Subscription E-Commerce Platform Market Size 2025-2029

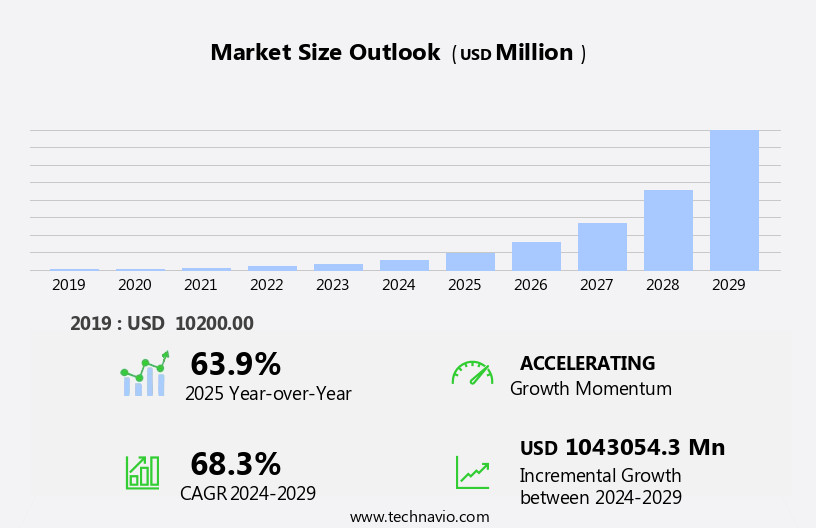

The subscription e-commerce platform market size is forecast to increase by USD 1043.05 billion, at a CAGR of 68.3% between 2024 and 2029.

- The market is witnessing significant growth, driven by the convenience and personalization offered by subscription services. This trend is not limited to traditional industries such as media and entertainment but is expanding into new sectors, including food and beverage, fashion, and home essentials. However, this expanding market comes with its challenges. Increasing competition is intensifying, making it essential for companies to differentiate themselves through innovative offerings and exceptional customer experiences. Additionally, managing complex logistics and ensuring timely delivery of products to subscribers remains a significant hurdle.

- To capitalize on the opportunities and navigate these challenges effectively, companies must focus on delivering personalized experiences, leveraging advanced technologies such as AI and machine learning, and building robust supply chain networks. By doing so, they can not only retain existing customers but also attract new ones in this highly competitive landscape.

What will be the Size of the Subscription E-Commerce Platform Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The subscription e-commerce market continues to evolve, with dynamic market activities shaping its landscape. Seamless integration of various components is crucial for success in this sector. Third-party applications enhance functionality, with data security a top priority. Customer segmentation and email marketing boost customer engagement, while recurring billing ensures a steady revenue stream. A/B testing and targeted advertising boost conversions, fostering customer loyalty through promotional offers and sales forecasting. Order processing relies on robust server infrastructure and customer support, with mobile optimization and personalized recommendations catering to diverse user preferences. Lead generation and discount strategies expand customer bases, while database management and subscription management streamline operations.

How is this Subscription E-Commerce Platform Industry segmented?

The subscription e-commerce platform industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Offline

- Online

- Application

- Beauty and personal care

- Food and beverages

- Clothing and fashion

- Entertainment

- Health and fitness

- Frequency

- Monthly

- Quarterly

- Annual

- Subscription Type

- Replenishment

- Curated

- Access

- Geography

- North America

- US

- Mexico

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- UAE

- APAC

- Australia

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

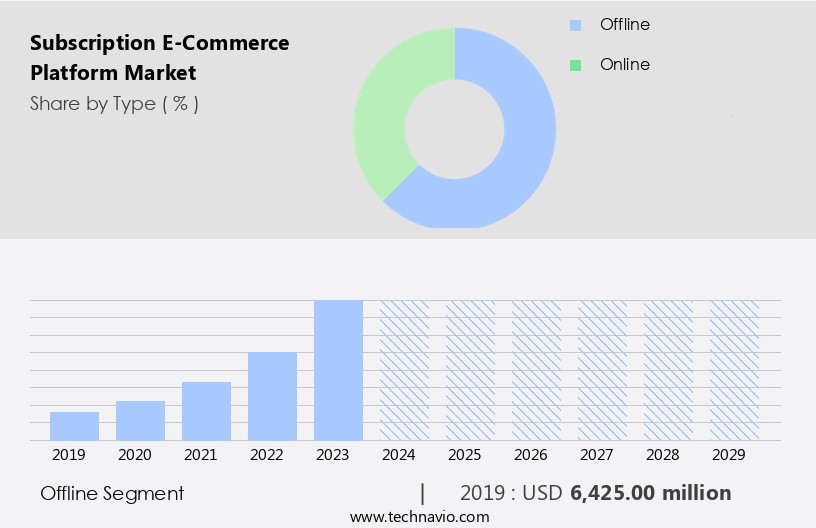

By Type Insights

The offline segment is estimated to witness significant growth during the forecast period.

In the subscription e-commerce market, offline businesses have emerged as a significant segment. Offline mode refers to traditional brick-and-mortar stores offering subscription-based services, catering to the demand for physical presence and personalized experiences. Birchbox is an illustrative example, enabling customers to visit their stores and personally select products for their monthly subscription boxes. FabFitFun, another popular brand, offers seasonal subscription boxes that customers can customize in-store and transact both online and offline. Customer segmentation is crucial, allowing businesses to target specific demographics and preferences. Email marketing and promotional offers are effective tools for retaining customers and driving sales. Recurring billing and subscription management simplify the payment process, while data analytics provide insights for sales forecasting and inventory management.

Third-party applications, such as targeted advertising and personalized recommendations, enhance the user experience. Data security is paramount, with security protocols and compliance regulations ensuring customer trust. Mobile optimization and user interface design are essential for engaging customers on the go. Subscription tiers, pricing models, and customer feedback help build brand loyalty. E-commerce platforms provide various features, including campaign tracking, rating systems, and shipping integrations, to streamline operations and improve customer service.

The Offline segment was valued at USD 6.43 billion in 2019 and showed a gradual increase during the forecast period.

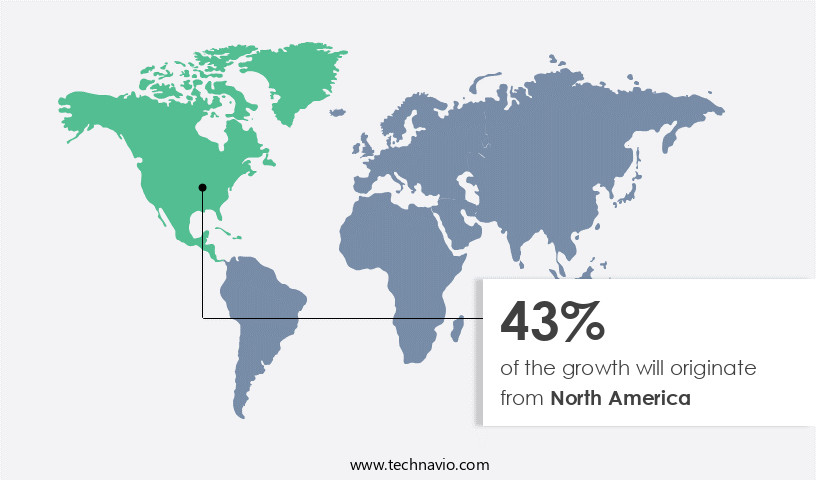

Regional Analysis

North America is estimated to contribute 43% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the global subscription e-commerce market, North America leads with its advanced technology landscape and robust economy. This region's dominance is driven by high internet penetration, extensive smartphone usage, and a consumer preference for convenience and personalization. Subscription services span various sectors, including digital content, beauty and personal care, food and beverages, and health and wellness. Companies in North America utilize technologies like AI and machine learning to deliver superior customer experiences through personalized product recommendations and predictive analytics. This competitive edge, coupled with a strong focus on customer satisfaction, enables North American businesses to maintain a significant market presence.

Subscription platforms in this region offer third-party applications, ensuring seamless integration of additional features. Data security is a top priority, with robust security protocols and compliance regulations in place. Customer segmentation and email marketing strategies help businesses target specific demographics and engage their audience effectively. Recurring billing and sales forecasting tools facilitate efficient revenue management. Order processing and inventory management systems streamline operations, while server infrastructure and customer support ensure a reliable and responsive user experience. Mobile optimization and personalized recommendations cater to the growing number of mobile users. Lead generation, discount strategies, and database management tools help businesses attract and retain customers.

Subscription management, product catalog, and content licensing enable flexible offerings for consumers. API integrations and payment gateways facilitate seamless transactions. Analytics dashboards provide valuable insights into customer behavior and market trends. Marketing automation and campaign tracking help businesses optimize their marketing efforts. Social media integration and content curation foster community building and user engagement. Affiliate marketing and conversion rate optimization strategies boost sales. Fraud prevention and digital asset management ensure secure and efficient operations. Pricing models cater to various business needs, while churn rate analysis helps retain customers. Subscription tiers, customer feedback, email deliverability, and customer onboarding processes enhance the overall user experience.

Customer service chatbots and marketing campaigns cater to diverse customer needs. Shipping integrations and technical support ensure smooth transactions and resolve any issues promptly. In summary, the North American subscription e-commerce market is characterized by technological innovation, customer-centric approaches, and a focus on convenience and personalization. Companies in this region are leveraging advanced technologies and a strong consumer base to maintain a competitive edge in the global market.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the dynamic and ever-evolving world of e-commerce, the subscription business model has emerged as a game-changer. Subscription e-commerce platforms offer customers the convenience of recurring deliveries of products, from groceries and household essentials to fashion, beauty, and tech gadgets. These platforms leverage advanced technologies like AI and machine learning to personalize offerings, predict consumer behavior, and optimize inventory management. They prioritize user experience, seamless payment processing, and flexible subscription plans. Key features include automated reordering, discounts for longer commitments, and customizable delivery schedules. Subscription services cater to diverse niches, including books, arts and crafts, and pet supplies, making them a versatile solution for businesses and consumers alike. With growing consumer preference for convenience and value, the subscription e-commerce market is poised for significant growth.

What are the key market drivers leading to the rise in the adoption of Subscription E-Commerce Platform Industry?

- Subscription services' convenience and personalization are primary factors fueling market growth. The global subscription e-commerce market is driven by the increasing demand for customized and convenient purchasing experiences. Subscription services eliminate the need for repetitive ordering and provide automated deliveries based on preset schedules, offering a time-saving solution for consumers. These platforms collect and utilize client information and preferences to deliver personalized product recommendations and curated selections, enhancing the overall customer experience and fostering feelings of exclusivity and satisfaction. Subscription e-commerce platforms cater to various sectors, including beauty and personal care, clothing and fashion, and others, by providing ease and personalization. They enable brands to build stronger customer relationships through targeted email marketing, customer segmentation, and promotional offers.

- Third-party applications, such as a/b testing, targeted advertising, and sales forecasting, further optimize the customer journey and boost sales. Data security is a crucial aspect of subscription e-commerce platforms, ensuring the protection of sensitive customer information. Server infrastructure, customer support, mobile optimization, and personalized recommendations are essential features that contribute to a seamless and harmonious user experience. Recurring billing and order processing systems ensure a consistent revenue stream for businesses while maintaining a robust and immersive platform.

What are the market trends shaping the Subscription E-Commerce Platform Industry?

- The expansion of subscription models is becoming a significant market trend, with various industries adopting this business model. This shift towards recurring revenue streams is a professional and strategic approach to meet customer needs and ensure business growth.

- The market is witnessing significant growth as businesses in various sectors beyond the conventional areas of healthcare, fitness, and education adopt subscription models. This trend is driven by the increasing customer demand for personalized and convenient experiences. For instance, healthcare subscriptions offer services like medication deliveries, telemedicine consultations, and customized wellness plans. In the realm of fitness, subscriptions provide access to virtual exercise sessions, personalized training plans, and equipment rentals. Education subscriptions grant online courses, skill development programs, and learning materials. These subscription models contribute value, convenience, and customization, leading to increased customer engagement and satisfaction.

- Moreover, advanced features such as lead generation, discount strategies, database management, subscription management, product catalog, content licensing, API integrations, security protocols, search functionality, pay-per-click (PPC), compliance regulations, product discovery, data analytics, automated emails, in-app purchases, and pricing models are essential components of these platforms. Ensuring robust security, seamless integrations, and adherence to regulations are crucial for businesses to build trust and maintain customer loyalty. In conclusion, the market is evolving rapidly as businesses across various industries recognize the potential of subscription models to provide value, convenience, and personalized experiences to their customers. The integration of advanced features and technologies enables businesses to streamline operations, improve customer engagement, and stay competitive in the market.

What challenges does the Subscription E-Commerce Platform Industry face during its growth?

- The intensifying competition in The market poses a significant challenge to the industry's growth trajectory.

- The market is witnessing intense competition due to its saturation, making it challenging for new entrants to differentiate themselves from established players. With numerous options available, clients are spoiled for choice, and new firms must offer unique selling points or innovative strategies to gain a foothold. Churn rate is a significant concern for businesses in this market, emphasizing the need for effective retention strategies. Social media integration, content curation, and affiliate marketing are essential tools for conversion rate optimization. Fraud prevention, digital asset management, and analytics dashboards are crucial for ensuring website performance and security.

- Payment gateways, review management, and campaign tracking are essential features for seamless operations. Inventory management and rating systems are also vital for maintaining customer satisfaction. To succeed in this competitive landscape, new entrants must focus on niche market segments, cutting-edge technology, and exceptional customer service.

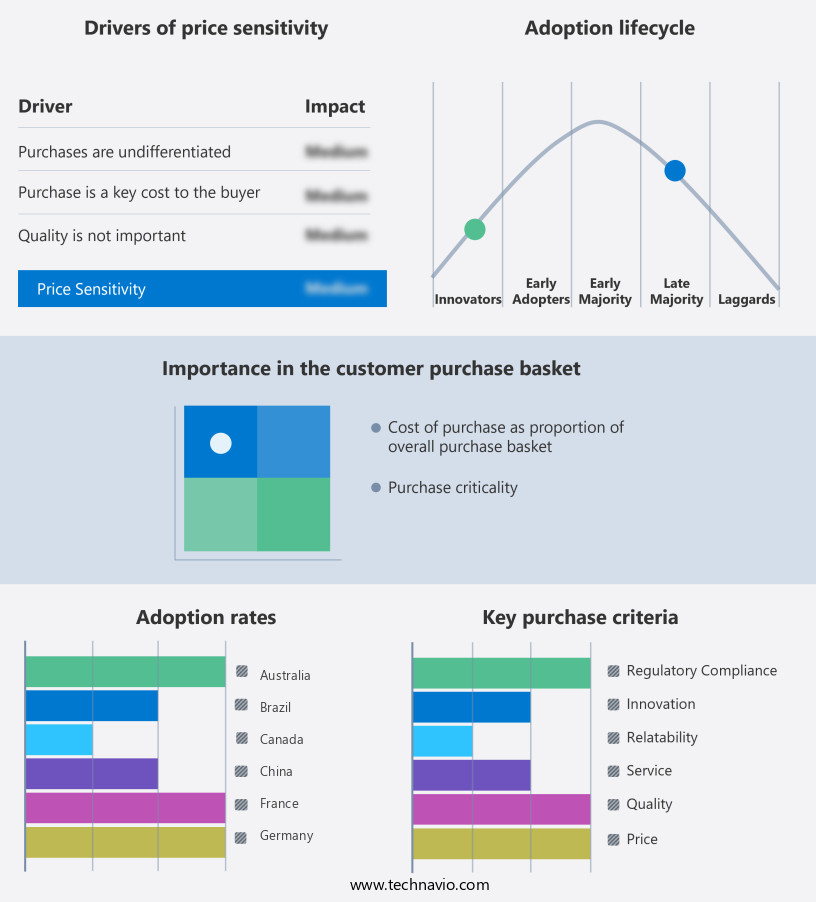

Exclusive Customer Landscape

The subscription e-commerce platform market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the subscription e-commerce platform market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, subscription e-commerce platform market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Amazon Subscribe & Save - The company delivers subscription-based eCommerce platform solutions, including Adobe Commerce. Leveraging AI and advanced data sharing, we create customized B2C and B2B commerce journeys from a unified platform. Flexible, extensible, and scalable, this solution caters to diverse business needs. AI-driven personalization enhances user experience, while data sharing ensures seamless integration across systems. Empower your business with a versatile, intelligent commerce solution.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amazon Subscribe & Save

- BarkBox

- Birchbox

- Blue Apron Holdings Inc.

- Boxed Inc.

- ButcherBox

- Cratejoy Inc.

- Dollar Shave Club (Unilever)

- FabFitFun

- HelloFresh SE

- Ipsy

- JustFab (TechStyle Fashion Group)

- MealPal Inc.

- NatureBox

- Pet Treater

- Stitch Fix Inc.

- The Farmer's Dog

- Thrive Market

- Trunk Club (Nordstrom)

- Winc Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Subscription E-Commerce Platform Market

- In January 2024, Shopify (NYSE: SHOP) announced the launch of Shopify Fulfillment Services, enabling subscription e-commerce platform users to manage their inventory and shipping directly from Shopify, marking a significant push into order fulfillment and logistics (Shopify Press Release, 2024).

- In March 2024, Amazon (NASDAQ: AMZN) and Microsoft (NASDAQ: MSFT) entered into a strategic partnership, with Amazon Advertising becoming the preferred advertising solution for Microsoft's Dynamics 365 and Power Platform users, expanding Amazon's reach in the subscription e-commerce market (Amazon Press Release, 2024).

- In May 2024, ReCharge, a leading subscription e-commerce platform, raised a USD115 million Series D funding round, bringing its total funding to USD240 million, signaling continued investor confidence in the subscription commerce model (Crunchbase, 2024).

- In April 2025, Magento Commerce, an Adobe (NASDAQ: ADBE) company, unveiled its new subscription billing feature, allowing merchants to offer recurring payment options to customers, further strengthening Magento's position as a comprehensive e-commerce solution for businesses (Adobe Press Release, 2025).

Research Analyst Overview

- In the subscription e-commerce market, shipping carriers and push notification services play crucial roles in delivering physical goods and engaging customers in real-time. AI and machine learning technologies power predictive analytics for customer churn prediction and lifetime value estimation. CRM, help desk, marketing automation, and customer support software enable personalized interactions. Compliance and security software ensure data privacy and regulatory adherence. Cloud computing, serverless functions, and big data analytics facilitate efficient operations.

- Product catalog, content licensing, and API integrations expand offerings, with security protocols safeguarding sensitive data. Search functionality, pay-per-click (PPC), and compliance regulations ensure effective product discovery, while data analytics and automated emails provide valuable insights. In-app purchases and pricing models cater to various customer segments, with churn rate a key performance indicator. Social media integration, content curation, and affiliate marketing expand reach, with conversion rate optimization and fraud prevention enhancing efficiency. E-commerce platforms offer analytics dashboards, payment gateways, and review management, enabling effective campaign tracking and rating systems. Inventory management, website performance, push notifications, and user interface (UI) and user experience (UX) design optimize the shopping experience.

- Subscription tiers, customer feedback, email deliverability, and customer onboarding processes further strengthen customer relationships. Customer service chatbots and marketing automation streamline operations, with marketing campaigns and shipping integrations ensuring seamless transactions. Technical support and community building foster long-term customer loyalty, with user authentication and user reviews providing valuable feedback. These evolving patterns continue to shape the subscription e-commerce market, ensuring a dynamic and ever-changing landscape.

- Payment processing platforms and fraud detection software secure transactions. Email marketing services and web/mobile development frameworks expand reach and engagement. E-commerce platforms cater to both digital products and physical goods, integrating various tools to optimize business operations.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Subscription E-Commerce Platform Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

197 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 68.3% |

|

Market growth 2025-2029 |

USD 1043054.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

63.9 |

|

Key countries |

US, China, Germany, Japan, UK, Australia, India, France, Brazil, UAE, Rest of World (ROW), Saudi Arabia, France, South Korea, Mexico, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Subscription E-Commerce Platform Market Research and Growth Report?

- CAGR of the Subscription E-Commerce Platform industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the subscription e-commerce platform market growth of industry companies

We can help! Our analysts can customize this subscription e-commerce platform market research report to meet your requirements.