Sorghum Market Size 2025-2029

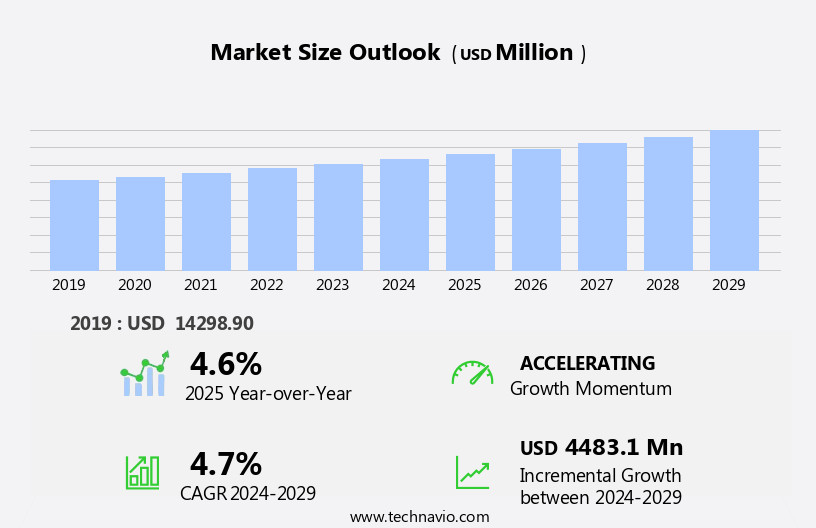

The sorghum market size is forecast to increase by USD 4.48 billion, at a CAGR of 4.7% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing demand for gluten-free and healthy food options. Consumers' preference for vitamin and nutritious and allergen-free alternatives is fueling the market's expansion. In response, companies are focusing on developing advanced sorghum hybrids to cater to this trend. However, the market faces challenges due to climate change and weather variability. Extreme weather conditions can negatively impact sorghum production, leading to supply chain disruptions and price volatility. Producers must adapt to these conditions through sustainable farming practices and technological innovations to ensure consistent yields and maintain market competitiveness.

- Companies seeking to capitalize on the market's opportunities should focus on developing high-quality, nutrient-dense sorghum products and implementing robust supply chain strategies to mitigate the risks associated with climate change and weather variability.

What will be the Size of the Sorghum Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

Sorghum, a versatile and resilient crop, continues to garner attention in various sectors due to its dynamic market landscape. Sustainable production is a key focus, with ongoing research in weed management, water conservation, and intercropping systems. Sorghum's drought tolerance and robust root architecture make it an ideal choice for areas prone to water scarcity. Moreover, the exploration of sorghum's byproducts and their utilization in various industries adds to its market value. Breeding programs are continually advancing, leading to improved hybrids with enhanced nutritional content, pest resistance, and climate resilience. Fertilization strategies and crop rotation plans are also essential components of sustainable sorghum farming.

Sorghum's economic impact is significant, with applications ranging from food and feed to bioenergy and industrial uses. Water scheduling and nutrient management are crucial aspects of sorghum processing techniques to ensure optimal grain yield. As research progresses, sorghum's potential continues to unfold, with advancements in genetic improvement, stalk strength, and biomass production. The continuous evolution of the market dynamics is driven by the interconnected nature of these various aspects. By addressing challenges in production, processing, and utilization, the sorghum industry remains at the forefront of agricultural innovation.

How is this Sorghum Industry segmented?

The sorghum industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Grain sorghum

- Forage sorghum

- Sweet sorghum

- End-user

- Food and beverages

- Animal feed

- Others

- Distribution Channel

- Offline

- Online

- End-User

- Food and Beverage Industry

- Livestock Industry

- Energy Sector

- Geography

- North America

- US

- Mexico

- Middle East and Africa

- Ethiopia

- APAC

- China

- India

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

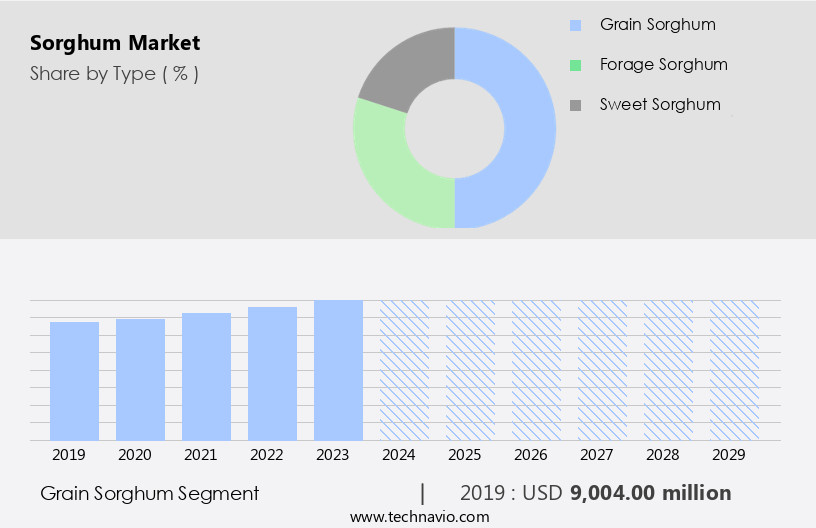

The grain sorghum segment is estimated to witness significant growth during the forecast period.

Grain sorghum, or milo, is a drought-resistant cereal crop with significant market potential. Primarily grown for its edible grains, sorghum is utilized in various sectors, including food, animal feed, and industry. Its resilience to unfavorable weather conditions makes it a reliable source of nutrition and energy. In the food industry, sorghum's gluten-free properties make it an essential ingredient in flours, cereals, bread, snacks, and alcoholic beverages, catering to the increasing demand for gluten-free products. Its nutritional profile, rich in proteins and antioxidants, adds value to its use. The animal feed sector benefits from sorghum as a high-energy, cost-effective alternative to corn, particularly in livestock and poultry feed.

In sustainable production, sorghum's drought tolerance and intercropping systems contribute to water conservation and improved soil health. Mechanized harvesting and processing techniques increase efficiency, while breeding programs focus on genetic improvement, pest resistance, and climate resilience. Fertilization strategies and crop rotation ensure optimal nutrient management and yield. Sorghum's versatility and benefits extend to industrial applications, including ethanol production and biomass energy. Its economic impact is substantial, with continued research and development in sorghum's genetic improvement, irrigation scheduling, and nutrient management driving market growth.

The Grain sorghum segment was valued at USD 9 billion in 2019 and showed a gradual increase during the forecast period.

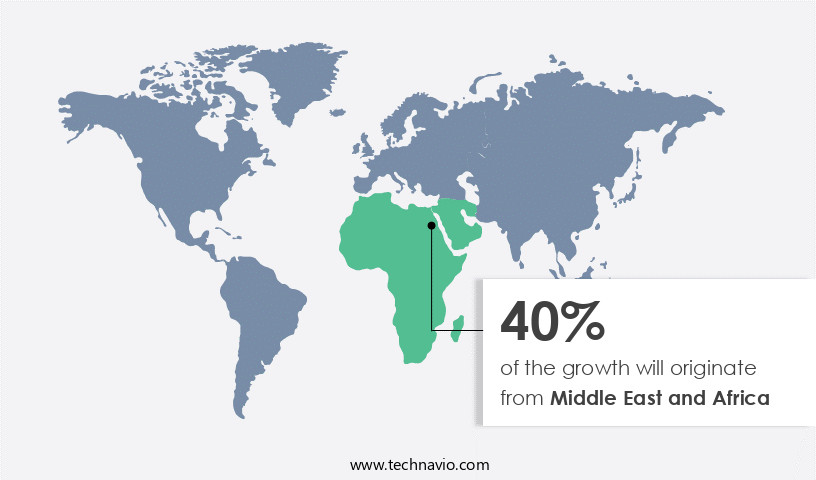

Regional Analysis

Middle East and Africa is estimated to contribute 40% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The Middle East and Africa (MEA) region is a significant consumer of sorghum, particularly in Africa, where it serves as a vital food crop. Food security concerns, livestock feed demand, and bioethanol production drive the market's growth. Major producers and consumers include Sudan, Nigeria, Ethiopia, Egypt, and South Africa. In Sudan, sorghum is a primary agricultural focus, with extensive cultivation in Gezira, Blue Nile, and Kordofan regions. This crop is essential for food and animal feed in the country. Traditional dishes like Kisra (flatbread) and Asida (porridge) are made from sorghum. Sorghum's drought tolerance and hardy root architecture make it an attractive option for sustainable production in arid regions.

Mechanized harvesting techniques and advanced processing methods improve efficiency and grain quality. Irrigation scheduling and water conservation practices enhance yields, while weed management and nutrient management ensure optimal growth. Breeding programs and genetic improvement focus on climate resilience, stalk strength, pest resistance, and nutritional content. Intercropping systems and byproduct utilization contribute to sustainable farming practices. Sorghum's economic impact extends to bioethanol production, making it a valuable commodity. Sorghum's versatility and nutritional benefits make it a staple food and essential feed ingredient. As the demand for sustainable and climate-resilient crops grows, the market continues to evolve, offering opportunities for innovation and growth.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The global sorghum market size and forecast projects growth, driven by sorghum market trends 2025-2029. B2B sorghum supply solutions leverage sustainable sorghum cultivation technologies for quality. Sorghum market growth opportunities 2025 include sorghum for animal feed, dietary fiber and gluten-free sorghum products, meeting demand. Sorghum supply chain software optimizes operations, while sorghum market competitive analysis highlights key producers. Sustainable sorghum farming practices align with eco-friendly agriculture trends. Sorghum regulations 2025-2029 shapes sorghum demand in North America 2025. High-yield sorghum solutions and premium sorghum market insights boost adoption. Sorghum for food processing and customized sorghum products target niches. Sorghum market challenges and solutions address yield variability, with direct procurement strategies for sorghum and sorghum pricing optimization enhancing profitability. Data-driven sorghum market analytics and sustainable grain trends drive innovation.

What are the key market drivers leading to the rise in the adoption of Sorghum Industry?

- The surge in consumer preference towards gluten-free and health-conscious food options serves as the primary market driver.

- Sorghum, a naturally gluten-free grain, is gaining popularity in the global market due to the rising demand for healthy and gluten-free food options. With an increasing awareness of celiac disease and gluten intolerance, consumers are turning to grains like sorghum, quinoa, and millet. The preference for plant-based and whole-grain diets also contributes to the growing demand for this nutritious and sustainable food source. Sorghum is rich in fiber, protein, antioxidants, and essential minerals such as iron, magnesium, and phosphorus. Its low glycemic index makes it suitable for diabetic-friendly diets, while its high fiber content supports digestive health and weight management.

- Moreover, sorghum's drought tolerance and adaptability to various climates make it an attractive crop for farmers, especially in regions prone to water scarcity. In terms of storage methods, sorghum can be stored for long periods without significant loss in quality, making it a reliable food source. Harvest mechanization and processing techniques have also advanced, leading to increased sorghum grain yield and improved product quality. Irrigation scheduling optimizes water usage, enhancing crop productivity and reducing water wastage. These factors contribute to the overall growth of the market.

What are the market trends shaping the Sorghum Industry?

- Focusing on the development of advanced sorghum hybrids is a current market trend. This area of professional expertise is essential for staying competitive in the agricultural biotechnology industry.

