Rugged Handheld Devices Market Size 2025-2029

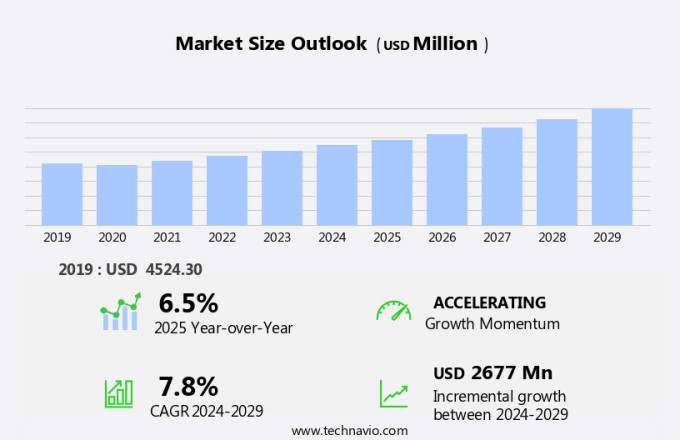

The rugged handheld devices market size is forecast to increase by USD 2.68 billion at a CAGR of 7.8% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing demand for data management systems from various end-users, particularly in industries such as logistics, transportation, and field services. This trend is fueled by the need for real-time data access and increased operational efficiency. Technological advancements in rugged handheld devices, including longer battery life, enhanced processing power, and ruggedized displays, are further boosting market growth. However, the market faces challenges as well. Regulatory hurdles impact adoption in certain industries, such as healthcare and military, due to stringent regulations regarding data security and device durability. Supply chain inconsistencies also temper growth potential, as rugged handheld devices require specialized components and manufacturing processes.

- Despite these challenges, companies seeking to capitalize on market opportunities can focus on addressing these issues by investing in research and development to meet regulatory requirements and improve supply chain efficiency. Additionally, the trend of using consumer-grade devices in place of rugged devices presents both an opportunity and a threat. While consumer-grade devices offer lower costs and ease of use, they lack the durability and security features necessary for rugged applications. To differentiate themselves, rugged handheld device manufacturers must emphasize the benefits of their products, such as longer battery life, ruggedness, and enhanced security features.

What will be the Size of the Rugged Handheld Devices Market during the forecast period?

- The market is experiencing significant growth, driven by the increasing demand for remote control capabilities in various industries. Data security is a top priority, leading to the integration of advanced encryption and authentication features in these devices. Form capture and data analysis are essential functions for businesses, making formative solutions a key trend. Remote diagnostics and mobile device management enable predictive maintenance and operational efficiency, while IoT integration and smart device management facilitate real-time data processing. Enterprise mobility solutions provide integrated hardware platforms for application development, voice recognition, and workforce optimization.

- Industry-specific software, digital signature capture, fleet management, and asset management are crucial for businesses seeking to streamline processes and improve customer relationship management. Operating systems and software solutions continue to evolve, offering mobile payment processing, real-time data analysis, and voice control capabilities.

How is this Rugged Handheld Devices Industry segmented?

The rugged handheld devices industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Rugged mobile computer

- Rugged tablet

- End-user

- Industrial

- Commercial

- Military

- Government

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Product Insights

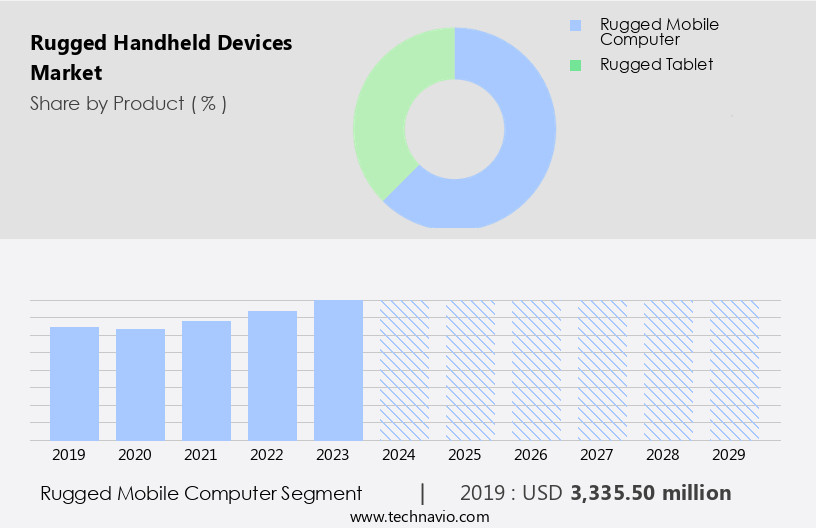

The rugged mobile computer segment is estimated to witness significant growth during the forecast period.

The rugged handheld mobile devices market encompasses rugged smartphones and PDAs, extensively utilized in logistics and industrial sectors. The segment's growth is fueled by the rising adoption of semi-rugged and fully rugged handheld devices in various industries to enhance operational efficiency and minimize downtime. IoT integration and advancements in mobile communication technologies are major catalysts for the widespread use of IoT devices in the industrial sector. These devices facilitate real-time data access and analysis from the field, enabling informed business decisions to optimize processes and enhance customer experience. Public safety entities, field service management teams, and utility workers rely on ruggedized handheld devices with extended battery life for mission-critical tasks.

These devices are equipped with features such as biometric authentication, barcode scanners, GPS navigation, drop resistance, and IP67 rating, ensuring reliable performance under harsh conditions. Mobile workforce management, inventory management, data synchronization, and cloud computing are essential applications for rugged handheld devices in industries like manufacturing, transportation, and logistics. Additionally, the integration of machine learning, artificial intelligence, and augmented reality enhances productivity and accuracy in data capture and field data collection. Handheld computers with physical keyboards and touchscreen inputs cater to the needs of sales representatives and point-of-sale applications. Wearable technology, such as smart glasses and head-mounted displays, offers hands-free functionality and improved productivity for warehouse workers and first responders.

The market also includes mobile payments, location services, remote monitoring, and asset tracking applications. With the increasing demand for real-time data access and analysis, the market is expected to continue growing, driven by the need for rugged, reliable, and feature-rich devices across various industries.

The Rugged mobile computer segment was valued at USD 3.34 billion in 2019 and showed a gradual increase during the forecast period.

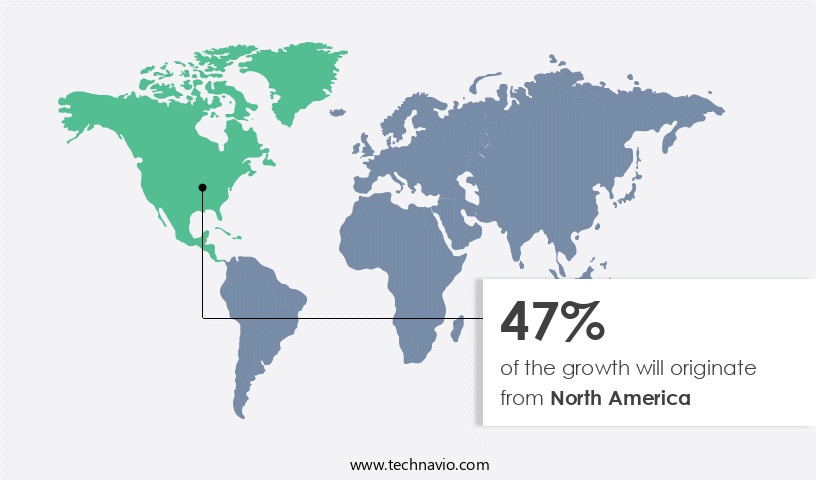

Regional Analysis

North America is estimated to contribute 47% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing significant growth due to their increasing adoption in various industries. In the logistics and warehouse sector, these devices enable efficient inventory management, data synchronization, and real-time location services for mobile workforces. Ruggedized designs with extended battery life, drop resistance, and IP67 ratings ensure durability for utility workers and first responders in harsh environments. Public safety agencies utilize rugged handheld devices equipped with barcode scanners, RFID readers, and biometric authentication for secure data storage and access. Mobile computing solutions with bright displays and cellular networks enable real-time data capture and field data collection for field service management and industrial automation applications.

Government agencies and military personnel rely on rugged handheld devices for asset tracking, remote monitoring, and data capture in mission-critical situations. Wearable technology, such as smart glasses and head-mounted displays, integrated with machine learning, artificial intelligence, and augmented reality, enhance situational awareness and productivity. Sales representatives and point-of-sale applications benefit from rugged handheld devices with touchscreen input, mobile payments, and GPS navigation. Companies in the market are collaborating with software providers to offer advanced features, such as GIS mapping, data capture, and wireless communication, to cater to the evolving needs of diverse industries.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Rugged Handheld Devices market drivers leading to the rise in the adoption of Industry?

- The increasing requirement for robust data management systems from end-users serves as the primary catalyst for market growth.

- The market experiences significant growth due to the increasing requirement for secure data storage and management in various industries. These devices enable businesses to collect and analyze data in real-time, replacing outdated paper-based processes. The industrial and commercial sectors' automation trend fuels the demand for rugged handheld devices, which are essential for data-intensive applications. In logistics services, rugged handheld devices facilitate raw material procurement management, while in warehouse systems, they ensure efficient inventory management and storage capacity optimization. Industrial manufacturing units leverage these devices for production capacity monitoring, machinery management, and on-site data management. Transportation and fleet management applications utilize global positioning system (GPS) tracking and navigation to optimally allocate assets and vehicles.

- In the construction industry, rugged handheld devices are crucial for on-site data management and instantaneous updates. Rugged handheld devices play a pivotal role in supply chain management, allowing warehouse staff to collect and update data accurately and securely. Additionally, these devices support touchscreen input, mobile payments, location services, remote monitoring, and asset tracking, enhancing operational efficiency and reducing costs. Thermal protection ensures the devices' durability and reliability in harsh environments, making them indispensable tools for businesses seeking to optimize their operations.

What are the Rugged Handheld Devices market trends shaping the Industry?

- The trend in the market is leaning towards technological advancements in rugged handheld devices. Two lines: 1. Rugged handheld devices are witnessing significant technological advancements, which is the current market trend. 2. These innovations aim to enhance functionality, durability, and user experience in these devices.

- Rugged handheld devices, characterized by their durability and advanced capabilities, are gaining traction in various industries due to the digitalization trend and advancements in communication technologies. These devices, designed to function optimally in harsh environments, are increasingly replacing consumer handheld devices in sectors such as field service management, public safety, and utility work. Integration of features like RFID readers, biometric authentication, mobile workforce management, and machine learning further boosts their appeal. Mobile computing devices, such as smartphones and tablets, equipped with rugged features, are increasingly adopted for applications in industries. These devices facilitate effective inventory management, supply chain management, and operations management.

- Moreover, in the retail and hospitality sectors, they enhance customer experience through contactless transactions and real-time data access. Public safety agencies, including first responders, benefit significantly from rugged handheld devices. These devices enable them to access critical information in real-time, improving response efficiency and ensuring public safety. Additionally, the integration of smart glasses and extended battery life enhances the functionality and usability of these devices in such high-pressure situations.

How does Rugged Handheld Devices market faces challenges face during its growth?

- The use of consumer-grade devices instead of rugged ones poses a significant challenge to industry growth, as these devices may lack the durability and reliability required for certain applications, potentially leading to increased maintenance costs and decreased productivity.

- The market experiences growth challenges due to the increasing adoption of consumer-grade devices in industrial applications. Warehouse workers and those in industrial automation sectors often opt for consumer-grade smartphones and tablets, which are less expensive and offer similar ruggedness levels as rugged handheld devices. Some manufacturers, such as SAMSUNG ELECTRONICS and Sony, are enhancing the ruggedness of their consumer devices, with the iPhone 15 featuring an IP68 rating and the upcoming Galaxy S25 expected to launch with an IP69 rating.

- However, these devices lack essential features for industrial use, such as physical keyboards, head-mounted displays, barcode scanners, vibration resistance, GPS navigation, and drop resistance. Rugged handheld devices are specifically designed to meet the demands of harsh environments and offer superior functionality and durability. Despite their advantages, the market growth may be impeded by the cost-effective alternatives and the continuous evolution of consumer devices.

Exclusive Customer Landscape

The rugged handheld devices market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the rugged handheld devices market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, rugged handheld devices market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Aeroqual Ltd. - The company specializes in supplying rugged handheld devices for environmental monitoring. Notable offerings include the Aeroqual Ranger handheld monitor, equipped with interchangeable sensors for air quality assessment and dust measurement.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aeroqual Ltd.

- ARBOR Technology Corp.

- BARTEC Top Holding GmbH

- Bluebird Inc.

- Caterpillar Inc.

- CipherLab Co. Ltd.

- Datalogic SpA

- DT Research Inc.

- Getac Technology Corp.

- HID Global Corp.

- Honeywell International Inc.

- Juniper Systems Inc.

- KYOCERA Corp.

- Leonardo DRS Inc.

- MilDef Group AB

- Panasonic Holdings Corp.

- Samsung Electronics Co. Ltd.

- Touchstar Plc

- Unitech Computer Co. Ltd.

- Zebra Technologies Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Rugged Handheld Devices Market

- In February 2024, Honeywell announced the launch of its newest rugged handheld computer, the Dolphin 10 Pro, featuring an extended battery life and enhanced data capture capabilities (Honeywell Press Release). In the same year, Zebra Technologies and DHL Supply Chain signed a strategic partnership to integrate Zebra's rugged mobile computers and real-time location solutions into DHL's supply chain operations (Zebra Technologies Press Release).

- In March 2025, Trimble acquired privately-held rugged tablet manufacturer, Forsite Technologies, to expand its portfolio of rugged computing solutions and strengthen its presence in the construction industry (Trimble Press Release). In the same month, Panasonic unveiled its Toughbook N1 tablet, the world's first fanless, fully rugged 10.1-inch tablet with an Intel Core i5 processor, demonstrating significant technological advancements in rugged handheld devices (Panasonic Press Release).

Research Analyst Overview

The market continues to evolve, driven by the diverse needs of various sectors. Field service management teams rely on these devices for efficient data capture and real-time communication. RFID readers integrated into rugged handhelds streamline inventory management and asset tracking in warehouses. Public safety agencies and first responders leverage these devices for biometric authentication, mobile computing, and real-time data synchronization during emergency situations. Government agencies and utility workers benefit from extended battery life, ruggedized design, and GPS navigation for effective field data collection. Mobile workforce management solutions enable secure data storage and machine learning capabilities to optimize workflows. Rugged handhelds are increasingly adopted in industrial automation, featuring an IP67 rating, bright displays, and cellular networks for remote monitoring and control.

Wearable technology, such as smart glasses and head-mounted displays, equipped with barcode scanners and touchscreen input, enhance productivity in manufacturing and logistics. Rugged handhelds cater to the demanding requirements of field technicians, sales representatives, and point-of-sale transactions with features like vibration resistance, drop resistance, and MIL-STD-810 G certification. These devices offer advanced capabilities like augmented reality, GIS mapping, artificial intelligence, and wireless communication to optimize workflows and improve operational efficiency.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Rugged Handheld Devices Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

207 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.8% |

|

Market growth 2025-2029 |

USD 2677 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.5 |

|

Key countries |

US, Germany, China, UK, Canada, Brazil, France, Japan, India, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Rugged Handheld Devices Market Research and Growth Report?

- CAGR of the Rugged Handheld Devices industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the rugged handheld devices market growth of industry companies

We can help! Our analysts can customize this rugged handheld devices market research report to meet your requirements.