Organic Rice Flour Market Size 2025-2029

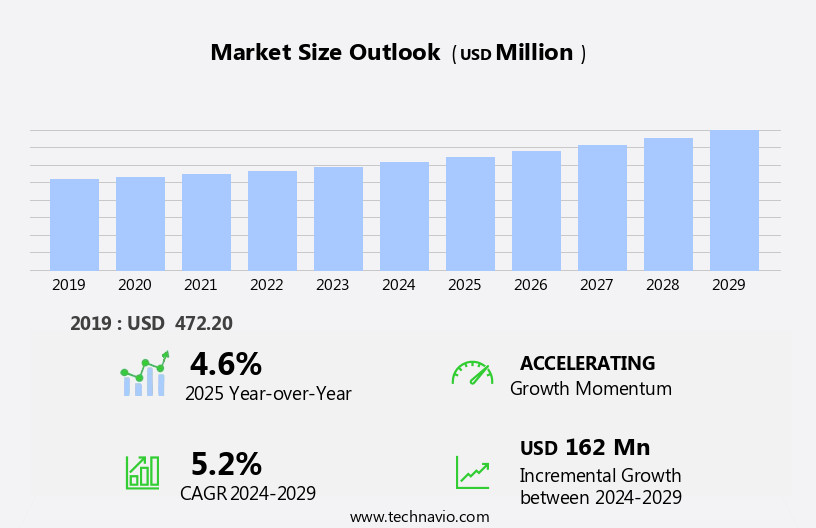

The organic rice flour market size is forecast to increase by USD 162 million, at a CAGR of 5.2% between 2024 and 2029.

- The market witnesses significant growth, driven by the increasing adoption of organic-based food products and the rise in preference for home-cooked meals. Organic rice flour is gaining popularity In the market due to its increasing use in various applications, particularly in the cosmetics industry and as a key baking ingredient for gluten-free food products. The demand for flour in the production of cakes, cookies, baked goods, and confectionery items is on the rise, as consumers seek healthier alternatives to wheat-based products. However, the market faces challenges due to the unpredictability of organic rice production caused by climatic changes. Extreme weather conditions, such as droughts and heavy rainfall, can significantly impact rice yields and, consequently, the availability of organic rice for flour production.

- These challenges necessitate the need for effective risk management strategies and the exploration of alternative production methods, such as hydroponic farming and controlled environment agriculture, to ensure a consistent supply of organic rice flour. Companies seeking to capitalize on market opportunities must focus on sustainable and resilient production methods while navigating the challenges posed by unpredictable weather patterns.

What will be the Size of the Organic Rice Flour Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market exhibits a dynamic and evolving landscape, shaped by various market forces and consumer trends. Consumers' increasing focus on health and wellness, dietary restrictions, and ethical sourcing are driving demand for organic rice flour in various sectors. Rice starch, a byproduct of rice flour production, is gaining traction in the food industry for its functional properties. Product lifecycle management and quality control are crucial for maintaining consumer trust and loyalty. Food safety and adherence to stringent food standards are essential, given the growing prevalence of food allergies and celiac disease. Brand positioning and product differentiation are key strategies for market players seeking competitive advantage.

Rice flour's versatility in gluten-free baking and its role in reducing food waste are contributing factors to its popularity. The global market for rice flour is expanding, with international trade and sustainable agriculture playing significant roles. Rice flour's nutritional value and potential for new product innovation are attracting food manufacturers. Rice bran, rice germ, and various rice flours like brown rice flour, glutinous rice flour, and white rice flour cater to diverse consumer preferences. Ethical sourcing and fair trade practices are becoming increasingly important in the rice flour market. Production costs, pricing strategies, inventory management, and demand forecasting are essential aspects of supply chain management.

Circular economy principles and waste reduction are gaining traction in the rice processing industry. Food regulations and certifications are shaping the market's future trajectory.

How is this Organic Rice Flour Industry segmented?

The organic rice flour industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Bakery and confectionery

- Breakfast foods

- Baby food

- Others

- Type

- White rice flour

- Brown Rice

- Sweet Rice

- Distribution Channel

- Direct Sales

- Indirect Sales

- Nature

- Organic

- Conventional

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Application Insights

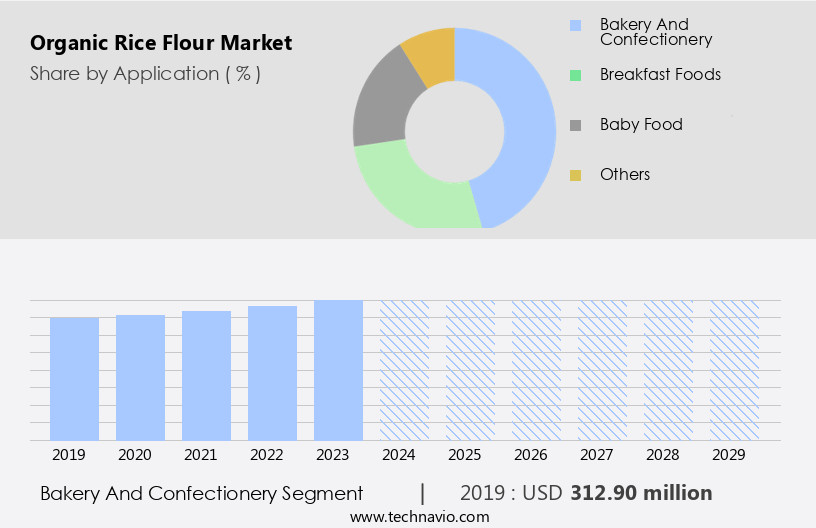

The bakery and confectionery segment is estimated to witness significant growth during the forecast period.

Organic rice flour, a gluten-free alternative, is gaining popularity in the health foods sector due to its long shelf life and versatility. Its usage extends beyond baking, as it serves as a coating for tempura and fried foods, providing a crispy texture. In the confectionery industry, it enhances the texture of rice cakes, rice crispy treats, and energy bars. The global market for organic rice flour is driven by consumer preferences for gluten-free diets and food allergies. Food safety certifications and regulations, such as those for celiac disease, further boost demand. Rice flour's production involves rice processing, including milling and starch extraction.

Sustainable agriculture and ethical sourcing are crucial in the supply chain management of organic rice flour. Waste reduction is a significant concern, with rice bran and germ utilized for added nutritional value and cost savings. Product development and brand positioning are essential for competitive advantage, with product differentiation through organic farming and fair trade practices. The market for organic rice flour is influenced by consumer behavior and food manufacturing trends. New product innovation, such as glutinous rice flour and sweet rice flour, cater to diverse consumer preferences. Rice starch and product lifecycle management are crucial for maintaining quality control and food safety.

Inventory management and pricing strategies are essential for efficient operations. Demand forecasting and circular economy principles contribute to sustainable growth in the market.

The Bakery and confectionery segment was valued at USD 312.90 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

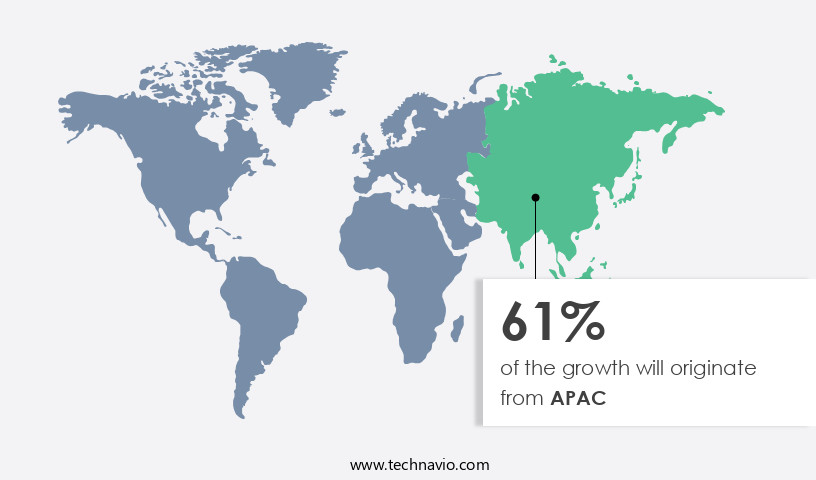

APAC is estimated to contribute 61% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in APAC is experiencing growth due to increasing consumer awareness and preference for healthier food options. Organic rice flour is free from pesticide and fertilizer residues, as the raw materials used for its production are cultivated through organic farming methods. APAC, being the largest rice producer globally, is witnessing an increase in organic rice production, with China, India, Australia, and Indonesia being major contributors. New players are entering the market, offering a variety of organic rice flour products. Food safety certifications and regulations are essential for organic rice flour production, ensuring product quality and consumer safety. Gluten-free and celiac consumers are a significant market segment, driving demand for gluten-free rice flour.

Waste reduction and supply chain management are crucial aspects of the market, with a focus on ethical sourcing and sustainable agriculture. Online sales and rice processing technologies have streamlined the distribution and production processes, enabling brands to offer competitive pricing strategies. Product development and innovation are key trends, with product lifecycle management and quality control ensuring consistent product differentiation. Rice starch, rice bran, rice germ, and various rice flours, including brown rice flour and sweet rice flour, are gaining popularity in food manufacturing, gluten-free baking, and food processing industries. Nutritional value and production costs are essential considerations for brands, with fair trade and circular economy practices becoming increasingly important.

Consumer behavior and food allergies influence the market, with food standards and ingredient sourcing playing a significant role in brand positioning. Rice flour's versatility and wide application in various industries, including food manufacturing and health foods, make it a valuable ingredient in the market. Product differentiation and competitive advantage are crucial factors for brands, with food safety and product innovation being key drivers of growth.

Market Dynamics

The Organic Rice Flour Market is experiencing significant expansion, driven by the surging demand for gluten-free baking alternatives. Organic rice flour in its forms, including organic brown rice flour and organic white rice flour, is a cornerstone of the gluten-free flour segment. As consumers increasingly prioritize healthy choices, the broader organic food industry is benefiting from the numerous rice flour benefits. This demand extends to diverse organic rice products and fuels the organic gluten-free products sector. A key application is baby food organic rice flour, catering to sensitive dietary needs. Manufacturers and organic rice flour suppliers are crucial in meeting the rising buy organic rice flour intent. The market is also propelled by the demand for vegan baking ingredients and other natural food ingredients, reflecting broader organic food market growth and evolving organic rice flour trends.

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Organic Rice Flour Industry?

- The significant growth in the market can be attributed to the increasing preference for organic-based rice flour as a healthier and more sustainable alternative.

- Organic rice flour has gained significant traction in the food industry due to increasing consumer awareness and preference for healthier food options. This product is derived from rice that is organically cultivated, ensuring it is free from synthetic fertilizers, pesticides, preservatives, and harmful chemicals like arsenic. The demand for organic rice flour stems from the growing trend towards clean labeling and the rejection of artificial food additives. Consumers are increasingly seeking non-GMO, hormone-free, or natural/organic ingredients for their food and beverages. This preference is driven by a desire for a healthier lifestyle and the belief that organic farming practices, such as sustainable agriculture and ethical sourcing, contribute positively to personal well-being and the environment.

- The international trade of organic rice flour has also grown, as consumers and food manufacturers in various regions recognize the benefits of this ingredient. Rice processing techniques ensure the purity and consistency of organic rice flour, making it an excellent choice for gluten-free baking and other food manufacturing applications. Online sales channels have further expanded the reach of organic rice flour, allowing consumers from diverse locations to access this product easily.

What are the market trends shaping the Organic Rice Flour Industry?

- The preference for home-cooked meals is gaining popularity as the latest market trend. Home cooking is increasingly favored over ready-made or restaurant meals.

- Organic rice flour has experienced significant growth in demand due to the increasing trend of home-cooking among cost-conscious consumers in the US. This preference for home-cooked meals has led to an increase in the usage of organic rice flour for the production of pasta, soups, and other food items. The food industry has witnessed a shift towards organic and natural ingredients, with organic rice flour being no exception. Product lifecycle management and quality control are crucial aspects of the market. Stringent food safety regulations and food standards ensure the production of high-quality organic rice flour. Product differentiation is achieved through various methods, including the sourcing of ingredients from certified organic farms and the use of rice starch derived from brown rice flour.

- Food allergies have become a significant concern for consumers, leading to an increased focus on ingredient sourcing and nutritional value. Organic rice flour is gluten-free and free from other common allergens, making it a popular choice for individuals with food sensitivities. The nutritional value of organic rice flour is another factor driving its demand, as it is rich in fiber, protein, and various essential minerals. Competitive advantage is gained through the implementation of efficient supply chain management and effective marketing strategies. Companies in the market prioritize product differentiation, innovation, and customer satisfaction to maintain their competitive edge.

- Overall, the market is expected to continue its growth trajectory due to the rising consumer preference for organic and natural food products.

What challenges does the Organic Rice Flour Industry face during its growth?

- Organic rice production is negatively impacted by climatic changes, presenting a significant challenge to the industry's growth trajectory.

- The market is influenced by several factors, primarily the production and availability of organic rice as the key raw material. India is a significant producer of organic rice globally, and any fluctuations in its yield can impact the market's growth. Climatic changes and weather conditions pose a risk to the volume and quality of the organic rice crop, potentially leading to increased production costs and pricing strategies for organic rice flour. Moreover, the growing preference for gluten-free diets has fueled the demand for organic rice flour, which is naturally gluten-free. New product innovation, such as sweet rice flour, and the emphasis on fair trade practices, are also driving the market forward.

- Inventory management is crucial in the food processing industry, and accurate demand forecasting is essential to maintain a consistent supply of organic rice flour. The circular economy concept is gaining traction in the food industry, and organic rice flour production aligns with this approach as it involves minimal waste and the use of renewable resources. Overall, the market is dynamic, and understanding these factors is crucial for businesses looking to enter or expand in this sector.

Exclusive Customer Landscape

The organic rice flour market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the organic rice flour market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, organic rice flour market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Ardent Mills LLC - This company specializes in the production and distribution of premium rice flours, including Super Fine White Rice Flour, Super Fine Brown Rice Flour, and Super Fine Sweet Waxy White Rice Flour, catering to various culinary applications with their high-quality organic offerings.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ardent Mills LLC

- Aryan International

- Associated British Foods Plc

- Bay State Milling Co.

- Bobs Red Mill Natural Foods Inc.

- Burapa Prosper Co. Ltd.

- Clearspring Ltd.

- Ingredion Inc.

- Koda Farms Inc.

- Kroner Starke GmbH

- La Milanese

- Lieng Tong Rice Vermicilli Co. Ltd.

- Namaste Foods LLC

- Real Organics

- Rose Brand

- Shree Bhagwati Flour and Foods Pvt. Ltd.

- Terra Greens Organic

- Thai Flour Industry Co. Ltd.

- Whitworth Ltd.

- Woodland Foods Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Organic Rice Flour Market

- In January 2024, Cargill, a leading global food ingredient provider, announced the expansion of its organic rice flour production capacity by 50% at its Wenling, China, facility. This expansion aimed to meet the growing demand for organic rice flour in the Asia Pacific region (Cargill Press Release, 2024).

- In March 2024, Ardent Mills, a leading flour-milling and ingredient company in North America, launched a new line of organic rice flour under its Ardent Elevate brand. This move expanded their organic offerings and catered to the increasing consumer preference for organic ingredients (Ardent Mills Press Release, 2024).

- In April 2025, Ajinomoto Co. Inc., a Japanese food and amino acid company, entered into a strategic partnership with Organic Valley, a leading organic cooperative in the US. The partnership aimed to develop and market organic rice-based food products, further expanding Ajinomoto's organic product portfolio (Ajinomoto Co. Inc. Press Release, 2025).

- In May 2025, the European Union (EU) approved the use of rice bran oil as a novel food ingredient in food products. This approval paved the way for the increased use of organic rice flour in various food applications across Europe, providing a significant growth opportunity for market players (European Commission Press Release, 2025).

Research Analyst Overview

- The market encompasses various applications, including rice flour blends for food and cosmetics. Farming practices significantly impact product quality and food authenticity. In the food sector, rice flour cakes, pancakes, and waffles are popular, while rice flour finds usage as an ingredient in infant formula and food additives. However, microbial contamination is a concern, necessitating stringent storage conditions and post-harvest handling. Rice flour's sensory attributes, such as texture and flavor, are essential for consumer taste preferences. Gluten-free bread, pasta, and baked goods utilize rice flour as a substitute. Shelf-life extension is another critical factor, achieved through fortified rice flour, enzyme technology, and packaging materials.

- The cosmetics industry uses rice flour derivatives as coloring agents and texture modifiers. In animal feed, rice flour serves as a nutritious supplement. Crop yields and food preservation are essential factors influencing market dynamics. Pest control and supply chain transparency are crucial aspects of rice flour production. Furthermore, rice flour's role extends to the production of specialty flours and food additives, enhancing product quality and consumer appeal. Overall, the market's trends reflect a growing demand for natural, gluten-free, and high-quality ingredients.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Organic Rice Flour Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

220 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.2% |

|

Market growth 2025-2029 |

USD 162 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.6 |

|

Key countries |

China, US, Japan, India, South Korea, Germany, UK, France, Canada, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Organic Rice Flour Market Research and Growth Report?

- CAGR of the Organic Rice Flour industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the organic rice flour market growth of industry companies

We can help! Our analysts can customize this organic rice flour market research report to meet your requirements.