Self-Adhesive Label Market Size 2024-2028

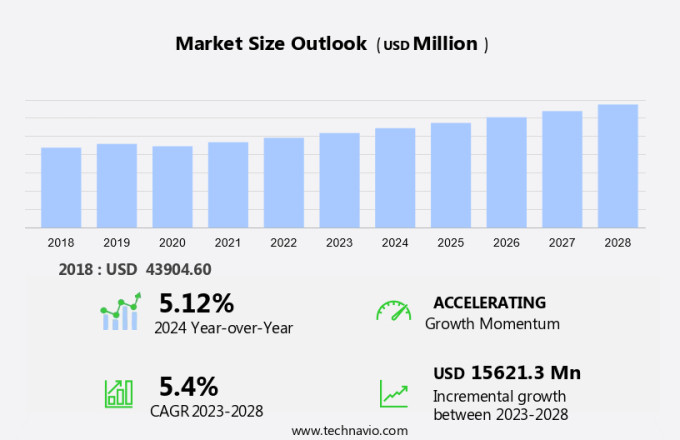

The self-adhesive label market size is forecast to increase by USD 15.62 billion at a CAGR of 5.4% between 2023 and 2028. The market is experiencing significant growth, driven by several key trends and challenges. One of the primary factors fueling market expansion is the increasing urban population and subsequent rise in demand for consumer goods, particularly in the food and beverage sector. Another trend influencing the market is the adoption of advanced technologies, such as two-dimensional (2D) and three-dimensional (3D) barcode technology, which enhances product traceability and supply chain efficiency. However, the market also faces challenges, including the increasing use of wet glue labels over self-adhesive labels due to their cost-effectiveness and the need for high reel capacity and transportation cost efficiency. Additionally, the preference for polymer films, such as biaxially oriented polypropylene (BOPP), over traditional film release liners due to their tiny particles and ease of application in wraparound labels for bottles, is a significant market trend. Overall, these factors contribute to the dynamic growth and evolution of the market.

The market plays an essential role in the supply chains of various industries, providing product identification, ingredient information, and cautionary notifications. Consumption of self-adhesive labels is driven by the increasing demand for packaging and labeling solutions in various end-use industries. However, production halts due to supply chain disruptions, and the availability of substitutes like linerless labels poses challenges to market growth. Sustainable practices are gaining importance in the market, with the use of BOPP and polymer films increasing due to their eco-friendliness. Marketers are focusing on catering to the increasing consumers' attention towards transparency and labeling requirements. Adhesive selection is a critical factor in the market, with pressure sensitive labels being the preferred choice due to their ease of application and removal.

Furthermore, the adhesive side of self-adhesive labels is a critical factor, with tiny particles affecting the label's performance. Release liners, such as film release liners, play a crucial role in the production and application of self-adhesive labels. The reel capacity and transportation cost of release liners impacts the overall cost of self-adhesive labels. Legal requirements and cautionary notifications are essential considerations in the design and production of self-adhesive labels, with adherence to these regulations ensuring compliance and consumer safety.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Food and beverages

- Personal care

- Consumer durables

- Healthcare

- Others

- Type

- Permanent

- Removable

- Repositionable

- Geography

- APAC

- China

- Japan

- Europe

- Germany

- France

- North America

- US

- South America

- Middle East and Africa

- APAC

By End-user Insights

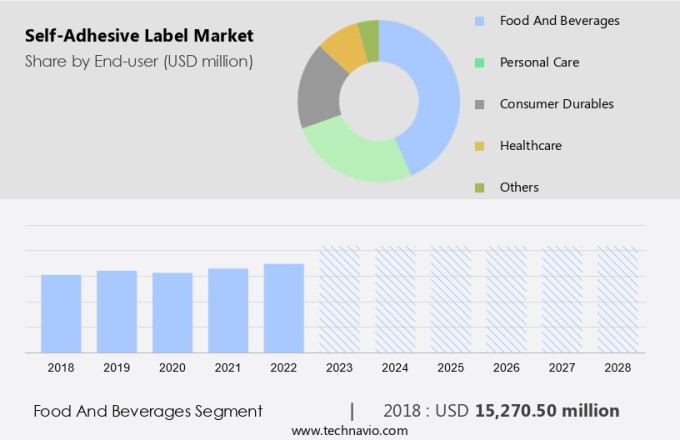

The food and beverages segment is estimated to witness significant growth during the forecast period. The market holds significant importance in various industries, with the food and beverage sector being a major contributor. The increasing preference for packaged goods and the need for product identification, ingredient information, and cautionary notifications have led marketers to extensively use self-adhesive labels. These labels offer several advantages, including easy application, high-quality printing, and cost-effectiveness. The convenience food trend is driving the growth of the market in the food and beverage industry. Consumers' busy lifestyles demand quick and easy-to-carry food options, and self-adhesive labels enable manufacturers to package their products in various sizes and shapes, enhancing their appeal and convenience.

Moreover, legal requirements mandate the use of self-adhesive labels for product identification and safety notifications, further boosting market growth. Adhesive capacity expansions and technological advancements are also expected to fuel the market's expansion in the coming years.

Get a glance at the market share of various segments Request Free Sample

The food and beverages segment was valued at USD 15.27 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

APAC is estimated to contribute 48% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market in the Asia Pacific (APAC) region is experiencing significant growth due to the increasing trend of e-commerce and the rising demand for packaged goods. Marketers are recognizing the importance of providing accurate ingredient information, product identification, and cautionary notifications on their labels to meet the needs of potential consumers. Advanced labeling technologies, such as Radio Frequency Identification (RFID) and Near Field Communication (NFC), are being adopted by companies to enhance their brand image and ensure product authenticity. These technologies offer real-time tracking capabilities, making it easier for consumers to verify the origin and quality of products.

Furthermore, the APAC region is home to several developing countries, including China, India, and Vietnam, which are experiencing rapid economic growth and offer favorable business environments. Government initiatives promoting industrialization in these countries are also contributing to the expansion of the market in the region.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

The increasing urban population is the key driver of the market. The market plays an essential role in packaging and labeling various consumer goods, particularly in supply chains where production halts can significantly impact consumption. With the growing urban population, the demand for self-adhesive labeled items, including medications, drinks, fast-moving consumer goods (FMCGs), and consumer durables, is on the rise. The demographic shift from rural to urban regions, particularly in Asia Pacific (APAC), is accelerating this trend. According to the United Nations Population Division, the APAC region's overall population is projected to reach 5.1 billion by 2050, with cities accounting for at least 68% of the total.

Furthermore, substitutes for self-adhesive labels, such as linerless labels, are gaining traction due to their sustainability practices. Consumers' increasing attention to eco-friendly packaging solutions is driving the demand for these alternatives. As the global population continues to urbanize, the market is poised to meet the growing demand for efficient and sustainable labeling solutions.

Market Trends

Implementation of two-dimensional (2D) and three-dimensional (3D) barcode technology is the upcoming trend in the market. Self-adhesive labels, a crucial component of packaging and labeling, play an essential role in various industries by facilitating efficient supply chain management. The integration of advanced technologies, such as 2D barcodes, has significantly enhanced their functionality. These labels use intricate patterns of squares and rectangles to encode vast amounts of data, including product information, serial numbers, and special instructions.

Furthermore, the adoption of 2D barcodes has minimized errors, optimized inventory management, and streamlined logistics processes. Moreover, the trend towards sustainable practices in the packaging industry has led to the emergence of linerless labels, which eliminate the need for wasteful liners. Despite production halts and consumption fluctuations in certain sectors, the demand for self-adhesive labels remains strong due to their versatility and the consumers' increasing attention to product traceability. Substitutes like inkjet labels and direct part marking are gaining traction, but self-adhesive labels continue to dominate the market due to their cost-effectiveness and ease of use.

Market Challenge

Increasing adoption of wet glue labels over self-adhesive labels is a key challenge affecting the market growth. Self-adhesive labels have long held a prominent position in packaging and labeling applications due to their convenience and ease of use. However, the supply chains of self-adhesive labels have been disrupted by production halts and increased consumer attention towards sustainability. In response, the market for self-adhesive labels is witnessing a shift towards alternative solutions, such as linerless labels, which offer reduced waste and improved sustainability. Linerless labels eliminate the need for a release liner, making them a more eco-friendly option. While self-adhesive labels require a liner to be peeled off before application, linerless labels are applied directly to the container, reducing waste and the need for additional materials.

Furthermore, this not only benefits the environment but also streamlines the production process. Moreover, the trend towards sustainable practices in packaging and labeling is driving the demand for self-adhesive labels that are produced using renewable resources and recycled materials. Consumers are increasingly paying attention to the environmental impact of the products they purchase, and companies are responding by adopting more sustainable production methods and materials. Despite these trends, self-adhesive labels continue to play an essential role in various industries due to their versatility and cost-effectiveness. However, as consumers become more environmentally conscious, the demand for more sustainable labeling solutions is expected to grow, and self-adhesive labels may face increased competition from alternatives such as wet glue labels and linerless labels.

Moreover, wet glue labels offer a strong and long-lasting adhesive bond, making them a popular alternative to self-adhesive labels in certain applications. Unlike self-adhesive labels, wet glue labels are produced by applying adhesive to the label material at the labeling station, creating a bond between the label and the container once pressure is applied. This bond is stronger and more reliable than what is achieved with self-adhesive labels, ensuring a secure hold. Additionally, wet glue labels are more environmentally friendly as they do not require a release liner, reducing waste and the need for additional materials. In conclusion, the market is facing challenges from production disruptions and increasing consumer demand for sustainable labeling solutions.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Asteria Group - The company offers self-adhesive labels on rolls for various products in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Asteria Group

- Avery Dennison Corp.

- BSP Labels Ltd.

- CCL Industries Inc.

- Coveris Management GmbH

- CPC Montreuil

- Fuji Seal International Inc.

- H.B. Fuller Co.

- HERMA GmbH

- Holoflex

- Huhtamaki Oyj

- JK Labels Pvt. Ltd.

- LINTEC Corp.

- Mondi Plc

- Optimum Group

- SATO Holdings Corp.

- Skanem AS

- Thai KK Industry Co. Ltd.

- Torraspapel S.A.

- UPM Kymmene Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market plays an essential role in the supply chains of various industries, including electronics production for personal devices and appliances, food and beverage packaging, pharmaceuticals, and cosmetics. The market has experienced significant growth due to the increasing consumption of packaged goods, especially among the middle class population and emerging economies. In food processing, weavers play a crucial role in packaging medicines and food ingredients, utilizing pressure sensitive labels and wraparounds for effective package labeling while ensuring the quality of raw materials. However, production halts and capacity expansions have posed challenges for label manufacturers. Substitutes like linerless labels and RFID-based labels have gained traction due to their sustainability practices and convenience. Consumers' attention towards ingredient information, product identification, and cautionary notifications has driven the demand for self-adhesive labels in the food and pharmaceutical sectors.

Furthermore, legal requirements, such as date of manufacture and medication contamination, also necessitate the use of self-adhesive labels. The adhesive used in self-adhesive labels is a critical factor, with BOPP and polymer films being the most common choices. The reel capacity, transportation cost, and adhesive side are essential considerations for manufacturers. Hindustan Unilever and Britannia are among the largest bases for self-adhesive labels in the food industry. The ecommerce market, particularly platforms like Flipkart, has also fueled the demand for self-adhesive labels in various sectors. The market faces pressures from raw material costs and the need for innovation, such as the development of tiny particles for high-performance adhesives and the use of release liners like film release liners. The market is expected to continue its growth trajectory due to economic growth, the convenience of self-adhesive labels, and the increasing popularity of ecommerce. The aesthetic characteristics of self-adhesive labels in cosmetics and food packaging are also driving demand. However, the market faces challenges from legal requirements, such as the metric system and net content labeling, and the need to minimize paper waste.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

182 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.4% |

|

Market Growth 2024-2028 |

USD 15.62 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.12 |

|

Regional analysis |

APAC, Europe, North America, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 48% |

|

Key countries |

China, US, Japan, Germany, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Asteria Group, Avery Dennison Corp., BSP Labels Ltd., CCL Industries Inc., Coveris Management GmbH, CPC Montreuil, Fuji Seal International Inc., H.B. Fuller Co., HERMA GmbH, Holoflex, Huhtamaki Oyj, JK Labels Pvt. Ltd., LINTEC Corp., Mondi Plc, Optimum Group, SATO Holdings Corp., Skanem AS, Thai KK Industry Co. Ltd., Torraspapel S.A., and UPM Kymmene Corp. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch