US Food Truck Services Market Size 2024-2028

The US food truck services market size is forecast to increase by USD 634.8 million, at a CAGR of 7.44% between 2023 and 2028.

- The Food Truck Services Market in the US is experiencing significant growth, driven primarily by the increasing demand for mobile food services. This trend is fueled by consumers' preferences for convenient, affordable, and diverse culinary options. Moreover, food trucks offer unique and innovative menus, often featuring ethnic and fusion cuisine, which caters to the evolving palates of consumers. Another key driver in the market is the strategic partnerships among companies. These collaborations foster innovation, enhance brand visibility, and create synergies that benefit both parties. However, the market is not without challenges. The potential for food contamination poses a significant risk to both companies and consumers.

- Ensuring food safety and maintaining stringent hygiene standards are essential to mitigate this risk and maintain consumer trust. Companies seeking to capitalize on market opportunities must prioritize food safety measures and invest in robust quality control systems. Effective operational planning, including efficient logistics and inventory management, is also crucial to remain competitive in the dynamic food truck services market.

What will be the size of the US Food Truck Services Market during the forecast period?

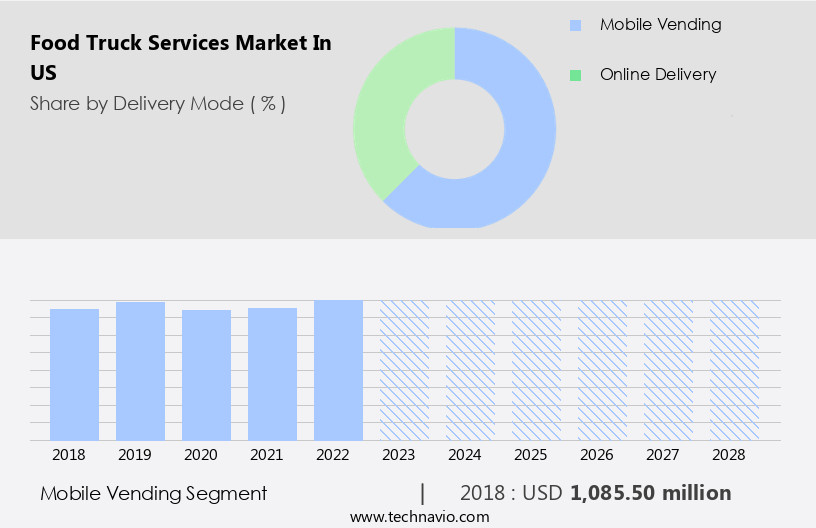

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

- The food truck services market in the US continues to evolve, with mobile kitchens gaining significant social media popularity. These mobile kitchens offer cooking facilities, catering to the growing demand for a mobile lifestyle. Specialty beverages and gourmet food trucks are becoming increasingly common, providing an alternative to traditional local fast food. Online food ordering systems enable customers to easily place orders, enhancing the convenience of mobile food services.

- Female employees are making their mark in this industry, contributing to its diversity. Urban areas serve as hotspots for food trucks, providing opportunities to cater to social gatherings and diverse populations. Street food companies contribute to the vibrant food scene, offering unique culinary experiences to consumers.

How is this market segmented?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Delivery Mode

- Mobile vending

- Online delivery

- Product

- Food

- Desserts

- Beverages

- Type

- American

- Mexican

- Chinese

- Thai

- Others

- Geography

- North America

- US

- North America

By Delivery Mode Insights

The mobile vending segment is estimated to witness significant growth during the forecast period.

The food truck services market in the US has witnessed noteworthy growth in the mobile vending segment. Food trucks, which are a part of this segment, provide a diverse range of ethnic dishes, local fast food, gourmet burgers, vegan goods, and unique cuisine to customers in urban areas and social gatherings. The popularity of social media has significantly contributed to the rise of food trucks, enabling them to reach a wider audience and attract more customers. Food trucks come in various sizes, from extra large vehicles to large vans, allowing companies to offer a comprehensive menu, including specialty desserts, meatless protein, plant-based BBQ, kettle corn, ice cream, and a variety of beverages, both non-alcoholic and alcoholic.

These mobile kitchens cater to the growing demand for convenience and the mobile lifestyle, particularly among Gen Z. The food truck industry's success is further fueled by technology trends, such as online ordering platforms, mobile apps, and customer-driven apps, which streamline the ordering process and provide a seamless experience for consumers. Additionally, food festivals and office parks have become popular venues for food trucks, contributing to increased revenues for companies. Despite the challenges posed by zoning laws and mobile vending regulations, the food truck industry continues to evolve, with gourmet food trucks offering cooking facilities and a focus on gourmet foods and specialty beverages.

The industry's future looks promising, with continued growth expected in the coming years.

The Mobile vending segment was valued at USD 1.08 billion in 2018 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the dynamic and burgeoning food truck services market in the US, entrepreneurs are revolutionizing the way Americans enjoy on-the-go meals. From gourmet burgers and tacos to authentic ethnic cuisine and vegan delights, food trucks offer a diverse and affordable culinary experience. These mobile kitchens leverage advanced food preparation technology, ensuring quick service and high-quality dishes. Sustainability is a priority, with many trucks utilizing renewable energy sources and eco-friendly packaging. Location-based services and social media marketing enable food trucks to connect with customers, offering real-time menus and promotions. Food truck services cater to various events, from corporate functions and festivals to weddings and private parties. With flexible menus and customizable options, food trucks cater to diverse dietary needs, including gluten-free, vegetarian, and vegan diets. The food truck services market in the US continues to evolve, offering innovative and delicious dining experiences for consumers.

What are the US Food Truck Services Market drivers leading to the rise in adoption of the Industry?

- The surge in consumer preference for convenient and on-the-go dining experiences is primarily fueling the growth of the mobile food services market.

- The food truck services market in the US is experiencing significant growth due to several key factors. One of the primary drivers is the increasing popularity of ethnic dishes and specialty foods, which are often served by food trucks. This trend is particularly strong among younger generations, including Gen Z, who are drawn to the unique and immersive dining experiences offered by food trucks. Another factor contributing to the growth of the market is the use of social media to promote and build a customer base. Food trucks often have a strong online presence, allowing them to reach a wider audience and engage with customers in real-time.

- Specialty beverages and desserts are also popular offerings, providing food trucks with a competitive edge against traditional local fast food establishments and food chain restaurants. In addition, the growing demand for meatless protein options and vegan goods is leading some food trucks to adapt their menus to meet this demand. Mobile food service outlets, such as food trucks and carts, offer several advantages over brick-and-mortar restaurants. They have lower yearly overhead costs and initial capital investments, making them a more attractive option for entrepreneurs. Furthermore, the popularity of street food among urban populations continues to rise, providing food trucks with a steady customer base.

- In conclusion, the food truck services market in the US is experiencing growth due to the increasing popularity of ethnic dishes, social media, specialty beverages and desserts, and the convenience and cost-effectiveness of mobile food service outlets. These factors are expected to continue driving the growth of the market in the coming years.

What are the US Food Truck Services Market trends shaping the Industry?

- The increasing number of strategic partnerships among companies in the United States represents a significant market trend. This trend reflects the growing recognition of the benefits derived from collaborative business relationships.

- The food truck services market in the US is witnessing an increase in strategic collaborations among market players. These alliances enable participants to expand their reach and gain access to innovative technologies. Many food service establishments are partnering with online food ordering and delivery platforms. Under these arrangements, restaurants are registered on various delivery platforms, which handle the delivery process. Unlike food aggregators, these platforms manage both online ordering and logistics. For instance, in September 2021, easyJet announced a food-delivery partnership with Uber Eats for passengers returning home from their travels via Gatwick or Luton airports. This collaboration allows passengers to order meals from their preferred restaurants and have them delivered to their doorstep upon arrival.

- Additionally, food offerings in the market are diversifying to cater to various dietary preferences. Non-alcoholic and alcoholic beverages, plant-based BBQ, vegan meat blends, kettle corn, and ice cream are some popular offerings. Online ordering platforms facilitate the convenience of fast food for the mobile lifestyle.

How does US Food Truck Services Market faces challenges face during its growth?

- The increase in potential food contamination poses a significant challenge to the growth of the industry. Food safety concerns, arising from various sources, continue to be a major issue that requires constant attention and effective mitigation strategies from industry professionals.

