Transparent Electronics Market Size 2024-2028

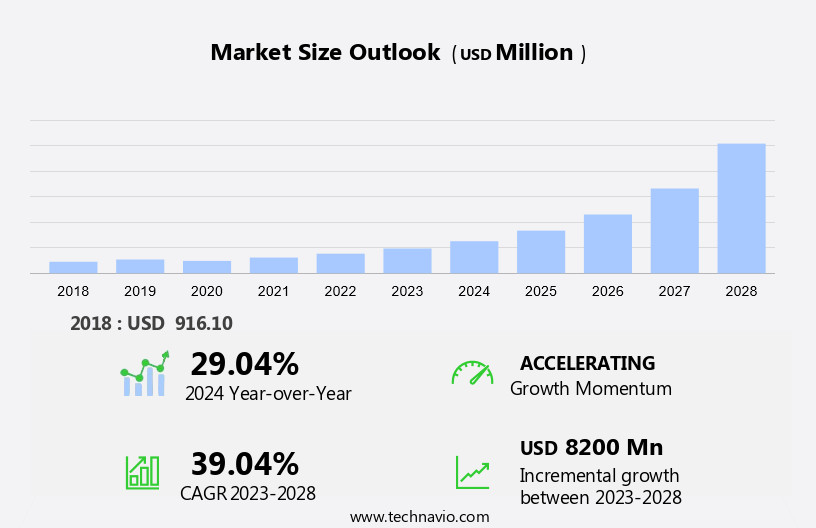

The transparent electronics market size is forecast to increase by USD 8.2 billion, at a CAGR of 39.04% between 2023 and 2028.

- Transparent electronics, a burgeoning technology market, is experiencing significant growth due to several key trends. The increasing adoption of digital signage in various sectors, including retail, healthcare, and transportation, is driving market expansion. companies are also focusing on new product launches to cater to the evolving needs of consumers and industries. However, high costs associated with the production of transparent electronics remain a challenge, which may hinder market growth. Despite this, the future of transparent electronics looks promising, with potential applications in flexible displays, smart windows, and wearable technology. As technology advances and costs decrease, we can expect to see widespread adoption in various industries and applications.

What will be the Size of the Transparent Electronics Market During the Forecast Period?

- The market encompasses a range of technologies, including see-through displays for various applications such as windshield heads-up displays, security systems, and road traffic warnings. Transparent solar cells are another significant segment, focusing on energy conversion efficiency. Keyboard and mouse designs incorporating transparency are gaining traction In the consumer electronic sector, alongside multi-touch technology in smartphones and tablets. Silicon compounds play a crucial role in the development of these products, enabling advancements in transparency and functionality.

- Transparent displays are also finding applications in construction, healthcare, military and defense, augmented reality, advertising, and other industries. The market's growth is driven by the increasing demand for advanced, sleek, and functional consumer electronic products, as well as the potential for energy generation and information dissemination through transparent technologies.

How is this Transparent Electronics Industry segmented and which is the largest segment?

The transparent electronics industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Consumer electronics

- Automotive

- Healthcare

- Others

- Product

- Transparent displays

- Transparent solar panels

- Transparent windows

- Geography

- North America

- US

- APAC

- China

- Japan

- Europe

- Germany

- UK

- South America

- Middle East and Africa

- North America

By Application Insights

- The consumer electronics segment is estimated to witness significant growth during the forecast period.

Transparent electronics technology enables the creation of electronic devices on glass surfaces, revolutionizing various industries. In consumer electronics, this innovation drives the miniaturization trend by integrating touch-enabled functions into devices, replacing traditional keyboards and mice. Transparent conducting oxides (TCOs) such as ZnO, CdO, In2O3, and SnO2 facilitate electricity transmission In these devices. Wide band-gap semiconductors are utilized to achieve invisible circuitry. Transparent electronics applications extend beyond consumer electronics, including smart windows, security systems, the automotive sector, and solar cells.

The market growth is fueled by the increasing use of touch-enable devices, renewable energy sources, and the demand for energy-efficient solutions. Transparent displays, solar panels, and sensors are integral components of this technology, with smartphones, tablets, and wearables leading the adoption. Transparent circuits, touchscreens, and interactive retail displays are also gaining traction. The high cost of production remains a challenge, but advancements in flexible electronics, environmental awareness, and customizable electronics are expected to offset this hurdle.

Get a glance at the Transparent Electronics Industry report of share of various segments Request Free Sample

The consumer electronics segment was valued at USD 436.70 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- APAC is estimated to contribute 39% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in North America held the largest revenue share in 2023, driven by the presence of major market players and the growth of the automotive industry, particularly electric vehicles. The automotive sector's adoption of high-tech features, such as transparent displays, is increasing, providing opportunities for companies to expand their business scope. Research and development activities are intensifying to explore new applications for transparent displays and form partnerships with retailers and display manufacturers. The increasing digitalization of industries like automotive, healthcare, and consumer electronics is further fueling the growth of the regional market. Transparent displays are finding applications in various sectors, including smartphones, tablets, consumer electronic products, smart windows, and automotive.

Technologies like silicon compounds, oxide semiconductors, and transparent circuits are integral to the development of these displays. The market encompasses smartphones, tablets, smart windows, solar cells, batteries, sensors, touchscreens, and smart gadgets, among others. Transparent displays offer benefits such as energy conversion efficiency, enhanced security, and road traffic information, making them suitable for various applications. Key end-users include automotive, healthcare, military and defense, security systems, and construction. The market is expected to grow significantly due to the increasing demand for renewable energy sources, electricity demand, and solar power. Transparent solar panels, which can be embedded on glass surfaces, are a promising area of research and development.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of the Transparent Electronics Industry?

Increasing adoption of digital signage in numerous service sectors is the key driver of the market.

- The market encompasses see-through displays, solar cells, and circuits, gaining traction in various industries, including consumer electronics, automotive, construction, healthcare, military and defense, and security systems. Transparent displays, such as those used in smartphones and tablets, are increasingly popular due to their ability to blend technology with everyday life, offering features like multi-touch technology, camera, flash, and LED indicators on a semi-transparent section. The automotive sector is a significant market for transparent displays, with smartphone companies integrating these technologies into windshields for road traffic warnings, life-saving information, and augmented reality.

- Transparency solar cells, a subset of this market, offers energy conversion efficiency, providing renewable energy sources to meet electricity demand. Transparent circuits, sensors, and touchscreens are also essential components of this market, powering smart windows, smartphones, and other smart gadgets. Despite their high cost, the demand for these technologies is increasing due to their potential to enhance consumer experiences and offer customizable electronics, such as smart textiles and interactive retail displays.

What are the market trends shaping the Transparent Electronics Industry?

The increasing focus of companies on new product launches is the upcoming market trend.

- Transparent electronics, including see-through displays and solar cells, are gaining traction in various industries, particularly In the automotive sector. Innovations in this field are enhancing passenger comfort and safety, with applications ranging from smart windows to road traffic warnings. Transparent circuits, such as those used in smartphones and tablets, are being integrated into consumer electronic products, including keypads, keyboards, mice, and touchscreen devices. Silicon compounds and oxide semiconductors are being used to develop transparent display technology, which is being adopted by smartphone companies for touch-enable devices. The integration of transparent displays into smartphones and other consumer electronics is also driving the development of renewable energy sources, such as solar power, to meet increasing electricity demand.

- Transparent solar panels, which can be embedded on the glass surface of vehicles or buildings, offer a solution for energy conversion efficiency. These panels can be integrated into semi-transparent sections of smart windows, providing additional functionality as sensors, cameras, flash, LED indicators, and light emitters. The automotive industry is investing heavily in research and development to integrate these advanced technologies into their vehicles. Transparent displays are being used for augmented reality applications, advertising, and smart windows. The use of transparent displays in automotive applications is expected to grow, driven by the increasing demand for energy efficiency, environmental awareness, and advanced safety features.

What challenges does the Transparent Electronics Industry face during its growth?

High costs associated with transparent electronics is a key challenge affecting the industry growth.

- Transparent electronics, including see-through displays for windshields and smart windows, are gaining traction in various industries due to their potential to provide life-saving information, warnings, and energy conversion through transparency solar cells. However, the high cost of these solutions has limited their adoption to large commercial enterprises, particularly in smart buildings and automotive sectors. Despite the initial investment challenges, the demand for renewable energy sources and electricity efficiency is driving the market. Transparent solar panels, integrated into smartphone display panels, can serve as a potential solution to address electricity demand.

- In the automotive industry, these solutions can enhance safety and functionality, while in consumer electronics, they can offer touch-enable devices with multi-touch technology and augmented reality. The high cost of transparent electronics is a significant barrier to entry for many industries, including healthcare, military and defense, and construction. However, as the market matures and technology advances, we expect the cost to decrease, making these solutions more accessible to a broader range of applications. The automotive and consumer electronics segments are expected to lead the market growth due to their high demand for advanced features and energy efficiency.

Exclusive Customer Landscape

The transparent electronics market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the transparent electronics market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, transparent electronics market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- BOE Technology Group Co. Ltd.

- Brite Corp.

- Cambrios Technologies Corp.

- ClearLED Inc.

- Corning Inc.

- Gauzy Ltd.

- Gentex Corp.

- LG Electronics Inc.

- OLEDWorks LLC

- Onyx Solar Group LLC

- Panasonic Holdings Corp.

- Planar Systems Inc.

- Pro Display

- RavenWindow

- Samsung Electronics Co. Ltd.

- Shenzhen AuroLED Technology Co. Ltd.

- SHENZHEN NEXNOVO TECHNOLOGY Co. Ltd.

- Street Communication Inc.

- TDK Corp.

- Ubiquitous Energy Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Transparent electronics, a burgeoning technology segment, is gaining significant traction in various industries due to its unique ability to offer functionality without compromising transparency. This technology, which allows for the creation of see-through displays, solar cells, and circuits, among other applications, is poised to revolutionize consumer electronic products and numerous sectors. The integration of transparent electronics in consumer electronic devices, such as smartphones and tablets, presents numerous advantages. For instance, these devices can offer enhanced user experience by allowing users to view essential information, such as notifications or time, without obstructing their view. Moreover, the integration of transparent displays in smartphones and tablets can lead to the development of touch-enabled devices, providing users with a more interactive experience.

Further, transparent electronics also offer significant potential In the automotive sector. Windshields can be transformed into smart windows that display essential road traffic information, life-saving warnings, and even serve as a platform for augmented reality applications. Furthermore, the integration of transparent solar cells into windshields can lead to energy generation while driving, reducing electricity demand and increasing the use of renewable energy sources. The use of transparent electronics extends beyond consumer electronics and automotive applications. In the construction industry, these technologies can be used to create smart windows that regulate temperature and light, providing energy efficiency and environmental awareness.

In healthcare, transparent sensors and displays can be used to monitor patients' vital signs and provide real-time health information. In the military and defense sector, transparent displays can be used for surveillance and communication systems, offering stealth and security benefits. The manufacturing hub for transparent electronics is witnessing significant investment and innovation. Transparent solar panels, for example, are being developed with high energy conversion efficiency, making them a viable alternative to traditional silicon-based solar cells. Transparent circuits, made from oxide semiconductors, are also gaining popularity due to their flexibility and potential for use in wearable devices and interactive retail displays.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

163 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 39.04% |

|

Market Growth 2024-2028 |

USD 8.2 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

29.04 |

|

Key countries |

US, China, Germany, UK, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Transparent Electronics Market Research and Growth Report?

- CAGR of the Transparent Electronics industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the transparent electronics market growth of industry companies

We can help! Our analysts can customize this transparent electronics market research report to meet your requirements.