Saudi Arabia Healthcare IT Market Size 2025-2029

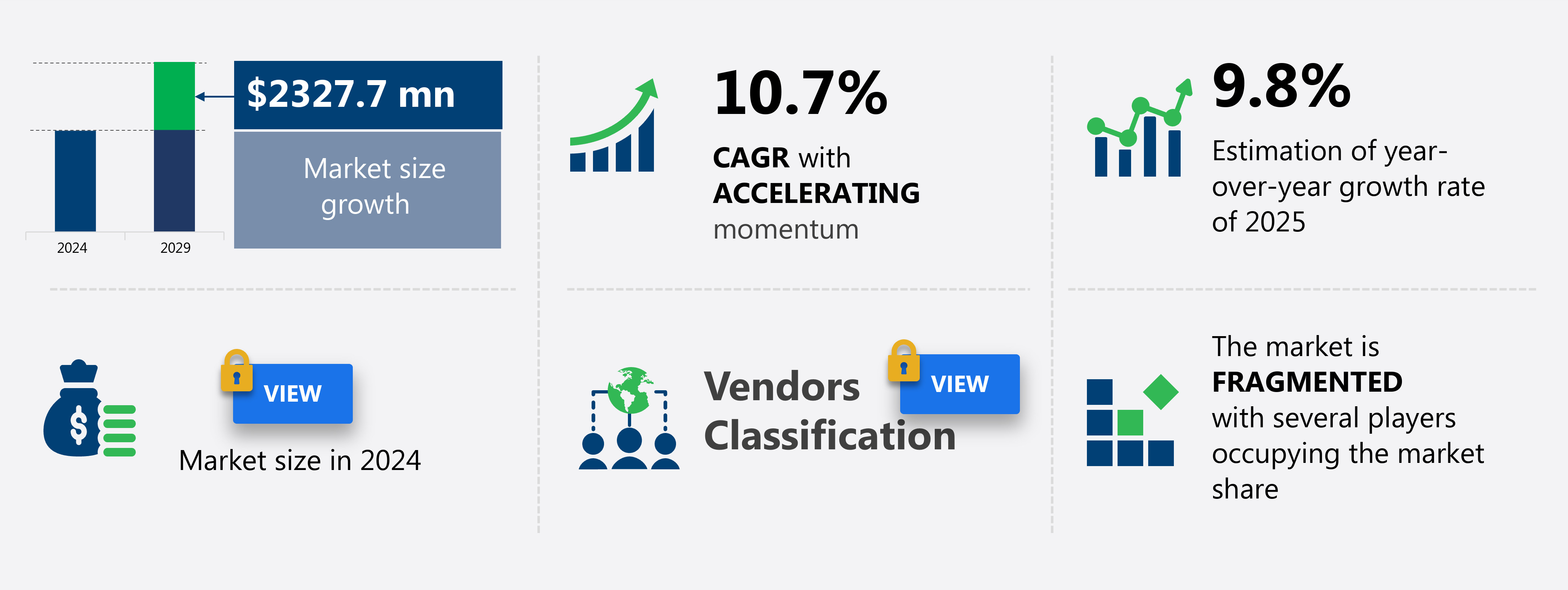

The Saudi Arabia healthcare IT market size is forecast to increase by USD 2.33 billion at a CAGR of 10.7% between 2024 and 2029.

- The market is experiencing significant growth due to several key factors. The increasing prevalence of chronic diseases is driving the need for advanced IT solutions to manage patient data and improve healthcare delivery. Telemedicine and other digital health solutions are gaining popularity, enabling remote patient monitoring and virtual consultations, which are increasing accessibility and convenience for patients. However, the lack of skilled IT professionals In the healthcare sector poses a challenge to the implementation and effective utilization of these technologies. These trends and challenges highlight the importance of investing in IT infrastructure and workforce development to meet the evolving needs of the healthcare industry.

What will be the Size of the market During the Forecast Period?

- The market is experiencing significant growth due to the increasing prevalence of chronic diseases and the aging population. Automation, telemedicine, digital health, social media analytics, and internet-enabled mobile technologies are transforming healthcare delivery, enabling more efficient communication and collaboration among healthcare providers. Electronic Health Records (EHRs) and Healthcare Information Exchanges (HIE) are streamlining administrative tasks, reducing errors, and improving patient safety.

- Healthcare analytics facilitates medical research by analyzing anonymized data from studies and clinical trials, enhancing the accuracy and effectiveness of treatments. Telehealth and telemedicine are bridging geographical gaps, allowing remote consultation and monitoring for patients. Communication tools and healthcare analytics are optimizing workflows, enabling healthcare teams to collaborate more effectively and deliver better patient care.

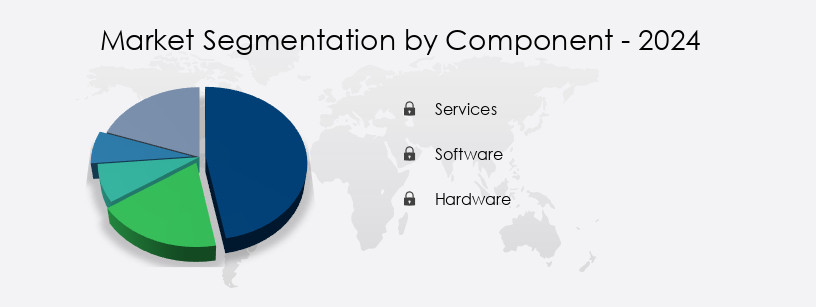

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Component

- Services

- Software

- Hardware

- End-user

- Healthcare providers

- Healthcare payers

- Method

- Acute care

- Post-acute care

- Ambulatory care

- Geography

- Saudi Arabia

By Component Insights

- The services segment is estimated to witness significant growth during the forecast period.

The Saudi Arabian healthcare IT market is experiencing significant growth due to the government's focus on leveraging technology for efficient and effective healthcare delivery. Key services in this market include Electronic Medical Records (EMR), telemedicine, Health Information Exchange (HIE), and patient engagement solutions. EMR systems enable healthcare providers to digitally manage patient health records, enhancing access to accurate and complete patient information. Leading providers have been adopted by several hospitals in Saudi Arabia, including King Saud Medical City in Riyadh, resulting in improved patient care, clinical decision-making, and operational efficiency. Telemedicine and HIE facilitate remote consultations and seamless data sharing between healthcare facilities, addressing healthcare accessibility challenges in remote areas and reducing redundant tests and administrative tasks.

Digital health solutions, including social media analytics, Internet-enabled mobile devices, and artificial intelligence, are also gaining traction in enhancing patient care and engagement, as well as disease surveillance and population health management. The market scenario is further driven by the aging population, increasing healthcare costs, and the need for personalized medicine and predictive analytics. The research team anticipates continued growth in this sector, with a focus on improving patient outcomes, patient-centric care, and resource allocation in hospitals and clinics.

Get a glance at the market report of share of various segments Request Free Sample

Market Dynamics

Our market researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Saudi Arabia Healthcare IT Market?

Increasing number of chronic diseases is the key driver of the market.

- The market is experiencing significant growth due to the increasing prevalence of chronic diseases In the aging population. Chronic diseases, such as diabetes, require ongoing management and medical attention, leading to a higher demand for automated information systems and digital health tools. Telemedicine and telehealth platforms are becoming increasingly important for providing efficient patient care in remote areas, reducing the need for costly hospital visits and administrative tasks. Healthcare providers are leveraging Electronic Health Records (EHRs) and Healthcare Analytics to improve patient outcomes, reduce medication errors, and streamline communication among healthcare teams. Digitalization of healthcare data is also facilitating medical research, enabling anonymized data studies, clinical trials, and disease surveillance.

- Population health management and public health management are key areas of focus, with Hospitals and Clinics implementing Health Information Exchanges (HIE) to improve resource allocation and reduce redundant tests. Health insurance companies are also investing in IT outsourcing services for claims management, member eligibility management, and provider network management to enhance customer relationship management. The use of artificial intelligence, medical image analysis, and predictive analytics is transforming personalized medicine and patient-centric care, ultimately improving the quality of healthcare.

What are the market trends shaping the Saudi Arabia Healthcare IT market?

An increase in the adoption of telemedicine and other digital health solutions is the upcoming trend In the market.

- The market is witnessing significant growth due to the increasing prevalence of chronic diseases and an aging population. Automation, telemedicine, digital health, social media analytics, and Internet-enabled mobile devices are transforming healthcare delivery by improving patient care, efficiency, and communication among healthcare teams. Electronic health records (EHRs), healthcare analytics, telehealth and telemedicine, and health information exchanges (HIE) are key tools and applications facilitating these advancements. The adoption of these technologies aims to reduce administrative tasks, errors, and redundant tests, enabling better resource allocation and cost reduction. Telemedicine platforms and remote monitoring are particularly crucial in addressing healthcare accessibility issues in remote areas.

- Artificial intelligence, medical image analysis, and predictive analytics are driving personalized medicine and enhancing patient outcomes. Healthcare providers, payers, and IT outsourcing services are investing in clinical and nonclinical healthcare IT solutions, including claims management, member eligibility management, provider network management, customer relationship management, and population health management. The focus on patient-centric care and patient engagement is also leading to the development of innovative products and services. Despite these advancements, challenges persist, such as ensuring patient safety, addressing medication errors, and maintaining data privacy and security. Additionally, healthcare teams must effectively communicate and collaborate to optimally utilize these technologies and improve the overall quality of healthcare.

What challenges does Saudi Arabia Healthcare IT market face during the growth?

The lack of skilled professionals is a key challenge affecting the market growth.

- The healthcare IT market In the US is experiencing significant growth due to the increasing prevalence of chronic diseases and an aging population. Automation, telemedicine, digital health, and social media analytics are key trends driving market expansion. Healthcare providers are increasingly relying on information systems, software, tools and applications to improve patient care, efficiency, and communication among healthcare teams. Electronic health records (EHRs), healthcare analytics, telehealth and telemedicine, health information exchanges (HIE), and predictive analytics are among the most sought-after solutions. However, the industry faces challenges such as errors in administrative tasks, redundant tests, and resource allocation. Artificial intelligence, medical image analysis, and personalized medicine are being adopted to mitigate these issues and enhance patient outcomes.

- Healthcare accessibility in remote areas is also a concern, leading to the growth of telemedicine platforms and remote monitoring. Cost reduction, disease surveillance, public health management, and health insurance are other areas where healthcare IT plays a crucial role. The governing body is emphasizing the importance of digitalization, quality of healthcare, and patient-centric care. Healthcare IT outsourcing services are increasingly being utilized for claims management, member eligibility management, provider network management, and customer relationship management. Despite these advancements, there are challenges to overcome, including patient safety concerns, medication errors, and diagnoses. Anonymized data from clinical trials and studies are essential for medical research and improving patient care.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the market.

3M Co. - The company offers 3M 360 Encompass Computer Assisted Coding and 3M 360 Encompass Professional System.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abbott Laboratories

- athenahealth Inc.

- Bupa Arabia

- Cognizant Technology Solutions Corp.

- Dassault Systemes SE

- Dell Technologies Inc.

- Epic Systems Corp.

- General Electric Co.

- Informa PLC

- International Business Machines Corp.

- King Faisal Specialist Hospital and Research Centers General Orga

- Koninklijke Philips NV

- Microsoft Corp.

- Ministry of National Guard Health Affairs

- Oracle Corp.

- Siemens AG

- Tata Sons Pvt. Ltd.

- Wipro Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The healthcare industry is experiencing a significant shift towards digitalization and automation as a response to the increasing prevalence of chronic diseases and the aging population. This trend is driven by the need to improve patient care, and efficiency, and reduce costs. Healthcare providers are increasingly adopting digital health tools and applications to enhance patient care and communication within healthcare teams. Information systems and software solutions are being integrated into healthcare facilities to streamline administrative tasks and improve the quality of healthcare. Telemedicine and telehealth platforms are gaining popularity as they offer remote access to healthcare services, particularly in areas where healthcare facilities are limited.

Moreover, these platforms enable healthcare providers to offer consultations, diagnoses, and treatment plans to patients in real-time, reducing the need for travel and saving time and resources. Healthcare analytics is another area of focus, with anonymized data being used to identify trends, improve patient outcomes, and reduce redundant tests. Predictive analytics and artificial intelligence are being employed to analyze patient data and provide personalized medicine, leading to better patient engagement and improved patient-centric care. Telehealth and telemedicine are also being used to improve disease surveillance and public health management. Remote monitoring of patients with chronic conditions is becoming more common, enabling healthcare providers to monitor patient health in real-time and intervene early if necessary.

Furthermore, healthcare payers are also embracing digitalization, with IT outsourcing services being used to manage claims management, member eligibility management, and provider network management. These solutions enable payers to improve customer relationship management and population health management, leading to cost reduction and improved quality of healthcare. Despite the benefits of digitalization, there are challenges to overcome. Errors and communication issues can arise from the use of digital tools and applications, and healthcare teams must be trained to use them effectively. Additionally, there are concerns about data privacy and security, particularly with the increasing amount of sensitive healthcare data being stored and transmitted digitally.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

167 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.7% |

|

Market Growth 2025-2029 |

USD 2.33 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

9.8 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Saudi Arabia

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch