Submarine Cable Market Size 2025-2029

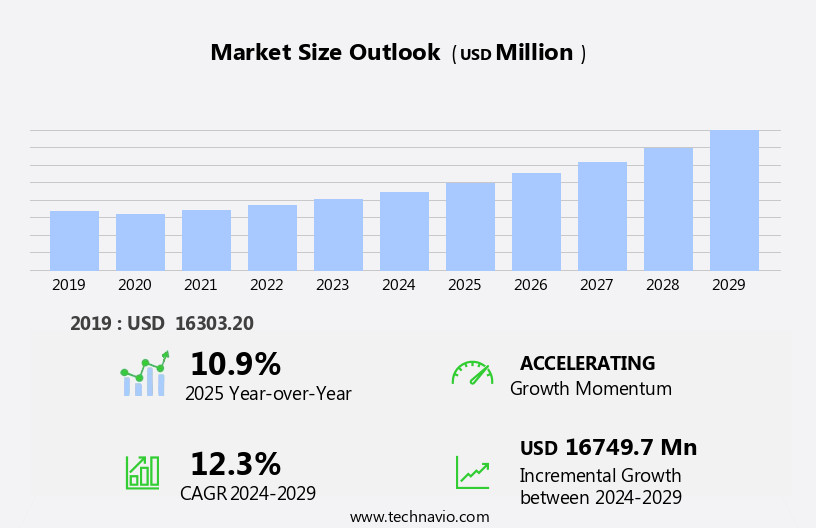

The submarine cable market size is forecast to increase by USD 16.75 billion at a CAGR of 12.3% between 2024 and 2029.

- The market is witnessing significant growth, driven by the expansion of cloud computing and data centers. Tech giants are investing in private submarine cable projects to ensure uninterrupted connectivity and reduce reliance on third-party providers. This trend is expected to continue as the demand for low-latency, high-bandwidth data transmission increases. However, the market faces challenges from security and cyber threats. Submarine cables are critical infrastructure, and their vulnerability to sabotage and cyber attacks poses a significant risk to data security.

- As the volume of data transmitted through these cables continues to grow, securing them against potential threats becomes increasingly important. Companies must invest in advanced security measures and collaborate with industry partners to mitigate risks and protect their valuable data assets.

What will be the Size of the Submarine Cable Market during the forecast period?

- The market continues to evolve, driven by the increasing demand for international connectivity and the digital transformation of various sectors. Subsea cables play a crucial role in data transmission, with ongoing advancements in fiber optic technology leading to higher capacity and faster transmission speeds. Cable installation and maintenance remain key activities, with cable trenching and cable protection essential for ensuring the longevity of these systems. Regulatory compliance and cable routing are also significant factors, with undersea cables traversing diverse environments and requiring careful planning and adherence to regulations. Industry consolidation and ownership changes continue to shape the market, with players investing in infrastructure and innovation to stay competitive.

- Submarine cable systems are increasingly being used for subsea power and deep-sea exploration, as well as for network resilience and data center connectivity. Technology innovation, such as repeater systems, cable integrity monitoring, and fault detection, are essential for maintaining network reliability and ensuring the long lifespan of these complex systems. The market is further influenced by the deployment of transpacific and transatlantic cables, as well as the integration of underwater connectors and cable landing stations. The ongoing unfolding of market activities and evolving patterns in the market reflect the dynamic nature of this essential communications infrastructure.

- Network capacity expansion and infrastructure investment are key trends, with the potential for subsea cables to contribute to big data and cloud computing, as well as to oceanographic research and subsea power. The market remains competitive, with ongoing innovation and regulatory compliance essential for success.

How is this Submarine Cable Industry segmented?

The submarine cable industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Power cable

- Communication cable

- Component

- Dry plant

- Wet plant

- Voltage

- Medium Voltage

- High Voltage

- Extra High Voltage

- End-User

- Telecom Operators

- Internet Service Providers

- Government

- Energy Sector

- Geography

- North America

- US

- Mexico

- Europe

- France

- Germany

- Italy

- Spain

- UK

- Middle East and Africa

- UAE

- APAC

- Australia

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

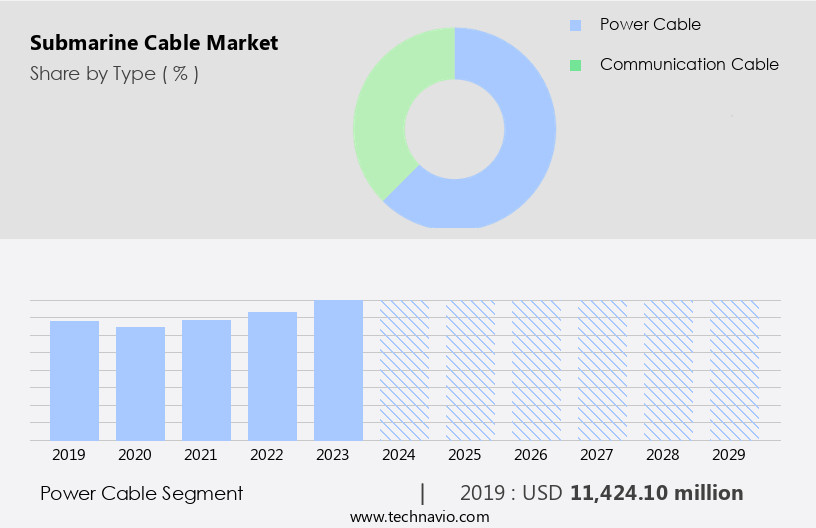

The power cable segment is estimated to witness significant growth during the forecast period. Submarine cable systems play a pivotal role in international connectivity by transmitting data and power between continents and regions. The demand for these underwater cables is driven by the increasing need for network resilience, data transmission, and digital transformation. Cable laying and installation are crucial processes in deploying submarine cable systems, with advanced fiber optic technology enabling high-capacity data transmission and long cable lifespans. Regulatory compliance and cable protection are essential considerations for cable ownership and industry consolidation. Deep-sea exploration and scientific data collection have expanded the applications of submarine cables, including seismic data transmission and oceanographic research. Subsea robotics and cable maintenance are vital for ensuring network reliability and cable integrity monitoring.

Cable burial and cable trenching are important for protecting cables from external damage. Transpacific and transatlantic cables are critical infrastructure investments for global communications, with capacity expansion a constant priority. Technology innovation, such as optical amplifiers and repeater systems, is essential for maintaining network performance and extending cable lifespan. Cable repair and cable landing stations are crucial for maintaining network connectivity and data center connectivity. Submarine power cables are increasingly important for integrating renewable energy sources, such as offshore wind farms, into power grids. These cables enable the transmission of electrical power from offshore platforms and wind farms to onshore grids, enhancing energy security and optimizing electricity distribution.

The growing investment in renewable energy projects, particularly in Europe, North America, and the Asia-Pacific region, is driving the demand for submarine power cables. Market competition is fierce, with various players focusing on cable deployment, capacity expansion, and network reliability. Big data and cloud computing are transforming the industry, with cable licensing and underwater connectors playing a crucial role in facilitating these developments. Network connectivity and infrastructure investment are essential for driving the growth of the market.

The Power cable segment was valued at USD 11.42 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

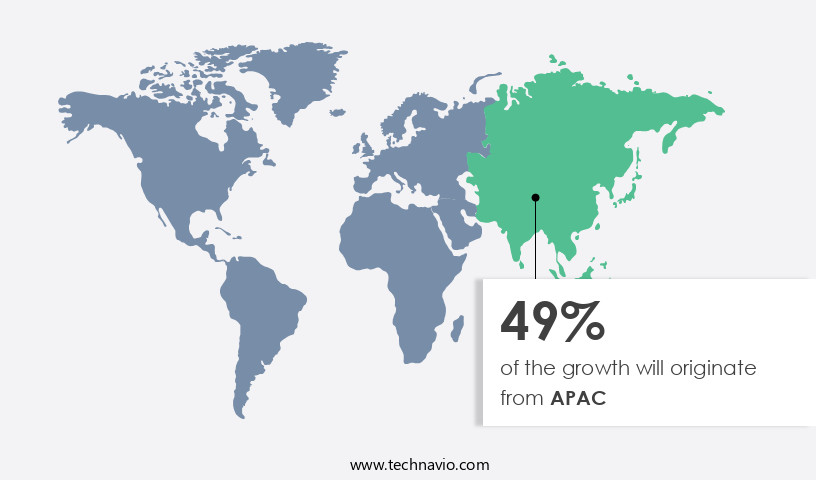

APAC is estimated to contribute 49% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in the Asia-Pacific (APAC) region is experiencing significant growth due to the expanding digital economies, increasing adoption of cloud services, and rising internet penetration. Key players, including China, Japan, India, and South Korea, are driving this growth, fueled by escalating data traffic and substantial investments in undersea cable infrastructure. Hyperscale cloud providers and telecom operators in APAC are responding to the surge in demand for high-speed internet and data storage by investing heavily in new cable projects to meet both regional and international connectivity needs. In November 2022, a consortium led by Singtel and China Telecom Global Limited (CTG) secured a USD 300 million contract to construct the Asia Link Cable (ALC) system.

This project, along with others, underscores the commitment of industry players to enhance international connectivity and support the digital transfofrmation sweeping the region. Submarine cable systems, including transpacific and transatlantic cables, are being deployed to expand capacity and ensure network resilience. Deep-sea exploration, marine surveys, and cable trenching are crucial elements of cable installation, while cable protection, regulatory compliance, and cable maintenance are essential for ensuring cable longevity. Subsea robotics, repeater systems, and optical amplifiers play vital roles in cable functionality and performance. Additionally, subsea power cables are gaining traction for their ability to transmit electricity underwater, contributing to the growth of the market.

The market competition is intensifying, with players focusing on technology innovation, infrastructure investment, and capacity expansion to stay ahead. Cable ownership and industry consolidation are also shaping the market landscape. Despite the challenges, the market is poised for growth, with data transmission and network reliability remaining key priorities.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The Global Submarine Cable Market expands with high-capacity submarine fiber cables and submarine cables for 5G connectivity. Submarine cable market trends 2025 emphasize undersea cables for cloud computing and submarine cables for data centers. Fiber optic cable for submarine and submarine cables for global internet ensure connectivity, per submarine cable market forecast. Subsea cables for renewable energy leverage smart submarine cable monitoring, while submarine cables for telecom networks enhance speed. Submarine cable cybersecurity solutions and undersea cables for IoT connectivity drive security. Submarine cables for digital infrastructure, high-speed submarine cable systems, and submarine cables for AI (artificial intelligence) networks support eco-friendly submarine cables. Submarine cable installation technologies, subsea cables for cross-border trade, submarine cables for smart cities, advanced submarine cable materials, and global submarine cable supply chain fuel growth through forecast year.

What are the key market drivers leading to the rise in the adoption of Submarine Cable Industry?

- The expansion of cloud computing and data centers is a primary factor fueling market growth, as businesses increasingly adopt cloud solutions to streamline operations and enhance data processing capabilities.

- The market is experiencing significant growth due to the increasing demand for data transmission and network reliability. With the ongoing digital transformation, cloud computing and data centers have become essential components of modern business infrastructure. Submarine cables play a crucial role in providing network connectivity and data center connectivity for these services, enabling organizations to store, process, and access data over the internet. Oceanographic research and subsea power cables are also contributing to the expansion of the market. Fault detection and cable repair technologies have improved network reliability, making submarine cables a preferred choice for long-distance data transmission.

- Cable landing stations are essential infrastructure components for cable maintenance and repair, ensuring minimal disruption to network connectivity. Capacity expansion is another factor driving the growth of the market. As businesses and consumers continue to generate and consume more data, the need for increased capacity is inevitable. Submarine cables offer a cost-effective and efficient solution for meeting this demand, making them an indispensable part of the communications infrastructure. In conclusion, The market is witnessing robust growth due to the increasing demand for data transmission, network reliability, and digital transformation. The expansion of cloud computing and data centers, as well as advancements in cable technology, are key factors fueling this growth.

- Submarine cables provide a reliable and cost-effective solution for meeting the growing need for high-performance computing resources and network connectivity.

What are the market trends shaping the Submarine Cable Industry?

- Tech giants are increasingly investing in private submarine cable projects, marking a significant trend in the telecommunications market. This undertaking reflects their commitment to enhancing global connectivity and data transfer capabilities.

- Submarine cables play a crucial role in international connectivity, with major tech companies like Google and Amazon investing heavily to meet their expanding data transmission needs. These investments focus on reducing reliance on third-party providers and ensuring secure, high-bandwidth, and low-latency connectivity for cloud services and data centers. In January 2025, Amazon filed an application with the Irish Maritime Area Regulatory Authority to deploy a subsea cable connecting Ireland and the US. The proposed cable would land in County Cork, with potential sites near Castlefreke, Rosscarbery, and Long Strand, before traversing the Celtic Sea and Atlantic Ocean to an undisclosed US East Coast location.

- Marine surveys are essential for cable laying and ensuring the integrity of these systems. Deep-sea exploration and advanced technologies like subsea power, subsea robotics, ocean bottom cables, repeater systems, and cable maintenance contribute to the success of these projects. Seismic data is also crucial for cable route planning and ensuring the safety of these underwater infrastructure projects. Fiber optic cables are the backbone of these systems, providing high-speed data transmission. In conclusion, the increasing demand for reliable and secure international connectivity is driving the growth of the market, with companies investing in advanced technologies and infrastructure to meet these needs.

What challenges does the Submarine Cable Industry face during its growth?

- The growth of the industry is significantly impacted by the pressing issue of security and cyber threats. These risks pose a substantial challenge that requires the attention and expertise of professionals to mitigate and safeguard against potential damages.

- The market plays a crucial role in facilitating international data traffic, carrying approximately 99% of all communications between continents. These undersea cables are essential for various sectors, including internet connectivity, financial transactions, and government communications. However, their significance also makes them attractive targets for hostile states and cybercriminals, posing significant security challenges. Recently, the UK Joint Committee on the National Security Strategy (JCNSS) launched an inquiry on January 28, 2025, to assess the vulnerabilities of undersea cables and evaluate the country's resilience against potential disruptions. This investigation aims to strengthen the UK's ability to defend critical subsea infrastructure, including shore-based connections.

- Submarine cables rely on advanced fiber optic technology for transmitting data. Cable installation involves cable trenching, regulatory compliance, and cable routing. Cable protection is another essential aspect, ensuring the cables' longevity against natural hazards and human activities. Industry consolidation and cable ownership have been key trends in the market. Regulatory compliance and cable regulation play a significant role in shaping the market dynamics. As the demand for high-speed data transmission continues to grow, the market is expected to witness further advancements in technology, including optical amplifiers and other innovative solutions.

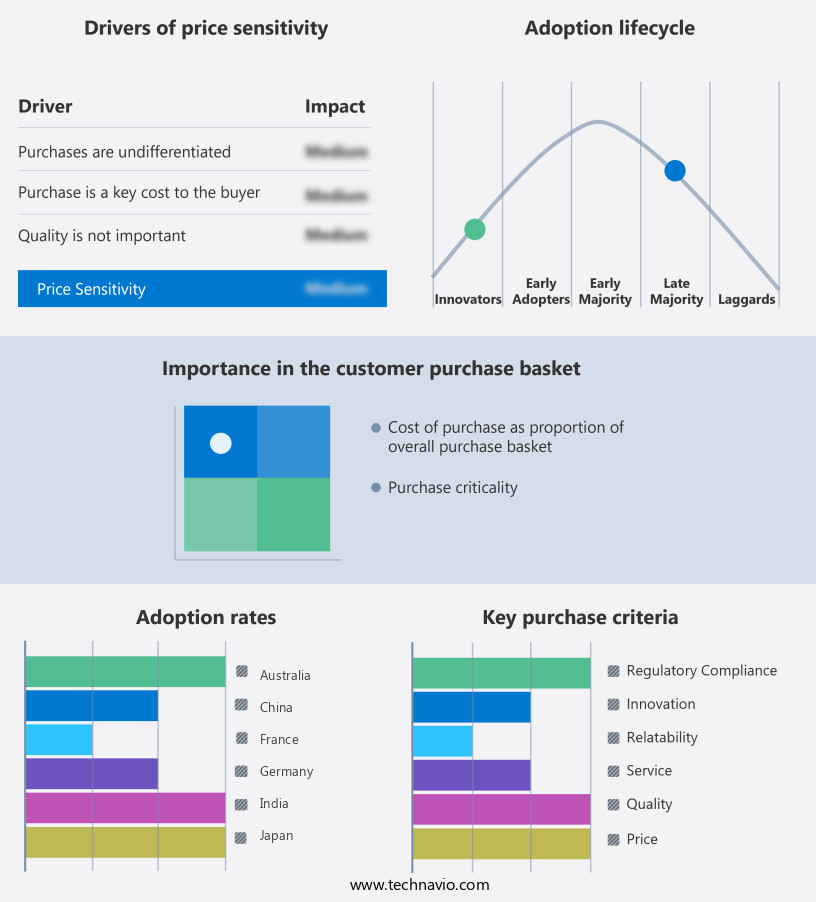

Exclusive Customer Landscape

The submarine cable market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the submarine cable market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, submarine cable market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- SubCom

- NEC Corporation

- Alcatel Submarine Networks

- Prysmian Group

- Nexans

- Amazon

- Microsoft

- Huawei Marine

- Sumitomo Electric

- Ciena

- TE Connectivity

- Xtera Communications

- Global Marine

- Kokusal Cable Ship

- Orange Marine

- Hengtong Group

- Norddeutsche Seekabelwerke

- Cable & Wireless Communications

- ZTT

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Submarine Cable Market

- In March 2023, TE SubCom, a leading submarine cable systems provider, announced the successful deployment of the INDEX Submarine Cable System, connecting Singapore and Jakarta with a record-breaking capacity of 60 Terabits per second (Tbps) . This technological advancement sets a new standard for high-speed international connectivity in the Asia-Pacific region.

- In July 2024, Nokia and Google formed a strategic partnership to develop and manufacture subsea fiber-optic cables for Google's undersea networks. This collaboration is expected to strengthen Nokia's position in the market and enhance Google's network infrastructure.

- In November 2024, the European Union approved the â¬1.3 billion (USD1.47 billion) Horizon Europe project, which includes the development and deployment of several new submarine cables to enhance Europe's digital infrastructure and reduce its dependence on third-party providers. This significant investment marks a key regulatory approval and policy change driving the growth of the European the market.

- In February 2025, Huawei Marine Networks and Angola Cables signed a Memorandum of Understanding (MoU) to collaborate on the development of the SACS-1 submarine cable system, connecting South America, Europe, and Africa . This strategic partnership represents an important geographic expansion for both companies and is expected to significantly improve connectivity between these continents.

Research Analyst Overview

The market encompasses various aspects of design, manufacturing, and maintenance to ensure optimal cable performance and network security. Cable termination plays a crucial role in ensuring reliable connections, while marine cable coating protects against external damage. Cable latency, a key performance metric, is continually improving to enhance communication efficiency. Cable fault localization and cable interoperability are essential for minimizing downtime and maintaining network reliability. Network security measures are increasingly integrated into cable systems to safeguard against cyber threats. Cable manufacturing and cable deployment timeframes are critical factors influencing market dynamics. Subsea cable lifespan is extended through cable protection measures, including burial depth optimization and route survey for hazard assessment.

The submarine cable market is growing rapidly, driven by rising demand from Internet of Things (IoT) and Content Delivery Networks (CDNs). Technologies like Wavelength Division Multiplexing (WDM) enhance data capacity, while Remotely Operated Vehicles (ROVs) and Autonomous Underwater Vehicles (AUVs) support deep-sea cable operations. Transpacific cables remain critical for connectivity. Cable material science advances contribute to improved cable bandwidth capacity and environmental impact assessment. Subsea cable testing and performance monitoring are ongoing processes to maintain cable integrity and ensure optimal network functionality. Cable route optimization and cable performance metrics are essential for minimizing cable cost and maximizing network efficiency. Environmental impact assessments are crucial for sustainable cable deployment and operation. Submarine cable cost is influenced by factors such as manufacturing, deployment, and maintenance expenses. Cable security measures, including cable coating and burial depth, are vital for safeguarding against potential threats. Cable integrity assessment is an ongoing process to ensure cable reliability and prevent cable faults. Subsea cable testing is crucial for verifying cable functionality and identifying potential issues before they cause network disruptions.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Submarine Cable Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

203 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 12.3% |

|

Market growth 2025-2029 |

USD 16749.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

10.9 |

|

Key countries |

US, China, Germany, Japan, UK, Australia, India, France, Brazil, UAE, Rest of World (ROW), Saudi Arabia, France, South Korea, Mexico, Italy, and Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Submarine Cable Market Research and Growth Report?

- CAGR of the Submarine Cable industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the submarine cable market growth of industry companies

We can help! Our analysts can customize this submarine cable market research report to meet your requirements.