Brazil Paper Packaging Market Size 2024-2028

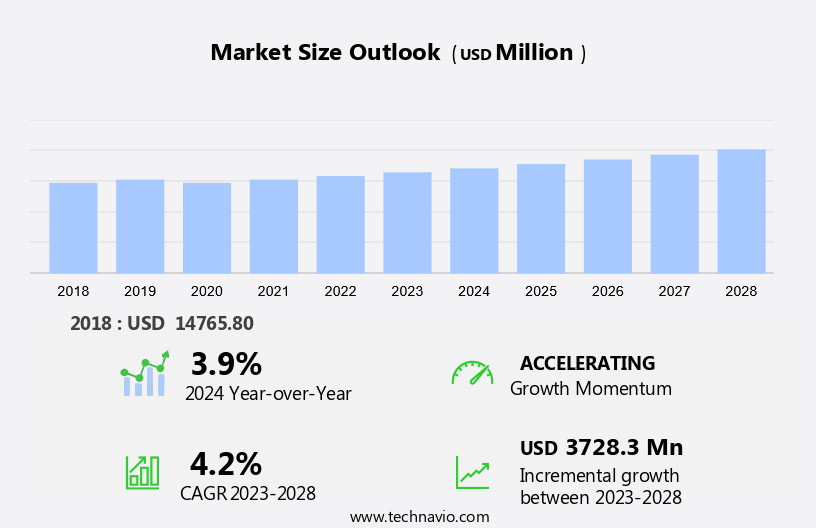

The Brazil paper packaging market size is forecast to increase by USD 3.73 billion at a CAGR of 4.2% between 2023 and 2028.

- The paper packaging market is experiencing significant growth due to several key drivers. One major factor is the increasing preference for eco-friendly options in response to environmental concerns. Paper packaging, which is recyclable and biodegradable, is a popular choice for consumers and businesses seeking to reduce their carbon footprint. Additionally, the rise of e-commerce has led to a demand for lightweight and customizable packaging solutions. Lightweight paper packaging reduces shipping costs and is more convenient for consumers. However, the market also faces challenges, such as the limited durability of paper bags compared to their plastic counterparts. To address this, innovations in paper packaging technology, including the use of plastics alternatives and smart packaging, are gaining traction.

- The European Union's Single-Use Plastics Directive, which aims to reduce plastic waste, is also driving demand for paper-based alternatives to single-use plastics. Overall, the paper packaging market is expected to continue growing as businesses and consumers prioritize sustainability and customization in their packaging choices.

What will be the size of the Brazil Paper Packaging Market during the forecast period?

- The market is experiencing significant growth due to increasing consumer preferences for eco-friendly and sustainable options. This trend is particularly prominent in the food and beverage industry, where online shopping and food deliveries have become commonplace. Paper-based packaging, including paperboard cartons, bags, and cups, is gaining popularity as a plastic alternative. These packaging solutions offer several advantages, such as being lightweight, recyclable, and moisture resistant. Moreover, they can be customized to meet specific branding and product requirements. The use of recycled paper and virgin paper in paper packaging production is another key trend.

- Recycled paper reduces the need for virgin raw materials, making it an eco-friendly choice. On the other hand, virgin paper offers superior print quality and strength, making it suitable for high-end applications. Food and beverage packaging is a significant segment of the paper packaging market. With the rise of online shopping and food deliveries, there is a growing demand for eco-friendly options that can maintain the freshness and quality of perishable items. Paper-based packaging solutions, such as folding boxboards and cups, are ideal for this purpose. The European Union's Single-Use Plastics Directive has also contributed to the growth of the paper packaging market. This regulation aims to reduce the use of single-use plastics and promote sustainable alternatives. As a result, paper packaging is becoming an increasingly popular choice for various industries, including food and beverages, cosmetics, and pharmaceuticals.

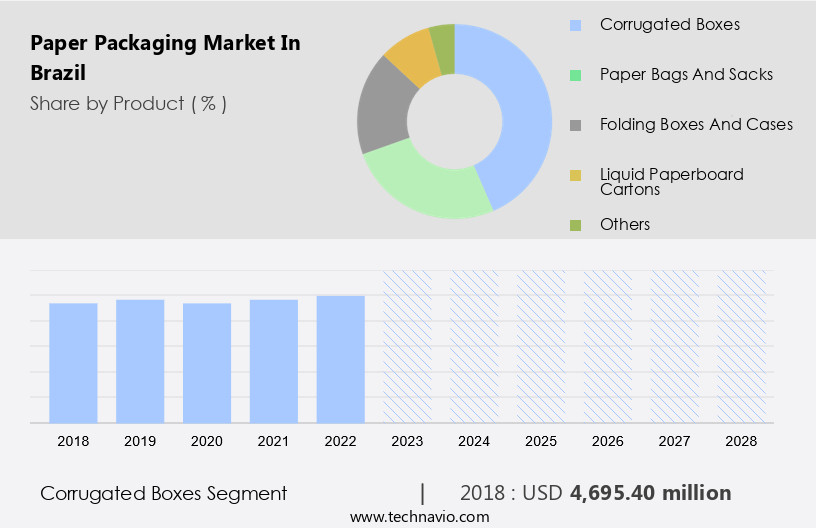

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Corrugated boxes

- Paper bags and sacks

- Folding boxes and cases

- Liquid paperboard cartons

- Others

- End-user

- Food

- Beverages

- Healthcare

- Personal care and home care

- Others

- Geography

- Brazil

By Product Insights

- The corrugated boxes segment is estimated to witness significant growth during the forecast period. In the realm of transit packaging, paper-based solutions continue to gain traction in the market. Paperboard cartons, bags, and cups are among the popular paper packaging options, offering several benefits to both consumers and businesses. These packaging solutions provide excellent hygienic storage and are renewable, aligning with the growing concern for reducing plastic pollution. Corrugated paper packaging, such as boxes, is manufactured using sophisticated systems, including automation and robotics. The distinctive design, known as fluting, involves an arched paper layer sandwiched between two flat ones. By 2023, these eco-friendly containers will remain a preferred choice for shipping, storing, and promoting various products, including heavy pharmaceuticals and bulk food items.

- Moreover, paper packaging is customizable, ensuring optimal product protection. It is made from recycled materials, such as old newspapers and used corrugated cartons, making it a sustainable alternative to plastic. Incorporating these paper packaging solutions into your business strategy not only enhances your brand image but also aligns with the increasing consumer preference for eco-friendly products.

Get a glance at the market share of various segments Request Free Sample

The Corrugated boxes segment was valued at USD 4.69 billion in 2018 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Brazil Paper Packaging Market?

- Environmental benefits associated with paper and paperboard containers are the key driver of the market. Paper and paperboard containers, a popular choice for tertiary packaging in various industries, have gained significant traction in the market due to their eco-friendly attributes. These containers are manufactured using recyclable materials, making them an ideal alternative to plastic packaging. The biodegradable nature of paper and paperboard containers allows them to decompose naturally, reducing the amount of waste that ends up in landfills. Moreover, they are reusable, which further minimizes the environmental impact. In the era of online shopping and food deliveries, the demand for sustainable packaging solutions has risen. Paper-based packaging, with its recyclable and biodegradable properties, aligns perfectly with this trend.

- By opting for paper and paperboard containers, businesses can not only reduce their carbon footprint but also appeal to the growing number of consumers who prioritize sustainability. Additionally, the energy-saving benefits of paper packaging, as it is often manufactured from locally sourced materials, further adds to its appeal.

What are the market trends shaping the Brazil Paper Packaging Market?

- Increased popularity of smart packaging is the upcoming trend in the market. In the realm of packaging, smart solutions have emerged as a significant trend in 2023. Integrating sensor technology and the Internet of Things (IoT), smart packaging enhances product value and ensures quality. Notably, industries such as food and beverage, and healthcare, have adopted this technology to monitor product freshness, display quality information, and ensure safety. Meanwhile, the paper packaging market has witnessed substantial growth. This expansion can be attributed to advancements in lightweight, eco-friendly options, including microsensors, printed electronics, authentication platforms, and IoT. By offering recyclable and plastic alternative packaging solutions, paper packaging caters to the increasing demand for sustainability in e-commerce.

- Furthermore, customizable packaging options enable brands to differentiate themselves in the market. The Single-Use Plastics Directive, a regulatory initiative aimed at reducing plastic waste, is expected to further fuel market growth. By staying informed about these trends and incorporating them into your business strategy, you can position your brand for success in the evolving paper packaging landscape.

What challenges does Brazil Paper Packaging Market face during the growth?

- Limited durability of paper bags is a key challenge affecting the market growth. In the market, the shift towards sustainable packaging solutions has led to a notable rise in the usage of paper packaging types, including corrugated boxes and folding cartons, for various industries. However, the selection depends on the specific requirements of the product. For instance, biopharmaceutical drugs necessitate specialized packaging, such as kraft paper or molded pulp, to ensure the integrity and safety of the contents. Despite the advantages, such as its recyclability and eco-friendliness, it may not be the best choice for all applications. For instance, paper packaging may not be suitable for heavy food items or liquid food products due to its inherent weakness.

- This can result in food loss and spillage, posing challenges for restaurants and foodservice providers offering takeaways. In response to these challenges, innovations in technology continue to emerge, aiming to address the limitations of traditional paper packaging. For example, advancements in coating technologies can enhance the durability and water resistance of paper bags, making them more suitable for transporting food items. Additionally, the development of alternative paper packaging solutions, such as composite packaging, which combines the benefits of paper and other materials, can offer improved strength and functionality. As the demand for sustainable packaging solutions continues to grow, businesses must stay informed about the latest trends and innovations in paper packaging.

Exclusive Brazil Paper Packaging Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Clearwater Paper Corp.

- DS Smith Plc

- Graphic Packaging Holding Co.

- International Paper Co.

- Klabin S.A.

- NEFAB GROUP

- ORBIS Corp.

- Rengo Co. Ltd.

- Sappi Ltd.

- Signode Brasileira LTDA

- Sonoco Products Co.

- SSI Schafer IT Solutions GmbH

- Tetra Laval SA

- Tetra Pak International SA

- WestRock Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing demand for eco-friendly and sustainable packaging solutions. Online shopping and food deliveries have driven the need for paper-based packaging types such as corrugated boxes, folding cartons, and molded pulp. These packaging solutions offer several advantages, including lightweight, recyclability, and biodegradability. Food and beverages, biopharmaceutical drugs, and non-durable goods are the major industries driving the demand. Corrugated board, kraft paper, and specialty paper are the most commonly used materials in this market. Recycled paper and virgin paper are the two main types of raw materials used in the production.

Moreover, eco-friendly options, such as biodegradable and recycled paper, are gaining popularity due to growing concerns over plastic waste and pollution. Customizability is another key factor driving the growth of the market. Paper-based packaging solutions offer excellent moisture resistance and barrier properties, making them suitable for various applications. Tertiary packaging, such as pallets and shipping containers, made of paper and paperboard, are also gaining traction due to their lightweight and renewable nature. The market is expected to grow further as more companies adopt paper-based packaging to enhance their brand image and meet the demand for sustainable and hygienic storage solutions.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

144 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.2% |

|

Market growth 2024-2028 |

USD 3.73 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.9 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Brazil

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch