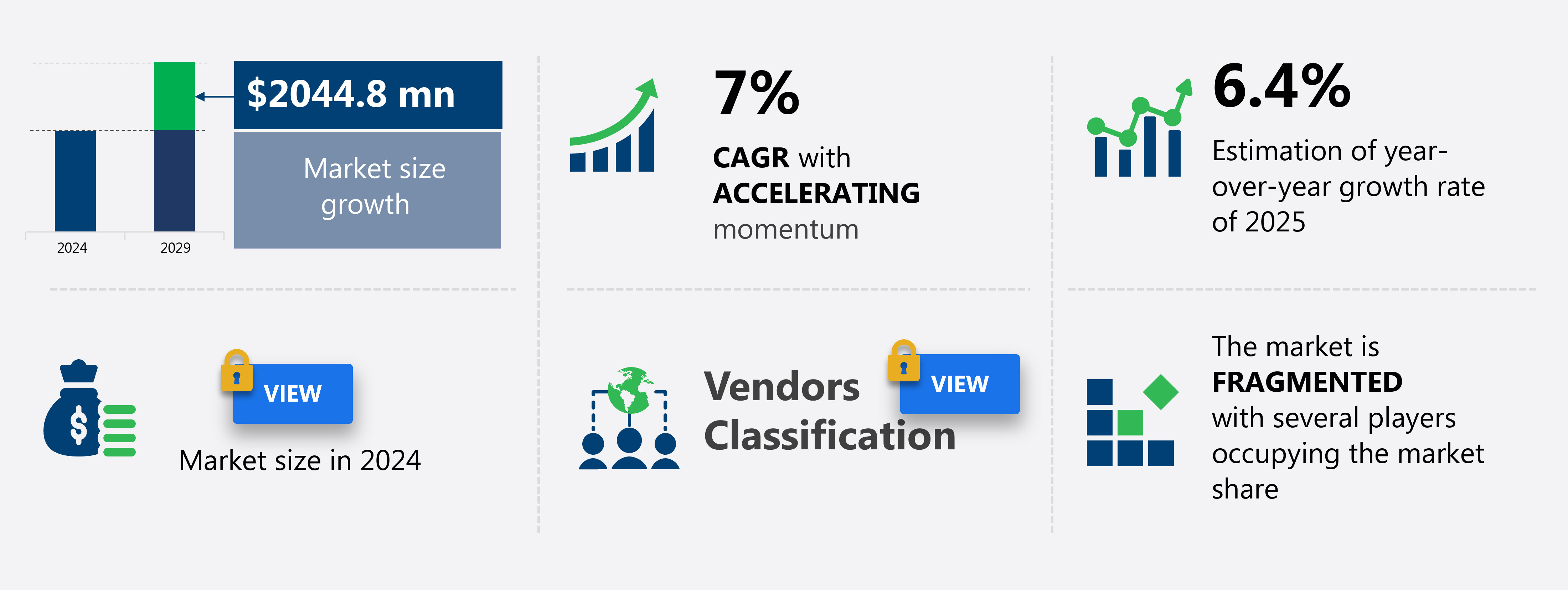

Vietnam Semiconductors Market Size 2025-2029

The Vietnam semiconductors market size is forecast to increase by US $2.04 billion at a CAGR of 7% between 2024 and 2029. The semiconductor market is experiencing significant growth, driven by the increasing adoption of low-cost communication devices. This trend is in line with the sustainable growth observed in the global semiconductor industry.

Major Market Trends & Insights

- Based on the Application, the Consumer electronics segment led the market and was valued at USD 2.73 billion of the global revenue in 2022.

- Based on the End-user, the Memory segment accounted for the largest market revenue share in 2022.

Market Size & Forecast

- Market Opportunities: USD 67.57 Million

- Future Opportunities: USD 2.04 Billion

- CAGR (2024-2029): 7%

Semiconductor metrology and 3D semiconductor packaging are crucial in ensuring high-performance computing chips meet stringent requirements for defect density reduction and design for manufacturability. Logic chip technology and memory chip technology advancements continue to fuel progress in artificial intelligence chips, consumer electronics semiconductors, and high-frequency semiconductor devices. Process variability control and supply chain optimization are essential in maintaining the competitiveness of semiconductor manufacturers. For instance, a leading semiconductor manufacturer reduced its defect rate by 25% through advanced node technology implementation and improved its supply chain efficiency by 30% through strategic partnerships. The market's continuous dynamism is further emphasized by the ongoing research and development in compound semiconductor materials, high-performance computing chips, and semiconductor intellectual property.

What will be the size of the Vietnam Semiconductors Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

- The semiconductor market in Vietnam continues to evolve, with ongoing advancements in technology driving innovation across various sectors. Lithography resolution enhancement and material characterization techniques are essential in nanoscale semiconductor fabrication, enabling the production of smaller, more efficient chips. Cost reduction strategies, such as semiconductor equipment maintenance and circuit board assembly automation, remain a priority for manufacturers. In the automotive industry, the demand for advanced safety features and electric vehicle technology drives the adoption of semiconductor components, accounting for over 10% of the global semiconductor market. Industrial applications, including robotics and automation, also contribute significantly to the market's growth, with expectations of a 12% compound annual growth rate (CAGR) through 2026. The memory segment is the second largest segment of the type and was valued at USD 2.49 billion in 2022.

- The market continues to evolve in various sectors. However, market dynamics are not without challenges. One such obstacle is the excessive semiconductor inventory, which poses a threat to market players' profitability. This inventory glut is a result of oversupply and weak demand, particularly in the automotive and industrial sectors. To capitalize on the market's potential, companies must effectively manage their inventory levels and explore opportunities in emerging sectors, such as consumer electronics and telecommunications.

- Strategic partnerships and collaborations could also help in mitigating the challenges and enhancing competitiveness. In summary, the semiconductor market in Vietnam presents both opportunities and challenges. Companies must navigate the inventory glut while leveraging the growing demand for low-cost communication devices to secure their market position and drive sustainable growth.

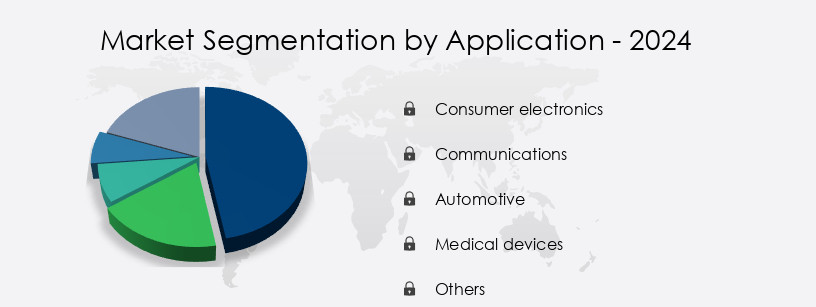

How is this Vietnam Semiconductors Market segmented?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Consumer electronics

- Communications

- Automotive

- Medical devices

- Others

- End-user

- Memory

- Foundry

- IDM

- Device

- Power Management Integrated Circuits (PMICs)

- Microchips

- Radio Frequency Identification (RFID)

- Semiconductor Materials

- Fabrication

- Pacakging

- Geography

- APAC

- Vietnam

- APAC

By Application Insights

The consumer electronics segment is estimated to witness significant growth during the forecast period. The segment was valued at USD 2.72 billion in 2022. It continued to the largest segment at a CAGR of 5.98%.

The semiconductor industry in Vietnam is experiencing significant growth, driven by advancements in semiconductor material science, manufacturing processes, and testing protocols. Gallium nitride semiconductors and silicon carbide semiconductors are gaining popularity due to their superior electrical properties and high temperature capabilities. Vietnam's semiconductor manufacturing sector benefits from advanced packaging solutions, such as microelectronics assembly and failure analysis techniques, which ensure high yield and reliability. Semiconductor manufacturing automation, process control monitoring, and design verification methods are essential for maintaining high production standards. For instance, chemical mechanical planarization and photolithography equipment enable precise chip manufacturing processes. Thin film deposition techniques contribute to the production of complex semiconductor devices, such as digital integrated circuits, mixed-signal integrated circuits, and power semiconductor devices.

The semiconductor industry in Vietnam is expected to grow at a substantial rate, with the global semiconductor market projected to reach USD 1.1 trillion by 2025, representing a significant expansion from its current size. This growth is attributed to the increasing demand for energy-efficient semiconductors, power consumption reduction strategies, and electronic design automation tools. Semiconductor thermal management and circuit simulation software are crucial for optimizing semiconductor performance and reducing power consumption. One notable example of innovation in Vietnam's semiconductor industry is the development of ion implantation systems for the production of high-performance silicon wafers. This technology has led to significant improvements in semiconductor device physics and silicon wafer fabrication processes, contributing to the overall growth of the industry.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

- The market is experiencing significant growth, driven by the country's strategic location and competitive labor costs. Vietnamese semiconductor manufacturers are focusing on advanced technologies such as semiconductor manufacturing automation systems and advanced packaging techniques for high-density chips to remain competitive in the global market. Cost-effective semiconductor production methods are also a priority for Vietnamese manufacturers, who are improving yield in their fabrication plants through process control and monitoring using electronic design automation tools. Silicon carbide MOSFET device characteristics and gallium nitride high-electron mobility transistors are of particular interest for power semiconductor applications. Failure analysis of integrated circuits is crucial for maintaining quality and reliability, and thermal management solutions for power semiconductors are essential to ensure optimal performance.

- Semiconductor supply chain risk mitigation is another key concern, with manufacturers implementing robust strategies to minimize disruptions. Semiconductor material properties and their applications are a significant focus for research and development in Vietnam. Nanoscale transistors fabrication challenges are being addressed through advanced lithography techniques for next-generation chips. Design verification using electronic design automation tools and semiconductor device modeling and simulation are essential for bringing new products to market efficiently. Efficient power semiconductor packaging solutions are also a priority to meet the demands of high-frequency applications of gallium nitride and other advanced semiconductor technologies. Silicon wafer quality control and inspection are critical to maintaining consistency and reducing defects in the manufacturing process. Overall, the semiconductor industry in Vietnam is poised for continued growth and innovation, driven by a combination of local expertise and global market trends.

What are the Vietnam Semiconductors Market drivers leading to the rise in adoption of the Industry?

- The global semiconductor industry's sustainable growth serves as the primary catalyst for market expansion.

- The global semiconductor market is experiencing steady growth, driven by the increasing demand for consumer electronics and microelectronics. The consumer electronics industry's advancements, such as the introduction of 3D and ultra-UHD TVs, as well as hybrid laptops, are fueling this need for semiconductor integrated circuits (ICs). This trend is expected to continue, leading to a gradual rise in sales. Moreover, the demand for improved DRAM and NAND-integrated mobile devices and data centers is surging due to the growing requirement for devices with enhanced performance levels.

- For instance, the sales of semiconductor devices in the automotive industry are projected to increase by 15% by 2025, reflecting the market's expanding scope. Overall, the semiconductor market is poised for significant growth, with industry analysts anticipating a double-digit expansion in the coming years.

What are the Vietnam Semiconductors Market trends shaping the Industry?

- The increasing utilization of affordable communication devices represents a significant market trend. This trend is characterized by the growing preference for cost-effective solutions in the communication sector.

- The semiconductor market in Vietnam is experiencing a surge due to the increasing adoption of communication services and the emergence of new players, leading to a decline in communication device prices. Technological advances have facilitated the standardization of device capacity and throughput, simplifying manufacturing processes and reducing costs. This affordability has accelerated the development and adoption of IoT in Vietnam, which has the second-highest number of smartphone users in Southeast Asia, with 61.3 million users.

- The country's urban and suburban populations continue to improve their standard of living, driving demand for high-quality, reasonably priced devices. The market is expected to grow robustly, with a significant increase in demand for smartphones and other IoT devices.

How does Vietnam Semiconductors Market faces challenges face during its growth?

- The issue of excess semiconductor inventory poses a significant challenge to the industry's growth trajectory.

- The market faces significant challenges due to excess inventory and volatile demand. With the semiconductor industry's inherent cyclical nature, accurate demand forecasting proves to be a major hurdle. In the second quarter of 2022, the average inventory period expanded to 121 days from 117 days in the previous quarter, reflecting this issue. The primary cause of this inventory buildup is the declining demand for DRAM and NAND memory. These products, which experienced increased production volumes a few years ago, are currently experiencing negative demand, leading to inventory accumulation and reduced prices.

- According to industry reports, the semiconductor market is expected to grow by over 15% in the next five years, presenting opportunities for companies that can effectively manage inventory and adapt to market fluctuations.

Exclusive Vietnam Semiconductors Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Advanced Micro Devices Inc.

- Analog Devices Inc.

- Broadcom Inc.

- Fuji Electric Co. Ltd.

- Hitachi Ltd.

- Infineon Technologies AG

- Intel Corp.

- MediaTek Inc.

- Microchip Technology Inc.

- NVIDIA Corp.

- NXP Semiconductors NV

- ON Semiconductor Corp.

- Qualcomm Inc.

- Renesas Electronics Corp.

- Samsung Electronics Co. Ltd.

- SK hynix Co. Ltd.

- STMicroelectronics NV

- Texas Instruments Inc.

- Toshiba Corp.

- Vishay Intertechnology

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Semiconductors Market In Vietnam

- In January 2024, Intel Corporation announced the expansion of its manufacturing facility in Saigon Hi-tech Park, investing an additional USD1 billion to increase its production capacity in Vietnam (Intel press release, 2024). This expansion marked Intel's commitment to strengthen its presence in the Southeast Asian market.

- In March 2024, Taiwan Semiconductor Manufacturing Company (TSMC) and Samsung Electronics signed a strategic collaboration agreement to build a 3nm semiconductor fabrication plant in Vietnam (TSMC press release, 2024). This partnership aimed to cater to the growing demand for advanced semiconductor technology in the region.

- In May 2024, SK Hynix, a leading global semiconductor manufacturer, broke ground on its new USD9 billion memory chip plant in the Vietnam-Singapore Industrial Park (SK Hynix press release, 2024). This investment represented the largest foreign direct investment in Vietnam's semiconductor sector.

- In April 2025, the Vietnamese government issued Decree 111, which provided incentives for foreign investors in the semiconductor industry, including tax exemptions and simplified administrative procedures (Vietnam Investment Review, 2025). This decree aimed to attract more international players to Vietnam's semiconductor market.

Research Analyst Overview

The semiconductor market in Vietnam continues to evolve, driven by advancements in material science and technology. Semiconductor testing protocols play a crucial role in ensuring defect detection analysis and maintaining high product quality. Gallium nitride semiconductors, for instance, have gained significant attention due to their superior electrical properties and potential applications in power electronics. Semiconductor manufacturing processes involve intricate techniques such as chemical mechanical planarization, cleanroom facility standards, and photolithography equipment, which are essential for creating digital integrated circuits. Semiconductor thermal management and manufacturing automation are also critical aspects of the industry, with yield optimization strategies and process control monitoring ensuring efficiency and reducing power consumption.

Advanced packaging solutions, including microelectronics assembly and thin film deposition, are increasingly important in the semiconductor industry. For example, a leading semiconductor manufacturer recently reported a 25% increase in yield due to the implementation of advanced packaging techniques. The semiconductor industry is expected to grow at a robust rate of 12% annually, driven by the demand for more efficient and powerful electronic devices. Semiconductor device physics, silicon carbide semiconductors, and silicon wafer fabrication are some of the key areas of research and development. Design verification methods, circuit simulation software, and integrated circuit design are also essential components of the semiconductor manufacturing process.

Power semiconductor devices, ion implantation systems, etching techniques using plasma, and reliability testing methods are other critical aspects of the industry. In summary, the semiconductor market in Vietnam is characterized by continuous innovation and dynamism. From defect detection analysis and semiconductor testing protocols to advanced packaging solutions and power semiconductor devices, the industry is driven by a relentless pursuit of technological advancements and efficiency improvements.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Semiconductors Market in Vietnam insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

186 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7% |

|

Market growth 2025-2029 |

USD 2044.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.4 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Vietnam

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch