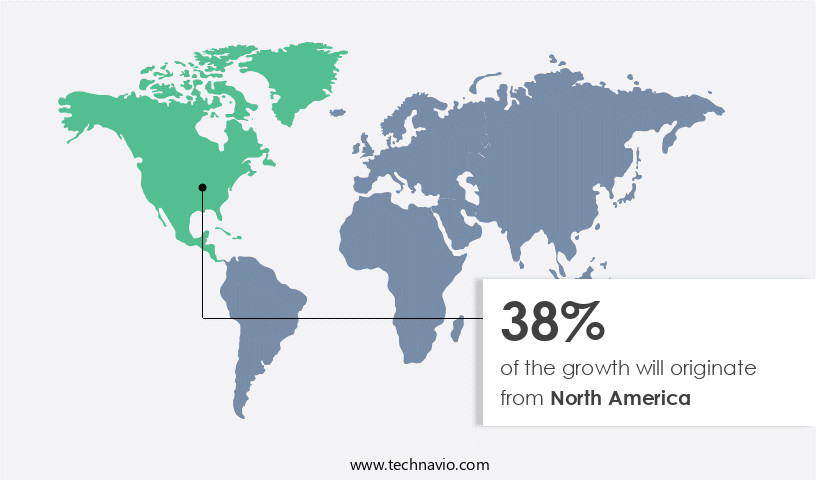

- In North America, higher education institutions are increasingly embracing digital platforms to deliver photography education. These platforms cater to both enthusiasts looking to explore photography as a hobby and professionals seeking to enhance their skills. The widespread adoption of online learning tools is helping to meet the growing demand for flexible and diverse photography education options in the region.

What will be the Size of the Online Photography Education in Higher Education Market During the Forecast Period?

- The online photography education market has experienced significant growth in recent years, driven by the widespread availability of digital platforms and resources for enthusiasts and professionals alike. This market encompasses a range of offerings, from basic photography skills instruction to advanced techniques in editing and software use. Digital education in photography has become increasingly accessible through internet-enabled devices, education apps, and social networking platforms.

How is this Online Photography Education in Higher Education Industry segmented and which is the largest segment?

The online photography education in higher education industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Degree

- Non-degree

- End-user

- Academic institutions

- Individual learners

- Geography

- North America

- Canada

- US

- APAC

- China

- Europe

- Germany

- France

- South America

- Middle East and Africa

- North America

By Type Insights

- The degree segment is estimated to witness significant growth during the forecast period.

Online photography education in higher education encompasses certificate and degree programs offered at accredited institutions. Students can pursue Bachelor of Arts (BA), Bachelor of Fine Arts (BFA), or Bachelor of Science Photography degrees. These programs teach students essential photography skills, including camera operations, lighting techniques, and Adobe Photoshop editing. Students learn to capture images, apply digital filters, and store photographs on laptops. Advanced courses cover niche photography skills, business practices, and industry trends. Online learning platforms provide hands-on experience, community building, and access to social media platforms for networking.

Despite skepticism regarding the efficacy of online education, the convenience and affordability of these programs have made them increasingly popular. Key areas of photography, such as sports, events, and digital media, are explored, along with post-production technologies and software use. Internet connectivity and smartphone penetration have expanded opportunities for photography enthusiasts and professionals alike.

Get a glance at the Online Photography Education in Higher Education Industry report of share of various segments. Request Free Sample

The degree segment was valued at USD 1.03 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- North America is estimated to contribute 38% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

Higher education institutions in North America are embracing digital platforms to deliver photography education, catering to both enthusiasts and professionals. With the proliferation of Internet connectivity and the widespread use of digital devices, students can access a wealth of resources for learning basic photography skills and advanced techniques, including editing software use and business practices. Online learning platforms offer hands-on experience through interactive tools such as smart education and virtual classrooms, addressing skepticism regarding the efficacy of digital education. Niche photography areas, such as sports, events, and church directories, can be explored through digital media, blogging, networking, and photo sharing. The photography industry continues to evolve, incorporating technologies like augmented reality and virtual reality for innovative learning experiences.