- The market is witnessing significant advancements in sorghum production, driven by research initiatives focused on enhancing the genetic traits of sorghum to address agricultural challenges. One such initiative, launched on January 24, 2025, aims to develop nitrogen-saving sorghum hybrids with a USD38 million investment from the ARPA-E program of the US Department of Energy. This project intends to improve nitrogen-use efficiency, reduce dependence on synthetic fertilizers, and lower costs for farmers while minimizing nitrogen pollution. Additionally, research is underway to explore sorghum intercropping systems, water conservation strategies, and utilization of sorghum byproducts.

- Sorghum breeding programs are also focusing on developing hybrids with improved weed management and fertilization strategies for sustainable sorghum production. These efforts are essential to meet the growing demand for sorghum and ensure its long-term viability as a sustainable crop option.

What challenges does the Sorghum Industry face during its growth?

- Climate change and weather variability pose significant challenges to industry growth, requiring organizations to adapt and mitigate the impacts on their operations and supply chains.

- Sorghum, a resilient crop known for its drought tolerance, faces challenges from climate change and weather variability. Flooding, extreme temperatures, and irregular rainfall patterns pose significant risks to sorghum cultivation, impacting yield consistency. Flooding can damage root systems, hinder nutrient uptake, and lead to crop failure. Extreme temperatures, whether high or low, can negatively affect sorghum growth and development. High temperatures can cause heat stress, reducing photosynthesis and lowering yields. To mitigate these risks, ongoing research focuses on sorghum genetic improvement, including stalk strength, pest resistance, disease resistance, and nutritional content.

- Hybrid development is another area of focus to enhance sorghum's climate resilience and improve its ability to withstand various environmental stressors. These efforts aim to ensure a stable and consistent supply of sorghum in the face of increasingly unpredictable weather patterns.

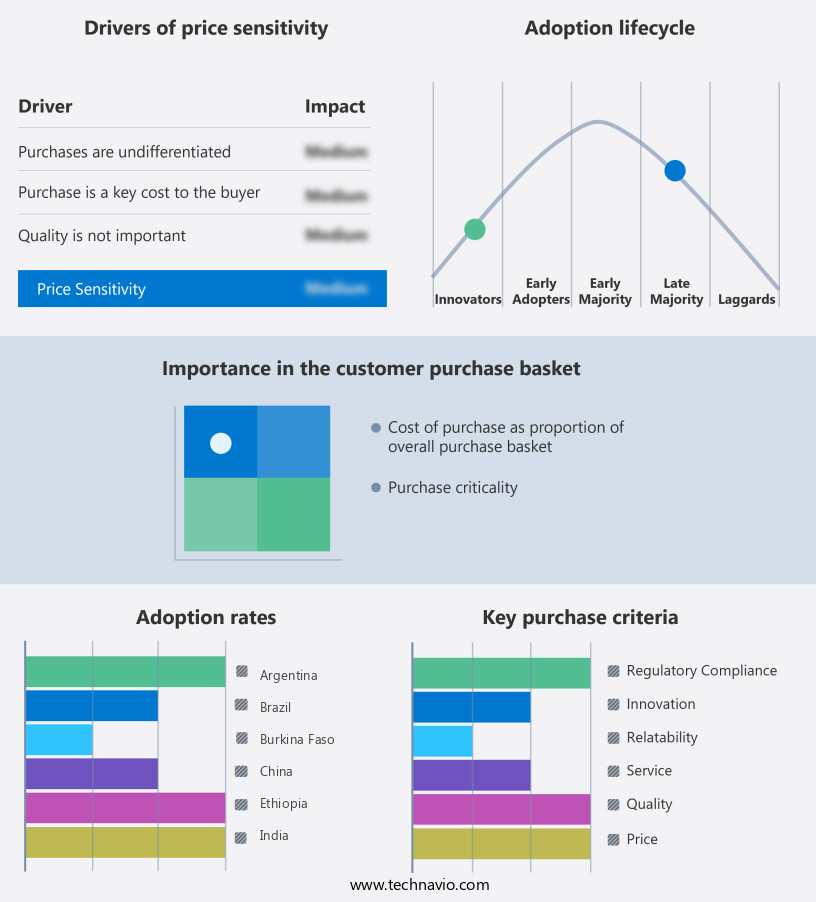

Exclusive Customer Landscape

The sorghum market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the sorghum market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, sorghum market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Advanta Seeds - This company specializes in advanced sorghum hybrid varieties, incorporating cutting-edge technologies such as Igrowth for effective weed control and Aphix for robust aphid resistance. These innovations enhance agricultural productivity and sustainability.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Advanta Seeds

- Allied Seed LLC

- Archer Daniels Midland Co.

- Ardent Mills LLC

- Bunge Global SA

- Cargill Inc.

- Corteva Inc.

- Ernst Conservation Seeds

- Guna Agro industries

- Ingredion Inc.

- Kaveri Seed Co. Ltd.

- KWS SAAT SE and Co. KGaA

- Nu Life Market

- Ratnaraj Foods

- Rizwan Seed Co.

- Samasta Foods

- Seedway LLC

- The Scoular Co.

- Welter Seed and Honey Co.

- YESRAJ AGRO EXPORTS PVT. LTD.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Sorghum Market

- In January 2024, Ardent Mills, a leading flour-milling and ingredient company, announced the expansion of its sorghum processing capabilities at its facility in Amarillo, Texas (Ardent Mills Press Release, 2024). This investment aimed to increase the production capacity of sorghum flour and expand its offerings to meet growing customer demand for gluten-free and nutritious food options.

- In March 2024, PepsiCo and Ingredion Incorporated entered into a strategic partnership to develop and commercialize high-protein sorghum ingredients for use in beverages (PepsiCo Press Release, 2024). This collaboration was expected to result in innovative, plant-based beverage products, catering to the growing consumer trend towards healthier and more sustainable food and beverage choices.

- In July 2024, GrainCorp, a leading Australian agribusiness, completed the acquisition of the sorghum milling assets of Cargill in Australia (GrainCorp Press Release, 2024). This acquisition strengthened GrainCorp's position in the Australian the market, providing the company with increased production capacity and a broader product portfolio.

- In May 2025, the European Commission approved the use of sorghum as a feed ingredient, following a successful application by the European Sorghum Producers Association (European Commission Press Release, 2025). This approval opened up new opportunities for the European the market, allowing for increased production and exports to countries with a high demand for animal feed.

Research Analyst Overview

- Sorghum, a versatile and resilient crop, fuels various industries beyond food. In the biomaterials sector, sorghum is utilized for producing eco-friendly plastics and bioproducts. Simultaneously, the baking industry embraces sorghum flour for its unique taste and nutritional benefits. Sorghum silage production caters to the livestock feed market, while ethanol production addresses the biofuel industry's demands. Genetic diversity in sorghum is a significant focus in genomics research, driving advancements in hybrid vigor and precision agriculture. Additionally, sorghum malt production caters to the brewing industry, and distilling uncovers new opportunities in spirits production.

- Sorghum straw utilization for biofuel and biogas production further expands its economic potential. Concurrently, remote sensing technology enhances crop management and yield optimization. These diverse applications underscore sorghum's market relevance and adaptability.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Sorghum Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

206 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.7% |

|

Market growth 2025-2029 |

USD 4483.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.6 |

|

Key countries |

China, Nigeria, Sudan, Mexico, Ethiopia, Brazil, US, India, Burkina Faso, and Argentina |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Sorghum Market Research and Growth Report?

- CAGR of the Sorghum industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Middle East and Africa, APAC, North America, South America, and Europe

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the sorghum market growth of industry companies

We can help! Our analysts can customize this sorghum market research report to meet your requirements.