Tank Level Monitoring System Market Size 2024-2028

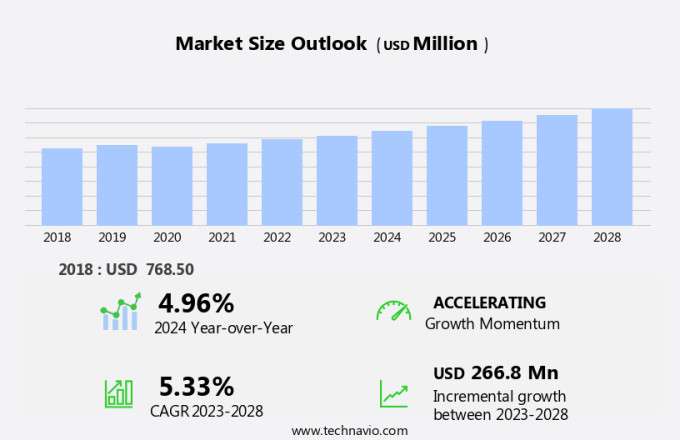

The tank level monitoring system market size is forecast to increase by USD 266.8 billion at a CAGR of 5.33% between 2023 and 2028.

- The market is witnessing significant growth due to the increasing demand from process industries. This trend is driven by the need for real-time inventory management and the prevention of overfilling or underfilling of tanks, which can lead to operational inefficiencies and potential safety hazards. Technological advancements in tank level monitoring systems, such as the integration of IoT and AI, are also contributing to market growth. However, the high cost associated with these systems can be a challenge for smaller businesses and may limit market penetration. Despite this, the benefits of accurate and efficient tank level monitoring are compelling, making it a worthwhile investment for businesses looking to optimize their operations and improve safety.

What will be the Size of the Tank Level Monitoring System Market During the Forecast Period?

- The market encompasses solutions utilized in various industries, including oil and gas, transportation, power generation, mining, chemical plants, pulp and paper, steel mills, and glass manufacturing, to optimize inventory levels and ensure operational efficiency. These systems leverage wireless sensor networks to provide real-time data on tank levels, enabling businesses to make informed decisions on production, logistics, and maintenance. Data analytics and artificial intelligence (AI) technologies are increasingly integrated into tank management solutions, enabling anomaly detection, inventory optimization, and predictive maintenance. Environmental regulations drive the demand for accurate and reliable tank level monitoring systems, particularly In the mining industry and power plants.

- The market is expected to grow significantly due to the increasing focus on automation, real-time data analysis, and regulatory compliance.

How is this Tank Level Monitoring System Industry segmented and which is the largest segment?

The tank level monitoring system industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Oil and gas

- Chemical industry

- Water and wastewater management

- Food and beverage

- Others

- Product

- Non-invasive systems

- Invasive systems

- Geography

- North America

- US

- Europe

- Germany

- France

- APAC

- China

- India

- Japan

- South America

- Middle East and Africa

- North America

By Application Insights

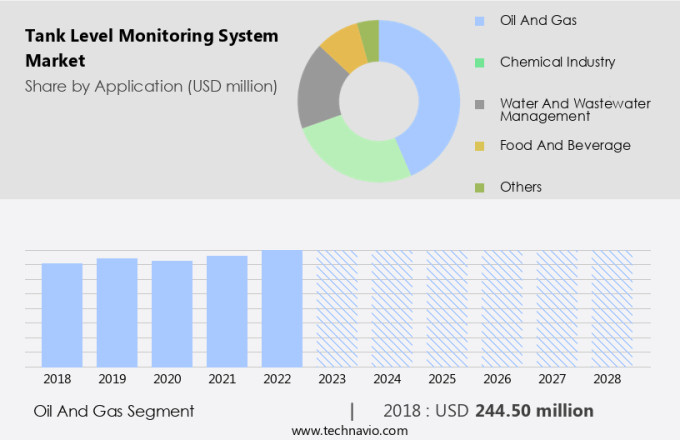

- The oil and gas segment is estimated to witness significant growth during the forecast period.

The market encompasses various industries, with the oil and gas sector holding a substantial share due to the necessity for precise and dependable monitoring of petroleum products, crude oil, LNG, and other hydrocarbon fluids. In this sector, accurate inventory management, prevention of overfills or shortages, and ensuring safety during storage and transportation are crucial. Tank level monitoring systems are integral to achieving these objectives In the intricate and high-risk oil and gas facilities. In addition to oil and gas, industries such as manufacturing, power generation, mining, chemical plants, pulp and paper, steel mills, glass manufacturing, and others employ tank level monitoring systems for inventory optimization, anomaly detection, and regulatory compliance.

Technologies like wireless IoT solutions, ultrasonic transmitters, radar transmitters, wireless sensor networks, data analytics, AI, and tank management solutions are integral to these systems. Industrial automation and Industry 4.0 further enhance their functionality. Compliance with environmental regulations is also a significant factor driving the adoption of these systems.

Get a glance at the Tank Level Monitoring System Industry report of share of various segments Request Free Sample

The Oil and gas segment was valued at USD 244.50 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

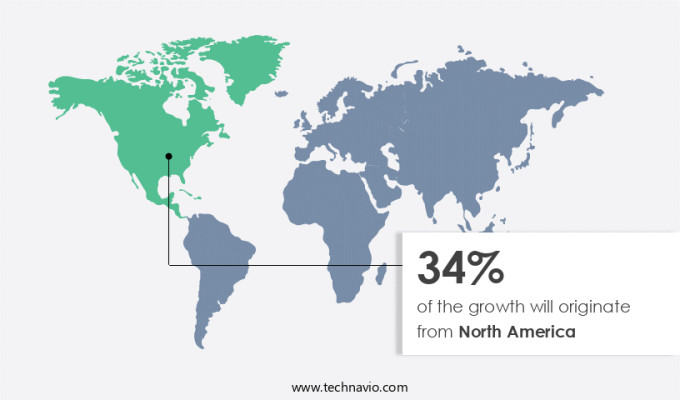

- North America is estimated to contribute 34% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American the market is experiencing significant growth due to increasing demand from sectors such as chemical and food and beverages. The US and Canada are major contributors to this expansion, with their advanced infrastructure and high technological adoption rates. The focus on optimizing fuel usage, cost reduction, and environmental regulation compliance is driving market growth In these countries. The US, being the largest market In the region, benefits from a diverse range of industries, including chemicals, food and beverages, and others. Innovative solutions, such as wireless IoT solutions, ultrasonic transmitters, radar transmitters, and wireless sensor networks, are transforming tank management systems, enabling real-time data analytics, artificial intelligence, and inventory optimization.

The mining and power generation industries are also adopting these technologies to enhance operational efficiency and ensure regulatory compliance.

Market Dynamics

Our tank level monitoring system market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Tank Level Monitoring System Industry?

- The growing demand for tank level monitoring system from process industries is notably driving market growth. Tank level monitoring systems have gained significant traction in various industries, including manufacturing, oil and gas, power generation, mining, chemical plants, pulp and paper, steel mills, glass manufacturing, and wire and cable. These systems employ wireless IoT solutions, ultrasonic transmitters, and radar transmitters to ensure accurate and real-time fluid level monitoring in LNG, petrochemical, and other industrial applications. Wireless sensor networks, data analytics, and artificial intelligence (AI) are integral components of advanced tank management solutions.

- Moreover, anomaly detection and inventory optimization are crucial features that enable environmental regulations compliance and industrial automation in Industry 4.0. The mining industry and power plants significantly benefit from tank level monitoring systems in the transportation segment. Ultrasonic sensors and IoT-powered systems provide static pressure sensing, ensuring efficient and reliable fluid level monitoring. These systems enhance safety, reduce operational costs, and contribute to the overall success of industrial processes. Thus, such factors are driving the growth of the market during the forecast period.

What are the market trends shaping the Tank Level Monitoring System Industry?

- The technological advancements in tank level monitoring system is the key trend in the market. Tank level monitoring systems have gained significant traction in various industries, including manufacturing, oil and gas, power generation, mining, chemical plants, pulp and paper, steel mills, glass manufacturing, and wire and cable. These systems employ wireless IoT solutions, such as ultrasonic transmitters and radar transmitters, to monitor fluid levels in tanks. The power generation sector, particularly in LNG and petrochemical plants, heavily relies on tank management solutions for inventory optimization and environmental regulations compliance. Industrial automation chemical industry and Industry 4.0 have further pushed the adoption of tank level monitoring systems.

- Moreover, IoT-powered systems, including wireless sensor networks and data analytics, enable real-time monitoring and anomaly detection. Artificial intelligence (AI) and static pressure sensing technologies enhance the accuracy and efficiency of these systems. The mining industry and power plants have also adopted tank level monitoring systems in the transportation segment to optimize logistics and ensure safety. Ultrasonic sensors and radar transmitters play a crucial role in fluid level monitoring, while wireless sensor networks facilitate seamless data transfer and analysis. Thus, such trends will shape the growth of the market during the forecast period.

What challenges does the Tank Level Monitoring System Industry face during its growth?

- The high cost associated with tank level monitoring system is the major challenge that affects the growth of the market. Tank level monitoring systems have gained significant traction in various industries, including manufacturing, oil and gas, power generation, mining, chemical plants, pulp and paper, steel mills, glass manufacturing, and wire and cable. These systems employ wireless IoT solutions, such as ultrasonic transmitters and radar transmitters, to monitor fluid levels in tanks. Ultrasonic sensors utilize high-frequency sound waves to measure the distance between the sensor and the fluid surface, while radar transmitters use electromagnetic waves to determine the tank's liquid level.

- However, the transportation segment, particularly in the LNG and petrochemical industries, heavily relies on tank management solutions for inventory optimization and anomaly detection. Data analytics and artificial intelligence (AI) technologies are increasingly integrated into these systems to ensure environmental regulations are met and industrial automation is optimized, aligning with Industry 4.0 trends. Wireless sensor networks facilitate real-time monitoring, enabling timely intervention and reducing operational costs. Tank level monitoring systems are essential for industries that require static pressure sensing, such as mining, power plants, and steel mills, to maintain efficient and safe operations. IoT-powered systems provide accurate, reliable, and cost-effective solutions for fluid level monitoring, enhancing overall industrial productivity. Hence, the above factors will impede the growth of the market during the forecast period.

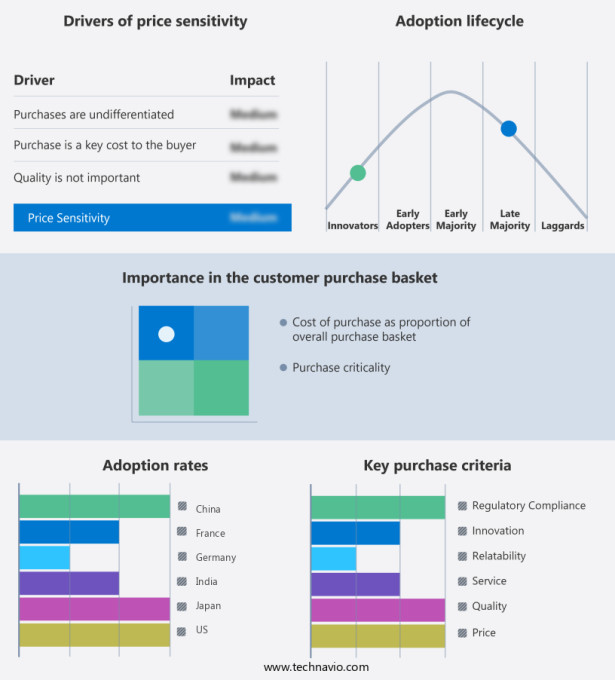

Exclusive Customer Landscape

The tank level monitoring system market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the tank level monitoring system market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, tank level monitoring system market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

ABB Ltd. - Our company specializes in providing advanced Tank Level Monitoring Systems for US industries. Solutions include Guided Wave Radar (GWR), Magnetostrictive, and Ultrasonic level transmitters and switches. These technologies ensure accurate and reliable level measurement, enhancing operational efficiency and reducing costs associated with inventory management and maintenance. GWR transmitters employ non-contact technology for measuring levels in various tank configurations, while Magnetostrictive transmitters deliver high accuracy in applications with difficult-to-measure liquids. Ultrasonic level transmitters and switches provide versatile solutions for various tank sizes and liquid types. By implementing our Tank Level Monitoring Systems, clients can optimize their inventory levels, minimize product losses, and ensure regulatory compliance.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB Ltd.

- AMETEK Inc.

- Automation Products Group Inc.

- Emerson Electric Co.

- Endress Hauser Group Services AG

- FAFNIR GmbH

- Flowline, Inc

- Fuji Electric Co. Ltd.

- Garner Industries LLC

- Gems Sensors Inc.

- Graco Inc.

- Honeywell International Inc.

- IVEDA SOLUTIONS, INC.

- KROHNE Messtechnik GmbH

- L and J Technologies

- Madison Co., Inc.

- Omega Engineering Inc.

- OMNTEC Mfg., Inc.

- Rochester Sensors

- Schneider Electric SE

- Siemens AG

- Tag IT Technologies

- Tek-Trol LLC

- Temposonics LLC

- VEGA Grieshaber KG

- Yokogawa Electric Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a range of applications across various industries, including manufacturing, oil and gas, transportation, power generation, mining, chemical plants, pulp and paper, steel mills, glass manufacturing, and others. In these sectors, accurate and reliable tank level monitoring is crucial for efficient operations, inventory management, and ensuring regulatory compliance. In the manufacturing sector, tank level monitoring systems help optimize production processes by ensuring the timely availability of raw materials and intermediates. These systems enable real-time visibility into inventory levels, reducing the need for manual inspections and minimizing the risk of stockouts or overstocking. The oil and gas industry relies heavily on tank level monitoring systems for the safe and efficient transportation and storage of petroleum products.

Accurate and timely monitoring of fluid levels in pipelines, tanks, and terminals is essential for maintaining operational excellence and ensuring regulatory compliance with environmental regulations. In the transportation sector, tank level monitoring systems play a vital role in ensuring the safe and efficient transport of liquids, such as LNG and petrochemicals. Real-time monitoring of fluid levels helps prevent overfilling or underfilling, reducing the risk of spills and improving overall safety. Power generation industries, including power plants, utilize tank level monitoring systems to ensure the smooth operation of their cooling systems and other essential processes. Accurate and timely monitoring of fluid levels In these applications helps prevent downtime and optimize performance.

In the mining industry, tank level monitoring systems help manage the storage and transportation of various minerals and chemicals. Real-time monitoring of fluid levels in mining ponds and other storage facilities is essential for ensuring safe and efficient operations and minimizing the risk of environmental contamination. The chemical industry requires precise tank level monitoring to maintaIn the safety and quality of their products. Real-time monitoring helps prevent overfilling or underfilling, reducing the risk of spills and ensuring consistent product quality. In the pulp and paper industry, tank level monitoring systems help optimize production processes by ensuring the timely availability of raw materials and intermediates.

Real-time monitoring of fluid levels in various tanks and storage facilities helps prevent downtime and improve overall efficiency. Steel mills and glass manufacturing facilities also rely on tank level monitoring systems to optimize their production processes and ensure the availability of raw materials. Real-time monitoring helps prevent downtime and improve overall operational efficiency. The use of wireless IoT solutions, such as ultrasonic transmitters and radar transmitters, has revolutionized tank level monitoring, enabling real-time data collection and analysis. Wireless sensor networks and data analytics tools help optimize inventory levels, improve operational efficiency, and ensure regulatory compliance. Artificial intelligence (AI) and Industry 4.0

technologies are increasingly being integrated into tank level monitoring systems to enhance their capabilities. Anomaly detection and inventory optimization algorithms help identify potential issues before they become critical, reducing downtime and improving overall operational efficiency. Environmental regulations continue to drive the adoption of tank level monitoring systems across various industries. These regulations require accurate and timely monitoring of fluid levels to prevent spills and minimize the risk of environmental contamination. In conclusion, tank level monitoring systems play a crucial role in various industries, from manufacturing to oil and gas, transportation, power generation, mining, chemical plants, pulp and paper, steel mills, glass manufacturing, and beyond.

Real-time monitoring of fluid levels helps optimize production processes, improve operational efficiency, and ensure regulatory compliance. The integration of IoT solutions, AI, and Industry 4.0 technologies is driving innovation in this space, enabling more accurate and timely monitoring and analysis of fluid levels.

|

Tank Level Monitoring System Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

212 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.33% |

|

Market growth 2024-2028 |

USD 266.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.96 |

|

Key countries |

US, Germany, China, France, Japan, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Tank Level Monitoring System Market Research and Growth Report?

- CAGR of the Tank Level Monitoring System industry during the forecast period

- Detailed information on factors that will drive the Tank Level Monitoring System growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the tank level monitoring system market growth of industry companies

We can help! Our analysts can customize this tank level monitoring system market research report to meet your requirements.