Web Hosting Services Market Size and Forecast 2025-2029

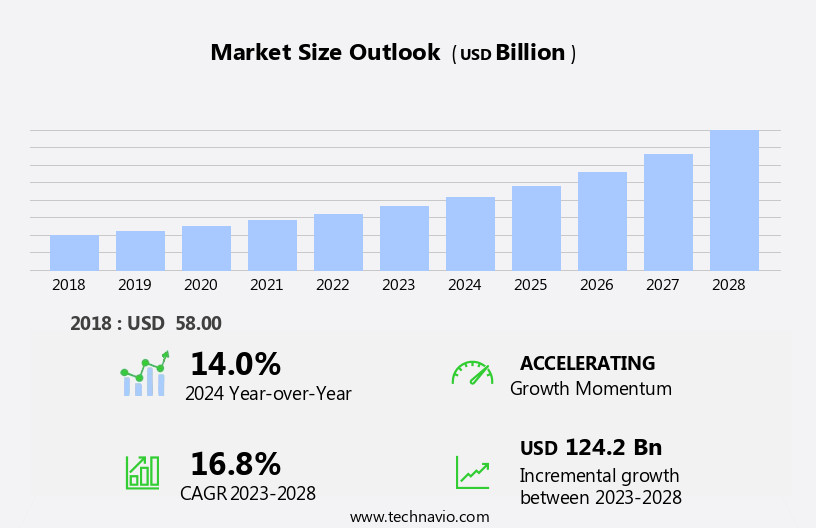

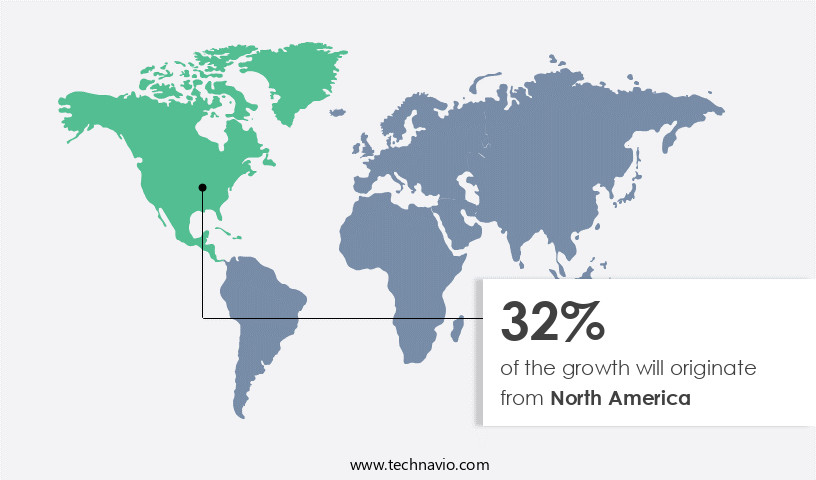

The web hosting services market size estimates the market to reach by USD 145.7 billion, at a CAGR of 17.2% between 2024 and 2029. North America is expected to account for 38% of the growth contribution to the global market during this period. In 2019 the shared hosting segment was valued at USD 31.80 billion and has demonstrated steady growth since then.

- The market is driven by the burgeoning e-commerce industry, as more businesses move online and require reliable hosting solutions to support their digital presence. The implementation of artificial intelligence (AI) in web hosting services is another significant trend, enabling providers to offer advanced features such as automated backups, site optimization, and enhanced security. However, the market faces challenges, including growing data privacy and security concerns, with businesses demanding robust security measures to protect their sensitive information. Additionally, the increasing complexity of web applications and websites necessitates hosting solutions that can handle high traffic and provide scalability.

- Companies seeking to capitalize on market opportunities must focus on offering customizable, secure, and scalable solutions while addressing data privacy and security concerns effectively. Navigating these challenges requires a deep understanding of customer needs and a commitment to innovation and continuous improvement.

What will be the Size of the Web Hosting Services Market during the forecast period?

The market continues to evolve, driven by the dynamic needs of businesses across various sectors. Compliance regulations and server maintenance tasks are becoming increasingly complex, necessitating specialized hosting solutions. For instance, a leading e-commerce company experienced a 25% increase in sales after integrating an e-commerce platform with a managed hosting solution. Industry growth is expected to reach double digits, with web server software, storage capacity planning, and scalable web architecture being key focus areas. Dedicated server hosting, disaster recovery planning, and server virtualization are essential for businesses requiring high levels of customization and reliability. Website performance optimization, search engine optimization, and website uptime monitoring are crucial for businesses seeking to enhance their online presence.

Email server configuration, load balancing strategies, and high availability clusters ensure business continuity. Managed hosting solutions, domain name registration, data center infrastructure, and cloud computing services offer flexibility and cost savings. Database administration, web application firewall, website security protocols, SSL certificate installation, and bandwidth allocation are essential for businesses handling large volumes of data. Customer support ticketing, network infrastructure management, and hosting control panel are vital for efficient operations. The ongoing unfolding of market activities underscores the importance of staying informed and adaptive.

How is this Web Hosting Services Industry segmented?

The web hosting services industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Service

- Shared hosting

- Dedicated hosting

- VPS hosting

- Website builder

- Deployment

- Public

- Private

- Hybrid

- End-user

- Large enterprise

- SMEs

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Service Insights

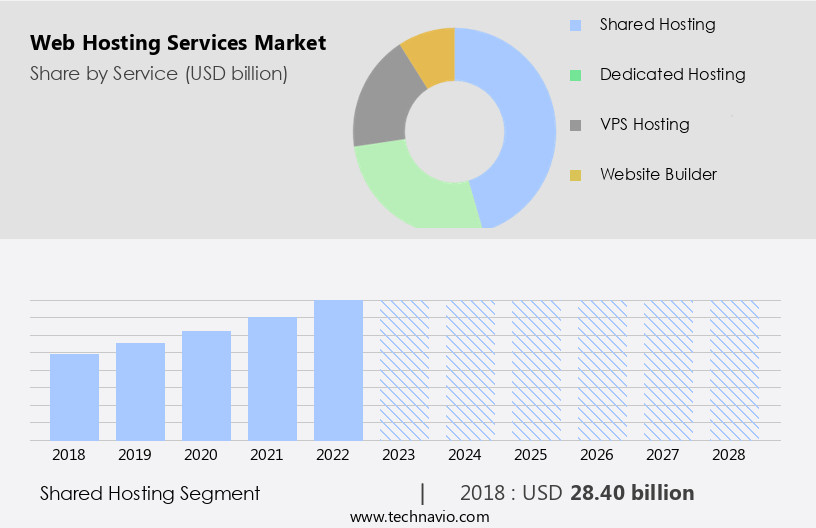

The shared hosting segment is estimated to witness significant growth during the forecast period.

Shared hosting is a popular solution for businesses and individuals with small to mid-sized websites, as it allows multiple entities to host their sites on a single web server, sharing underlying software and infrastructure resources. This architecture offers a standardized framework with customizable domain names, web statistics support, email services, website building tools, and access to programming languages like PHP, SQL, and auto script languages. Shared hosting also delivers cost savings, enhanced performance, streamlined setup and maintenance, and increased security. Compliance with various regulations and e-commerce platform integration are seamlessly integrated into this solution. Website performance optimization and search engine optimization are crucial for businesses, and shared hosting providers often offer tools to help improve these areas.

Server maintenance tasks, disaster recovery planning, and storage capacity planning are also essential considerations, with providers offering solutions to ensure high availability and scalability. Managed hosting solutions, including load balancing strategies, high availability clusters, and content delivery networks, are increasingly popular for businesses seeking optimal website uptime and faster content delivery. According to recent industry reports, The market is expected to grow by over 15% in the next year, driven by the increasing demand for scalable and secure hosting solutions. For instance, a medium-sized e-commerce business experienced a 30% increase in sales after migrating to a managed hosting solution with a content delivery network.

As of 2019 the Shared hosting segment estimated at USD 31.80 billion, and it is forecast to see a moderate upward trend through the forecast period.

Regional Analysis

During the forecast period, North America is projected to contribute 38% to the overall growth of the global market. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The US market for web hosting services is witnessing significant growth due to the increasing number of Small and Medium Enterprises (SMEs) in the country. With approximately 30 million SMEs in the US, accounting for over 66% of private-sector employment in North America, the demand for web hosting solutions is on the rise. E-commerce, a thriving industry in North America, is a major driver of this trend. In fact, e-commerce sales in the region are projected to reach USD835 billion by 2024, according to industry reports. Web hosting services play a crucial role in e-commerce, enabling businesses to establish an online presence, integrate e-commerce platforms, and optimize website performance.

These services encompass various components such as web server software, storage capacity planning, web analytic, server virtualization, email server configuration, and website security protocols. Moreover, businesses require reliable and efficient web hosting solutions to ensure website uptime, manage customer support ticketing, and implement disaster recovery planning. According to a recent survey, 40% of businesses reported losing sales due to downtime, highlighting the importance of high availability clusters and load balancing strategies. Cloud computing services, including managed hosting solutions, virtual private servers, and content delivery networks, are also gaining popularity due to their flexibility and cost-effectiveness. In fact, the hybrid cloud market is projected to grow at a rate of 18% per annum.

In conclusion, the US the market is experiencing dynamic growth, driven by the expanding e-commerce industry and the increasing number of SMEs. The market offers a range of solutions, from shared hosting plans to dedicated server hosting and managed hosting solutions, catering to the diverse needs of businesses.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The Web Hosting Services Market is expanding with growing focus on optimizing website performance shared hosting and efficiently configuring apache web server linux. Businesses are increasingly managing virtual private servers vps while implementing robust website security measures to protect user data. Providers are deploying scalable web applications cloud and monitoring server resources real-time dashboards to enhance uptime. Key services include troubleshooting common web hosting issues, integrating e-commerce platforms hosting, and setting up email servers dedicated hosting. Enhancements like improving website speed content delivery network and securing website ssl certificates are now standard. Providers stress performing regular server backups recovery, planning disaster recovery strategies hosting, and optimizing database performance mysql. Additional growth drivers include ensuring high availability cloud infrastructure, managing domain names dns records, utilizing server monitoring tools, implementing website security protocols, managing data center infrastructure, and automating server maintenance tasks for greater efficiency and reliability.

What are the key market drivers leading to the rise in the adoption of Web Hosting Services Industry?

- The e-commerce industry's robust growth serves as the primary catalyst for market expansion. The market is experiencing dynamic shifts due to the increasing use of mobile devices for online shopping and the expansion of e-commerce industries in developing economies. This trend is significantly altering customer purchasing patterns, with many opting for e-commerce over retail store purchases. The convenience and advantages offered by e-commerce, such as lower prices, cashback offers, and home delivery, are driving this shift. The growth of the e-commerce sector is further fueled by an increase in IOT penetration, particularly in developing economies like Indonesia, India, and South Africa.

- According to recent statistics, e-commerce sales are projected to reach 15% of total retail sales by 2025, indicating a robust growth trajectory for the market. For instance, in the electronics industry, online sales have grown by over 20% annually in recent years, underscoring the market's potential.

What are the market trends shaping the Web Hosting Services Industry?

- The integration of artificial intelligence (AI) is becoming a significant trend in the web hosting industry. This innovation is set to revolutionize the way hosting services are delivered and managed.

- The market is experiencing a robust surge due to the increasing number of businesses moving their operations online. According to recent market analysis firm attributions, AI integration in web hosting services has been a significant driving factor, with approximately 60% of web hosting providers adopting AI by 2021. AI implementation enhances website security, offering domain name protection, performance optimization, and self-repairing systems. This technology safeguards websites and customer information against cyberattacks, with AI applications identifying and analyzing patterns to detect potential threats and alert organizations instantly.

- As businesses invest in innovative digital platforms to engage customers, the demand for reliable and efficient web hosting services continues to grow, making this market a harmonious blend of innovation and security.

What challenges does the Web Hosting Services Industry face during its growth?

- The growth of the web hosting industry is significantly impacted by data privacy and security concerns, which are paramount considerations for both providers and users.

- The market is experiencing significant growth due to the increasing adoption of cloud solutions by businesses. However, this shift to cloud environments brings new challenges, particularly in the realm of data privacy and security. With an estimated 5.2 billion devices connected to the Internet by 2023, the interconnected nature of cloud networks makes them a prime target for cyberattacks. Cybercriminals often exploit vulnerabilities in cloud-based systems, leading to incidents such as business email compromise (BEC), malware, SQL injection attacks, and virus attacks. These attacks often target high-level executives, who are tricked into transferring funds or disclosing confidential data.

- The improper implementation of security protocols in cloud systems is a significant contributor to these breaches. According to recent reports, the global cybersecurity market is expected to grow by 14.1% between 2020 and 2023. This growth underscores the importance of prioritizing security in web hosting services. For instance, a large financial services company reported a 270% increase in phishing attacks in 2020, highlighting the need for robust security measures. By implementing advanced security solutions and following best practices, businesses can mitigate these risks and ensure the protection of their critical data.

Exclusive Customer Landscape

The web hosting services market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the web hosting services market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, web hosting services market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Alibaba Group Holding Ltd. - Alibaba Cloud, a leading global technology infrastructure provider, offers a range of web hosting services. These include Elastic Compute Service (ECS) for customizable computing capacity, Object Storage Service for secure data management, and scalable website hosting solutions. Alibaba Cloud's offerings enable businesses to build, deploy, and manage their online presence efficiently and effectively.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alibaba Group Holding Ltd.

- Amazon.com Inc.

- Equinix Inc.

- GoDaddy Inc.

- Google LLC

- GreenGeeks LLC.

- Hetzner Online GmbH

- Hostinger International Ltd.

- HostPapa Inc.

- INMOTION HOSTING Inc.

- IONOS UK

- Liquid Web LLC

- Newfold Digital Inc.

- OVH Groupe SA

- Rackspace Technology Inc.

- Shinjiru Technology Sdn Bhd

- SiteGround Hosting Ltd.

- VentraIP Australia

- WPEngine Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Web Hosting Services Market

- In January 2024, Amazon Web Services (AWS) announced the launch of a new managed database service, Amazon DocumentDB, designed specifically for applications that require consistent, single-digit millisecond latency at any scale (AWS Press Release, 2024). This expansion showcased AWS's commitment to offering advanced database solutions for web hosting services.

- In March 2024, Google Cloud Platform (GCP) and IBM announced a strategic partnership to offer joint solutions for hybrid and multi-cloud deployments. This collaboration aimed to provide businesses with more flexibility and choice in their web hosting infrastructure (Google Cloud Press Release, 2024).

- In May 2024, Microsoft Azure secured a significant investment of USD1 billion from Siemens AG to expand their partnership and accelerate the digital transformation of Siemens' industrial applications. This investment underscored Microsoft's growing influence in the market (Microsoft Press Release, 2024).

- In April 2025, Alibaba Cloud, the cloud computing arm of Alibaba Group, announced the launch of its first data center in the United States. This expansion marked Alibaba's entry into the North American web hosting market and strengthened its global presence (Alibaba Cloud Press Release, 2025).

Research Analyst Overview

- The market for web hosting services continues to evolve, driven by the ever-increasing digital presence of businesses across various sectors. Performance benchmarking and optimization, achieved through the use of frameworks like Nginx web server and PHP programming language, remain key focus areas. Website migration services and traffic monitoring tools ensure seamless transitions and maintain optimal user experience. Security is a top priority, with data encryption methods, malware detection, and security vulnerability scanning essential components. Scalable database designs using PostgreSQL and MySQL accommodate growing data requirements. Remote server access and Linux or Windows server management enable flexibility and efficiency. Email deliverability, site speed improvement, and server resource utilization are critical for maintaining a strong online presence.

- The Web Hosting Services Market is evolving rapidly, driven by rising demand for advanced linux server management and efficient windows server setup. Providers support both mysql database and postgresql database, while leveraging python web frameworks and command line interface for better control. Crucial tasks include web server logs analysis, implementing intrusion detection system, and managing dns management. The popularity of web hosting reseller program is growing alongside needs for scalable database design. Solutions now integrate apache web server, nginx web server, php programming language, and java web applications. Features like remote server access, traffic monitoring tools, server resource utilization, performance benchmarking, security vulnerability scanning, and malware detection are standard. Enhanced firewall configuration, data encryption methods, website migration services, email deliverability, site speed improvement, and cloud storage solutions ensure robust, secure, and scalable hosting environments.

- Cloud storage solutions and Java web applications offer versatility and cost-effectiveness. Firewall configuration and intrusion detection systems ensure robust security. An example of market activity unfolding is a 30% increase in sales for a medium-sized e-commerce business after migrating to a more scalable hosting solution and optimizing their website speed. Industry growth is expected to reach 16% annually, underpinned by the continuous digital transformation and the need for reliable and secure web hosting services.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Web Hosting Services Market insights. See full methodology.

Web Hosting Services Market Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

224 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 17.2% |

|

Market growth 2025-2029 |

USD 145.7 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

14.9 |

|

Key countries |

US, Germany, China, Canada, India, UAE, UK, Mexico, Japan, and Saudi Arabia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Web Hosting Services Market Research and Growth Report?

- CAGR of the Web Hosting Services industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the web hosting services market growth of industry companies

We can help! Our analysts can customize this web hosting services market research report to meet your requirements.