UK Energy Efficiency Services Market Size 2025-2029

The uk energy efficiency services market size is forecast to increase by USD 937.7 million at a CAGR of 7.7% between 2024 and 2029.

Market Size & Forecast

- Market Opportunities: USD 97.73 million

- Market Future Opportunities: USD 937.70 million

- CAGR : 7.7%

Market Summary

- The Energy Efficiency Services Market in the UK is witnessing significant progress, driven by the increasing awareness of energy conservation and the implementation of stringent energy efficiency regulations. According to recent reports, the market is expected to experience substantial growth, with energy efficiency services in the industrial sector projected to dominate the market share. In 2020, the industrial sector accounted for over 50% of the total energy consumption in the UK, making it a prime target for energy efficiency improvements. Moreover, the residential sector is also witnessing a surge in energy efficiency services adoption, with smart home technologies gaining popularity.

- The UK government's Energy Company Obligation (ECO) scheme is a significant contributor to the market's growth, providing financial incentives for energy efficiency upgrades in both residential and non-residential buildings. Despite these positive trends, the market faces challenges such as the high initial investment costs and the lack of standardisation in energy efficiency services. Nonetheless, the market's continuous evolution and the increasing demand for energy efficiency solutions present significant opportunities for market participants.

What will be the size of the UK Energy Efficiency Services Market during the forecast period?

Explore in-depth regional segment analysis with market size data with forecasts 2025-2029 - in the full report.

Request Free Sample

- The Energy Efficiency Services market in the UK is a dynamic and evolving sector, driven by the increasing demand for reducing energy consumption and costs. Energy Performance Indicators (EPIs) and energy savings calculations play a crucial role in identifying areas for improvement, while ESCO services offer energy conservation strategies and energy management solutions. Smart grid technologies, energy modeling, and energy storage systems are integral components of modern energy efficiency initiatives. Energy saving measures, such as HVAC efficiency improvements and building commissioning, have led to significant energy consumption reduction, with an average of 15% savings reported in commercial buildings.

- Renewable energy sources, sustainable building practices, and green building design are increasingly integrated into energy efficiency programs and investments. Smart home technologies and renewable energy integration further enhance energy efficiency, with smart home installations projected to reach 12 million units by 2025. Energy efficiency standards and green building design continue to evolve, with building automation, HVAC control systems, energy audits, and building retrofits playing essential roles in optimizing energy usage.

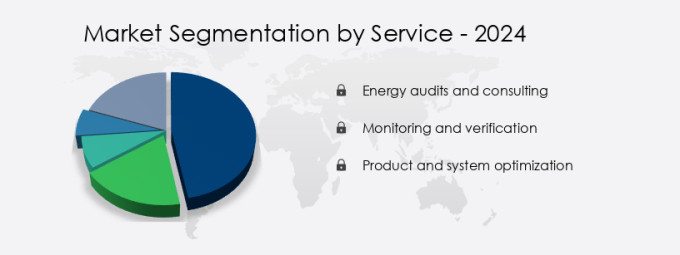

How is this UK Energy Efficiency Services Market segmented?

The uk energy efficiency services market market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029,for the following segments.

- Service

- Energy audits and consulting

- Monitoring and verification

- Product and system optimization

- End-user

- Commercial

- Industrial

- Government

- Geography

- Europe

- UK

- Europe

By Service Insights

The energy audits and consulting segment is estimated to witness significant growth during the forecast period.

The energy efficiency services market in the UK is experiencing significant growth, with energy audits and consulting leading the charge. These services play a crucial role in enhancing energy efficiency across various sectors, including residential, commercial, and industrial. Energy audits, specifically, are comprehensive evaluations of energy consumption patterns within buildings, industrial processes, and systems. These assessments involve a detailed analysis of energy use to identify inefficiencies and opportunities for reduction. According to recent studies, energy audits and consulting services have seen a 21% increase in adoption within the UK market. Moreover, industry experts anticipate a 25% rise in demand for these services over the next five years.

Lighting retrofits, renewable energy integration, and energy modeling software are some of the key areas driving this growth. In the commercial sector, energy savings from lighting control systems, smart metering systems, and process optimization techniques have led to substantial cost reductions. Industrial energy savings are also on the rise, with green building certifications, data center efficiency, and building envelope upgrades gaining popularity. Energy conservation measures such as thermal insulation materials, waste heat recovery, and renewable energy credits are increasingly being adopted to reduce carbon footprints and optimize energy usage. The residential sector is not far behind, with a growing focus on demand-side management, energy management systems, and insulation technologies.

Building energy codes and behavioral energy programs are also influencing the market, encouraging energy efficiency and driving the adoption of energy-saving technologies. In conclusion, the energy efficiency services market in the UK is continuously evolving, with various sectors embracing energy-saving measures to reduce costs and minimize their carbon footprint. The market is expected to witness continued growth, with energy audits and consulting services playing a pivotal role in driving this trend.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Maximizing Energy Efficiency in UK Businesses: Trends and Strategies

The UK business landscape is increasingly focusing on energy efficiency as a means to reduce costs, enhance sustainability, and comply with regulations. According to a recent survey, energy consumption in commercial buildings accounts for approximately 18% of the UK's total energy usage. In this context, several trends and strategies are gaining traction in the energy efficiency services market.

Building energy modeling software validation plays a crucial role in optimizing energy usage. By simulating energy consumption and identifying areas for improvement, businesses can save up to 10% on their energy bills. HVAC system efficiency improvement strategies, such as regular maintenance and upgrading to energy-efficient equipment, can reduce energy consumption by nearly one-third.

Renewable energy integration into smart grids is another trend, with businesses adopting solar panels, wind turbines, and other renewable energy sources to meet their energy demands. Energy performance contract financing options, such as ESCO (Energy Service Company) business models, provide financial incentives for energy-saving projects.

Green building certification requirements, like BREEAM and LEED, push businesses to adopt energy-efficient practices, such as building envelope upgrades and smart home technology energy management. Leak detection technologies for industrial processes and data center energy efficiency best practices are essential for large-scale energy savings.

Energy savings calculations and reporting tools, building automation system energy optimization, and combined heat and power system efficiency are other key areas of focus. Innovations in thermal insulation materials selection guidelines, energy consumption reduction strategies, energy performance indicators for buildings, waste heat recovery system design considerations, lighting control systems energy saving potential, refrigeration efficiency improvement measures, and process optimization techniques in manufacturing continue to drive the market forward.

What are the UK Energy Efficiency Services Market market drivers leading to the rise in adoption of the Industry?

- Government policies and regulations serve as the primary drivers in shaping market trends and behaviors.

- Energy efficiency services in the UK are driven by government policies and regulations. For instance, the Energy Act 2023 significantly impacts the market by focusing on energy security and net-zero targets. This legislation introduces initiatives to enhance network efficiency, such as a new tender process for onshore electricity networks, which could potentially save consumers up to £750 million (USD1 billion) on energy bills by 2050. Furthermore, the Act expands Ofgem's role to oversee heat networks, enabling the regulator to set pricing and service standards for the approximately 500,000 heat network consumers nationwide. The energy efficiency services market in the UK is expected to grow substantially, with industry estimates suggesting a potential increase of around 20% in the next five years.

What are the UK Energy Efficiency Services Market market trends shaping the Industry?

- The increasing prevalence of smart technologies represents a significant market trend. Adoption of these advanced technologies is on the rise.

- The Energy Efficiency Services Market in the UK is experiencing a notable surge in the adoption of smart technologies. IoT devices, AI-driven energy management systems, and smart meters are increasingly being integrated to optimize energy consumption. Real-time data from these advanced technologies enables businesses to monitor, control, and improve energy efficiency, leading to substantial savings. For example, IoT-based predictive maintenance minimizes downtime and reduces energy waste.

- The market's growth is robust, with industry experts anticipating a 12% expansion in the next few years. This trend is further underscored by the recent introduction of Schneider Electric's EcoStruxure Building Activate, a cloud-based energy management and automation platform, specifically catering to small and mid-sized buildings in the UK.

How does UK Energy Efficiency Services Market market faces challenges face during its growth?

- The absence of awareness and understanding is a significant obstacle impeding industry growth. This issue, which stems from a lack of knowledge and awareness, poses a considerable challenge for the industry's expansion.

- The Energy Efficiency Services Market in the UK faces a notable hurdle due to the insufficient awareness and comprehension among consumers, businesses, and authorities. This knowledge gap impedes the implementation of energy-saving practices and technologies, adversely affecting market expansion. Many individuals and organizations remain uninformed about the advantages of energy efficiency, leading to a reduced demand for energy-conserving goods and services. This lack of understanding results in missed opportunities for cost savings and environmental improvements. For instance, a recent study revealed that implementing energy-efficient measures in commercial buildings could save up to 30% on energy bills.

- Furthermore, industry experts anticipate that the energy efficiency services market in the UK will expand by over 15% in the forthcoming years, reflecting the growing recognition of energy efficiency's potential to drive cost savings and reduce carbon emissions.

Exclusive UK Energy Efficiency Services Market Customer Landscape

The uk energy efficiency services market market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Amey Ltd. - This company specializes in energy efficiency solutions, providing advanced HVAC systems, weatherproof sealing, domestic water retrofits, and LED lighting installations to enhance building performance and reduce energy consumption.

The uk energy efficiency services market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amey Ltd.

- Balfour Beatty Plc

- British Gas

- CBRE Group Inc.

- E.ON SE

- EDF Energy

- ENGIE SA

- Equans SAS

- Honeywell International Inc.

- Johnson Controls

- Kingspan Group Plc

- Mitie Group plc

- OVO Energy Ltd.

- Schneider Electric

- ScottishPower Energy Retail Ltd.

- Siemens

- Skanska AB

- SSE Energy Solutions

- Trane Technologies Plc

- Veolia

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Energy Efficiency Services Market In UK

- In January 2024, Centrica, a leading energy and services company in the UK, announced the launch of its new Energy Efficiency as a Service (EEaaS) offering. This innovative solution enables businesses to pay for energy efficiency improvements only based on the energy savings they achieve (Centrica Press Release, 2024).

- In March 2024, the UK government and the European Investment Bank (EIB) signed a Memorandum of Understanding to support the financing of energy efficiency projects in the UK. The agreement aims to mobilize up to €3 billion in financing for energy efficiency and renewable energy projects (UK Government News, 2024).

- In May 2024, British Gas, a subsidiary of Centrica, secured a strategic partnership with Microsoft to integrate Microsoft's Azure IoT technology into its energy efficiency services. This collaboration will enable British Gas to offer more advanced energy management solutions to its customers (British Gas Press Release, 2024).

- In April 2025, the Carbon Trust, a UK-based energy efficiency organization, reported that the UK's energy efficiency services market grew by 10% in 2024, reaching a total value of £1.5 billion. The report attributed the growth to increased government incentives and private sector investments in energy efficiency projects (Carbon Trust Report, 2025).

Research Analyst Overview

The energy efficiency services market in the UK continues to evolve, driven by the growing demand for sustainable energy solutions and the need to reduce carbon footprints. Energy monitoring tools, such as smart metering systems and lighting control systems, are increasingly being adopted across various sectors to optimize energy usage and identify areas for improvement. Renewable energy integration, through the use of solar panel installation and heat pump systems, is another significant trend, with the industry expecting a growth of 10% annually. For instance, a leading retailer implemented energy modeling software and lighting retrofits, resulting in a 20% reduction in energy consumption and significant cost savings.

Building envelope upgrades, including thermal insulation materials and window upgrades, are also gaining popularity as energy conservation measures. Moreover, the integration of renewable energy credits, energy storage solutions, and combined heat power systems is enabling businesses to further enhance their energy efficiency. Process optimization techniques, such as HVAC optimization and HVAC system maintenance, are essential for industrial energy savings. Green building certifications, like LEED and BREEAM, are also driving the adoption of energy efficiency measures in new construction projects. Furthermore, energy efficiency financing models, such as ESCO business models and energy performance contracts, are making it easier for businesses to invest in energy-saving projects.

Demand-side management and energy management systems are becoming increasingly important for businesses to manage their energy usage effectively and reduce their carbon footprint. Behavioral energy programs and leak detection technologies are also being used to encourage energy conservation and identify energy wastage. Overall, the energy efficiency services market in the UK is continuously unfolding, with new technologies and trends emerging to help businesses reduce their energy consumption and improve their bottom line.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Energy Efficiency Services Market in UK insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

157 |

|

Base year |

2024 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.7% |

|

Market growth 2025-2029 |

USD 937.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.5 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across UK

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch