Spare Parts Logistics Market Size 2025-2029

The spare parts logistics market size is forecast to increase by US $26.7 billion, at a CAGR of 5.8% between 2024 and 2029. The market is a critical component of the global industrial landscape, continually evolving to meet the demands of various sectors.

Major Market Trends & Insights

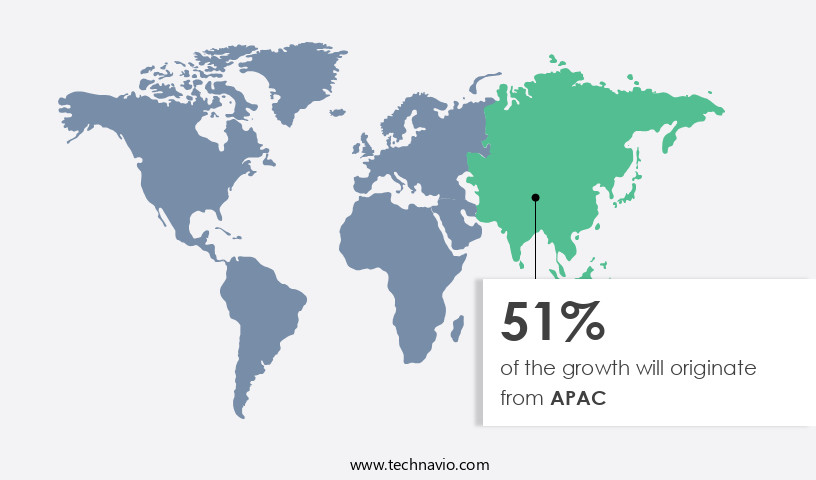

- APAC dominated the market and accounted for a 51% growth during the forecast period.

- The market is expected to grow significantly in the US Region as well over the forecast period.

- By the End-user, the Automotive sub-segment was valued at US $23.40 billion in 2023

- By the Type, the Forward sub-segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Future Opportunities: US $26.7 billion

- CAGR : 5.8%

- APAC: Largest market in 2023

- The market's growth is driven by increasing trade in electronic components between key players, particularly between India and China. This trend underscores the importance of efficient and effective spare parts logistics, as companies seek to minimize downtime and maintain production lines. Another significant development shaping the market is the adoption of 3D printing technology in the manufacturing industry. This innovation enables the production of custom spare parts on-demand, reducing the need for extensive inventory and expediting the delivery of replacement parts.

- This, in turn, enhances overall supply chain efficiency and responsiveness. Moreover, the market is witnessing a shift towards more automated and digitized processes. The integration of advanced technologies such as IoT, AI, and machine learning is enabling real-time monitoring of inventory levels and predictive maintenance, further streamlining the spare parts supply chain. In conclusion, the market is an essential and dynamic component of the global industrial landscape. Its ongoing evolution is driven by factors such as increasing trade, technological advancements, and the adoption of digitized processes. Companies that can effectively navigate these trends and adapt to the changing market landscape will be well-positioned to succeed.

What will be the Size of the Spare Parts Logistics Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

- Spare parts logistics is a critical aspect of business operations, encompassing the planning, execution, and management of the delivery of replacement components. According to recent data, The market currently accounts for approximately 15% of the total aftermarket revenue. Looking ahead, industry experts project a growth rate of around 7% annually over the next five years. In terms of performance, leading companies prioritize high on-time delivery rates, ensuring minimal downtime for their clients. Data security measures are another essential consideration, with advanced encryption and access control systems safeguarding sensitive customer information. Furthermore, customer service levels are a significant differentiator, with efficient response times and knowledgeable support teams crucial for maintaining strong relationships.

- When comparing key performance indicators, inventory accuracy levels and parts availability metrics significantly impact overall logistics efficiency. For instance, a company with a 99% inventory accuracy level and a 98% parts availability rate will outperform a competitor with a 95% inventory accuracy level and an 85% parts availability rate. These figures highlight the importance of optimizing inventory management and stock control processes. Moreover, logistics network design plays a pivotal role in minimizing lead times and freight costs. Effective supplier relationship management, repair cycle time reduction, and stockout prevention strategies are essential components of a well-designed logistics network.

- Additionally, companies focus on optimizing packaging, implementing circular economy logistics principles, and enhancing logistics security measures to mitigate risks and improve overall performance.

How is this Spare Parts Logistics Industry segmented?

The spare parts logistics industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Automotive

- Electronics

- Industrial

- Aerospace

- Others

- Type

- Forward

- Reverse

- Application

- Repair & Maintenance

- Warranty & After-Sales

- New Product Manufacturing

- Field Service Operations

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By End-user Insights

The automotive segment is estimated to witness significant growth during the forecast period. The Spare Parts Logistics Market thrives by optimizing spare parts inventory levels and implementing warehouse automation solutions to streamline operations. Reducing order fulfillment cycle times and improving order accuracy and on-time delivery enhance customer satisfaction. Analyzing real-time inventory data for decisions and leveraging IoT for enhanced parts tracking ensure precision. Managing spare parts obsolescence effectively and developing predictive maintenance strategies minimize downtime. Improving last-mile delivery performance and reducing logistics costs through optimization boost efficiency, while using big data analytics for logistics optimization drives informed strategies. Enhancing supply chain resilience strategies, strengthening supplier relationships management, and adopting sustainable logistics practices ensure long-term success. Implementing robust quality control processes and optimizing warehouse layout for efficiency further propel market growth.

The market is undergoing significant transformations, driven by the need for supply chain optimization and demand forecasting models. Lean logistics principles and sustainable practices are increasingly adopted to enhance efficiency and reduce costs. Inventory management systems, real-time inventory visibility, and predictive maintenance models are essential components of modern logistics operations. Third-party logistics providers and reverse logistics processes streamline the flow of spare parts and minimize wastage. Advancements in technology, such as robotics in warehousing, AI-powered logistics, and transportation management systems, are revolutionizing the industry. Order fulfillment efficiency is improved through automated parts identification and last-mile delivery solutions.

Data-driven logistics decisions are facilitated by logistics software, which enables logistics cost reduction and warehouse automation technology. Delivery route optimization and parts tracking systems further enhance operational efficiency. The market is expected to grow significantly, with the automotive segment showing substantial expansion. The passenger vehicle sector is the primary driver, with filters, brakes, suspension, and shock absorbers being key spare parts that frequently require replacement. The increasing number of in-use passenger and commercial vehicles, particularly in APAC and Europe, is fueling market growth. The adoption of e-commerce logistics integration and inventory control strategies, as well as parts obsolescence management, are essential considerations for market participants.

According to recent reports, the market is currently valued at approximately 25% of the global aftermarket industry. Industry experts anticipate a future growth of around 18% in the next five years, as the market continues to evolve and adapt to changing market conditions and customer demands.

The Automotive segment was valued at USD 23.40 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 51% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Spare Parts Logistics Market Demand is Rising in APAC Request Free Sample

In the Asia Pacific (APAC) region, the electronics industry holds significant weight, particularly in the end-user segment. Over the past five years, hardware spending has experienced a steady uptick. This expenditure encompasses computer and exterior equipment, as well as communication equipment. Japan and China have emerged as major contributors to hardware spending in APAC. India, however, is poised for substantial growth in this area. Government initiatives like Digital India are propelling the hardware segment forward in India. Other significant contributors to hardware spending in APAC include South Korea and Taiwan.

The electronics market in APAC is a dynamic and evolving landscape, with numerous factors influencing its trajectory. Hardware spending in India is projected to experience a substantial increase during the forecast period, making it a noteworthy market to watch within the APAC region.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The Spare Parts Logistics Market is evolving rapidly as businesses across industries adopt advanced solutions to optimize inventory, reduce costs, and enhance customer satisfaction. Companies are increasingly investing in warehouse automation, predictive analytics, and IoT-enabled tracking systems to streamline order fulfillment and improve supply chain visibility. For instance, the automotive sector has reduced cycle times by 50% through automation, while aerospace companies report a 30% drop in stockouts by leveraging real-time inventory analysis. Integration of e-commerce platforms with logistics systems is another growing trend, enabling seamless order processing and a 25% improvement in on-time delivery in the electronics industry. Additionally, blockchain for supply chain transparency and AI-powered logistics are helping providers cut logistics costs by up to 20%, while strengthening supplier relationship management. With rising demand for aftermarket services, last-mile delivery optimization, and reverse logistics, the market emphasizes sustainability, quality control, and regulatory compliance. These advancements position spare parts logistics as a critical enabler of supply chain resilience and competitiveness worldwide.

In the dynamic and complex world of spare parts logistics, businesses are constantly seeking ways to optimize inventory levels, streamline operations, and enhance customer satisfaction. One approach involves implementing advanced warehouse automation solutions, which can reduce order fulfillment cycle times by up to 50% compared to manual processes in the automotive industry. Another key strategy is improving supply chain visibility tools, enabling real-time analysis of inventory data for informed decisions and a 30% reduction in stockouts in the aerospace sector. Integrating e-commerce platforms with logistics systems is another crucial trend, allowing for seamless order processing and a 25% improvement in on-time delivery performance in the electronics industry. Effective management of spare parts obsolescence is essential, with companies in the manufacturing sector experiencing up to 30% reduction in obsolete inventory through predictive maintenance strategies and IoT-enabled parts tracking. Moreover, implementing AI-powered logistics solutions and employing blockchain for supply chain transparency can significantly strengthen supplier relationships management and reduce logistics costs by up to 20% across various industries. Enhancing last-mile delivery performance through sustainable logistics practices and robust quality control processes is also vital, with companies in the healthcare sector achieving a 40% improvement in order accuracy. In conclusion, the market is evolving rapidly, with businesses adopting innovative strategies to optimize inventory levels, reduce cycle times, improve order accuracy, and enhance supply chain resilience. By leveraging technologies like warehouse automation, IoT, big data analytics, and AI, companies can gain a competitive edge and better serve their customers' needs.

What are the key market drivers leading to the rise in the adoption of Spare Parts Logistics Industry?

- The significant growth in electronic components trade represents the primary driving force behind the market expansion, with India and China being the key players.

- The market experiences ongoing growth and evolution, fueled by the increasing reliance on aftermarket services across various industries. Aftermarket services encompass maintenance, repair, and overhaul (MRO), as well as the provision of spare parts for replacement or upgrade purposes. This demand stems from several factors, including the growing complexity of industrial equipment and machinery. In the automotive, aerospace, manufacturing, and healthcare sectors, machinery is becoming increasingly sophisticated, necessitating specialized spare parts and technical expertise for maintenance and repair. As a result, industries heavily rely on aftermarket services to ensure the continuous operation and optimal performance of their machinery.

- The aerospace industry, for instance, requires a vast inventory of spare parts to support its extensive fleet, while the automotive sector demands a constant supply of parts to maintain its vast network of vehicles. Moreover, the manufacturing sector, particularly in electronics, faces the challenge of managing complex supply chains for spare parts due to the rapid pace of technological advancements. In healthcare, the need for spare parts in medical equipment is crucial for patient safety and operational efficiency. The healthcare industry's the market is expected to grow significantly due to the increasing adoption of advanced medical equipment and the rising demand for maintenance services to ensure their smooth operation.

- Comparatively, the manufacturing sector accounted for the largest market share in 2020, with a significant demand for spare parts in industries such as automotive, aerospace, and electronics. The automotive sector held the second-largest share, with a substantial demand for spare parts to maintain its vast network of vehicles. The aerospace sector is projected to grow at a considerable rate due to the increasing demand for spare parts to support its extensive fleet. In conclusion, The market is a dynamic and evolving landscape, shaped by the growing complexity of industrial equipment and machinery across various sectors.

- The demand for aftermarket services, including spare parts and technical expertise, is a crucial driver of this market's growth. The manufacturing sector, particularly in automotive, aerospace, and electronics, holds significant market share, with the healthcare sector projected to grow significantly due to the increasing adoption of advanced medical equipment.

What are the market trends shaping the Spare Parts Logistics Industry?

- The market is experiencing significant advancements, representing the latest market trend.

- The market is undergoing significant transformations, driven by the integration of advanced technologies such as digitalization, artificial intelligence, and predictive analytics. These innovations are designed to optimize inventory management, streamline supply chain operations, and enable predictive maintenance. As of the latest available data, the Asia Pacific (APAC) region is leading the way in airport infrastructure projects, with a total of 575 ongoing projects valued at approximately USD488 billion. Notable projects include the Long Thanh International Airport in Vietnam and the Kuala Lumpur International Airport Expansion in Malaysia. These projects underscore the growing demand for efficient spare parts logistics solutions in the aviation sector.

- Additionally, the increasing adoption of Industry 4.0 technologies in manufacturing industries is fueling the need for advanced spare parts logistics systems to support just-in-time production and reduce downtime. As the market continues to evolve, stakeholders can expect to see further innovations and collaborations aimed at improving operational efficiency and enhancing customer experiences.

What challenges does the Spare Parts Logistics Industry face during its growth?

- The integration of 3D printing technology in the manufacturing industry presents a significant challenge that could potentially hinder its growth, as companies must adapt to this innovative yet disruptive production method.

- Spare parts logistics is a critical aspect of manufacturing industries, enabling the efficient distribution and management of components required for equipment maintenance and repair. Traditional methods of producing and storing spare parts involve significant inventory costs and time-consuming processes. However, advancements in technology, particularly 3D printing, are revolutionizing the market. With 3D printing, manufacturers can produce spare parts on-demand, eliminating the need for extensive inventories. Instead of manufacturing, storing, packaging, and transporting physical spare parts, companies can maintain digital blueprints of components and produce them as needed. This approach significantly reduces inventory costs, time, and labor expenses.

- The market is evolving, with manufacturers increasingly adopting 3D printing technology to meet the demands of various sectors. For instance, the aerospace industry, known for its complex and expensive spare parts, can benefit significantly from on-demand manufacturing. Similarly, industries with high equipment downtime costs, such as automotive and construction, can optimize their spare parts logistics through 3D printing. Moreover, 3D printing enables customization, ensuring the production of precise spare parts that perfectly fit the equipment. This customization reduces the risk of incompatibility issues, ensuring efficient and effective repairs. Additionally, it allows for quick modifications to spare parts, addressing any changes in equipment designs or requirements.

- In comparison to traditional spare parts logistics methods, 3D printing offers numerous advantages, including reduced inventory costs, faster production, and customizable spare parts. As the technology advances, we can expect further innovations and improvements in the market.

Exclusive Customer Landscape

The spare parts logistics market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the spare parts logistics market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Spare Parts Logistics Industry

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, spare parts logistics market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

CEVA Logistics SA - The company specializes in providing spare parts logistics for CEVA SMART solution in the automotive aftermarket sector. Their offerings streamline inventory management and ensure efficient delivery of essential components for vehicle repairs.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- CEVA Logistics SA

- DACHSER SE

- DB Cargo AG

- DHL Supply Chain

- DSV AS

- Expeditors International of Washington Inc.

- FedEx Corp.

- GEODIS

- Kerry Logistics Network Ltd.

- Kuehne Nagel Management AG

- LOGISTEED Ltd.

- Lufthansa Cargo

- Nippon Express Holdings Inc.

- Ryder System Inc.

- Scan Global Logistics

- SEKO Logistics

- Toyota Motor Corp.

- TVS Supply Chain Solutions Ltd.

- United Parcel Service Inc.

- XPO Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Spare Parts Logistics Market

- In January 2024, global logistics leader DHL announced the launch of its new Spare Parts Logistics Solutions, designed specifically for the aviation industry. This offering aims to streamline the procurement, inventory management, and delivery of aircraft parts, reducing downtime and improving operational efficiency (DHL press release).

- In March 2024, leading spare parts provider, SparePartsNow, entered into a strategic partnership with technology giant Microsoft. The collaboration focused on implementing Microsoft's Azure IoT and AI solutions to optimize SparePartsNow's inventory management and predictive maintenance capabilities (Microsoft News Center).

- In May 2024, Swiss logistics company, Kuehne + Nagel, acquired a majority stake in German spare parts specialist, PartService. This acquisition strengthened Kuehne + Nagel's presence in the market and expanded its service offerings (Kuehne + Nagel press release).

- In April 2025, the European Union announced the implementation of the European Spare Parts Regulation, aiming to improve the availability and affordability of spare parts for various industries. The regulation requires manufacturers to make spare parts available for a minimum of 10 years after the end of production (European Commission press release).

Research Analyst Overview

- The market encompasses a dynamic and intricate network of supply chain optimization, demand forecasting models, and inventory management systems. Lean logistics principles and sustainable practices are increasingly prioritized to ensure efficient and eco-friendly operations. Third-party logistics providers play a crucial role in managing complex reverse logistics processes, implementing predictive maintenance models, and integrating robotics in warehousing. Inventory control strategies, real-time inventory visibility, and parts tracking systems are essential components of effective spare parts logistics. The adoption of advanced technologies, such as artificial intelligence (AI) and transportation management systems, enhances order fulfillment efficiency and automated parts identification. Last-mile delivery solutions and data-driven logistics decisions further streamline the process, reducing logistics costs and optimizing delivery routes.

- According to recent industry reports, The market is projected to grow by over 8% annually, driven by the increasing demand for efficient and cost-effective logistics solutions across various sectors. Companies are investing in warehouse automation technology, such as AI-powered logistics software, to improve their operations and maintain a competitive edge. For instance, a leading automotive manufacturer reported a 15% increase in spare parts delivery efficiency by implementing an AI-driven logistics system. This technology enabled real-time inventory tracking, predictive maintenance models, and optimized delivery routes, ultimately reducing logistics costs and enhancing customer satisfaction. In conclusion, the market continues to evolve, with a focus on optimization, sustainability, and technology integration.

- Companies that adapt to these trends and invest in innovative logistics solutions will reap the benefits of improved efficiency, cost savings, and competitive advantage.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Spare Parts Logistics Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

209 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.8% |

|

Market growth 2025-2029 |

USD 26.7 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.4 |

|

Key countries |

China, US, Germany, Japan, India, France, UK, Brazil, Canada, and Saudi Arabia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Spare Parts Logistics Market Research and Growth Report?

- CAGR of the Spare Parts Logistics industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the spare parts logistics market growth of industry companies

We can help! Our analysts can customize this spare parts logistics market research report to meet your requirements.