Students can benefit from personalized learning experiences and community building on social media platforms. Digital education encompasses photography applications in various sectors, including manufacturing, science, security surveillance, art, recreation, data storage, professional photography, photo books, automotive, machine vision, medical visualization, and more.

Market Dynamics

Photography enthusiasts and professionals seek out online learning opportunities to expand their knowledge and skills in various niche areas, such as sports, events, church directories, digital media, blogging, and networking. The market's size and direction are influenced by the growing demand for digital photography and post-production technologies. Popular tools and digital cameras continue to shape the landscape of online photography education. Overall, the market's trend towards microlearning and digital education shows no signs of slowing down, offering endless opportunities for those looking to enhance their photographic abilities.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Online Photography Education in Higher Education Industry?

Growing advantages of online learning is the key driver of the market.

- Online photography education in higher education is projected to expand due to the integration of digital platforms and technologies. Factors such as the growing usage of digital cameras, post-production technologies, and software like Adobe Photoshop are driving this trend. The inefficiency of traditional education methods and the rising demand for niche photography skills in various industries, including sports, events, and digital media, are also contributing factors. Online learning platforms offer students hands-on experience, personalized learning, and access to a global community of enthusiasts and professionals. Moreover, the convenience of online education enables students to learn at their own pace and schedule.

- The use of social media platforms for community building and networking is another significant advantage. However, skepticism regarding the efficacy of online education persists, and traditional methods continue to be preferred by some. Innovative ways, such as augmented reality and virtual reality, are being explored to enhance the learning experience. The photography industry's evolution, including the rise of smartphone penetration, 5G penetration, and the increasing use of wireless cameras and video platforms, is creating new opportunities for online education. Young people, who are increasingly reliant on internet-enabled devices and education apps, are embracing online microlearning and social networking as valuable resources for acquiring photography skills.

- Thus, online photography education in higher education is poised for growth due to the availability of comprehensive resources, the convenience of learning, and the industry's evolving needs. Brands that offer value-added services, such as soft skills development, career counseling, and access to advanced techniques and editing software, will differentiate themselves in this competitive market.

What are the market trends shaping the Online Photography Education in Higher Education Industry?

Growing popularity of education apps is the upcoming market trend.

- The global market for Online Photography Education via digital platforms is experiencing significant growth, driven by the increasing use of Internet-enabled devices among students and professionals alike. Higher education institutions are embracing technology, implementing one-to-one computing initiatives that allow students to access digital resources, including photography courses, on their devices. This trend is expected to continue over the next five years, leading to a growth in demand for digital education tools. Photography enthusiasts and professionals can now access a wealth of resources online, from basic photography skills and advanced techniques to editing software use and business practices. Online learning platforms offer hands-on experience, skepticism towards efficacy notwithstanding.

- These platforms also provide opportunities for students to build communities and connect with peers and industry experts through social media. Moreover, the photography industry is evolving, with digital media, blogging, networking, and photo sharing becoming increasingly important. Digital cameras and post-production technologies are becoming more accessible, enabling niche photography skills in areas such as sports, events, church directories, and more. The use of innovative technologies like augmented reality and virtual reality is also transforming the way we create and consume photographs. As Internet connectivity becomes more widespread, young people, especially those with high smartphone penetration, are turning to photography applications for personalized learning experiences.

- These applications offer a range of features, from Adobe Photoshop and digital cameras to photo processing equipment and interchangeable lenses. The market for photography software, photo looks, and photo processing is also expanding, with DSLRs, professional video, and photo shootings gaining popularity. The photography industry is diverse, encompassing fields such as manufacturing, photolithography, business, science, security and surveillance equipment, art, recreation, data storage, and professional photography. From photo books and automotive to machine vision and medical visualization, the opportunities for photographers are vast. As 5G penetration increases and wireless cameras and video platforms become more accessible, the potential for growth is immense.

- Thus, the Online Photography Education market is witnessing double-digit growth, driven by the increasing use of Internet-enabled devices and the evolving needs of the photography industry. From basic photography skills to advanced techniques, editing software use, and business practices, learners can now access a wealth of resources online. The trend towards digital education is expected to continue, offering innovative ways for students to learn and connect with their peers and industry experts.

What challenges does the Online Photography Education in Higher Education Industry face during its growth?

Inadequate cybersecurity measures is a key challenge affecting the industry growth.

- Online Photography Education in the digital age has experienced significant growth, with an increasing number of learners and educational institutions embracing digital platforms for acquiring basic photography skills and advanced techniques. Digital resources, such as software for editing and using post-production technologies, business practices, and industry insights, are readily available online. This shift to online learning has expanded the reach of photography education to enthusiasts and professionals alike, enabling them to access niche photography skills and personalized learning experiences. However, the adoption of online photography education faces challenges, particularly In the realm of cybersecurity. With the rise of internet connectivity and the use of Internet-enabled devices, such as digital cameras and smartphones, comes the risk of data breaches and privacy concerns.

- Cybersecurity measures are essential to protect the software and hardware in digital systems, as well as the data fed into these systems. Despite these challenges, the photography industry continues to innovate, with the integration of augmented reality and virtual reality in online learning platforms, and the use of social media platforms for community building and networking. The future of online photography education lies in providing hands-on experiences, efficient and effective learning, and catering to the diverse needs of students In the photography industry.

Exclusive Customer Landscape

The online photography education in higher education market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the online photography education in higher education market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, online photography education in higher education market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alison

- Chris Bray Photography

- Coursera Inc.

- Domestika Inc.

- Edtech Services LLC

- Eduonix Learning Solutions Pvt. Ltd.

- edX LLC

- Fiverr International Ltd.

- Jerad Hill Courses

- Magnum Photos Inc.

- McCann Learning Ltd.

- Microsoft Corp.

- Nikon Corp.

- Scholiverse Educare Pvt. Ltd.

- Seek Ltd.

- SkillShare Inc.

- The Photo Academy SA

- The School of Photography

- Udemy Inc.

- Manfred Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Online photography education has emerged as a significant trend In the digital platforms and resources landscape, catering to both enthusiasts and professionals seeking to enhance their skills in this visual art form. The photography industry, fueled by the proliferation of internet connectivity and the widespread use of internet-enabled devices, has seen a growth in online learning platforms offering various courses in basic photography skills and advanced techniques. Digital education in photography encompasses various aspects, including editing software use, business practices, and niche photography skills. These platforms provide students with innovative ways to learn, such as augmented reality and virtual reality technologies, enabling a more interactive and interactive learning experience. Despite the growing popularity of online photography education, skepticism regarding its efficacy persists. Traditional methods of learning, such as hands-on experience and in-person instruction, have long been the norm.

However, the convenience and accessibility of online learning platforms have made them an attractive alternative, particularly for those with busy schedules or limited access to traditional educational resources. The photography industry encompasses a wide range of applications, from digital media and blogging to manufacturing, security surveillance, and scientific research. As such, online photography education caters to a diverse student base, offering personalized learning experiences tailored to various niches and interests. Social media platforms have also played a significant role In the growth of online photography education. They provide a space for community building, networking, and photo sharing, allowing students to connect with peers and industry professionals, and showcase their work to a global audience. The use of photography applications on smartphones and wireless cameras has further democratized the art form, making it accessible to a broader audience. This has led to an increase in the number of young people taking up photography as a hobby or profession.

Thus, despite the many benefits of online photography education, it is essential to recognize the high expenses associated with professional-grade equipment, software, and post-production technologies. Additionally, the quality of education may vary between platforms, highlighting the importance of thorough research and due diligence when selecting a provider. Thus, online photography education has become an integral part of the digital platforms and resources landscape, offering a flexible and accessible alternative to traditional methods of learning. With its potential to cater to a diverse range of interests and applications, it is poised to continue shaping the photography industry in innovative ways.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

97 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.87% |

|

Market growth 2024-2028 |

USD 846.06 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.89 |

|

Key countries |

US, Canada, China, Germany, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Online Photography Education in Higher Education Market Research and Growth Report?

- CAGR of the Online Photography Education in Higher Education industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the online photography education in higher education market growth of industry companies

We can help! Our analysts can customize this online photography education in higher education market research report to meet your requirements.