Plastic Contract Manufacturing Market Size 2024-2028

The plastic contract manufacturing market size is forecast to increase by USD 12.43 billion, at a CAGR of 10.87% between 2023 and 2028.

- The market is experiencing significant growth due to the rise in demand for electronic devices and the development of high-quality plastic components in various industries. Polystyrene, polyethylene, polyvinyl chloride (PVC), and other rigid plastics are widely used in consumer electronics, computer-aided design, and household appliances. In the food and beverage industry, there is a growing trend toward using biodegradable plastics for packaging, particularly for rigid plastic containers and protective packaging. Key materials like acrylonitrile, butadiene, and polypropylene are used in insulation, construction, and aerostructures. Moreover, the adoption of advanced technologies such as computer-aided design, cloud computing, automation, and additive manufacturing is driving innovation in plastic contract manufacturing.

- The use of bioplastics and biodegradable materials is also gaining popularity due to increasing environmental concerns and regulations against pollution. The medical devices sector is another significant end-user, with a growing demand for plastic components in healthcare services. In the satellite industry, plastic components are used extensively due to their lightweight and durability. Overall, the market is expected to continue its growth trajectory, driven by these trends and the increasing demand for high-quality plastic components in various industries.

What will be the Size of the Plastic Contract Manufacturing Market During the Forecast Period?

- The market encompasses the production of various plastic products for numerous industries, including household appliances, electronics, healthcare services, and medical devices. Polystyrene, polyethylene, polypropylene, polyurethane, acrylonitrile butadiene styrene, and other lightweight plastics are commonly used materials in this sector. Market dynamics continue to evolve, with trends leaning towards eco-friendly and recyclable plastics, such as biodegradable polymers, to address environmental concerns. The integration of advanced technologies, like 3D printing and computer-aided design, streamlines manufacturing processes and enhances product customization. Several industries, including aerospace and defense, electronics, and consumer electronics, rely on plastic contract manufacturing for producing components and end-products.

- Notable applications include smartwatches, healthcare devices, video recorders, and various electronic gadgets. The market is expected to grow significantly due to the increasing demand for high-performance, cost-effective, and customizable plastic solutions. The market's expansion is driven by technological advancements, evolving consumer preferences, and the continuous development of new applications across various industries.

How is this Plastic Contract Manufacturing Industry segmented and which is the largest segment?

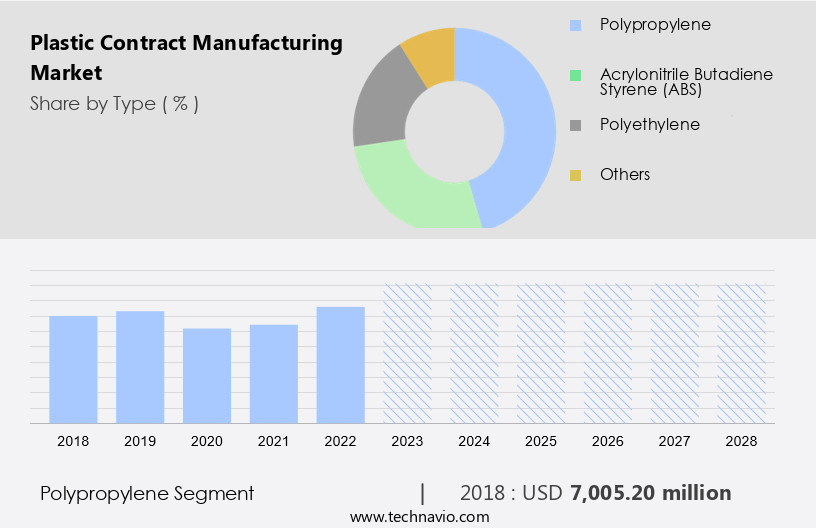

The plastic contract manufacturing industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Polypropylene

- Acrylonitrile butadiene styrene (ABS)

- Polyethylene

- Others

- End-user

- Consumer goods

- Automotive

- Medical

- Others

- Geography

- APAC

- China

- Japan

- North America

- US

- Europe

- Germany

- UK

- South America

- Middle East and Africa

- APAC

By Type Insights

- The polypropylene segment is estimated to witness significant growth during the forecast period.

The polypropylene segment is projected to experience the fastest growth in the market. Polypropylene is a versatile plastic widely used in various industries, including household appliances, electronics, healthcare, and aerospace. Its desirable properties, such as excellent rigidity, stiffness, and load-bearing capacity, make it an ideal choice for these applications. In the food and beverage sector, polypropylene's low density (0.895 g/cm-0.92 g/cm) and resistance to chemical corrosion and moisture make it a preferred material for producing food containers. The expanding base of small and medium-sized enterprises (SMEs) In the food and beverage industry is anticipated to fuel the demand for polypropylene plastic contract manufacturing services. Additionally, the adoption of lightweight and eco-friendly materials, such as polypropylene, in various industries is gaining momentum due to increasing environmental concerns and regulatory pressures. This trend is expected to further boost the market growth.

Get a glance at the Plastic Contract Manufacturing Industry report of various segments Request Free Sample

The polypropylene segment was valued at USD 7.01 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- APAC is estimated to contribute 32% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The Asia Pacific (APAC) region leads The market due to its large population and rising disposable income. Factors such as high production and consumption of consumer electronics, rapid urbanization, and increasing Internet usage further boost market growth. Key plastic materials used include Polystyrene, Polyethylene, Polypropylene, Polyurethane, and Acrylonitrile Butadiene Styrene (ABS). Applications span various industries such as Household appliances, Electronics products, Healthcare services, Medical devices, Consumer electronics, Aerospace and Defense, and more. Lightweight materials like Polyvinyl Chloride and eco-friendly alternatives such as biodegradable and recyclable plastics are gaining popularity. Technologies like 3D printing, Computer Aided Design, and advanced materials are transforming manufacturing processes. The market caters to numerous sectors, including Electrical components, Chassis, Medical segment, Aerostructure, System and support, Cabin interiors, Propulsion systems, Satellites, Insulation components, and more.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Plastic Contract Manufacturing Industry?

The increase in demand for electronic devices is the key driver of the market.

- The Plastics market encompasses various types of plastic materials, including Polystyrene, Polyethylene, Polypropylene, and Polyurethane. These plastics are utilized extensively in numerous industries, such as Household appliances, Electronics products, Healthcare services, and Medical devices. The consumer electronics sector includes TVs, Smartphones, Cameras, Laptops, and Recorders. In the Aerospace and Defense industry, plastics are used in Aircraft structures, Propulsion systems, and Satellites. The market's growth is fueled by the increasing demand for electronic gadgets, driven by rising disposable income and the shift towards remote work due to the COVID-19 pandemic. The adoption of IoT, IT-OT convergence, and cloud migration have further accelerated this trend.

- Plastics like Acrylonitrile Butadiene Styrene (ABS) and Polyvinyl Chloride are commonly used in 3D printing and Computer-Aided Design for creating lightweight and eco-friendly components. Additionally, the development of biodegradable and recyclable plastics is a significant market trend. Plastics play a crucial role in various industries, including Electronics, Aerospace and Defense, and Healthcare. The market's growth is driven by the increasing demand for electronic devices and the shift towards remote work due to the pandemic. The use of plastics in creating lightweight and eco-friendly components, such as ABS and Polyvinyl Chloride, is a significant trend. Furthermore, the development of biodegradable and recyclable plastics is expected to drive market growth during the forecast period.

What are the market trends shaping the Plastic Contract Manufacturing Industry?

Development of high-quality products is the upcoming market trend.

- Acrylonitrile Butadiene Styrene (ABS) and Polyvinyl Chloride are widely used in 3D printing and Computer-aided design processes. The increasing popularity of Eco-friendly materials and the growing need for sustainable manufacturing practices are expected to boost the Plastics market. The global economic growth and rising average household incomes have led consumers to prefer premium and unique products, particularly In the Consumer Electronics and Home Appliances sectors. Plastics play a crucial role in delivering high-quality products, which is essential for businesses to build customer trust and increase sales. The Plastics market is poised to grow significantly as industries continue to seek innovative solutions using these versatile materials.

What challenges does the Plastic Contract Manufacturing Industry face during its growth?

Stringent regulations and policies against pollution is a key challenge affecting the industry growth.

- Plastics, including polystyrene, polyethylene, polypropylene, and polyurethane, are extensively used in various industries such as household appliances, electronics products, healthcare services, and medical devices. Plastics like Acrylonitrile Butadiene Styrene (ABS) are utilized in aerospace and defense, cabin interiors, propulsion systems, and satellites. The use of plastics in consumer electronics, such as TVs, smartphones, cameras, laptops, and recorders, has increased significantly due to their lightweight properties and eco-friendly alternatives like biodegradable and recyclable plastics. Plastic waste, particularly in marine environments, poses a significant threat to wildlife, economic activity, and human health. Strict regulations and policies are in place to mitigate plastic pollution.

- Plastics such as Polyvinyl Chloride (PVC) and other non-biodegradable plastics contribute to this issue. The plastic industry has embraced advanced technologies like 3D printing, Computer-Aided Design, and Lightweight materials to create sustainable and eco-friendly solutions. The market dynamics for plastics are driven by the increasing demand for eco-friendly and sustainable materials, stringent regulations, and technological advancements. The medical segment, including smartwatches, healthcare devices, and video recorders, is a significant contributor to the growth of the plastic industry. Plastics play a crucial role in various industries, and their usage will continue to grow as technology advances and sustainability becomes a priority.

Exclusive Customer Landscape

The plastic contract manufacturing market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the plastic contract manufacturing market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, plastic contract manufacturing market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aztec Plastic Co.

- Baytech Plastics Inc.

- C and J Industries Inc.

- Coarc Manufacturing Inc.

- Dielectric Manufacturing Inc.

- EVCO Plastics

- Gregstrom Corp.

- IAG Holdings Ltd

- Intertech Machinery Inc.

- Lakshmi Machine Works Ltd

- Mack Molding Co.

- McClarin Plastics LLC

- Natech Plastics Inc.

- Permian Plastics LLC

- Plastikon Industries Inc.

- PTI Engineered Plastics Inc.

- RSP Inc.

- Stevanato Group S.p.A

- Tessy Plastics Corp.

- Toward Zero Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a diverse range of industries and applications, with polystyrene, polyethylene, polypropylene, polyurethane, and other types of plastics playing crucial roles. These materials are utilized extensively in various sectors, including household appliances, electronics products, and healthcare services. In the realm of household appliances, plastics contribute significantly to the production of durable and efficient appliances. Their lightweight properties enable easier transportation and installation, while their resistance to corrosion ensures longevity. Furthermore, plastics' insulating capabilities contribute to energy efficiency, reducing overall energy consumption. The electronics industry relies heavily on plastics for the manufacturing of various components. Polystyrene, polyethylene, polypropylene, and polyurethane are used In the production of electrical components, chassis, and insulation components.

Further, these materials offer excellent electrical insulation properties, making them indispensable In the production of electronic gadgets, such as smartphones, cameras, laptops, recorders, and power trains. The healthcare sector also benefits from plastic contract manufacturing, particularly in the medical segment. Plastics are used extensively In the production of medical devices, including those used in surgeries, medical diagnostics, and patient care. Polyurethane, for instance, is used in the production of medical implants, while acrylonitrile butadiene styrene (ABS) is used in the production of medical equipment casings. The aerospace and defense industry is another significant consumer of plastic contract manufacturing. Plastics are used In the production of aerostructures, system and support components, cabin interiors, and propulsion systems.

Lightweight materials, such as polymers, contribute to the reduction of fuel consumption and increased aircraft efficiency. Moreover, eco-friendly materials, including biodegradable and recyclable plastics, are increasingly being adopted to reduce the environmental impact of the industry. The use of plastics In the production of insulation components is prevalent in various industries, including satellites. Polystyrene, polyethylene, and polyurethane are commonly used for insulation due to their excellent insulating properties. These materials help maintain the required temperature levels in various applications, ensuring optimal performance and longevity. In the realm of automotive manufacturing, plastics are used extensively In the production of various components, including those used in power trains and engine parts.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

173 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.87% |

|

Market growth 2024-2028 |

USD 12.43 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

9.53 |

|

Key countries |

China, US, Germany, Japan, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Plastic Contract Manufacturing Market Research and Growth Report?

- CAGR of the Plastic Contract Manufacturing industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the plastic contract manufacturing market growth of industry companies

We can help! Our analysts can customize this plastic contract manufacturing market research report to meet your requirements.