Simulation Learning Market In Higher Education Size 2025-2029

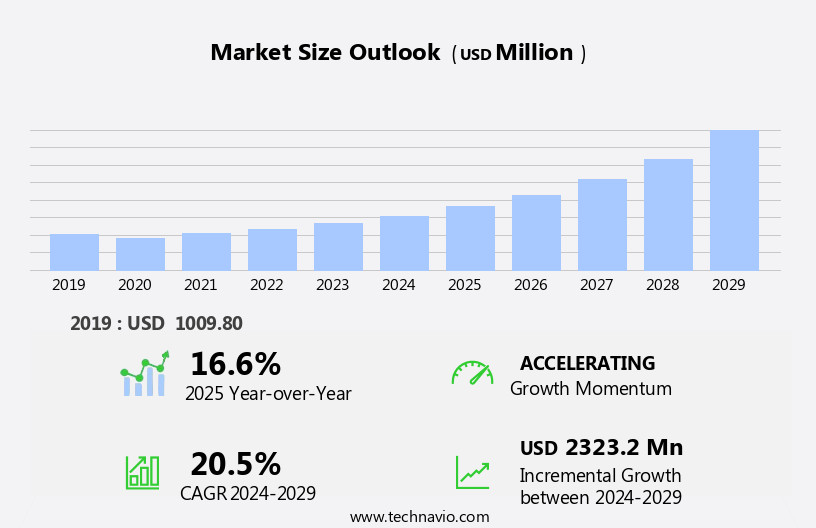

The simulation learning market in higher education size is forecast to increase by USD 2.32 billion at a CAGR of 20.5% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by the increased penetration of the Internet and the subsequent widespread adoption of mobile-based learning. This trend is transforming the educational landscape, enabling students to access simulation-based learning from anywhere, at any time. Another key driver is the integration of Artificial Intelligence (AI) technologies into medical simulation, enhancing the learning experience by providing personalized feedback and real-time analysis. However, the market also faces challenges, including integration and compatibility issues with various simulation software solutions.

- These obstacles necessitate collaboration and standardization efforts among stakeholders to ensure seamless implementation and optimal performance. Companies seeking to capitalize on market opportunities and navigate challenges effectively should focus on addressing these integration issues and leveraging the latest AI technologies to deliver innovative and effective simulation learning solutions in Higher Education.

What will be the Size of the Simulation Learning Market In Higher Education during the forecast period?

- The market continues to evolve, with various sectors embracing innovative technologies to enhance teaching and learning experiences. Mobile learning, virtual labs, and simulation modeling are increasingly integrated into STEM education, fostering interactive and personalized learning. Cloud computing enables access to business simulation, critical thinking, and data analytics tools, promoting real-time data analysis and machine learning. Virtual classrooms and immersive learning through augmented reality and virtual reality are revolutionizing medical education, while online learning platforms facilitate professional development and continuing education. Simulation training in engineering education and healthcare simulation offer hands-on experience, addressing integration challenges and improving learning outcomes.

- Learning management systems and assessment tools facilitate adaptive learning and feedback mechanisms, ensuring students engage with the content effectively. Artificial intelligence and machine learning algorithms are transforming curriculum design and skill development, enabling personalized learning experiences. The adoption rate of these technologies is on the rise, as higher education institutions recognize the importance of technology infrastructure in delivering effective training programs. Simulation software and interactive learning tools are essential components of this dynamic landscape, shaping the future of education.

How is this Simulation Learning In Higher Education Industry segmented?

The simulation learning in higher education industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- STEM simulation learning

- Non-STEM simulation learning

- Deployment

- On-premises

- Cloud-based

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Type Insights

The stem simulation learning segment is estimated to witness significant growth during the forecast period.

In the realm of higher education, simulation learning is gaining momentum as a preferred method for delivering STEM education, business training, and professional development. This trend is driven by the integration of mobile learning, virtual labs, cloud computing, and immersive technologies such as virtual and augmented reality. The STEM simulation learning segment holds a significant share in this market, with companies developing simulations for engineering, medical, and other scientific courses. These simulations offer a scalable solution for catering to the learning needs of a large student population, regardless of location. Furthermore, scenario-based learning, machine learning, and adaptive learning enhance the overall learning experience by providing personalized feedback mechanisms and real-time assessment tools.

The adoption rate of simulation learning is on the rise due to its ability to foster critical thinking, improve student engagement, and facilitate skill development. Despite the challenges in curriculum design and technology infrastructure integration, the benefits of simulation learning far outweigh the obstacles. The future of higher education lies in the harmonious blend of traditional classroom learning and simulation-based education.

