US Agricultural Machinery Market Size 2024-2028

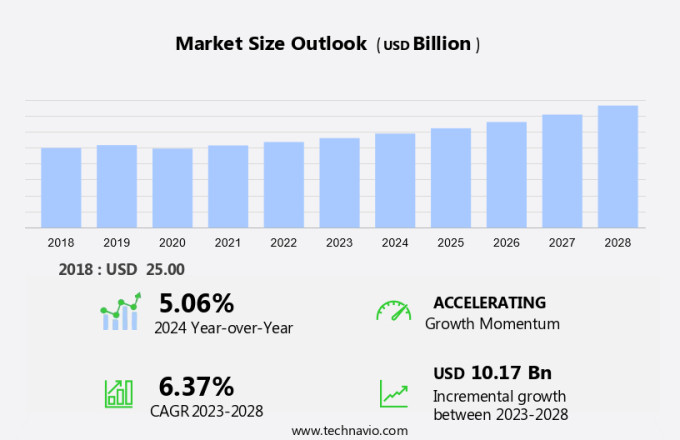

The US agricultural machinery market size is forecast to increase by USD 10.17 billion at a CAGR of 6.37% between 2023 and 2028.

- The agricultural machinery market in the US is witnessing significant growth due to the increasing adoption of advanced machinery. This trend is driven by the need for higher productivity and efficiency in farming operations. Moreover, the integration of data analytics and artificial intelligence (AI) in agricultural machinery is gaining momentum, enabling farmers to make data-driven decisions and optimize their yields. However, the high initial costs of purchasing and maintaining these advanced machines pose a challenge for small and medium-scale farmers.

- Moreover, emission regulations, such as TREM Stage-IV, are also influencing the market, pushing manufacturers to develop machines that comply with these standards. The US government's Farm Service Agency's FAME scheme is further encouraging the adoption of bio-diesel and other alternative fuels, which are more environmentally friendly and reduce the carbon footprint of agricultural machinery. Companies like CNH Industrial and JFarm Service are at the forefront of this innovation, offering advanced machinery and services to help farmers optimize their operations and increase their profits.

What will be the size of the market during the forecast period?

- The agricultural machinery market in the United States is experiencing significant growth due to several factors. With a focus on enhancing food production to ensure security for the growing population and addressing labor shortages, large-scale farming operations are increasingly relying on mechanization. Arable land in the US is vast, making the efficient use of resources essential. Agricultural machinery plays a crucial role in maximizing productivity on these lands. Mechanization of agriculture has become a necessity for farmers to maintain competitiveness and reduce operational costs. The labor force in the agricultural sector is shrinking, leading to a higher demand for machinery that can perform multiple tasks. Pre-owned agriculture equipment is also gaining popularity due to its affordability and availability. The Inflation Reduction Act, a US legislation, is expected to boost the agriculture machinery market. The act includes provisions for incentives and subsidies for farmers to invest in modern agricultural equipment and technologies. Farmers are turning to rental services like MacAllister Rentals and Farmkart to access the latest machinery without the upfront costs.

- Moreover, emission regulations, such as Tier 4, are driving the demand for advanced tractor models. The agriculture economy in the US is showing positive signs, with farmers investing in modern machinery to increase yields and reduce operational costs. Agriculture machinery and equipment are becoming essential components of modern farming operations. The US market for agriculture machinery is diverse, with key players like CNH Industrial, Kubota, and others offering a wide range of products. Farmers are increasingly adopting machinery to improve productivity, reduce labor requirements, and ensure optimal use of resources. In conclusion, the agricultural machinery market in the United States is witnessing steady growth due to factors such as the need for food security, labor shortages, and the availability of financing options. The market is expected to continue growing as farmers invest in modern machinery to enhance productivity and reduce operational costs.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Land development and seedbed preparation

- Sowing and planting

- Harvesting and threshing

- Others

- Type

- Tractors

- Harvesting

- Haying machinery

- Planting and fertilizing machinery

- Plowing and cultivating machinery

- Geography

- US

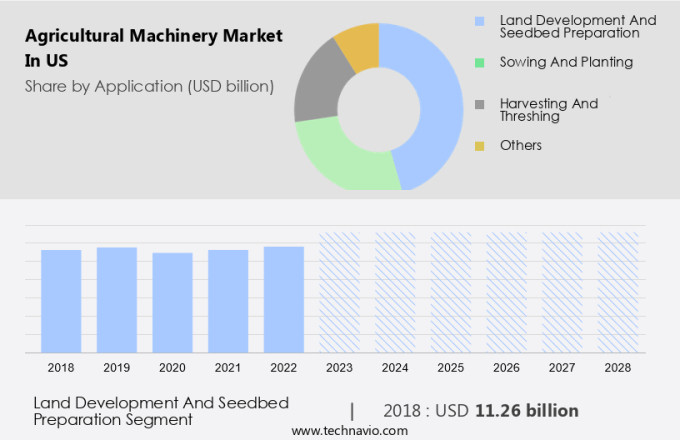

By Application Insights

- The land development and seedbed preparation segment is estimated to witness significant growth during the forecast period.

In the United States, the agricultural sector has seen an expansion in farm sizes due to various factors, including economies of scale and consolidation among farmers. To effectively manage larger acreages, farmers rely on advanced agricultural equipment for land development and seedbed preparation. The agriculture industry is continuously striving to enhance yields and optimize land utilization. Agricultural machinery is a vital component in the preparation of land for intensive farming practices, such as precision agriculture, high-density planting, and controlled-environment cultivation.

Moreover, innovations in agricultural machinery, including GPS guidance systems, automated steering, variable rate technology, and precision planting equipment, have significantly improved the efficiency and accuracy of land development and seedbed preparation processes. This, in turn, has led to a growing demand for sophisticated agricultural equipment among farmers.

Get a glance at the market share of various segments Request Free Sample

The land development and seedbed preparation segment was valued at USD 11.26 billion in 2018 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of US Agricultural Machinery Market?

Rising adoption of advanced agricultural machinery is the key driver of the market.

- In the United States, the agricultural machinery market is witnessing significant growth due to the increasing focus on food security and the need to maximize productivity on arable land. Large-scale farming operations are turning to mechanization to address labor force challenges and improve efficiency. Advanced agricultural machinery is playing a pivotal role in this transition, with technologies such as GPS guidance systems, precision farming tools, telematics, and automation solutions becoming increasingly common. These innovations enable farmers to optimize resource usage and enhance operational efficiency, leading to higher yields, improved resource utilization, and reduced environmental impact. CNH Industrial and other key players in the market are at the forefront of providing farmers with these advanced solutions.

- Moreover, by utilizing data-driven insights and real-time monitoring, farmers can make informed decisions regarding crop management, resulting in more effective use of inputs and improved overall farm performance. This trend is expected to continue as the agricultural industry continues to prioritize food security and productivity.

What are the market trends shaping the US Agricultural Machinery Market?

The rising integration of data analytics and artificial intelligence with agricultural machinery is the upcoming trend in the market.

- In the agricultural sector of the United States, the implementation of advanced technologies, such as data analytics and artificial intelligence (AI), is revolutionizing farming practices. Farmkart, among other key players, is equipping agricultural machinery with sensors, GPS technology, and AI algorithms to collect and analyze data in real-time. This data enables farmers to make informed decisions regarding planting, fertilizer application, irrigation, and pest management. The Farming community in the US is increasingly adopting data-driven approaches to optimize crop yields and profitability. Emission regulations, such as TREM Stage-IV, are driving the demand for advanced agricultural machinery. Furthermore, government initiatives like the FAME scheme are encouraging the adoption of AI and data analytics in agriculture.

- Moreover, JFarm Service, CNH Industrial, and other industry leaders are integrating AI and data analytics into their offerings to cater to the evolving needs of farmers. By analyzing historical data and monitoring current conditions, farmers can identify factors that impact productivity, such as soil quality, moisture levels, and weather patterns. This information allows farmers to adjust their cultivation practices and inputs to maximize yield potential and profitability. In conclusion, the integration of data analytics and AI in agricultural machinery is transforming farming practices in the US. This technology empowers farmers with actionable insights, enabling them to make data-driven decisions and optimize crop yields. Emission regulations and government initiatives are fueling the demand for advanced agricultural machinery, and industry leaders are responding by integrating AI and data analytics into their offerings.

What challenges does US Agricultural Machinery Market face during the growth?

High initial costs of agricultural machinery are key challenges affecting the market growth.

- The agricultural machinery market in the US faces a challenge due to the significant expense of equipment, particularly tractors, which can hinder small to medium-sized farmers' ability to invest. Tractor costs in the US range from USD30,000 to USD150,000, depending on factors like size, horsepower, features, and brand. This financial barrier limits farmers' access to modern mechanized farming machinery and technologies, impeding their adoption and market expansion. Moreover, ongoing expenses, such as fuel, maintenance, and repairs, add to the financial burden of owning and operating advanced agricultural machinery.

- Moreover, major agricultural machinery manufacturers, such as Kubota and Claas Group, offer financing and rental options through partners like MacAllister Rentals to help farmers manage costs. In the US, initiatives like the Inflaation Reduction Act may provide financial assistance to farmers to invest in new machinery. Additionally, organizations like KhetiGaadi and etHekwini Municipality in other regions offer affordable machinery solutions and financing options. By exploring these resources, farmers can invest in modern agricultural machinery and technologies, improving their productivity and competitiveness.

Exclusive US Agricultural Machinery Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market. The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AGCO Corp.

- Caterpillar Inc.

- CLAAS KGaA mBH

- CNH Industrial N.V.

- Daedong Corp.

- Deere and Co.

- Doosan Corp.

- HORSCH Maschinen GmbH

- J C Bamford Excavators Ltd.

- Kinze Manufacturing Inc.

- Kubota Corp.

- LS Tractor USA

- Mahindra and Mahindra Ltd.

- The New York Blower Co.

- Vermeer Corp.

- Yanmar Holdings Co. Ltd.

- Zetor North America

- EQUIPMENT TECHNOLOGIES INC.

- GVM Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The agricultural machinery market in the US is experiencing significant growth due to the increasing focus on large-scale farming and mechanization to enhance productivity and ensure food security on arable land. The labor force in agriculture is shrinking, leading farmers to adopt advanced machinery and equipment to reduce manual labor requirements. CNH Industrial, Kubota, and Claas Group are major players in the market, offering a range of tractors and farm mechanization solutions. The Inflation Reduction Act and the Farm Bill have provided incentives for farmers to invest in precision agriculture, IoT applications, GPS solutions, and AI-based equipment. Pre-owned agriculture equipment is also gaining popularity due to its affordability.

In summary, emission regulations, such as Tier 4, are driving the demand for advanced machinery and equipment. Precision farming, farm service agencies, and JFarm Service are key players in the agriculture economy, offering services and solutions to farmers. The economic survey reveals that the agriculture machinery and equipment sector contributes significantly to the Gross Domestic Product. Farmkart, Macallister Rentals, Khetigaadi, and Ethekwini Municipality are other notable players in the market.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

139 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.37% |

|

Market growth 2024-2028 |

USD 10.17 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.06 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across US

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch