Wafer Biscuit Market Size 2024-2028

The wafer biscuit market size is forecast to increase by USD 2.87 billion at a CAGR of 5.84% between 2023 and 2028. The wafer biscuit market is experiencing significant growth driven by innovation in flavors and varieties, catering to evolving consumer preferences. Brands are increasingly launching new products that incorporate unique ingredients, such as exotic fruits, savory spices, and even health-conscious options like protein-enriched wafers. This diversification not only appeals to a broader audience but also stimulates interest among adventurous eaters looking for novel snacking experiences. Furthermore, the rise in on-trade sales of confectionery bakery items, such as cafes and specialty stores, enhances visibility and accessibility of wafer biscuits. This trend fosters a premium positioning for these snacks, encouraging impulse purchases and elevating their status from everyday treats to gourmet experiences, thereby propelling market growth and brand loyalty.

The Protein-rich, Hypermarkets, Supermarkets, and Chocolate bars are significant contributors to the market. Fiber-rich wafers have gained popularity due to their health benefits, driving market growth. Biscuits, Coated with various flavors, cater to diverse consumer preferences. The Cream-filled wafers segment also experiences steady demand. Cookies and Cakes, often containing wafers, are part of this market landscape. Retailers outlets, such as hypermarkets and supermarkets, are crucial distribution channels. The market is expected to continue its growth trajectory, driven by consumer preferences for convenient and tasty snack options.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

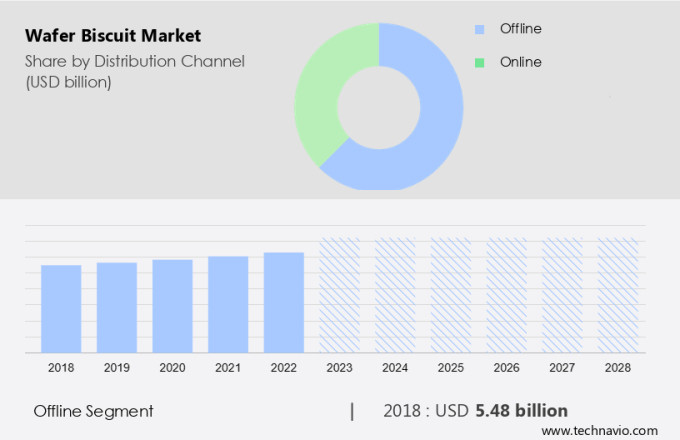

- Distribution Channel

- Offline

- Online

- Type

- Cream-filled

- Coated

- Geography

- Europe

- Germany

- UK

- Italy

- North America

- US

- APAC

- China

- Middle East and Africa

- South America

- Europe

By Distribution Channel Insights

The offline segment is estimated to witness significant growth during the forecast period. The offline distribution channels refer to the distribution of the biscuits through physical stores, supermarkets, and other brick-and-mortar retail outlets. This method of distribution has been the traditional method of selling the products and has been in use for a long time.

Further, offline distribution channels are characterized by the physical presence of retailers or distributors who sell biscuits to customers. This method of distribution offers customers the opportunity to interact with the products physically before making a purchase. It also allows consumers to get the biscuit immediately after purchase without waiting for delivery. However, offline distribution channels have some drawbacks, such as limited reach, high overhead costs, and limited product variety. Nevertheless, they still play a vital role in the market, especially for those who prefer to shop in person. Most customers prefer to buy the biscuits in offline stores because they can check the quality, color, and taste. Thus, the offline segment in the market is expected to witness moderate growth during the forecast period.

Get a glance at the market share of various segments Request Free Sample

The offline segment accounted for USD 5.48 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

Europe is estimated to contribute 31% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market encompasses various product categories, including Cream-Filled and Coated Wafer Biscuits. Madagascar vanilla is a popular flavoring for Cream-Filled Biscuits, while Chocolate coating is common for Coated Wafer Biscuits. Other related products include Chocolate bars, Cookies, and Ice creams. Retail outlets, supermarkets & hypermarkets, and online channels are key distribution channels. Urbanization drives market growth, with consumers increasingly opting for convenient snacking options. Key players offer a range of Cream-filled and Coated Wafer Biscuits, with Coffee Crisp being a notable brand. Cream flavoring and Chocolate coating are common features across product offerings.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Innovation in flavors and varieties in wafer biscuit is the key driver of the market. The Wafer Biscuits Market is pushed by innovation in flavors and varieties, with manufacturers introducing artisan biscuits in diverse forms. Companies like Pladis, Kellogg, and Lago experiment with chocolate bars, ice cream decorations, sandwich cookies, and coated wafer biscuits. Unique flavor combinations include exotic fruits, gourmet chocolates, nuts, spices, and indulgent creams. Premium ingredients such as Vitamin E and C are incorporated for health-conscious consumers.

Further, supermarkets and hypermarkets stock a wide range of wafer biscuits, including protein-rich, fiber-rich, and vitamin-enriched options. Flavors like Hazelnut, Vanilla, and Chocolate dominate the market, with Alpine milk and Italian hazelnuts adding a touch of authenticity. Cream flavoring is popular, and limited-edition variants cater to cultural trends and regional preferences.

Market Trends

The increase in popularity of gluten-free, dairy-free, and allergen-free wafer biscuits is the upcoming trend in the market. The Wafer Biscuits Market is witnessing a significant shift towards specialized options, with an increasing demand for gluten-free, dairy-free, and allergen-free variants. Artisan Biscuits, Pladis, Kellogg, and Lago are leading players in this market, catering to consumers with dietary restrictions or preferences. These companies offer a wide range of products, including chocolate bars, ice cream decorations, sandwich cookies, and coated wafer biscuits.

Additionally, the specialized biscuits are made from non-gluten-containing ingredients like rice flour and corn flour, and dairy-free alternatives like coconut or almond-based ingredients. These biscuits are available in various flavors such as chocolate, vanilla, hazelnut, and cream-filled. Supermarkets and hypermarkets stock these biscuits, making them easily accessible for consumers seeking healthy snacking options. Additionally, some companies add protein, fiber, vitamins, and essential nutrients like Vitamin E and Vitamin C to their products to cater to health-conscious consumers.

Market Challenge

The lack of organized retail distribution channels in developing markets is a key challenge affecting the market growth. The Wafer Biscuits Market in developing countries, including India, Nigeria, and Brazil, faces challenges due to unestablished retail distribution channels. Price-sensitive consumers, particularly in rural areas, prioritize affordability over quality. The distribution network is largely unstructured, leading to intense competition for international brands against local companies. Wafer Biscuits, including Artisan Biscuits, Chocolate Bars, Ice Cream Decorations, Sandwich Cookies, and Cream-filled or Coated varieties, are popular in developing countries due to their affordability. However, profit margins are limited. In India, the implementation of Goods and Services Tax (GST) in 2017 aimed to address transportation and distribution challenges, affecting product pricing.

Supermarkets and Hypermarkets are significant distribution channels for Wafer Biscuits, Ice Cream, Chocolate Bars, Cookies, and other snacks. Brands like Pladis, Kellogg, Lago, and Loacker Minis offer a range of flavors, including Chocolate, Hazelnut, Vanilla, and Cream flavoring, as well as health benefits such as Protein, Fiber, Vitamins E and C. Alpine milk and Italian hazelnuts are common ingredients in some Wafer Biscuits and Chocolate Bars.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Antonelli Bros Ltd: The company offers wafer biscuits such as I Love Gelato Wafers, Luxury Fan Wafer, and Personalised Wafer Discs.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- A. Loacker Spa AG

- Artisan Biscuits Products

- Bauducco

- BOLERO Confectionery of Thrace SA

- Ferrero International S.A.

- Gokulsnacks

- Greco Brothers Ltd.

- Lago Group Spa

- Lotte Corp.

- Mars Inc.

- Nestle SA

- Pickwick Hygienic Products Pvt. Ltd.

- pladis Foods Ltd.

- Pure Temptation Pvt. Ltd.

- Ravi Foods Pvt. Ltd.

- The Hershey Co.

- The J.M Smucker Co.

- Universal Robina Corp.

- Mondelez International Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is a significant part of the Plastics industry, specifically in the Cookies and Chocolates category. The Wafer Biscuits market is characterized by the use of various coatings and fillings, such as chocolate, cream, and fruit jams. These coatings and fillings are vital in enhancing the taste and appeal of the biscuits. The market for Wafer Biscuits is diverse, with various players offering different product ranges. Markets like India and China have a high demand for these biscuits due to their affordability and wide availability. The Supermarket and Hypermarket segments are the primary buyers of Wafer Biscuits, making them an essential item in the retail sector.

Further, the market for Wafer Biscuits is also witnessing a trend towards healthier options, with some players offering low-calorie and sugar-free variants. The market is expected to grow further due to increasing consumer awareness and changing lifestyle preferences. In conclusion, the Wafer Biscuits market is a dynamic and growing segment of the Plastics industry, with a diverse range of players and products catering to various consumer preferences. The use of coatings and fillings is a crucial factor in the market's growth, and the trend toward healthier options is expected to drive future growth.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

153 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.84% |

|

Market Growth 2024-2028 |

USD 2.87 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.8 |

|

Regional analysis |

Europe, North America, APAC, Middle East and Africa, and South America |

|

Performing market contribution |

Europe at 31% |

|

Key countries |

US, China, Germany, UK, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

A. Loacker Spa AG, Antonelli Bros Ltd., Artisan Biscuits Products, Bauducco, BOLERO Confectionery of Thrace SA, Ferrero International S.A., Gokulsnacks, Greco Brothers Ltd., Lago Group Spa, Lotte Corp., Mars Inc., Nestle SA, Pickwick Hygienic Products Pvt. Ltd., pladis Foods Ltd., Pure Temptation Pvt. Ltd., Ravi Foods Pvt. Ltd., The Hershey Co., The J.M Smucker Co., Universal Robina Corp., and Mondelez International Inc. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch