Woodworking Machines Market Size 2025-2029

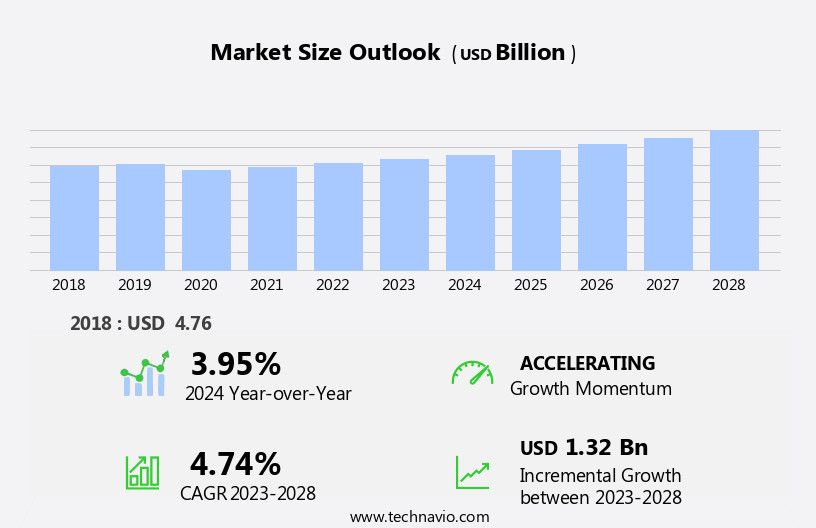

The woodworking machines market size is forecast to increase by USD 1.52 billion, at a CAGR of 4.6% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing adoption of automated solutions. This trend is being fueled by advancements in technology, particularly the integration of the Internet of Things (IoT) into woodworking machinery. This development enables real-time monitoring and remote control of machines, enhancing productivity and efficiency. However, the market faces challenges, including the declining availability and increasing prices of wood supplies.

- This issue, coupled with the rising cost of timber, poses a significant obstacle for manufacturers and operators in the woodworking industry. IoT enables real-time monitoring and predictive maintenance, leading to increased efficiency and cost savings. To capitalize on opportunities and navigate these challenges effectively, companies must stay informed of technological advancements and adapt to market trends while implementing sustainable sourcing strategies.

What will be the Size of the Woodworking Machines Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

- The market encompasses various technologies, including automated machining and digital fabrication, which continue to shape industry trends. Sustainable forestry practices and wood recycling are gaining momentum, driving the demand for eco-friendly woodworking solutions. Data analytics and machine learning are revolutionizing production processes, enabling real-time optimization of feed rates, cutting speeds, and tool life. Surface finish and material handling systems are essential components, ensuring high-quality output and efficient workflow. Safety features, noise levels, and power consumption are key considerations for manufacturers seeking to meet evolving environmental regulations. Wood composites and wood-based products are increasingly popular due to their durability and sustainability.

- Woodworking education, apprenticeships, and competitions foster innovation and skill development, contributing to the industry's growth. CAD/CAM integration and workholding systems are essential for precision cutting and ensuring consistent product quality. AI and machine learning are transforming the sector by streamlining processes and enhancing customization capabilities. Woodworking exhibitions provide a platform for showcasing the latest technologies and fostering industry collaboration. This market experiences significant activity due to increasing demand for sustainable construction practices, including modular construction and CLT (Cross-Laminated Timber) systems.

How is this Woodworking Machines Industry segmented?

The woodworking machines industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Furniture

- Construction

- Shipbuilding

- Distribution Channel

- Offline

- Online

- Type

- Electrical

- Mechanical

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- Spain

- UK

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

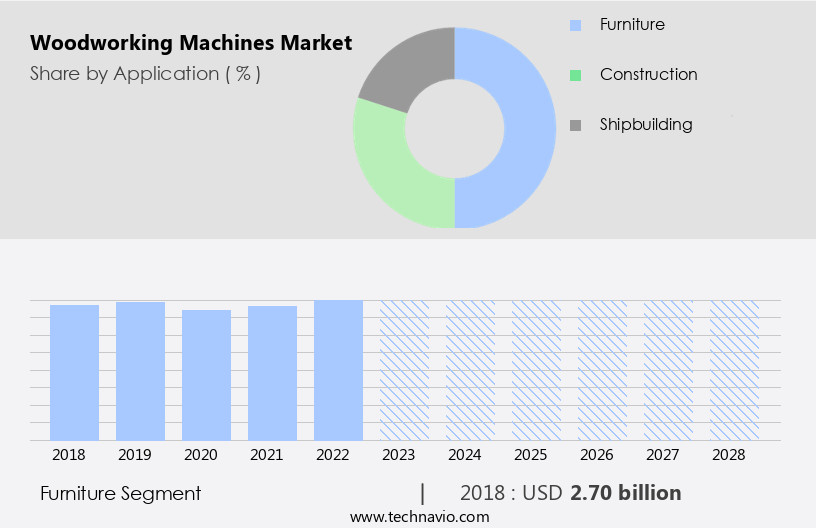

By Application Insights

The furniture segment is estimated to witness significant growth during the forecast period. Woodworking machines are integral to the furniture industry, enabling manufacturers to produce superior quality wooden furniture for both residential and commercial applications. The demand for wooden furniture persists in 2024, fueled by shifting consumer preferences and technological advancements in woodworking. In the residential sector, furniture serves dual functions - utility and aesthetics. Notably, there's a growing trend towards portable wooden furniture due to frequent home relocations. Essential residential furniture pieces include sofa sets, tables, chairs, entertainment units, decorative side tables, shelves, beds, dressing tables, wardrobes, and study tables. Decorative wooden items are also gaining traction as homeowners pursue unique and stylish interior designs.

Woodworking retailers offer a wide range of supplies, tools, and equipment to cater to diverse needs. Blade sharpening and design software help maintain and enhance the functionality and appearance of woodworking tools. The woodworking industry's rich history and heritage inspire continued passion and dedication among its practitioners. Woodworking machinery plays a crucial role in the production of personalized, customized wooden products, from beams and insulation to boards and intricately engineered furniture.

The Furniture segment was valued at USD 3.01 billion in 2019 and showed a gradual increase during the forecast period.

The woodworking industry encompasses various techniques, expertise, and equipment, including milling machines, table saws, sanding machines, band saws, CNC routers, and safety equipment. Woodworking software, glues, finishes, and accessories facilitate efficient production and enhance the final product's quality. Sustainability is a critical consideration in the woodworking industry, with a focus on using renewable resources and minimizing waste. The woodworking community fosters innovation, knowledge sharing, and collaboration, driving the industry's growth. Online platforms and classes provide access to woodworking resources, skills, and projects for hobbyists and professionals alike. Woodworking trends include the use of hardwood lumber, automation, and manufacturing processes that prioritize craftsmanship and artistry.

The Woodworking Machines Market is evolving with technological advancements and a focus on environmental impact. Companies are integrating artificial intelligence AI to enhance automation, improving efficiency and sustainability. Innovations in smart machinery help reduce waste, addressing key environmental concerns. Industry growth is also driven by skilled labor, with woodworking apprenticeships playing a crucial role in training the next generation of craftsmen. These programs provide hands-on experience in operating advanced equipment. Additionally, woodworking competitions foster creativity and excellence, encouraging professionals to showcase their expertise in machine craftsmanship. Machinery in this sector includes robotic arms, CNC (Computer Numerical Control) machines, and computerized control systems, enabling precise engineering and energy-efficient manufacturing processes.

Regional Analysis

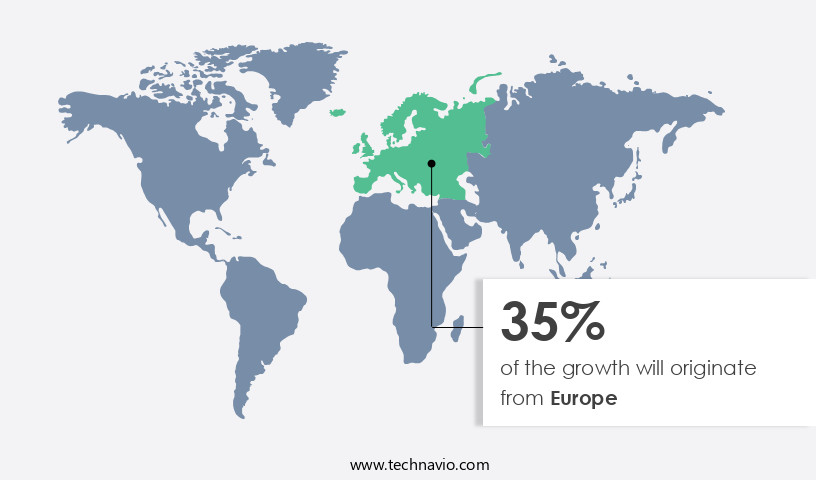

Europe is estimated to contribute 40% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The European market is experiencing significant growth, fueled by consumer demand for premium designs and sustainable materials. Italy, Germany, the UK, and France are key players in this industry, with major companies expanding production facilities to meet evolving consumer preferences. The trend towards eco-friendly furniture has further boosted the market, as consumers prioritize sustainability in their purchasing decisions. However, challenges such as fluctuating raw material prices and economic uncertainties may impact growth. The construction industry in Europe is also expanding, driven by infrastructure development and residential projects. Germany, as the region's largest economy, leads in construction activities, with increasing investments in housing and commercial spaces.

Woodworking machinery, including milling machines and table saws, play a crucial role in this sector, enabling the production of high-quality furniture and fixtures. Woodworking technology continues to advance, with innovations in woodworking software, automation, and manufacturing processes. Woodworking classes and online resources offer opportunities for hobbyists and professionals to enhance their skills and knowledge. Safety equipment and dust collection systems are essential components of the woodworking industry, ensuring a safe and productive work environment. The woodworking community is a vibrant and passionate one, with a rich heritage and tradition of craftsmanship. Woodworking techniques, from hand tools to CNC routers, reflect the diversity and creativity of this industry.

Woodworking accessories, glues, and finishes are essential components of the woodworking business, enhancing the aesthetic appeal and durability of woodworking projects. Softwood and hardwood lumber remain the primary raw materials for the woodworking industry, with a diverse range of applications in furniture, cabinetry, and construction. Woodworking trends reflect consumer preferences for sustainable and eco-friendly materials, as well as innovative designs and functional solutions. The European market is a dynamic and evolving one, driven by consumer demand for premium designs and sustainable materials. The construction industry's steady expansion and the advancement of woodworking technology further fuel growth in this sector.

Woodworking expertise, from hobbyists to professionals, continues to thrive, reflecting the enduring passion and creativity of this industry.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Woodworking Machines market drivers leading to the rise in the adoption of Industry?

- The significant rise in the implementation of automated woodworking machinery is the primary market catalyst. The global woodworking machinery market is experiencing significant growth due to the increasing automation in the industry. Woodworking technology is evolving, with a focus on flexibility and personalization driving the demand for specialized machinery. Automated standalone machines, enabled with Internet of Things (IoT) technology, are becoming increasingly popular. These machines offer easy integration with other machinery and monitoring systems, enabling large industrial plants to partially automate their production processes. This results in improved performance, flexibility, and a reduced requirement for human resources.

- Milling machines and table saws are essential tools in the woodworking industry, and their integration with automation and software solutions enhances their functionality. The woodworking industry's shift towards sustainability is also influencing the market, with a growing emphasis on energy efficiency and waste reduction in machinery design. Overall, the woodworking machinery market is an essential component of the woodworking industry, providing innovative solutions to meet the demands of modern production processes. Woodworking techniques continue to advance, with woodworking artistry and craftsmanship being preserved through the use of advanced software and machinery.

What are the Woodworking Machines market trends shaping the Industry?

- The increasing implementation of Internet of Things (IoT) technology in woodworking machines represents a significant market trend. This development is driven by the benefits of enhanced productivity, improved efficiency, and increased automation that IoT provides to the woodworking industry. The woodworking community continues to embrace technology, with an increasing number of woodworking machines integrating IoT capabilities. These advanced machines enable seamless communication between devices, enhancing productivity and efficiency in the woodworking industry.

- Woodworking history is rich with innovation, and the industry continues to evolve. Woodworking glues, for instance, have significantly improved, offering stronger bonds and increased versatility. The woodworking market is vast, catering to both wholesale and retail customers. Big data analytics plays a significant role in optimizing woodworking processes, allowing businesses to identify trends and make data-driven decisions. Sanding machines, a crucial part of woodworking equipment, have seen considerable advancements. Dust collection systems are now integrated into these machines, ensuring a cleaner and safer work environment. Woodworking hobbyists and professionals alike benefit from the availability of woodworking classes online, providing access to valuable skills and techniques.

How does Woodworking Machines market face challenges during its growth?

- The industry's expansion is being hindered by the concurrent challenges of decreasing wood supplies and escalating timber prices. The market is influenced by various factors, with raw material availability and pricing being significant concerns. In 2024, APAC accounted for a substantial share of the global wood industry, primarily driven by the furniture sector. However, the fluctuation in wood supply and increasing timber prices have negatively impacted the market. To mitigate the reliance on natural forests, many countries in APAC have turned to alternative sources such as rubber trees, Acacia, and other species for wood production.

- Woodworking businesses must adapt to these trends by investing in woodworking jigs, accessories, finishes, and safety equipment to improve efficiency and productivity. Woodworking knowledge and plans are essential for creating high-quality furniture and other wood products, making woodworking supplies a crucial investment for businesses. Staying informed about the latest woodworking trends and safety regulations is essential for maintaining a competitive edge in the industry. Environmental concerns have also played a role in government decisions regarding natural forest harvesting, further impacting the woodworking industry. As a result, the demand for woodworking machines in APAC is expected to increase, potentially exacerbating the raw material crisis.

Exclusive Customer Landscape

The woodworking machines market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the woodworking machines market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, woodworking machines market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Akhurst Machinery Ltd. - The company specializes in providing a range of high-quality woodworking machinery for various applications.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Akhurst Machinery Ltd.

- Biesse Group

- Chuan Chier Co.Ltd.

- Durr AG

- Grizzly Industrial Inc.

- HOLYTEK INDUSTRIAL CORP.

- IMA Schelling Group GmbH

- JPW Industries Inc.

- Masterwood Spa

- Michael Weinig AG

- Nihar Industries

- Oliver Machinery Co.

- Robland NV

- RSWOOD. CMC

- Salvador Srl

- SCM GROUP Spa

- Socomec

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Woodworking Machines Market

- In March 2023, German woodworking machinery manufacturer, Hüllmayer, introduced the innovative "GreenLine" CNC machining center, which integrates energy recovery technology, reducing energy consumption by up to 50% (Hüllmayer press release).

- In June 2024, American woodworking machinery manufacturer, Weinig, announced a strategic partnership with Chinese furniture manufacturer, Yongjia Furniture, to enhance their market presence in China and expand production capacity (Weinig press release).

- In October 2024, Swiss woodworking machinery company, SCM Group, completed the acquisition of Italian CNC machine tool manufacturer, Morbidelli, expanding their product portfolio and strengthening their position in the high-end CNC market (SCM Group press release).

- In January 2025, the European Union approved new regulations on the use of formaldehyde in wood-based products, driving the demand for advanced woodworking machinery with formaldehyde emission control features (European Commission press release).

Research Analyst Overview

The market continues to evolve, driven by advancements in technology and the diverse applications across various sectors. Woodworking accessories play a crucial role in enhancing the functionality of milling machines and other woodworking technology. The integration of sustainability into woodworking practices is a significant trend, with softwood lumber and woodworking finishes adapting to eco-friendly production methods. The woodworking industry is a dynamic business landscape, with safety equipment and woodworking expertise essential for professionals and hobbyists alike. Table saws and sanding machines are staples in woodworking, while woodworking software and online resources offer innovative solutions for design and project management. Woodworking passion transcends the profession, with craftsmanship and artistry showcased in furniture, jigs, and woodworking projects.

Knowledge and plans are essential resources for woodworking enthusiasts, with wholesale suppliers and classes providing access to woodworking supplies and tools. Dust collection systems ensure a safer and cleaner work environment, while woodworking history and heritage inspire new generations of woodworkers. Woodworking glues and clamps are essential for assembling projects, with CNC routers and band saws offering precision and automation in manufacturing. The woodworking market is a vibrant and evolving ecosystem, with ongoing innovation and trends shaping its future. From hardwood lumber to woodworking retail, every aspect of the industry is interconnected and constantly adapting to meet the demands of the market.

The Woodworking Machines Market is experiencing significant growth, driven by advancements in woodworking automation and woodworking design. Manufacturers are focusing on sustainable solutions, making woodworking sustainability a key trend. The industry encompasses a wide range of applications, from woodworking furniture production to specialized woodworking clamps for precision work. With increasing demand for customized woodworking plans, businesses are integrating modern techniques in woodworking manufacturing. The market also celebrates woodworking heritage, blending tradition with woodworking innovation to enhance efficiency. Skilled professionals leverage woodworking craftsmanship and woodworking skills to create quality products. Whether pursued as a woodworking hobby or woodworking profession, the industry thrives with woodworking wholesale, woodworking online sales, and strategic woodworking advertising efforts to expand global reach.

Dive into Technavio's strong research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Woodworking Machines Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

212 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.6% |

|

Market growth 2025-2029 |

USD 1.52 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.4 |

|

Key countries |

US, China, UK, Germany, Canada, Japan, India, France, Italy, and Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Woodworking Machines Market Research and Growth Report?

- CAGR of the Woodworking Machines industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, APAC, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the woodworking machines market growth of industry companies

We can help! Our analysts can customize this woodworking machines market research report to meet your requirements.