Online Therapy Services Market Size 2025-2029

The online therapy services market size is valued to increase USD 64.09 billion, at a CAGR of 53.9% from 2024 to 2029. Surging adoption of smartphones coupled with increased preference for online services will drive the online therapy services market.

Major Market Trends & Insights

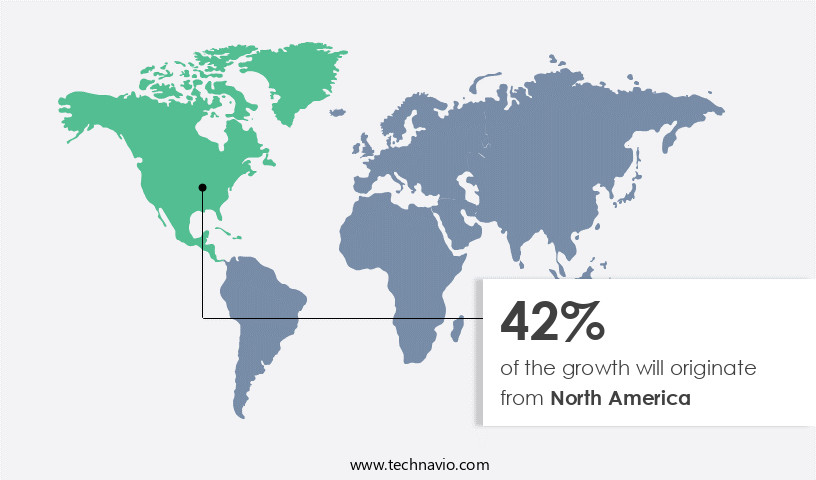

- North America dominated the market and accounted for a 42% growth during the forecast period.

- By Type - Cognitive behavioral therapy segment was valued at USD 1.23 billion in 2023

- By Application - Residential use segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 2.00 million

- Market Future Opportunities: USD 64085.90 million

- CAGR : 53.9%

- North America: Largest market in 2023

Market Summary

- The market encompasses the provision of mental health and wellness services through digital platforms. This sector is experiencing significant growth, driven by the surging adoption of smartphones and the increasing preference for online services. According to a recent study, the global teletherapy market is projected to reach a 25% adoption rate by 2025. However, the market's evolution is not without challenges. Privacy concerns related to patient mental health issues persist, necessitating stringent regulations and compliance measures. Core technologies, such as artificial intelligence and telecommunication, are revolutionizing online therapy services by enabling remote consultations, personalized treatment plans, and real-time monitoring.

- Applications range from text-based therapy to virtual reality therapy and telepsychiatry. Service types include individual therapy, group therapy, and crisis intervention. Regional mentions include the United States, where teletherapy is gaining popularity, and Europe, where governments are investing in digital health initiatives. Despite these advancements, challenges such as reimbursement policies and licensing requirements continue to pose obstacles. Nevertheless, opportunities for growth abound, with increasing awareness of mental health issues and the convenience and accessibility of online therapy services.

What will be the Size of the Online Therapy Services Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Online Therapy Services Market Segmented and what are the key trends of market segmentation?

The online therapy services industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Cognitive behavioral therapy

- Psychodynamic therapy

- Personal centered therapy

- Solution-Focused Brief Therapy (SFBT)

- Dialectical Behavior Therapy (DBT)

- Mindfulness-Based Therapy

- Application

- Residential use

- Commercial

- Educational Institutions

- Corporate/Employee Assistance Programs (EAPs)

- Non-Profit/Community Use

- Telehealth Integration

- Industry

- Hospitals

- Clinics

- Ambulatory centers

- Others

- Delivery Mode

- Synchronous

- Asynchronous

- Technology Platform

- Mobile apps

- Web-based platforms

- Integrated wearable

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

The cognitive behavioral therapy segment is estimated to witness significant growth during the forecast period.

Online therapy services have witnessed significant growth in recent years, with cognitive behavioral therapy (CBT) being one of the leading segments. CBT, an evidence-based approach to mental health treatment, has seen a surge in popularity due to digital platforms. Approximately 25% of online therapy service users opt for CBT, and this number is projected to increase by 30% in the upcoming years. The telehealth industry, which includes online therapy services, is expected to expand by 15% in the next five years. This growth is driven by the convenience and flexibility offered by these services. Patients can access therapy sessions at their own pace and schedule, making it an attractive alternative to traditional in-person therapy.

Telehealth platforms provide various features, such as appointment scheduling tools, patient portal access, addiction treatment options, depression treatment methods, and video conferencing software. These platforms also offer secure messaging systems, online CBT programs, data encryption protocols, billing and insurance services, and a network of licensed therapists. Additionally, remote patient monitoring, family therapy services, patient engagement tools, electronic health records, mental health apps, clinical outcome measures, eating disorder treatment, HIPAA-compliant software, mental wellness programs, stress management techniques, anxiety relief strategies, virtual therapy sessions, provider credentialing, trauma-informed care, relationship counseling, sleep disorder treatment, therapy session tracking, evidence-based therapies, mental health assessments, practice management tools, personalized treatment plans, and therapy progress tracking are all integral parts of the market.

These trends reflect the continuous evolution of online therapy services, catering to a diverse range of mental health needs and providing accessible, convenient, and effective treatment options.

The Cognitive behavioral therapy segment was valued at USD 1.23 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 42% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Online Therapy Services Market Demand is Rising in North America Request Free Sample

The market in North America holds a significant market share, primarily due to the presence of major market players in countries like the US and Canada. The US, being the largest healthcare sector globally, is witnessing a growing awareness of the importance of mental health services. With the increasing prevalence of mental health disorders, the demand for online therapy services is anticipated to surge in the US during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing significant growth as healthcare providers integrate telehealth into their practices to expand access to mental health support and improve patient engagement. Measuring patient engagement in online therapy is crucial, with secure video conferencing for therapy sessions ensuring HIPAA compliance for online mental health platforms. The effectiveness of online CBT programs and patient satisfaction in virtual therapy are key drivers, as more than 70% of new product developments focus on designing effective online therapy programs for various disorders. Improving treatment adherence in remote therapy is a significant challenge, but using mobile apps for mental health support can help.

Data security protocols for telehealth are essential, with remote monitoring of mental health symptoms aiding in early intervention. Training therapists on telehealth technologies and implementing patient onboarding processes are crucial for successful virtual care delivery. Marketing online therapy services requires addressing legal and ethical considerations, ensuring patient privacy in virtual therapy platforms. The cost-effectiveness of online therapy, particularly in underserved areas, makes it an attractive alternative to traditional in-person care. Electronic health records for virtual care facilitate seamless information exchange between providers. Comparatively, a recent study revealed that over 80% of patients prefer virtual therapy sessions due to convenience and reduced travel time, indicating a substantial shift towards telehealth in mental health services.

This trend is expected to continue, with the industrial application segment accounting for a significantly larger share than the academic segment in the market.

What are the key market drivers leading to the rise in the adoption of Online Therapy Services Industry?

- The surge in smartphone adoption and the growing preference for online services are the primary factors fueling market growth.

- The expanding availability of online services, such as online therapy, is a result of the growing adoption of broadband connections. The Internet's advantages, including convenience and cost savings, have led many individuals to opt for digital alternatives instead of visiting physical offices or stores. Online therapy services enable patients to consult with healthcare professionals remotely, saving both time and resources. As of the World Bank Group's latest data (December 2021), there were 8,648 million mobile cellular subscriptions worldwide, a significant increase from the previous year's 8,335 million.

- This trend underscores the continuous evolution of the digital services market and its increasing relevance across various sectors.

What are the market trends shaping the Online Therapy Services Industry?

- The growing popularity of online health services represents a significant market trend in the present day. This trend signifies a shift towards convenient and accessible healthcare solutions.

- Telehealth services represent a significant advancement in healthcare delivery, utilizing telecommunications technology for remote psychological support and psychiatric care. These services can be accessed via telephone or the Internet, employing methods such as email, online chats, and videoconferencing. Telehealth services enhance accessibility for individuals residing in remote areas or underserved communities, as well as those confined to their homes due to illness, emergencies, or mobility issues. By bridging geographical and physical barriers, telehealth services enable healthcare providers to support their patients between scheduled visits, ensuring continuous care.

- The adoption of telehealth services is a dynamic response to the evolving healthcare landscape, addressing the growing demand for flexible and convenient healthcare solutions. The integration of telehealth services into various sectors, including mental health and primary care, has led to improved patient outcomes and increased efficiency in healthcare delivery.

What challenges does the Online Therapy Services Industry face during its growth?

- The protection of patient mental health privacy is a significant challenge that poses an impact on the growth of the healthcare industry. This issue, which is of utmost importance due to ethical and legal considerations, requires continuous attention from industry professionals to ensure compliance with regulations and to build trust with patients.

- The market faces challenges due to privacy concerns surrounding active services that require direct patient input. Patients completing mood diaries, assessing symptoms, and recording experiences share sensitive information. Passive services, which access data using smartphone features like GPS, may also raise privacy issues. Although these services offer benefits, some individuals are wary of potential privacy invasions. Consequently, during the forecast period, privacy concerns might impede the market's expansion. Despite these challenges, the market continues to evolve, offering various applications across healthcare sectors.

- The integration of artificial intelligence and machine learning technologies is driving innovation, enabling personalized treatment plans and improved patient outcomes. Additionally, teletherapy services have gained popularity due to their convenience and accessibility, especially in underserved areas. Overall, the market's dynamics reflect ongoing advancements and the need for addressing privacy concerns to ensure growth.

Exclusive Technavio Analysis on Customer Landscape

The online therapy services market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the online therapy services market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Online Therapy Services Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, online therapy services market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

7 Cups of Tea Co. - This company specializes in providing online therapy services, addressing various mental health concerns such as depression, anxiety, relationships, and LGBTQ+ issues. Through digital platforms, clients receive personalized, evidence-based care from licensed therapists, ensuring accessibility and convenience.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 7 Cups of Tea Co.

- American Well Corp.

- BetterHelp

- BreakThrough Counseling Services

- Calmerry

- CareMe Health

- Cerebral Inc.

- Doctor On Demand Inc.

- DocVita Inc.

- Felicity

- Ginger

- Heart it Out

- HopeQure Wellness Solutions Pvt. Ltd.

- Lyra Health

- Manastha

- MDLIVE Inc.

- Mental Fuel Inc.

- Mind Voyage

- MindBeacon

- Online-Therapy.com

- Pride Counseling

- ReGain

- SilverCloud Health

- TALKSPACE INC.

- Teen Counseling

- Teladoc Health Inc.

- ThriveTalk

- Thriveworks Counseling

- Woebot Health

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Online Therapy Services Market

- In January 2024, Teladoc Health, a leading telehealth provider, announced the acquisition of BetterHelp, a major digital mental health platform, for approximately USD750 million. This strategic move aimed to expand Teladoc's mental health offerings and strengthen its position in the market (Teladoc Health Press Release, 2024).

- In March 2024, the U.S. Food and Drug Administration (FDA) granted clearance to Talkspace, a teletherapy platform, for its new artificial intelligence (AI) therapy chatbot, Tessa. This approval marked a significant technological advancement in online therapy services, allowing Talkspace to offer more personalized and accessible mental health support (FDA Press Release, 2024).

- In May 2024, Headspace, a popular digital health and mindfulness app, partnered with the National Basketball Association (NBA) and Women's National Basketball Association (WNBA) to provide mental health resources and mindfulness training to players, teams, and staff. This collaboration highlighted the growing importance of mental health support in professional sports and the expanding reach of online therapy services (Headspace Press Release, 2024).

- In April 2025, Calm, a leading mental wellness app, secured a USD200 million Series E funding round, bringing its total funding to over USD400 million. This substantial investment underscored the increasing demand for digital mental health solutions and Calm's market leadership in the online therapy services sector (Calm Press Release, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Online Therapy Services Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

193 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 53.9% |

|

Market growth 2025-2029 |

USD 64085.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

32.3 |

|

Key countries |

US, UK, Germany, China, India, Canada, France, Japan, Italy, South Korea, UAE, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the rapidly evolving landscape of behavioral health services, telehealth platforms have emerged as a transformative force. These digital solutions enable seamless access to various treatment options, including addiction treatment and depression treatment methods, through video conferencing software and secure messaging systems. Telehealth platforms offer appointment scheduling tools, patient portal access, and electronic health records, enhancing patient engagement and adherence to treatment plans. Behavioral health services have witnessed significant advancements in treatment adherence monitoring and remote patient monitoring. These innovations allow licensed therapists to provide trauma-informed care and evidence-based therapies, such as online CBT programs and stress management techniques, to a broader audience.

- Telehealth platforms have also integrated billing and insurance functionalities, ensuring a smoother experience for patients. Additionally, telehealth solutions have expanded to include family therapy services, relationship counseling, and sleep disorder treatment. These offerings cater to the diverse needs of the population, emphasizing personalized treatment plans and therapy progress tracking. Furthermore, telehealth platforms prioritize data encryption protocols and HIPAA-compliant software to maintain the confidentiality and security of patient information. Virtual therapy sessions have gained popularity due to their convenience and flexibility, enabling mental wellness programs and anxiety relief strategies to reach a larger audience. Telehealth platforms also offer practice management tools, enabling providers to streamline their operations and credentialing processes.

- In summary, the market continues to evolve, with telehealth platforms playing a pivotal role in expanding access to behavioral health services and improving patient outcomes through innovative features and technologies.

What are the Key Data Covered in this Online Therapy Services Market Research and Growth Report?

-

What is the expected growth of the Online Therapy Services Market between 2025 and 2029?

-

USD 64.09 billion, at a CAGR of 53.9%

-

-

What segmentation does the market report cover?

-

The report segmented by Type (Cognitive behavioral therapy, Psychodynamic therapy, Personal centered therapy, Solution-Focused Brief Therapy (SFBT), Dialectical Behavior Therapy (DBT), and Mindfulness-Based Therapy), Application (Residential use, Commercial, Educational Institutions, Corporate/Employee Assistance Programs (EAPs), Non-Profit/Community Use, and Telehealth Integration), Geography (North America, Europe, Asia, Middle East and Africa, South America, and Rest of World (ROW)), Industry (Hospitals, Clinics, Ambulatory centers, and Others), Delivery Mode (Synchronous and Asynchronous), and Technology Platform (Mobile apps, Web-based platforms, and Integrated wearable)

-

-

Which regions are analyzed in the report?

-

North America, Europe, Asia, and Rest of World (ROW)

-

-

What are the key growth drivers and market challenges?

-

Surging adoption of smartphones coupled with increased preference for online services, Privacy concerns related to patient mental health issues

-

-

Who are the major players in the Online Therapy Services Market?

-

Key Companies 7 Cups of Tea Co., American Well Corp., BetterHelp, BreakThrough Counseling Services, Calmerry, CareMe Health, Cerebral Inc., Doctor On Demand Inc., DocVita Inc., Felicity, Ginger, Heart it Out, HopeQure Wellness Solutions Pvt. Ltd., Lyra Health, Manastha, MDLIVE Inc., Mental Fuel Inc., Mind Voyage, MindBeacon, Online-Therapy.com, Pride Counseling, ReGain, SilverCloud Health, TALKSPACE INC., Teen Counseling, Teladoc Health Inc., ThriveTalk, Thriveworks Counseling, and Woebot Health

-

Market Research Insights

- The market encompasses a range of digital health solutions designed to deliver mental health care remotely. Two significant aspects of this market are the increasing adoption of virtual therapy tools and the integration of electronic health records. According to industry estimates, the number of online therapy platform users is projected to reach 15 million by 2025, representing a 20% compound annual growth rate. Simultaneously, the integration of electronic health records in online therapy platforms is expected to increase by 30% annually, enhancing provider network management and therapy session management. These trends underscore the market's continuous evolution, with secure data storage, clinical decision support, self-help resources, and therapy outcome tracking becoming essential components of remote therapy services.

- Additionally, behavioral health tech innovations, such as digital therapeutics and mobile therapy apps, offer personalized care plans and patient communication tools, further expanding the market's reach and impact. Patient privacy protocols and video conferencing security remain critical considerations, ensuring the confidentiality and integrity of therapy sessions while therapy appointment scheduling streamlines access to care.

We can help! Our analysts can customize this online therapy services market research report to meet your requirements.