North America Stevia Market Size and Trends

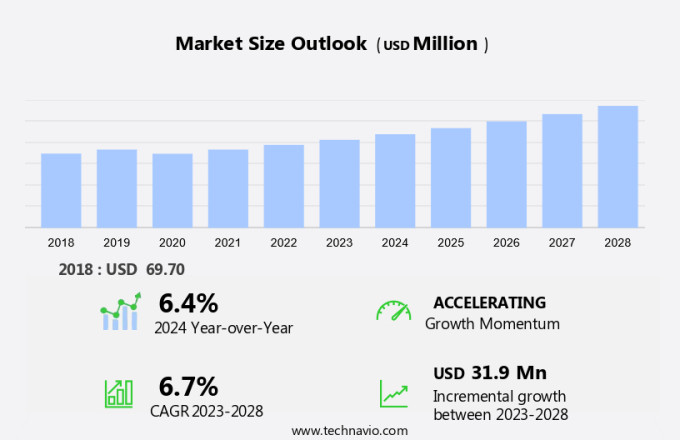

The North America stevia market size is forecast to increase by USD 31.9 million at a CAGR of 6.7% between 2023 and 2028. The market is experiencing significant growth due to the increasing demand for natural sweeteners and the health benefits they offer. Stevia, derived from the leaves of the Stevia rebaudiana plant, is a zero-calorie sweetener that provides a sweet taste without the added sugars found in traditional sweeteners. The market is witnessing an increase in demand for stevia in various forms, including chewing gum, chocolate, gummed candies, and tabletop sweeteners. Manufacturers of convenience foods, beverages, and food ingredients are increasingly using stevia as a replacement for sugar in diet carbonated drinks, flavored water, soft drinks, fruit juices, and zero-calorie beverages. The demand for stevia is driven by its ability to maintain the desired sweetness and mouthfeel while providing stability and extending shelf life. Additionally, the trend toward healthier foods and beverages is fueling the demand for stevia as a natural alternative to artificial sweeteners. However, challenges remain in the production and processing of stevia, including crystallization and texture issues, which can impact the final form and taste of the product. Manufacturers must carefully manage these challenges to ensure the highest quality and consistency in their stevia-based offerings. Stevia's zero-calorie and zero-glycemic index properties make it an attractive alternative for those managing calorie intake and blood sugar levels. The e-commerce sector has played a crucial role in the growth of the market, enabling easy access to a wide range of stevia-based products from both domestic and international brands.

The global market for stevia, a natural plant-based sweetener, continues to gain traction as consumers seek out zero-calorie alternatives to traditional sugar. Stevia glycosides, the primary sweet compounds derived from the Stevia rebaudiana plant, have emerged as popular sugar substitutes in various food and beverage applications. Stevia's role as a non-caloric sweetener in the food and beverage sector is significant, with its usage extending to dairy products, tabletop sweeteners, and beverages. In the dairy industry, stevia is increasingly being used to sweeten yogurts, ice creams, and milk, catering to the health-conscious consumer base. The beverage sector, too, has witnessed an increase in demand for stevia-sweetened drinks, including carbonated soft drinks, juices, and energy drinks. Stevia's versatility extends beyond powdered forms, with its application in bakery and confectionery products gaining momentum. As consumers continue to adopt calorie-controlled diets, the demand for stevia-based products in this sector is expected to grow. The shift towards natural and plant-based sweeteners has led to a decline in the popularity of artificial sweeteners.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018 - 2022 for the following segments.

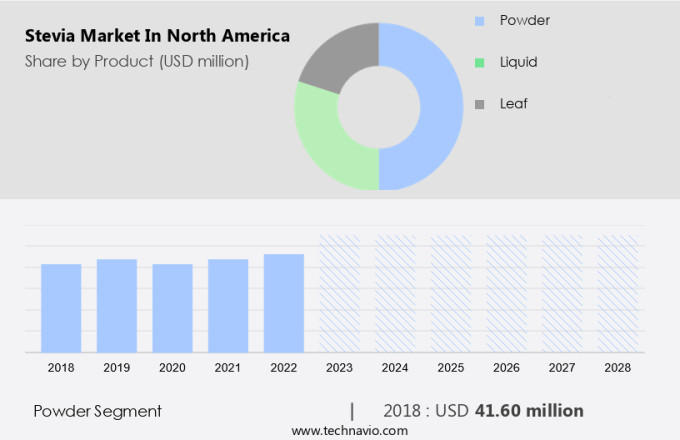

- Product

- Powder

- Liquid

- Leaf

- Geography

- North America

- Canada

- Mexico

- US

- North America

By Product Insights

The powder segment is estimated to witness significant growth during the forecast period. In the North American market, the demand for stevia powder is projected to expand significantly over the upcoming years. This growth can be attributed to the increasing preference for healthier food options with minimal calories. The powder form of stevia extract is widely used due to its versatility in various applications. The taste, sweetness, and cost of stevia powder extracts vary depending on their level of refinement and the quality of the stevia plant.

Get a glance at the market share of various segments Download the PDF Sample

The powder segment was the largest segment and was valued at USD 41.60 million in 2018. Some powdered stevia extracts may have a more pronounced aftertaste than others. Due to its intense sweetness, stevia powder is typically used sparingly when dissolved in liquid form. Stevia powder is commonly used in chewing gum, chocolate, gummed candies, and other confectionery products. It is also a popular choice for tabletop sweeteners, alternative sweeteners in zero-calorie beverages such as diet carbonated drinks, flavored water, soft drinks, and fruit juices. Hence, such factors are fuelling the growth of this segment during the forecast period.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

North America Stevia Market Driver

Health benefits associated with stevia is notably driving market growth. Stevia, a natural sweetener derived from the leaves of the Stevia rebaudiana plant, is gaining traction in the US market due to its role as a sugar substitute in various food options. This zero-calorie sweetener is particularly appealing to health-conscious consumers and those following dietary regimens, such as diabetics or those managing carbohydrate intake.

Stevia's sweetness comes from steviol glycosides, which have a sweetness intensity comparable to sugar but do not raise blood glucose levels. The increasing prevalence of hectic lifestyles and the desire for functional foods have fueled the demand for stevia-based products. These include a wide range of items, from cereals and nutrient supplements to candies and chocolates. Thus, such factors are driving the growth of the market during the forecast period.

North America Stevia Market Trends

Growing demand for flavored stevia is the key trend in the market. The North American market for stevia, a natural non-caloric sweetener derived from the stevia plant, is witnessing a rise in demand for flavored varieties. This trend is observable in the food and beverage industry, where stevia is increasingly being used as a sugar substitute in various applications.

This expansion of flavored offerings is expected to continue during the forecast period, driven by consumer preferences for low-calorie and natural sweeteners. The food and beverage industry categories that are expected to contribute significantly to the growth of the market include dairy products, tabletop sweeteners, beverages, convenience foods, sugar substitutes, and confectionery items such as hard candy, caramel, and taffy. Thus, such trends will shape the growth of the market during the forecast period.

North America Stevia Market Challenge

Increasing demand for other types of natural sweeteners is the major challenge that affects the growth of the market. Natural sweeteners, such as stevia and coconut sugar, are experiencing a rise in popularity due to the clean label trend in the food industry. Stevia, derived from the leaves of the Stevia rebaudiana plant, is a zero-calorie sweetener that has gained significant attention due to its natural origin and absence of bitter aftertaste. Coconut sugar, also known as coconut palm sugar, is another natural sweetener extracted from the sap of coconut tree flower blossoms.

It is marketed as a healthier alternative to refined sugar, with a lower glycemic index and more nutritional value. As a result, it is increasingly used in various food applications, including chocolate confectionery, bakery goods, snacks, and breakfast cereals. The increasing demand for natural sweeteners like coconut sugar may pose a challenge to the growth of the market in North America during the forecast period.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Archer Daniels Midland Co: The company offers stevia under the brand name SweetRight.

The market research and growth report also includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- BotanicalsPlus

- Cargill Inc.

- Chemill Inc.

- Evolva Holding AG

- GLG Life Tech Corp.

- Guilin Layn Natural Ingredients Corp.

- Ingredion Inc.

- Jiaherb Inc.

- Merck KGaA

- PureCircle Ltd.

- Pyure Brands LLC

- S and W Seed Co.

- Steviva Brands Inc.

- Sunwin Stevia International Inc.

- Tate and Lyle PLC

- Twinlab Consolidated Corp.

- WB Sweetners LLC.

- Westcoast Naturals

- Wisdom Natural Brands

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Stevia, a natural plant-based sweetener derived from the leaves of the Stevia rebaudiana plant, is gaining popularity in the food and beverages industry as a non-caloric sugar substitute. Stevia glycosides, the sweet compounds found in the plant, provide a clean taste with zero calories, zero carbohydrates, and a zero glycemic index. The sweetener is widely used in various food and beverage applications, including dairy products, tabletop sweeteners, beverages, convenience foods, and sugar substitutes market. Stevia offers health benefits, such as reducing calorie intake, managing blood sugar levels, and aiding in weight management. It is also preferred by health-conscious consumers due to its association with childhood obesity and non-communicable diseases reduction. Stevia is suitable for various forms, such as powder, liquid, and extracts, making it versatile for use in different food and beverage applications. The sweetener's stability, mouthfeel, and texture make it an ideal alternative to sugar and artificial sweeteners like aspartame, sucrose, dextrose, and corn syrups. Stevia's use in confectionery items, such as hard candy, caramel, taffy, chewing gum, chocolate, and gummed candies, provides a clean label trend in the industry. Stevia's sweetness intensity and flavor profile make it a popular choice for zero-calorie beverages, such as diet carbonated drinks, flavored water, soft drinks, and fruit juices. Stevia's production involves selective breeding and extraction techniques to ensure optimal sweetness intensity, solubility, taste modulation, and stability. The sweetener's clean taste and absence of bitterness make it a preferred choice for healthier food options, diets, and functional food and ingredients. Stevia's popularity is driven by the convenience of e-commerce and the availability of domestic brands, making it easily accessible to consumers.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

138 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.7% |

|

Market growth 2024-2028 |

USD 31.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.4 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Archer Daniels Midland Co., BotanicalsPlus, Cargill Inc., Chemill Inc., Evolva Holding AG, GLG Life Tech Corp., Guilin Layn Natural Ingredients Corp., Ingredion Inc., Jiaherb Inc., Merck KGaA, PureCircle Ltd., Pyure Brands LLC, S and W Seed Co., Steviva Brands Inc., Sunwin Stevia International Inc., Tate and Lyle PLC, Twinlab Consolidated Corp., WB Sweetners LLC., Westcoast Naturals, and Wisdom Natural Brands |

|

Market dynamics |

Parent market analysis, market report , market forecast , Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch