Web Development Market Size 2025-2029

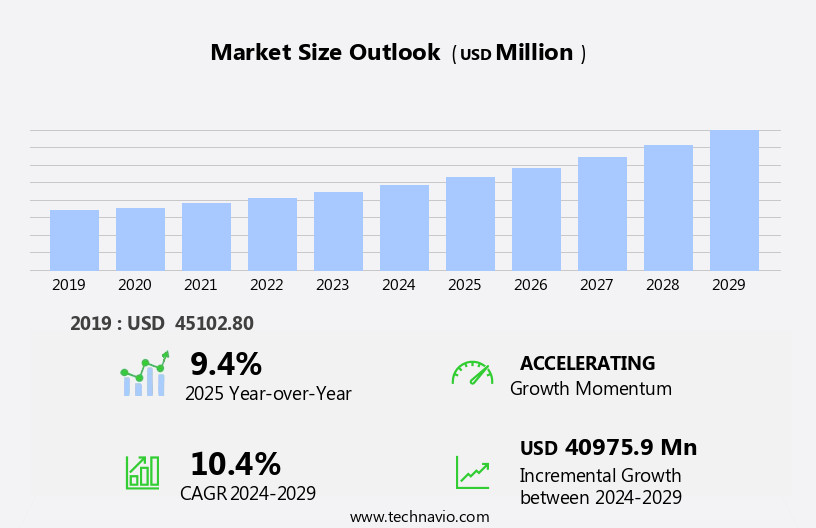

The web development market size is forecast to increase by USD 40.98 billion at a CAGR of 10.4% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing digital transformation across industries and the integration of artificial intelligence (AI) into web applications. This trend is fueled by the need for businesses to enhance user experience, streamline operations, and gain a competitive edge in the market. Furthermore, the rapid evolution of technologies such as Progressive Web Apps (PWAs), serverless architecture, and the Internet of Things (IoT) is creating new opportunities for innovation and expansion. However, this market is not without challenges. The ever-changing technological landscape requires web developers to continuously update their skills and knowledge. Additionally, ensuring web applications are secure and compliant with data protection regulations is becoming increasingly complex.

- Companies seeking to capitalize on market opportunities and navigate challenges effectively should focus on building a team of skilled developers, investing in continuous learning and development, and prioritizing security and compliance in their web development projects. By staying abreast of the latest trends and technologies, and adapting quickly to market shifts, organizations can successfully navigate the dynamic the market and drive business growth.

What will be the Size of the Web Development Market during the forecast period?

- The market continues to evolve at an unprecedented pace, driven by advancements in technology and shifting consumer preferences. Key trends include the adoption of Agile methodologies, DevOps tools, and version control systems for streamlined project management. JavaScript frameworks, such as React and Angular, dominate front-end development, while Magento, Shopify, and WordPress lead in content management and e-commerce. Back-end development sees a rise in Python, PHP, and Ruby on Rails frameworks, enabling faster development and more efficient scalability. Interaction design, user-centered design, and mobile-first design prioritize user experience, while security audits, penetration testing, and disaster recovery solutions ensure website safety.

- Marketing automation, email marketing platforms, and CRM systems enhance digital marketing efforts, while social media analytics and Google Analytics provide valuable insights for data-driven decision-making. Progressive enhancement, headless CMS, and cloud migration further expand the market's potential. Overall, the market remains a dynamic, innovative space, with continuous growth fueled by evolving business needs and technological advancements.

How is this Web Development Industry segmented?

The web development industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Retail and e-commerce

- BFSI

- IT and telecom

- Healthcare

- Others

- Business Segment

- SMEs

- Large enterprise

- Service Type

- Front-End Development

- Back-End Development

- Full-Stack Development

- E-Commerce Development

- Deployment Type

- Cloud-Based

- On-Premises

- Technology Specificity

- JavaScript

- Python

- PHP

- Ruby

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Spain

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

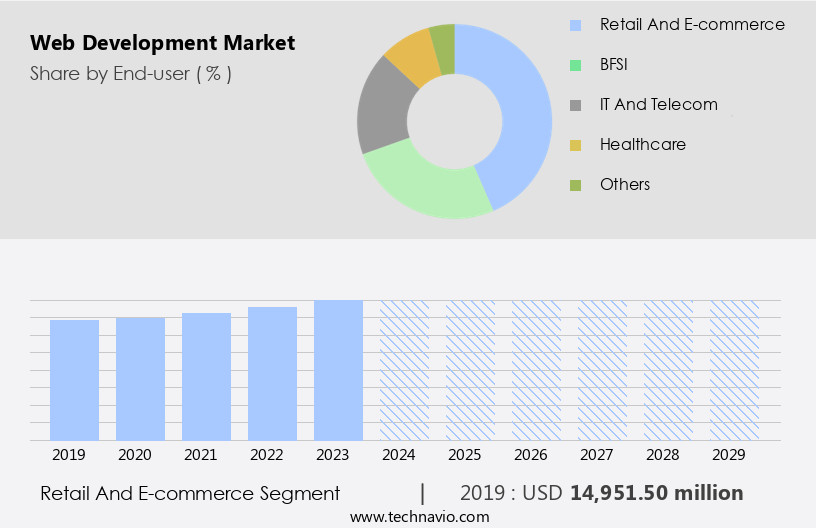

By End-user Insights

The retail and e-commerce segment is estimated to witness significant growth during the forecast period. The market is experiencing significant growth due to the digital transformation sweeping various industries. E-commerce and retail sectors lead the market, driven by the increasing preference for online shopping and improved Internet penetration. To cater to this trend, businesses demand user-engaging web applications with smooth navigation, secure payment gateways, and seamless product search and purchase features. Mobile shopping's rise necessitates mobile app development and mobile-optimized websites. Agile development, microservices architecture, and UI/UX design are essential elements in creating engaging and efficient web solutions. Furthermore, AI, machine learning, and data analytics enable data-driven decision making, customer loyalty, and business intelligence.

Web hosting, cloud computing, API integration, and growth hacking are other critical components. Ensuring web accessibility, data security, and e-commerce development is also crucial for businesses in the digital age. Online advertising, email marketing, content strategy, brand building, and data visualization are essential aspects of digital marketing. Serverless computing, user retention, and cross-platform development are emerging trends.

Get a glance at the market report of share of various segments Request Free Sample

The Retail and e-commerce segment was valued at USD 14.95 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

Europe is estimated to contribute 31% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The North American market is marked by a dynamic digital landscape, fueled by technological advancements and extensive internet penetration. The US dominates this sector, hosting tech giants like Google, Amazon, and Microsoft, as well as a flourishing startup scene, primarily in Silicon Valley. Small and medium-sized enterprises (SMEs), constituting 99.9% of all US businesses, according to the US Small Business Administration, significantly contribute to the market's growth. They seek cost-effective and scalable web development solutions to meet their unique requirements. Key trends shaping the market include Agile Development, Full-stack Development, User Engagement, and Mobile App Development. Additionally, businesses are leveraging technologies such as Artificial Intelligence (AI), Machine Learning (ML), and Blockchain Technology to enhance their digital presence.

Web Application Development, UI/UX Design, and API Integration are other essential areas of focus. Furthermore, businesses are investing in Data Analytics, Business Intelligence (BI), Email Marketing, and Content Marketing for data-driven decision making and customer acquisition. Cloud Computing, Web Hosting, and Serverless Computing facilitate cost savings and scalability. Security, including Data Security and Cloud Security, is a top priority. Overall, the North American the market is poised for growth, driven by the need for digital transformation and the continuous evolution of technology.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The Web Development Industry Market grows with front-end development services and back-end development solutions. Web development market trends 2024 highlight progressive web apps and single-page applications. E-commerce web solutions and mobile-responsive web design drive demand, per web development market forecast. AI-powered web development leverages cloud-based web platforms, while cybersecurity for web applications ensures trust. Full-stack development services and web development for healthcare enhance functionality. Web development for education, low-code development platforms, and web development supply chain optimize efficiency. Web development for retail, web accessibility solutions, web development for global markets, web development for digital transformation, and web development for B2B markets fuel growth through 2028.

What are the key market drivers leading to the rise in the adoption of Web Development Industry?

- Digital transformation is the key driver of the market. The market is experiencing significant growth as digital transformation becomes a key business priority for organizations worldwide. This trend is not merely about adopting new technologies but rather about fundamentally changing how businesses operate and engage with customers. Websites and web applications serve as the foundation for this transformation, enabling companies to establish an online presence, streamline operations, and expand their reach. The integration of data, automation, and connectivity into business models is making web development a critical enabler in today's digital landscape.

- As competition intensifies, the demand for web development services continues to rise, shaping the market's dynamics. This shift is not a passing fad but a fundamental change that will continue to shape the business world in the years to come.

What are the market trends shaping the Web Development Industry?

- Integration of artificial intelligence into web development is the upcoming market trend. The integration of artificial intelligence (AI) into web development is transforming the industry by automating tasks, enhancing user experiences, and optimizing website performance. AI-powered tools utilize machine learning, natural language processing (NLP), and predictive analytics to streamline development cycles, provide personalized experiences, and inform data-driven decisions. One significant application of AI is in automated web design and development. Wix ADI, AiDA from Bookmark, and AI Website Builder from Hostinger are examples of platforms enabling users to create functional websites with minimal coding.

- This trend is fueled by the demand for quicker development processes, customized user experiences, and data-driven decision-making. AI's impact on web development is undeniable, offering numerous benefits and shaping the future of digital solutions.

What challenges does the Web Development Industry face during its growth?

- Rapidly evolving technologies is a key challenge affecting the industry's growth. The market is undergoing significant technological advancements, presenting both opportunities and challenges for businesses and developers. New frameworks, programming languages, and development methodologies continually emerge, necessitating continuous skill updates and adaptability from professionals. Front-end development is dominated by technologies like React, Angular, Vue.js, and Svelte, while back-end frameworks such as Node.js, Django, and Laravel continue to evolve, offering enhancements in performance, scalability, and security.

- However, the short lifecycle of these frameworks and tools poses a significant challenge, requiring businesses and developers to stay abreast of the latest trends. This dynamic environment necessitates a proactive approach to web development, ensuring businesses remain competitive and their digital presence remains effective.

Exclusive Customer Landscape

The web development market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the web development market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, web development market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Accenture PLC - The company offers web development services through its Web Services Platform which integrates tools like Visual Studio .NET, reusable software components, and industry-standard protocols to accelerate application development, ensure interoperability, and optimize global collaboration for large-scale enterprise solutions.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Accenture PLC

- Cognizant Technology Solutions Corp.

- Cyient Ltd.

- Datamatics Global Services Ltd

- Fractal Analytics Pvt. Ltd.

- HCL Technologies Ltd.

- Hexaware Technologies Ltd.

- Infosys Ltd.

- KPIT Technologies Ltd.

- LTIMindtree Ltd.

- Mphasis Ltd.

- Persistent Systems Ltd.

- Quark Software Inc.

- Robert Bosch GmbH

- Tata Consultancy Services Ltd.

- Tech Mahindra Ltd.

- Virtusa Corp.

- Wipro Ltd.

- WNS Holdings Ltd.

- Zensar Technologies Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market continues to evolve at an unprecedented pace, driven by the ever-increasing demand for digital solutions. Full-stack development, encompassing both front-end and back-end aspects, has emerged as a popular approach to creating dynamic web applications. User engagement, a critical success factor, is achieved through various means, including social media integration and user experience (UX) design. Payment gateways, a vital component of e-commerce platforms, ensure secure and seamless transactions. Agile development methodologies, with their iterative and collaborative nature, have become the norm, enabling faster time-to-market and greater flexibility. Microservices architecture, which breaks down applications into smaller, independent components, enhances scalability and ease of maintenance.

Lead generation and business process automation are essential for driving growth and improving efficiency. Artificial intelligence (AI) and machine learning (ML) are increasingly being integrated into web applications to provide intelligent insights and personalized experiences. UI/UX design, focusing on the visual and interactive aspects of web applications, plays a pivotal role in user retention and customer loyalty. Data-driven decision making is a key trend, with data analytics and big data analytics providing valuable insights. Cloud computing and web hosting offer cost-effective and scalable solutions for web application development. API integration, enabling seamless communication between different systems, is a common requirement for modern web applications.

Growth hacking, a data-driven approach to marketing and user acquisition, is gaining popularity. E-commerce development, with its focus on customer acquisition and conversion, is a significant segment of the market. Business intelligence (BI) and data visualization tools help organizations make informed decisions based on data.Transaction and Email marketing and content marketing are effective channels for user engagement and lead generation. Brand building and content strategy are crucial for creating a strong online presence. Serverless computing and cross-platform development offer flexibility and cost savings. Web accessibility, ensuring equal access to web content for all users, is a growing concern. Domain registration and website development are foundational aspects of any online presence.

Security, a top priority, extends to both web hosting and cloud computing. Blockchain technology, with its decentralized and secure nature, is an emerging trend in web development. Online advertising, a significant revenue source, requires effective targeting and optimization. Responsive design, ensuring optimal viewing across devices, is essential for user experience. Back-end development, focusing on server-side logic and database management, is a critical aspect of web application development. Website development, encompassing design, development, and maintenance, is a comprehensive service. Web hosting, providing the infrastructure for websites and applications, is a fundamental requirement. The market is characterized by continuous innovation and adaptation to changing business needs. The trends discussed above reflect the market dynamics and the evolving requirements of organizations in the digital age.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

213 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.4% |

|

Market growth 2025-2029 |

USD 40.97 Billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

9.4 |

|

Key countries |

US, Germany, Canada, China, UK, India, France, Brazil, Japan, and Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Web Development Market Research and Growth Report?

- CAGR of the Web Development industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the web development market growth and forecasting

We can help! Our analysts can customize this web development market research report to meet your requirements.