Personal Care Appliances Market Size 2025-2029

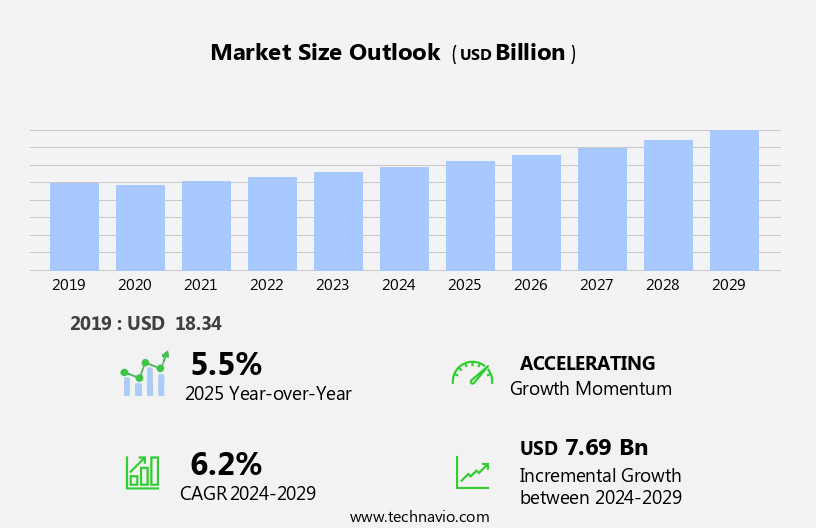

The personal care appliances market size is forecast to increase by USD 7.69 billion, at a CAGR of 6.2% between 2024 and 2029.

- The market is experiencing significant growth, driven by product innovations leading to portfolio extension and premiumization. Manufacturers are introducing advanced technologies and features to cater to evolving consumer preferences, resulting in increased demand for high-end personal care appliances. However, market expansion is not without challenges. Fluctuations in raw material prices and operating costs continue to pose significant hurdles for market participants. Beauty equipment, including epilators, hair removal appliances, hair straighteners, and hair stylers, are popular categories within this market. Despite these challenges, opportunities abound for companies that can effectively navigate these dynamics and deliver value to consumers. New product launches, strategic partnerships, and cost optimization strategies are key areas of focus for market players seeking to capitalize on the market's growth potential. Companies that can successfully balance innovation, affordability, and sustainability will be well-positioned to thrive in this dynamic market.

What will be the Size of the Personal Care Appliances Market during the forecast period?

- The market encompasses a range of electrically-powered devices designed to enhance individual beauty and grooming routines. This market exhibits strong growth, driven by the global trend towards increased beauty consciousness and the desire for brand consciousness among consumers. Oral care appliances are another significant segment, reflecting the importance of communication and engagement in maintaining dental health.

- The market's expansion is not limited to developed economies; emerging economies are also witnessing substantial growth as consumers in these regions increasingly prioritize personal grooming. Battery-operated appliances offer convenience and portability, further fueling market expansion. Economic activities and the influence of celebrities continue to shape consumer preferences and market trends within the personal care appliances industry.

How is this Personal Care Appliances Industry segmented?

The personal care appliances industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- Product

- Hair care appliances

- Hair removal appliances

- Oral care appliances

- Gender

- Women

- Men

- Unisex

- Type

- Corded

- Cordless

- Geography

- APAC

- China

- India

- Japan

- South Korea

- Europe

- France

- Germany

- Italy

- UK

- North America

- US

- Canada

- South America

- Middle East and Africa

- APAC

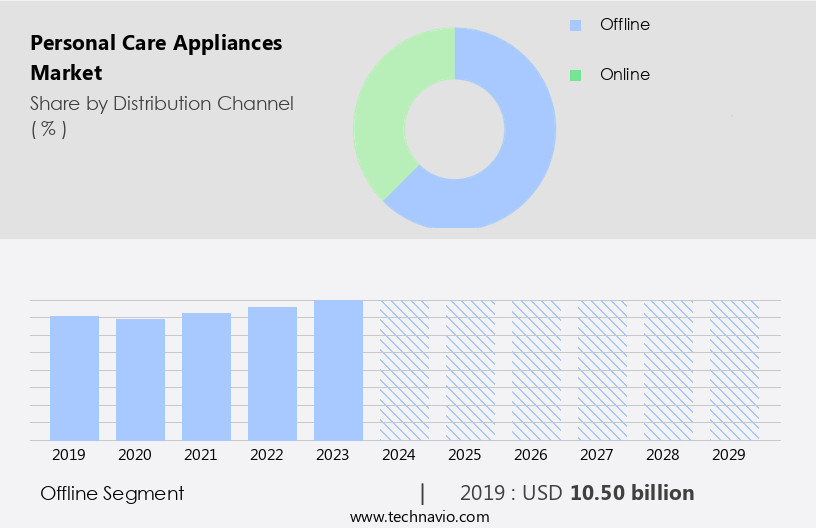

By Distribution Channel Insights

The offline segment is estimated to witness significant growth during the forecast period. The market encompasses a range of electrically-powered devices used for grooming and beauty purposes. This sector caters to the growing demand for convenience and self-confidence driven by beauty consciousness and rapid urbanization, particularly in developed nations and emerging economies. Key product categories include hair care appliances (dryers, curlers, straighteners, and stylers), dental care equipment, and hair removal appliances. Brands play a significant role in consumer decision-making, with many opting for premium options. The market is segmented into distribution channels, including physical stores and the direct-to-consumer channel. Specialty stores, also known as electronic and specialty retailers (EASRs), dominate the offline distribution landscape due to their extensive product offerings and brand presence.

Companies benefit from these retailers' dedicated focus on personal care appliances, enabling effective marketing, advertising, and promotional activities. The market is further influenced by economic activities, communication channels (social media), and the youth population's engagement with beauty and grooming products. Despite the positive influence of these trends, challenges such as lack of awareness and durability concerns persist. Local companies and multinationals, including Procter and Gamble, continue to innovate with newer products to address these issues and cater to the evolving needs of consumers. The premiumization trend and quality consciousness further fuel market growth.

Get a glance at the market report of share of various segments Request Free Sample

The offline segment was valued at USD 10.50 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 40% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in Asia Pacific is experiencing significant growth due to increasing beauty consciousness among consumers, particularly in developing economies. Key players in the market, including Philips, Panasonic, and Shiseido Co. Ltd., prioritize innovation and the introduction of new products to cater to evolving consumer preferences. Urban consumers, particularly the youth population, are increasingly prioritizing premium, high-quality, and technologically advanced appliances for grooming and oral care. Rapid urbanization and economic activities in countries like India and China are driving demand for personal care appliances.

Consumers are increasingly engaging with communication channels such as social media to stay informed about the latest trends and products. Personal care appliances, including hair curlers, hair dryers, hair removal appliances, hair straighteners, hair stylers, and oral care appliances, are becoming essential grooming items. However, lack of awareness and durability concerns in some emerging economies may negatively influence market growth. Despite these challenges, the personal care industry is expected to continue its positive influence on self-confidence and social interactions.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Personal Care Appliances Industry?

- Product innovations leading to portfolio extension and product premiumization is the key driver of the market. The market experiences continuous growth, driven by innovative advancements in product features, technology, and manufacturing processes. Breakthrough innovations focus on enhancing product performance and specifications, while radical innovations streamline production methods to decrease turnaround time. To cater to evolving consumer demands, market participants invest heavily in research and development, introducing new personal care appliances such as hair styling equipment. Overall, The market is characterized by dynamic innovation and a commitment to meeting consumer needs.

What are the market trends shaping the Personal Care Appliances Industry?

- New product launches in global personal care appliances market is the upcoming market trend. The market is experiencing growth due to the introduction of new products, which cater to evolving consumer needs and preferences. These innovations bring excitement and renewed interest to the market. For instance, companies unveiled a new hair straightener featuring nourishcare technology. This product addresses the concern of heat damage during hair styling, expanding the company's product portfolio and opening new market opportunities. Similar product launches contribute to the market's expansion and growth during the forecast period.

What challenges does the Personal Care Appliances Industry face during its growth?

- Fluctuations in raw material prices and operating costs is a key challenge affecting the industry growth. The market pricing is influenced by several factors, including manufacturing costs, labor expenses, raw material prices, and marketing expenditures. The prices of raw materials, such as steel, iron, plastic, glass, electronic equipment, and paints, significantly impact the final product price or manufacturers' profit margins. Procuring these materials involves additional costs, including transportation and necessary services, as well as constraints from suppliers and challenges in securing timely and adequate deliveries.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Amika LLC - The company offers personal care appliances such as hair straighteners, hair curlers, hair dryers, facial rollers.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Andis Co.

- Beauty Quest Group

- Colgate Palmolive Co.

- Conair Corp.

- Coty Inc.

- Drybar Holdings LLC

- Dyson Group Co.

- Elchim Spa

- Farouk Systems Inc.

- FKA Distributing Co. LLC

- IkonicWorld

- Koninklijke Philips NV

- Olivia Garden Int. Inc

- Panasonic Holdings Corp.

- Spectrum Brands Holdings Inc.

- T3 Micro Inc.

- The Procter and Gamble Co.

- Velecta Paramount

- Wahl Clipper Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a wide range of electrically operated devices designed to enhance an individual's grooming routine. These appliances cater to various needs, including hair care, dental care, and skin care, among others. The market for these appliances is driven by several factors, chief among them the growing trend of beauty consciousness in both developed and emerging economies. Beauty consciousness, fueled by the desire for self-confidence and engagement with social media, has led to an increase in demand. The market is further influenced by the premiumization trend, as consumers seek high-quality, durable products that offer superior performance.

Despite the positive influence of these factors, the market faces challenges. One such challenge is the lack of awareness and trust in local companies, leading consumers to prefer established, brand-conscious manufacturers. Another challenge is the negative influence of the lack of durability of some appliances, which can deter consumers from making repeat purchases. The direct-to-consumer channel has emerged as a significant distribution model in the market. This trend is driven by the convenience and affordability it offers, as well as the ability to reach a wider audience through digital communication channels. The personal grooming industry is undergoing rapid urbanization, with urban consumers being the primary target audience.

The youth population, in particular, is a significant demographic, as they are more likely to adopt new trends and technologies. Electricity is a critical input in the production and use. The availability and affordability of electricity in emerging economies can significantly impact the growth of the market in these regions. The market is diverse, with a range of products catering to different needs and preferences. Hair care appliances, including hair dryers, curlers, and straighteners, are among the most popular. Dental appliances, such as electric toothbrushes, are also gaining popularity due to their effectiveness and convenience.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

230 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.2% |

|

Market Growth 2025-2029 |

USD 7.69 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.5 |

|

Key countries |

US, China, Japan, UK, India, Germany, South Korea, Canada, Italy, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Personal Care Appliances Market Research and Growth Report?

- CAGR of the Personal Care Appliances industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the personal care appliances market growth of industry companies

We can help! Our analysts can customize this personal care appliances market research report to meet your requirements.