The STEM simulation learning segment was valued at USD 590.70 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

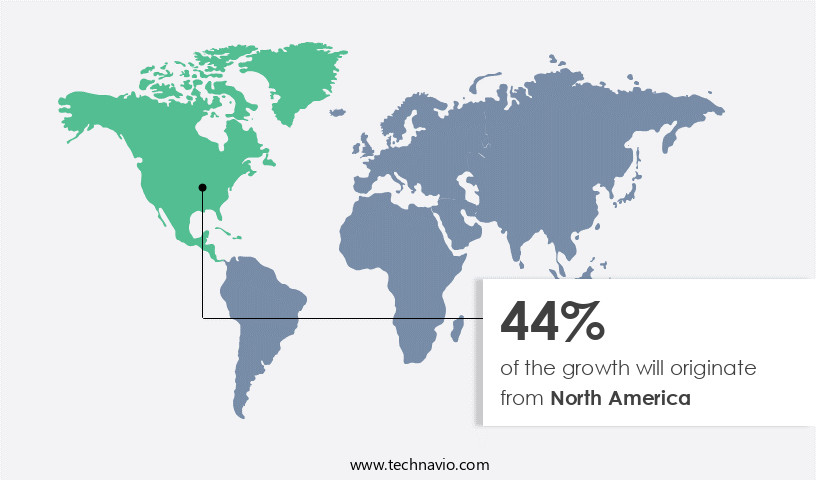

North America is estimated to contribute 44% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The higher education simulation learning market is experiencing significant growth due to the integration of advanced technologies such as mobile learning, virtual labs, cloud computing, and simulation modeling. In North America, this market holds a prominent position, driven by the adoption of these technologies, a focus on innovation, and the presence of major companies. STEM education and business simulation are key areas benefiting from this trend, with scenario-based learning and data analytics playing crucial roles in enhancing critical thinking and student engagement. Virtual classrooms, virtual field trips, and immersive learning through augmented and virtual reality are transforming the educational landscape.

Machine learning and artificial intelligence are also being employed to provide adaptive learning experiences and personalized feedback mechanisms. Healthcare simulation and engineering education are prominent industries leveraging these technologies for skill development and training programs. Despite the advantages, integration challenges persist, necessitating collaboration between higher education institutions and technology providers. Online learning platforms and simulation software are essential tools for continuing education and curriculum design. Business education, medical education, and professional development are major sectors capitalizing on these advancements. The adoption rate is on the rise, as the benefits of simulation learning extend beyond traditional classroom settings, offering flexible, interactive, and cost-effective alternatives.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Simulation Learning In Higher Education Industry?

- The significant expansion of Internet access and the subsequent widespread adoption of mobile learning are the primary factors fueling market growth in this sector.

- The market has gained significant traction due to the increasing use of mobile devices and the shift towards digital learning. The proliferation of smartphones and tablets, coupled with consumer demand for customized education, has fueled the growth of this market. Furthermore, the widespread adoption of cloud computing technology and virtual labs has enabled scenario-based learning, business simulations, and critical thinking exercises in a more immersive and harmonious manner. A learning management system (LMS) integrated with data analytics allows educators to monitor student progress and tailor instruction accordingly.

- Virtual classrooms and mobile learning platforms offer flexibility and convenience, making education more accessible to a broader audience. The e-learning market, including simulation learning in higher education, is poised for substantial growth due to the increasing Internet penetration rate and the shift towards e-learning models.

What are the market trends shaping the Simulation Learning In Higher Education Industry?

- The integration of artificial intelligence (AI) technologies is a significant trend in the medical simulation industry. This innovation enhances the realism and effectiveness of medical training programs.

- Artificial intelligence (AI) is revolutionizing simulation learning in higher education, particularly in medical education, by enhancing the training experience for professionals. AI technologies, such as machine learning algorithms, are integrated into medical simulation models to provide personalized feedback mechanisms, improving learning outcomes. These technologies enable immersive learning experiences through virtual and augmented reality platforms, offering a harmonious blend of theory and practice. AI-powered surgical simulation devices fill the gap between academic achievements and commercialization, providing personalized evaluation and feedback for surgeons. In medical education, AI is used for preoperative planning, intraoperative visualization, and guidance, all aimed at enhancing patient safety.

- The use of AI in simulation learning is not limited to medical education; it also plays a significant role in professional development across various industries. Case studies demonstrate the effectiveness of AI-driven simulation learning platforms in enhancing performance and skills. Overall, AI-driven simulation modeling is a valuable tool for higher education, offering a more effective and engaging learning experience.

What challenges does the Simulation Learning In Higher Education Industry face during its growth?

- The integration and compatibility issues between simulation software solutions pose a significant challenge to the industry's growth, hindering the seamless implementation and optimization of technological advancements.

- In the realm of higher education, simulation learning is gaining traction as an effective method for delivering immersive and personalized education in various disciplines, including engineering and business. Simulation training, fueled by advancements in technology infrastructure, offers assessment tools that enable students to learn through interactive experiences, thereby enhancing their understanding of complex concepts. However, the integration of simulation software into existing systems poses challenges. Compatibility issues with other software systems, such as CAD, PLM, and data management platforms, can hinder seamless data exchange, collaboration, and interoperability.

- Moreover, healthcare simulation and virtual field trips can benefit significantly from the integration of artificial intelligence and adaptive learning technologies, enabling more effective and efficient training. Despite these challenges, organizations continue to invest in simulation learning solutions, recognizing their potential to revolutionize education and prepare students for the workforce of the future.

Exclusive Customer Landscape

The simulation learning market in higher education forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the simulation learning market in higher education report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, simulation learning market in higher education forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

3D Systems Corp. - The company delivers sophisticated simulation solutions via its 3D EXPERIENCE platform. This technology empowers users with immersive, interactive applications, enhancing their ability to model complex systems and optimize performance. By leveraging advanced visualization tools and real-time analysis capabilities, this platform streamlines the design process and fosters innovation. It caters to diverse industries, enabling organizations to make informed decisions and improve overall efficiency.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3D Systems Corp.

- Capsim Management Simulations Inc.

- Edufic Digital

- Forio Corp.

- Infopro Learning Inc.

- Innovation Learning Inc.

- Laerdal Medical AS

- McGraw Hill LLC

- Oxford Medical Simulation Ltd.

- Pearson Plc

- Realityworks Inc.

- SIMmersion

- SimTutor

- Simulab Corp.

- zSpace Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Simulation Learning Market In Higher Education

- In February 2024, Microsoft Education announced the integration of Microsoft Simulation Learning into its Microsoft Teams platform, allowing universities to deliver immersive, interactive simulations directly to students (Microsoft Press Release, 2024). This strategic move aimed to enhance the learning experience and promote better engagement among students.

- In October 2024, IBM and Coursera partnered to bring IBM's professional certification programs to Coursera's platform, incorporating IBM's simulation-based courses into the offering (IBM Press Release, 2024). This collaboration expanded the reach of IBM's certification programs and increased Coursera's content diversity.

- In January 2025, Epic Games, the creator of Fortnite, launched Unreal Engine Education, a free version of its game development platform tailored for educational institutions (Epic Games, 2025). This initiative enabled universities to create simulation-based courses and projects, providing students with hands-on experience in game development and technology.

- In May 2025, the European Union's Erasmus+ program announced a â¬10 million investment in simulation-based learning projects across European universities (European Commission, 2025). This funding aimed to promote innovation and collaboration among European institutions, enhancing the quality and accessibility of simulation-based learning in higher education.

Research Analyst Overview

In the higher education sector, simulation learning has emerged as a prominent trend, integrating educational research and cognitive science to enhance student engagement and improve learning outcomes. Cost-benefit analysis reveals significant cost savings and increased efficiency, making it an attractive alternative to traditional classroom methods. Virtual reality headsets and data visualization tools enable immersive learning experiences, aligning with online learning trends and pedagogical approaches. Cloud-based simulations, powered by AI-driven adaptive learning algorithms, offer personalized learning pathways and real-time data analysis, fostering student success metrics and return on investment. 3D modeling, motion tracking, and haptic feedback bring learning to life, while interactive scenarios and virtual worlds engage students in a more effective and memorable way.

Technology adoption continues to accelerate, with digital literacy and instructional design at the forefront of the digital transformation. Learning analytics and data analysis tools provide valuable insights into student performance data, enabling educators to optimize teaching methods and pedagogical approaches. The future of education lies in the integration of game engines, AI-powered simulations, augmented reality glasses, and virtual environments, offering a more interactive, personalized, and effective learning experience. Simulation platforms are revolutionizing education, providing a dynamic and engaging learning environment that caters to diverse learning styles and enhances student success.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Simulation Learning Market In Higher Education insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

183 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 20.5% |

|

Market growth 2025-2029 |

USD 2323.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

16.6 |

|

Key countries |

US, Canada, Germany, UK, France, Italy, China, Japan, India, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Simulation Learning Market In Higher Education Research and Growth Report?

- CAGR of the Simulation Learning In Higher Education industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the simulation learning market in higher education growth of industry companies

We can help! Our analysts can customize this simulation learning market in higher education research report to meet your requirements.