- In the dynamic food service industry, the importance of maintaining food safety and hygiene cannot be overstated. Food contamination, often caused by cross-contamination, poses a significant risk to both consumers and businesses. Raw materials such as vegetables, meat, and dairy products, if not handled properly, can lead to foodborne illnesses. These contaminants can spread from foods to kitchen surfaces, floors, equipment, door handles, and hands, increasing the risk of cross-contamination. Cross-contamination is the leading cause of food poisoning, resulting in discarded or recalled products, operational disruptions, and potential sales losses. Authorities have the power to shut down businesses that fail to adhere to food safety regulations, imposing severe consequences.

- Customer-driven apps, social media, and online platforms have transformed the food truck industry, enabling street food companies to reach a broader audience. Gourmet foods, beverages, and unique cuisines have gained popularity, with office parks and food festivals becoming common venues for food trucks. Barbecue food and snack foods are among the most popular offerings. To mitigate the risks of food contamination, it is essential for food truck operators to implement rigorous food safety protocols. Regular inspections, proper storage and handling of raw materials, and thorough cleaning of equipment and facilities are some of the essential measures. By prioritizing food safety, food truck businesses can build trust with their customers and maintain a strong reputation.

Exclusive US Food Truck Services Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Coolhaus

- Cousins Maine Lobster LLC

- Curbside Kitchen

- Frios Gourmet Pops

- GASTROTRUCK

- Gorilla Cheese NYC

- Kogi BBQ

- Ms Cheezious

- Nationwide Transport Services LLC

- Off the grid

- Roaming Hunger LLC

- Rocket Fine Street Food

- Roxys Grilled Cheese

- Seabirds Kitchen

- Slide On By

- Stoked Pizza Co.

- Tenoch Mexican

- The Halal Guys Inc.

- Vibe Food Truck

- Waffle House Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Food Truck Services Market In US

- In January 2024, Grubhub, a leading food ordering and delivery marketplace, announced a strategic partnership with Roaming Hunger, a food truck event management platform. This collaboration aimed to streamline the process of booking food trucks for corporate events and festivals through Grubhub's platform (Grubhub Press Release, 2024).

- In March 2024, Comcast Corporation, the telecommunications conglomerate, invested USD10 million in Food Truck Emporium, a food truck fleet operator and franchisor. This investment was part of Comcast's venture arm's commitment to support innovative businesses in the food industry (Comcast Ventures, 2024).

- In May 2024, the Food and Drug Administration (FDA) issued new guidelines for food trucks to ensure better food safety and hygiene. These guidelines included stricter regulations on temperature control, food handling, and record-keeping (FDA, 2024).

- In February 2025, DoorDash, a leading on-demand food delivery platform, acquired Food Truck Mobility, a food truck fleet management software provider. This acquisition aimed to enhance DoorDash's offerings to food truck owners and operators (DoorDash Press Release, 2025).

Research Analyst Overview

The food truck services market in the US continues to evolve, with various sectors adapting to changing consumer preferences and technological advancements. Mobile food services, including plant-based BBQ and vegan meat blends, have gained significant traction among Gen Z consumers and urban areas. Online delivery and ordering platforms have become essential tools for businesses to reach customers, offering convenience and contactless services. Cooking facilities and non-alcoholic beverages are increasingly popular, catering to the growing demand for gourmet foods and health-conscious options. Alcoholic beverages are also a significant revenue driver, with mobile kitchens offering unique cuisine and social gatherings.

The food truck industry's mobile lifestyle and ability to offer specialty desserts, such as vegan ice cream and kettle corn, have made it a popular choice for street food companies and office parks. Technology trends, including customer-driven apps and mobile vending, have streamlined operations and expanded reach. Food festivals and barbeque food have further fueled the market's growth, providing opportunities for gourmet burgers, gourmet food trucks, and specialty beverages. However, zoning laws and mobile vending regulations continue to shape the industry's landscape. The beverages segment, including non-alcoholic and alcoholic options, is a critical component of the food truck services market.

Online platforms and mobile apps have revolutionized the way consumers order and receive their favorite drinks, further enhancing the overall customer experience. In conclusion, the food truck services market in the US remains dynamic, with various sectors continually adapting to consumer trends and technological advancements. From plant-based BBQ and vegan goods to online ordering and delivery, the industry's evolution shows no signs of slowing down.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Food Truck Services Market in US insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

136 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.44% |

|

Market growth 2024-2028 |

USD 634.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.4 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across US

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch