Supercomputer Market Size 2025-2029

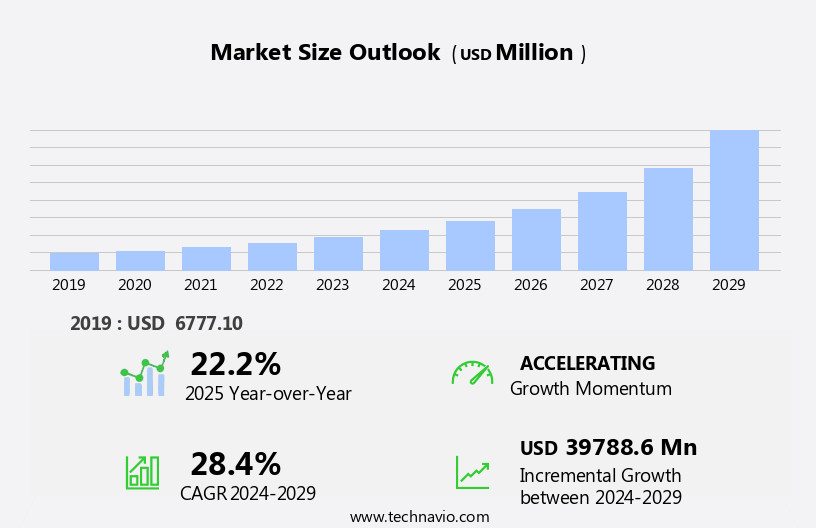

The supercomputer market size is forecast to increase by USD 39.79 billion at a CAGR of 28.4% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing adoption of these systems by commercial customers. This trend is driven by the need for advanced computing capabilities to handle complex data analysis and simulation tasks. However, the market faces challenges in the form of high ownership costs and large power consumption, which contribute to the total cost of implementing supercomputing solutions. Furthermore, the shift towards cloud-based computing is gaining traction, posing a threat to traditional supercomputer companies. Companies seeking to capitalize on market opportunities must focus on offering cost-effective solutions and energy efficiency.

- Additionally, exploring partnerships with cloud providers could be a strategic move to cater to the evolving market landscape. In summary, the market is witnessing robust demand from commercial customers, but high costs and power consumption, along with the rise of cloud computing, present significant challenges that must be addressed to remain competitive.

What will be the Size of the Supercomputer Market during the forecast period?

- The market continues to evolve, driven by advancements in system architecture, data science, and high-performance computing. Parallel processing and machine learning are key technologies fueling this growth, with applications spanning various sectors. Weather forecasting, energy efficiency, and financial modeling benefit from supercomputing's ability to process vast amounts of data. Research institutions and government agencies leverage supercomputing clusters for scientific computing and drug discovery. Cooling systems and power consumption management are crucial considerations for maintaining optimal performance. Compute nodes, memory bandwidth, and data management are essential components of supercomputing infrastructure. AI workloads, including deep learning and neural networks, require significant compute density and storage capacity.

- Quantum computing and edge computing are emerging trends, offering potential for unprecedented processing power and decentralized data processing. Supercomputing's role in data analytics, particularly in big data and life sciences, is increasingly important. Accelerated computing and application programming interfaces streamline software development and improve performance benchmarks. Hybrid computing and fault tolerance ensure uninterrupted operations, while data security and data visualization tools enhance data accessibility and interpretation. Oil and gas industries, energy, and manufacturing sectors are among those harnessing supercomputing's power for optimization and simulation. The ongoing dynamism of the market reflects the continuous integration of advanced technologies and evolving patterns in various industries.

How is this Supercomputer Industry segmented?

The supercomputer industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- OS

- Linux

- UNIX

- Mixed

- Windows

- End-user

- Government entities

- Scientific research and academic institutions

- Commercial industries

- Processor Type

- Intel

- IBM (Power)

- AMD

- Others

- Type

- Vector Processing

- Parallel Processing

- Cluster Computing

- Application

- Scientific Research

- Weather Forecasting

- AI & Machine Learning

- Defense

- Geography

- North America

- US

- Mexico

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- UAE

- APAC

- Australia

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

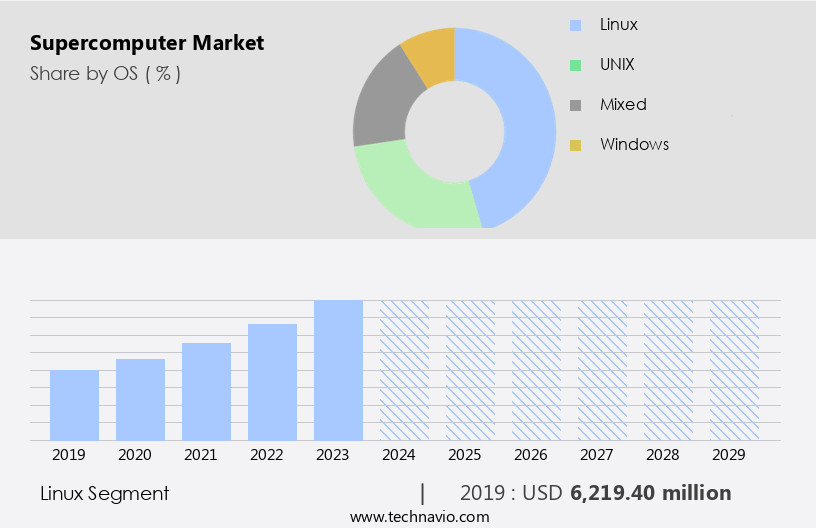

By OS Insights

The linux segment is estimated to witness significant growth during the forecast period.

Supercomputers, essential tools for weather forecasting, scientific research, and energy efficiency, are powered primarily by Linux, as reported by TOP500.Org. The open-source nature of Linux makes it an attractive choice for supercomputer companies due to its versatility and extensive hardware driver support. Linux caters to a wide range of hardware architectures and platforms, from small embedded systems to vast computing arrays. The superior quality and coverage of Linux drivers compared to those on other platforms further strengthen its position. Government agencies and research institutions rely on high-performance computing for data-intensive tasks such as financial modeling, data analytics, and machine learning.

Supercomputers are critical in these areas, enabling advanced data visualization, parallel processing, and memory bandwidth requirements. Moreover, supercomputing clusters are increasingly being used for big data applications in industries like life sciences, oil and gas, and quantum computing. Supercomputers' energy efficiency is a significant concern, with cooling systems and compute density playing essential roles in reducing power consumption. Cloud computing and edge computing are also gaining traction as they offer flexibility and cost savings. Fault tolerance and processor cores are essential considerations for supercomputer design, ensuring system reliability and performance. Supercomputing applications span various domains, including scientific computing, deep learning, and data security.

Software development and application programming interfaces are crucial for unlocking the full potential of these powerful systems. Performance benchmarks provide valuable insights into the capabilities of supercomputers, ensuring they meet the evolving demands of AI workloads and scientific research.

The Linux segment was valued at USD 6.22 billion in 2019 and showed a gradual increase during the forecast period.

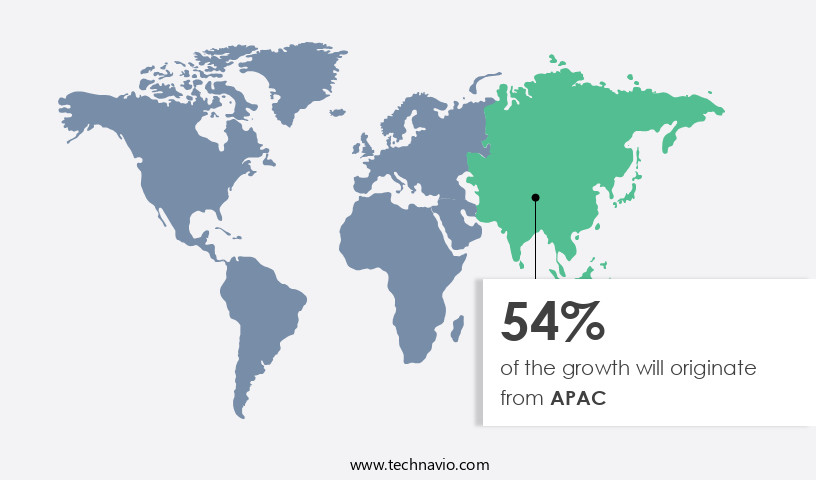

Regional Analysis

APAC is estimated to contribute 54% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in Asia Pacific is witnessing significant growth, with China, Japan, and South Korea leading the charge. China, in particular, has made strides in the field by utilizing its own resources to build supercomputers after restrictions on the import of hardware components. The Chinese government's commitment to supercomputing is evident in its support for research in various sectors, including life sciences and manufacturing. In the past decade, China's presence on the TOP500 list has grown from 28 systems to becoming a global leader. Japan, another technology powerhouse, is also investing heavily in the development of exascale supercomputers.

Energy efficiency is a critical factor in the market, with compute nodes and cooling systems being key areas of focus. Data management, data visualization, and data analytics are essential for handling the massive amounts of data generated by these systems. Artificial intelligence workloads, including machine learning and deep learning, are driving demand for high-performance computing. Government agencies are significant consumers of supercomputing technology, with applications ranging from weather forecasting to scientific computing. Quantum computing and hybrid computing are emerging trends, offering potential for exponential growth in processing power. Memory bandwidth, compute density, and fault tolerance are essential considerations for supercomputing clusters.

The financial sector relies on supercomputing for complex financial modeling, while software development and application programming interfaces enable customized solutions. Big data, oil and gas, and life sciences are other industries benefiting from supercomputing technology. Edge computing and cloud computing are expanding the reach of high-performance computing, making it accessible to a broader audience. Data security is a critical concern, with increasing focus on protecting sensitive information. Power consumption and cooling systems are also essential considerations for supercomputing centers. Supercomputing is a dynamic and evolving field, with research institutions and academic communities playing a crucial role in advancing the technology.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Supercomputer Industry?

- The significant growth in the adoption of supercomputing systems by commercial customers serves as the primary market driver.

- The market is experiencing significant growth due to the increasing demand from various industries for advanced computing capabilities. These systems are essential for complex applications such as weather forecasting, energy efficiency analysis, and artificial intelligence workloads. Government agencies also rely on supercomputers for data management, data visualization, financial modeling, and software development. Leading supercomputer companies are focusing on enhancing memory bandwidth and energy efficiency to cater to the evolving needs of their clients. The ability to handle large data sets and perform complex calculations in a short time frame is crucial for businesses to gain a competitive edge. Key industries, including automotive, manufacturing, pharmaceuticals, and energy, are investing in supercomputers to streamline their operations and improve productivity.

- For instance, Cray, a leading supercomputer company, counts three of the Fortune 500 companies among its customers. These commercial clients represent a significant growth opportunity for the market. Supercomputers are becoming increasingly important for businesses seeking to stay competitive in today's technology-driven economy. As technological advancements continue to reshape industries, businesses must adapt and invest in the latest computing technologies to remain competitive.

What are the market trends shaping the Supercomputer Industry?

- The increasing adoption of cloud technology is a significant market trend in the present business landscape. This shift towards cloud solutions is mandatory for organizations seeking to remain competitive and efficient in their operations.

- Supercomputing is evolving with the adoption of cloud computing, enabling organizations to manage workloads more efficiently. Currently, parallel applications are being executed in the cloud, while complex applications are expected to follow suit in the near future. Cray, a leading supercomputer manufacturer, recently partnered with Microsoft Corp. To expand its reach to Microsoft Azure's customer base. This collaboration allows Cray to offer dedicated Cray XC and CS-Storm supercomputers within Azure, empowering customers to run high-performance computing (HPC) and artificial intelligence (AI) applications alongside their other cloud workloads. The integration of quantum computing, accelerated computing, and big data analytics in high-performance computing is driving innovation in various industries, including life sciences, finance, and energy.

- Application programming interfaces (APIs) are essential for seamless integration of these advanced technologies into existing systems. Compute density, a critical factor in supercomputing, is being optimized to accommodate more processing power in less space. Cloud computing's flexibility, combined with the latest supercomputing technologies, is revolutionizing the way businesses process and analyze data, ultimately leading to better decision-making and increased productivity.

What challenges does the Supercomputer Industry face during its growth?

- The escalating costs associated with high ownership and large power consumption represent a significant challenge to industry growth.

- Supercomputers, characterized by their advanced system architecture, play a pivotal role in data-intensive applications, particularly in data science and scientific computing. Parallel processing, machine learning, and cooling systems are essential components of these high-performance systems. Supercomputing clusters, with their substantial storage capacity, facilitate research institutions' efforts in drug discovery and other complex scientific projects. The cost of acquiring and maintaining a supercomputer is substantial, ranging from USD100 million to USD300 million, inclusive of installation, power consumption, and maintenance. These systems consume around 6-7 megawatts of power on average, with peak usage approaching 9.5 megawatts, leading to an annual energy cost of approximately USD6-USD7 million.

- The energy expense over a supercomputer's lifetime can almost equal the initial investment. The energy demands of a supercomputer escalate with an increase in its computational power. Incorporating these advanced systems into business operations necessitates a significant financial commitment.

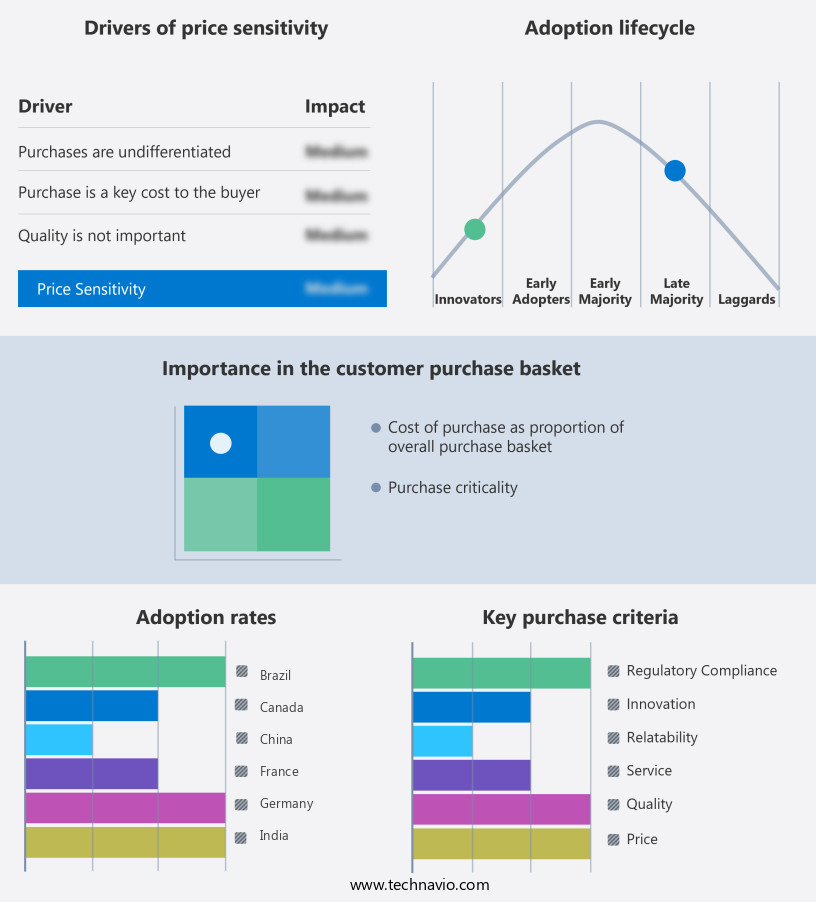

Exclusive Customer Landscape

The supercomputer market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the supercomputer market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, supercomputer market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Hewlett Packard Enterprise Company - The company specializes in advanced computing solutions through its Supercomputing Systems AG product line. Supercomputing Systems AG represents cutting-edge technology, delivering unparalleled processing power and efficiency. These systems are designed to tackle complex computational tasks, enabling groundbreaking research and innovation across various industries. By harnessing the power of high-performance computing, the company empowers organizations to solve intricate problems and gain valuable insights, ultimately driving progress and competitiveness in the global market.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Hewlett Packard Enterprise Company

- IBM Corporation

- Dell Technologies Inc.

- Lenovo Group Limited

- Cray Inc. (HPE)

- Atos SE

- NVIDIA Corporation

- Intel Corporation

- Advanced Micro Devices Inc.

- Fujitsu Limited

- NEC Corporation

- Sugon Information Industry Co. Ltd.

- Bull SA (Atos)

- Hitachi Ltd.

- Silicon Graphics International Corp.

- T-Systems International GmbH

- Eurotech S.p.A.

- Penguin Computing Inc.

- Rescale Inc.

- GIGABYTE Technology Co. Ltd

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Supercomputer Market

- In February 2023, IBM unveiled the new POWER10 processor, powering its latest supercomputer, El Capitan, which reached the number three spot on the Top500 list. This system, installed at Lawrence Livermore National Laboratory, delivers a performance of 2.5 exaflops (Exascale Computing Project, 2023).

- In June 2024, Fujitsu and HPE announced a strategic partnership to collaborate on supercomputing technologies, including co-developing next-generation Arm-based supercomputers and jointly marketing their offerings. This alliance aims to strengthen their positions in the high-performance computing market (Fujitsu, 2024).

- In October 2024, Cray Inc. Was acquired by Hewlett Packard Enterprise for approximately USD1.3 billion. This acquisition significantly expanded HPE's supercomputing capabilities and market share, positioning them as a major player in the exascale computing race (Mergerwire, 2024).

- In December 2025, China's National Supercomputing Center in Guangzhou deployed the Sunway TaihuLight-II supercomputer, reaching a peak performance of 1.1 exaflops. This system is the world's first exascale supercomputer powered entirely by indigenous technology (Xinhua, 2025).

Research Analyst Overview

The market is experiencing significant advancements in resource allocation and performance optimization, driven by the increasing demand for data-driven insights and scientific discovery in various industries. To address this need, companies are focusing on developing advanced system monitoring, cluster management, and security protocols to ensure high availability and data governance. Performance metrics, such as FPGA acceleration and GPU acceleration, are essential for achieving optimal results in deep learning frameworks and machine learning models. Moreover, power management and thermal management are critical considerations in the design of supercomputing systems, as they directly impact system efficiency and reliability.

Hybrid cloud solutions and predictive analytics are also gaining popularity, enabling organizations to leverage the benefits of cloud-based supercomputing while maintaining control over their data and ensuring data privacy. In the realm of research and development, there is a growing emphasis on parallel programming, quantum algorithms, and artificial intelligence to enhance system capabilities and unlock new possibilities. Job scheduling and edge computing infrastructure are also essential components of modern supercomputing systems, enabling real-time processing and analysis of data at the source. Security protocols and software frameworks are crucial for ensuring the protection of sensitive data and maintaining system integrity.

Disaster recovery and machine learning models are also vital for ensuring business continuity and improving overall system performance. Overall, the supercomputing market is dynamic and evolving, with a focus on delivering advanced capabilities and optimizing performance while addressing the challenges of power management, thermal management, and data privacy.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Supercomputer Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

239 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 28.4% |

|

Market growth 2025-2029 |

USD 39788.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

22.2 |

|

Key countries |

US, China, Germany, Japan, UK, Australia, India, France, Brazil, UAE, Rest of World (ROW), Saudi Arabia, France, South Korea, Mexico, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Supercomputer Market Research and Growth Report?

- CAGR of the Supercomputer industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the supercomputer market growth of industry companies

We can help! Our analysts can customize this supercomputer market research report to meet your requirements.