Smart Ovens Market Size 2024-2028

The smart ovens market size is forecast to increase by USD 519.8 million at a CAGR of 20.65% between 2023 and 2028.

- The market is witnessing significant growth, driven by the changing lifestyles in both developed and developing economies. Consumers are increasingly seeking convenience and efficiency in their daily lives, leading to a high demand for smart ovens that offer features such as voice control, remote access, and energy efficiency. However, the market also faces challenges, particularly in the area of safety issues in mobile applications. As more consumers use mobile devices to control their smart ovens, ensuring secure and reliable connectivity becomes a critical concern. Companies in the market must prioritize addressing these safety concerns through robust cybersecurity measures and user-friendly interfaces to meet consumer demands and maintain market competitiveness.

- Additionally, the market is expected to benefit from ongoing advancements in IoT and AI technologies, enabling more sophisticated cooking functions and personalized user experiences. Companies seeking to capitalize on these opportunities should focus on developing innovative features and collaborating with key industry players to stay ahead of the competition.

What will be the Size of the Smart Ovens Market during the forecast period?

- The market continues to evolve, integrating advanced technology into traditional kitchen appliances to cater to tech-savvy consumers and their evolving meal decisions. Smart ovens offer temperature control, wi-fi connectivity, and smart technology, enabling consumers to monitor and control cooking processes remotely. These devices are not limited to ovens, as blenders, coffee maker machines, and microwaves also incorporate similar features. Manufacturing hubs prioritize nutrition and health, with connected home appliances seamlessly integrated into functional kitchen spaces. Busy lifestyles and online shopping have fueled the demand for smart home technology, allowing consumers to preheat ovens and access recipe libraries from their smartphones or other devices.

- Consumer electronics moguls have responded with device connectivity, allowing for personalized product recommendations and hand free control. Nutritional information, calorie tracking, and dietary preferences are essential considerations for health-conscious consumers. Smart ovens offer pre-programmed cooking modes, additional cooking capabilities, and energy efficiency. Safety features, such as sensor technology and remote monitoring, provide peace of mind.

How is this Smart Ovens Industry segmented?

The smart ovens industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Distribution Channel

- Offline

- Online

- Product

- Smart microwave oven

- Small wall oven

- Connectivity

- Wi-Fi

- Bluetooth

- End-User

- Residential

- Commercial

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- UK

- Middle East and Africa

- UAE

- APAC

- Australia

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Distribution Channel Insights

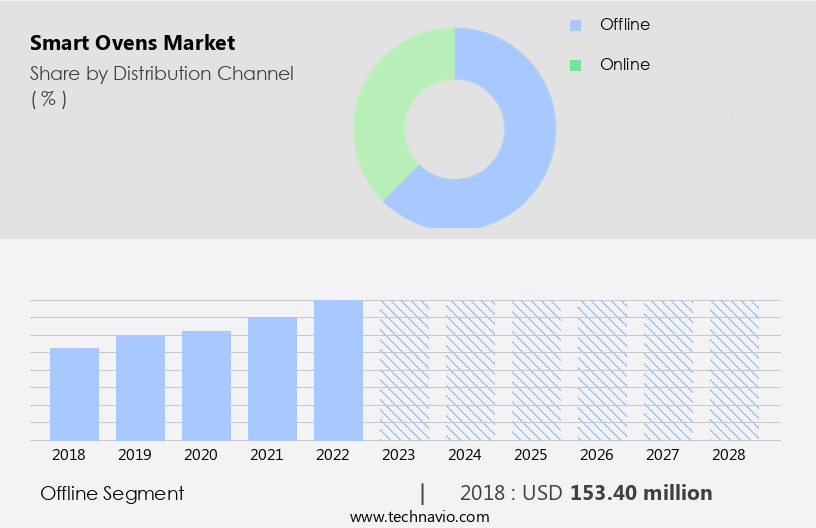

The offline segment is estimated to witness significant growth during the forecast period.

In the dynamic kitchen appliance market, tech-savvy consumers seek high-quality, energy-efficient, and convenient solutions for their functional kitchen spaces. Smart ovens, equipped with Wi-Fi connectivity, voice controls, and pre-programmed cooking modes, have gained significant traction. These appliances offer calorie tracking, personalized product recommendations, and built-in companion apps for remote monitoring and meal decisions. Safety features, such as temperature control and sensor technology, are essential considerations. However, data privacy and hacking concerns persist, necessitating robust security measures. Connected home appliances, including smart ovens, are part of the growing trend towards health and wellness, with dietary preferences and nutritional information becoming increasingly important.

companies are responding to these trends by offering additional cooking capabilities, offline channels, and delivery options. Haier Group, a leading consumer electronics mogul, has established strategic alliances with retailers like GOME Retail and Suning in China to boost sales through offline channels. Haier Smart Home Co. Ltd. Also maintains relationships with regional distributors through clubs like V58 and V140. Smart ovens cater to various cooking tasks and dietary restrictions, offering premium, visually appealing designs and hand-free control. Energy efficiency, convenience, and affordability are key factors driving demand for these appliances. As the market evolves, we can expect further innovations in smart technology, recipe libraries, and connected home devices.

In this bustling market, traditional ovens face competition from smart appliances and smartphone apps, offering healthy eating options and manual supervision through electric kettles and multiple function settings. The counter-top segment, including air fryers and coffee maker machines, is particularly popular among busy lifestyles. Despite the convenience of online shopping, physical stores remain an essential part of the sales landscape, with store hours and kitchen design playing crucial roles in consumer decision-making.

The Offline segment was valued at USD 153.40 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 40% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the dynamic market of kitchen appliances, smart ovens have emerged as a significant trend, with North America being the second-largest contributor to global sales in 2023. The region's growth can be attributed to increasing consumer awareness of the advantages of high-quality, connected cooking appliances, and the favorable infrastructure, including high Wi-Fi penetration and the widespread adoption of smart homes. Smart ovens offer features such as temperature control, calorie tracking, pre-programmed cooking modes, and voice controls, catering to tech-savvy consumers and their busy lifestyles. The US, as the leading country in this market, is expected to witness notable growth during the forecast period due to the rising popularity of smart home technology.

These appliances integrate with companion apps, allowing for personalized product recommendations and remote monitoring, enhancing the user experience. Additionally, smart ovens provide energy efficiency, safety features, and offline cooking capabilities, making them an attractive choice for households. The market's evolution also includes the integration of nutrition and dietary preference information, making healthy eating more convenient. The smart oven market in North America continues to expand, driven by consumer preferences for functional kitchen spaces and the increasing availability of online shopping platforms and delivery options.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Smart Ovens Industry?

- In developed and developing economies, the shift in consumer lifestyles serves as the primary catalyst for market growth.

- The global smart oven market caters to the growing demand for advanced cooking appliances that offer convenience and connectivity. Smart ovens, which often include features like Bluetooth connectivity and compatibility with smartphone apps, fall into the premium category due to their innovative technology. These appliances offer multiple function settings, making healthy eating easier with functions for air fryers, juicers, and healthy cooking. While manual supervision is still required, the appeal of smart appliances lies in their ability to enhance kitchen design and energy efficiency. However, security concerns may arise due to the need for connectivity. Affordability remains a consideration for some consumers, with counter-top options available for those who prefer an offline experience.

- Despite these factors, the market continues to grow as emerging economies, such as China and India, expand their middle class and embrace smart technologies. With over 80% of middle-class individuals residing in emerging countries by 2023, according to the World Bank, the potential for market expansion is significant.

What are the market trends shaping the Smart Ovens Industry?

- The increasing demand for energy-efficient microwave ovens represents a significant market trend. These appliances, which consume less power while delivering quick cooking results, are highly sought after by consumers prioritizing energy savings and cost-effective kitchen solutions.

- Smart ovens, a type of high-tech kitchen appliance, have gained popularity due to their energy efficiency and advanced features. These ovens offer data privacy, ensuring user information is secure. With temperature control and calorie tracking, they cater to various dietary preferences and help manage nutritional intake. Built-in companion apps and voice controls enable users to manage cooking tasks from their digital platforms. Pre-programmed cooking modes and multi-function capabilities add versatility to these appliances. Safety features ensure secure operation, while offline channels allow cooking without Wi-Fi connectivity.

- Personalized product recommendations offer customized solutions for consumers. As energy-efficient kitchen appliances become a priority in functional kitchen spaces, smart ovens offer significant savings on utility bills while providing additional cooking capabilities. Connected home appliances are the future, and smart ovens are an essential addition to this trend.

What challenges does the Smart Ovens Industry face during its growth?

- The growth of the mobile application industry is significantly impacted by safety concerns, which represent a crucial challenge that necessitates continuous attention and innovation from industry professionals.

- Smart ovens, equipped with advanced technology, cater to tech-savvy consumers seeking convenience and improved well-being in their meal decisions. These innovative appliances offer Wi-Fi connectivity, enabling hand-free control through smartphones. Consumers can preheat their ovens, manage cooking processes, and access recipe libraries from anywhere. Nutrition-conscious individuals benefit from smart ovens' ability to preserve nutrients, making them an essential addition to connected homes.

- Busy lifestyles have led to an increased demand for smart home devices, including coffee maker machines and blenders, all of which can be controlled via device connectivity. Online shopping has made it easier than ever to purchase these consumer electronics. Smart ovens' delivery option adds to their appeal, making meal preparation more efficient and hassle-free.

Exclusive Customer Landscape

The smart ovens market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the smart ovens market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, smart ovens market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Alto Shaam Inc. - This company specializes in advanced cooking solutions, featuring innovative smart ovens such as the Joule Oven Air Fryer Pro, Smart Oven Air Fryer Pro, and similar models. These state-of-the-art appliances optimize cooking processes through intelligent technology, enhancing the user experience and delivering consistent results. By integrating air fryer functionality, these smart ovens cater to health-conscious consumers seeking delicious, crispy meals without the added fat of traditional frying methods. The company's commitment to innovation and quality sets it apart in the market, providing consumers with a modern, efficient, and versatile cooking solution.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alto Shaam Inc.

- Brandt Group

- Breville Group Ltd.

- Electrolux group

- General Electric Co.

- GoWISE USA

- Haier Smart Home Co. Ltd.

- Hitachi Ltd.

- JS Global Lifestyle Co. Ltd.

- LG Electronics Inc.

- Maestro Food Co.

- MIDEA Group Co. Ltd.

- Miele and Cie. KG

- Panasonic Holdings Corp.

- Robert Bosch GmbH

- Samsung Electronics Co. Ltd.

- Sharp Corp.

- Smeg S.p.a.

- Weber Stephen Products HK Ltd.

- Whirlpool Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Smart Ovens Market

- In January 2024, Whirlpool Corporation, a leading appliance manufacturer, introduced the new "6th Sense Live" technology for their smart ovens, enabling real-time cooking monitoring and remote control via a smartphone app (Whirlpool Press Release, 2024). This innovation marks a significant advancement in the smart oven market, offering increased convenience and precision for home cooks.

- In March 2025, Bosch Home Appliances and Amazon announced a strategic partnership, allowing Alexa to control Bosch smart ovens, providing voice-activated cooking capabilities and seamless integration with other smart home devices (Bosch Press Release, 2025). This collaboration underscores the growing importance of IoT and voice-controlled technology in the smart oven market.

- In May 2024, Panasonic Corporation completed the acquisition of Just Kitchen, a startup specializing in AI-powered cooking technology, for approximately USD100 million (Reuters, 2024). This acquisition positions Panasonic to offer advanced cooking features and personalized recipes in their smart ovens, setting them apart from competitors.

- In October 2025, the European Union passed new regulations mandating energy efficiency standards for smart ovens, effective from 2027 (European Commission, 2025). This policy change emphasizes the importance of energy efficiency in the smart oven market and encourages manufacturers to innovate in this area.

Research Analyst Overview

In the dynamic the market, companion apps and online retail platforms are revolutionizing the way consumers purchase and use small kitchen appliances. These apps offer personalized product recommendations based on individual preferences and cooking history. Safety features, such as preheat alerts and cooking temperature controls, ensure convenient and safe use. Bluetooth and device connectivity enable hand-free control via smartphones, enhancing the user experience. Algorithms analyze cooking processes and provide calorie tracking and nutritional information for health-conscious consumers. Counter top segment growth is driven by the convenience of small, visually appealing devices. Wi-Fi and delivery options cater to busy lifestyles, while voice controls add functional kitchen spaces to the digital platform.

The counter top segment, including small kitchen appliances, offers affordability and convenience for consumers. Online retail platforms and offline channels cater to various preferences, with ratings and algorithms guiding purchasing decisions. Commercial applications, including kitchen fires and labor concerns, are addressed through smart appliances and smartphone apps.

The ongoing integration of smart technology into kitchen appliances reflects the dynamic nature of the market, with premium home appliances offering visually appealing designs and manual supervision options for chefs. Energy efficiency and healthy cooking functions are essential considerations for households, with air fryers and juicers gaining popularity. Despite the numerous benefits, security concerns and hacking risks persist, requiring ongoing attention from manufacturers and consumers alike. The market's continuous unfolding is shaped by the interplay of convenience, affordability, and evolving consumer preferences, with smart ovens and other connected home appliances becoming integral components of modern kitchen spaces.

Smart ovens integrate with juicers and other small appliances, expanding their capabilities. Physical stores remain relevant by offering demonstrations and expert advice. Overall, the market continues to evolve, meeting the needs of consumers seeking efficient, connected, and nutritious cooking solutions.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Smart Ovens Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

176 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 20.65% |

|

Market growth 2024-2028 |

USD 519.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

15.57 |

|

Key countries |

US, China, Germany, Japan, UK, Australia, India, France, Brazil, Canada, Brazil, UAE, Australia, Rest of World (ROW), Saudi Arabia, France, South Korea, and Mexico |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Smart Ovens Market Research and Growth Report?

- CAGR of the Smart Ovens industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the smart ovens market growth of industry companies

We can help! Our analysts can customize this smart ovens market research report to meet your requirements.